Forecasted Statements and Ratios

Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers.

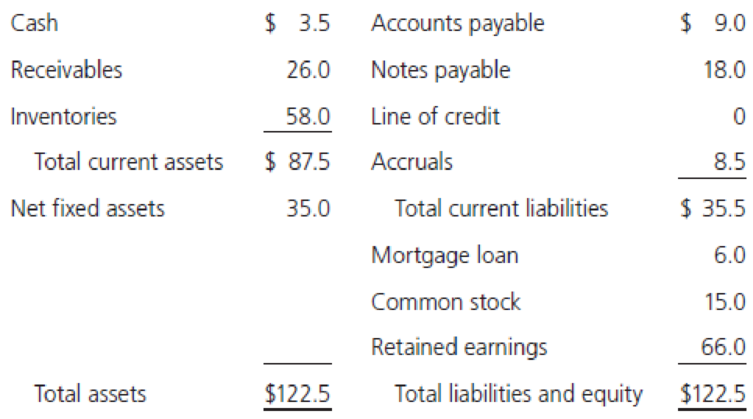

Upton’s balance sheet as of December 31, 2018, is shown here (millions of dollars):

Sales for 2018 were $350 million, and net income for the year was $10.5 million, so the firm’s profit margin was 3.0%. Upton paid dividends of $4.2 million to common stockholders, so its payout ratio was 40%. Its tax rate was 40%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2019.

- a. If sales are projected to increase by $70 million, or 20%, during 2019, use the AFN equation to determine Upton’s projected external capital requirements.

- b. Using the AFN equation, determine Upton’s self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ nonspontaneous external funds?

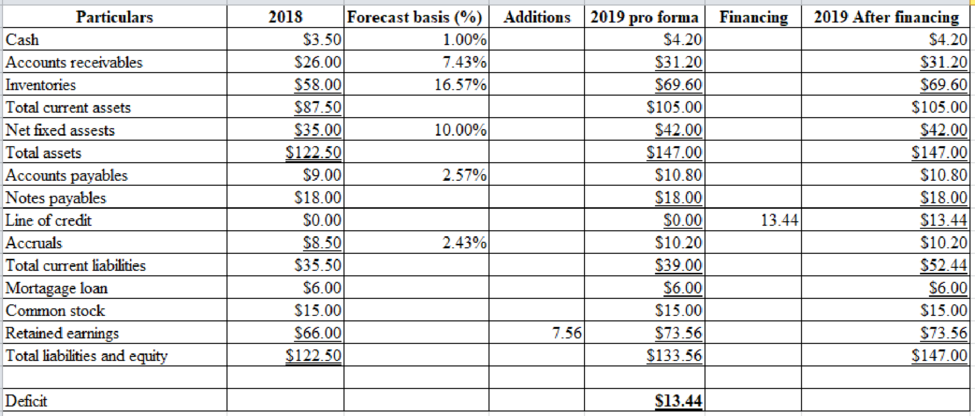

- c. Use the forecasted financial statement method to

forecast Upton’s balance sheet for December 31, 2019. Assume that all additional external capital is raised as a line of credit at the end of the year and is reflected (because the debt is added at the end of the year, there will be no additional interest expense due to the new debt). Assume Upton’s profit margin and dividend payout ratio will be the same in 2019 as they were in 2018. What is the amount of the line of credit reported on the 2019 forecasted balance sheets? (Hint: You don’t need toforecast the income statements because the line of credit is taken out on the last day of the year and you are given the projected sales, profit margin, and dividend payout ratio; these figures allow you to calculate the 2019 addition toretained earnings for the balance sheet without actually constructing a full income statement.)

a)

To determine: Company U’s projected external capital requirements.

Explanation of Solution

Calculation of company’s horizon value at year 3:

Therefore, AFN is $13.44 million.

b)

To determine: Self-supporting growth rate of Company U.

Explanation of Solution

Calculation of self-supporting growth rate:

Therefore, self-supporting growth rate is 6.38%.

c)

To construct: Balance sheet of Company U for December 31, 2019.

Explanation of Solution

Given information:

Forecasted sales is $420 million,

Profit margin is 3% ($10.5/$350),

Calculation of pay-out ratio:

Hence, pay-out ratio is 40%.

Calculation of net income:

Hence, net income is $12.6

The additional investment in assets is identical to the change in total assets because there are not short-term investments,

The additional financing from the increase in spontaneous liabilities and from the reinvested earnings is,

Calculation of financing surplus (deficit):

Therefore, financing deficit is -$13.44

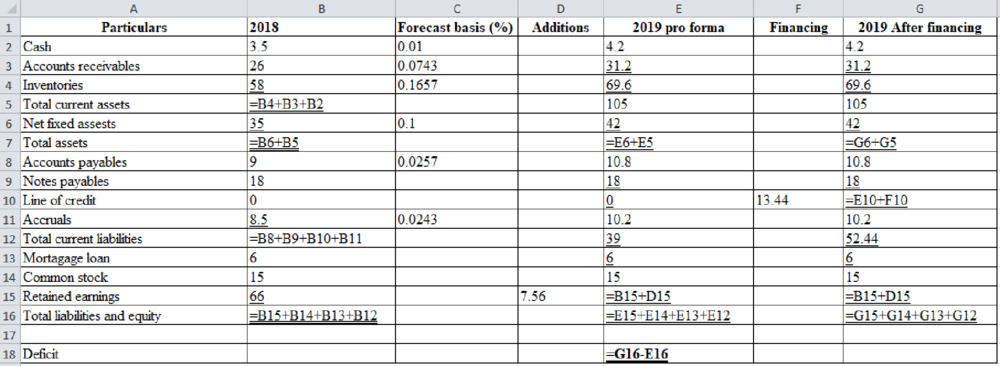

Excel workings:

Excel spread sheet:

Want to see more full solutions like this?

Chapter 9 Solutions

Bundle: Intermediate Financial Management, Loose-leaf Version, 13th + MindTap Finance, 1 term (6 months) Printed Access Card

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education