BUS 225 DAYONE LL

17th Edition

ISBN: 9781264116430

Author: BLOCK

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 46P

Your younger sister, Linda, will start college in five years. She has just informed your parents that she wants to go to Hampton University, which will cost

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Your younger sister, Brittany, will start college in five years. She has just informed your parents that she wants to go to Eastern State U., which will cost $30,000 per year for four years (cost assumed to come at the end of each year). Anticipating Brittany’s ambitions, your parents started investing $5,000 per year five years ago and will continue to do so for five more years.

How much more will your parents have to invest each year for the next five years to have the necessary funds for Brittany’s education? Use 10 percent as the appropriate interest rate throughout this problem (for discounting or compounding). Round all values to whole numbers.

Your sister will start college in five years. She has just informed your parentsthat she wants to go to a private university that will cost RM18,000.00 per yearfor four years (assumed at the end of each year). Your parents have startedinvesting RM3,000.00 per year since five years ago. How much will yourparents have to invest each year for the next five years to have the necessaryfunds for your sister's education? Use 10% interest rate throughout thisproblem.

Your five-year old daughter has just announced that she would like to attend college. Your best

guess is that it will cost approximately $25,000 per year for four years in tuition, books, rent,

etc. for her to attend State College 12 years from now (first payment beginning on year 13). You

believe that you can earn a rate of 9% on investment to meet this goal.

a. If you were to invest a lump sum today in hopes of covering your daughter’s college

costs, how much would you have to invest?

b. If you now decided to invest annually instead, how much would you have to invest every

year? (investment every year, years 1-12)

c. You just learned of a $10,000 inheritance and plan to invest it in your daughter’s college

fund (inheritance is available today at time 0). Given this new source of funds how much

do you have to invest every year?

d. Create a combo box that will switch provide the user with 5 different inheritance

amounts ($8,000, $9,000, $10,000, $11,000 and $12,000)

Chapter 9 Solutions

BUS 225 DAYONE LL

Ch. 9 - Prob. 1DQCh. 9 - How is the present value of a single sum related...Ch. 9 - Prob. 3DQCh. 9 - Does inflation have anything to do with making a...Ch. 9 - Adjust the annual formula for a future value of a...Ch. 9 - If, as an investor, you had a choice of daily,...Ch. 9 - What is a deferred annuity? (LO9-4)Ch. 9 - Prob. 8DQCh. 9 - Prob. 1PCh. 9 - Prob. 2P

Ch. 9 - a. What is the present value of $140,000 to be...Ch. 9 - If you invest $9,000 today, how much will you have...Ch. 9 - Prob. 6PCh. 9 - Your uncle offers you a choice of $105,000 in 10...Ch. 9 - Your father offers you a choice of $105,000 in 12...Ch. 9 - Prob. 9PCh. 9 - How much would you have to invest today to receive...Ch. 9 - If you invest $8,500 per period for the following...Ch. 9 - Prob. 12PCh. 9 - Mrs. Crawford will receive $7,600 a year for the...Ch. 9 - Phil Goode will receive $175,000 in 50 years. His...Ch. 9 - Sherwin Williams will receive $18,500 a year for...Ch. 9 - Carrie Tune will receive $19,500 for the next 20...Ch. 9 - The Clearinghouse Sweepstakes has just informed...Ch. 9 - Prob. 18PCh. 9 - Prob. 19PCh. 9 - Prob. 20PCh. 9 - At a growth (interest) rate of 10 percent...Ch. 9 - Prob. 22PCh. 9 - Prob. 23PCh. 9 - Prob. 24PCh. 9 - Juan Garza invested $20,000 10 years ago at 12...Ch. 9 - Prob. 26PCh. 9 - Prob. 27PCh. 9 - Prob. 28PCh. 9 - Prob. 29PCh. 9 - You need $28,974 at the end of 10 years, and your...Ch. 9 - Prob. 31PCh. 9 - Prob. 32PCh. 9 - Prob. 33PCh. 9 - Prob. 34PCh. 9 - Prob. 35PCh. 9 - Prob. 36PCh. 9 - Prob. 37PCh. 9 - Del Monty will receive the following payments at...Ch. 9 - Prob. 39PCh. 9 - Prob. 40PCh. 9 - Prob. 41PCh. 9 - Prob. 42PCh. 9 - Prob. 43PCh. 9 - Prob. 44PCh. 9 - Prob. 45PCh. 9 - Your younger sister, Linda, will start college in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that your parents wanted to have $160,000 saved for college by your 18th birthday and they started saving on your first birthday. They saved the same amount each year on your birthday and eamed 12.5% per year on their investments. a. How much would they have to save each year to reach their goal? b. If they think you will take five years instead of four to graduate and decide to have $200,000 saved just in case, how much would they have to save each year to reach their new goal? Ⓒ a. How much would they have to save each year to reach their goal? To reach the goal of $160,000, the amount they have to save each year is $ (Round to the nearest cent.)arrow_forwardYour younger sister, Barbara, will start college in five years. She has just informed your parents that she wants to go to Eastern University, which will cost $44,000 per year for four years (assumed to come at the end of each year). Anticipating Barbara's ambitions, your parents started investing $6,400 per year five years ago and will continue to do so for five more years. Use 10 percent as the appropriate interest rate throughout this problem (for discounting or compounding). How much more will your parents have to invest each year for the next five years to have the necessary funds for Barbara's education? (Use a Financial calculator to arrive at the answer. Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Investment each year $arrow_forwardSOLVE the following:i. Suppose that your five-year old daughter has just announced her desire toattend college. After some research, you determined that you will need aboutRM 100,000 on her 18th birthday to pay for four years of college. If you canearn 8% annually on your investments, how much do you need to invest todayto achieve your goal?ii. Suppose you have an extra RM100 today that you wish to invest in for oneyear. If you can earn 10% per annum on your investment, how much will youhave in one year?arrow_forward

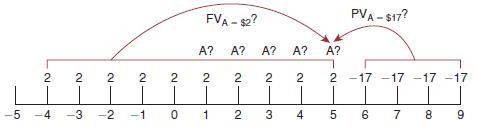

- 46. Your younger sister, Brittany, will start college in five years. She has just informed your parents that she wants to go to Eastern State U., which will cost $30,000 per year for four years (costs assumed to come at the end of each year). Anticipating Brittany's ambitions, your parents started investing $5,000 per year five years ago and will continue to do so for five more years. How much more will your parents have to invest each year for the next five years to have the necessary funds for Brittany's education? Use 10 percent as the appropriate interest rate throughout this problem (for discounting or compounding). Round all values to whole numbers. Annuity consideration (LO4) 47. Brittany (from Problem 46) is now 18 years old (five years have passed), and she wants to get married instead of going to college. Your parents have accumulated the necessary funds for her education. Instead of funding her schooling, your parents are paying $10,000 for her current wedding and plan to…arrow_forwardYour client has asked you what would be needed to fund your 2 children’s future college costs. Assume each child will begin college at age 18 and graduate in four years. Jamie is currently 14 years old and Johnny is currently 9 years old. Assume current costs are $24,000 per year and are expected to increase by 5% per year and investments earn 7%. Assuming no existing assets are dedicated to college, what is the annual savings required to fund the children’s education? Please include your calculator keystroke input for each step of this calculation.arrow_forwardYour younger sister, Linda, will start college in five years. She has just informed your parents that she wants to go to Hampton University, which will cost $45,000 per year for four years (cost assumed to come at the end of each year). Anticipating Linda’s ambitions, your parents started investing $6,500 per year five years ago and will continue to do so for five more years. Use 11 percent as the appropriate interest rate throughout this problem (for discounting or compounding). How much will your parents have to save each year (A?) for the next five years in addition to the $6,500 they are currently saving to have the necessary funds for Linda's education? Use Appendix C and Appendix D for an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forward

- You are thinking of building a new machine that will save you $3,000 in the first year. The machine will then begin to wear out so that the savings decline at a rate of 2% per year forever. What is the present value of the savings if the interest rate is 9% per year? The present value of the savings is $ (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer. All parts showing Clear All Check Answer MacBook Airarrow_forwardYou calculate that you will need $75,000 in ten years to be able to pay for your daughter's college education. If you invest $20,000 today, what rate of return will you need to achieve this goal? Select one: A. Between 12% and 13% B. Between 13% and 14% C. Between 14% and 15% D. Between 15% and 16%arrow_forwardYour mother wants to buy a car which will cost $15,000 five years from today. She would like save $2,450 at the end of each year (for the next five years) in an account, so as to have the amount she needs. What interest (to the closest percent) must she earn in this account to achieve this financial objective?arrow_forward

- Assume that your parents wanted to have $150,000 saved for university by your 18th birthday and they started saving on your first birthday. They saved the same amount each year on your birthday and earned 5.5% per year on their investments. a. How much would they have to save each year to reach their goal? b. If they think you will take five years instead of four to graduate and decide to have $190,000 saved, just in case, how much would they have to save each year to reach their new goal? a. To reach the goal of $150,000, the amount they have to save each year is $. (Round to the nearest cent.) Clear allarrow_forwardYou have an absolutely brilliant child who will be attending a private college in 11 years. You know that a four-year college now costs at least $15,000 per year, including tuition, books, room, and board. The cost of sending a child to college has increased by 4 percent per year, and you believe this will be true for the next 11 years. How much will the annual tuition be when your child is 18?arrow_forwardYou have a brilliant child who is five years old and will be attending a private college in thirteen years. You know that a four-year college now costs at least $25,000 per year, including tuition, books, and room and board. The cost of sending a child to college has increased by 9 percent per year, and you believe this will be true for the next thirteen years. How much will the annual tuition be when your child is eighteen? Assume tuition is paid at the beginning of each year. How much money will you need to have in your investment account when your child begins college? (Hint: what is the present value of the four years of college tuition?) If you can earn 11 percent on a mutual fund investment during the next thirteen years, how much will you have to invest at the beginning of each year to have enough to send your child to college for four years? O Expected Annual Tuition = $72,376.77; Total amount of money needed to pay for four years of tuition = $252,312.72; Amount needed to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

What Is A Checking Account?; Author: The Smart Investor;https://www.youtube.com/watch?v=vGymt1Rauak;License: Standard Youtube License