Concept explainers

(LO9–2, LO9–8)

On January 1, 2018, the general ledger of Freedom Fireworks includes the following account balances:

| Accounts | Debit | Credit |

| Cash | $ 11,200 | |

| 34,000 | ||

| Allowance for Uncollectible Accounts | $ 1,800 | |

| Inventory | 152,000 | |

| Land | 67,300 | |

| Buildings | 120,000 | |

| 9,600 | ||

| Accounts Payable | 17,700 | |

| Common Stock | 200,000 | |

| 155,400 | ||

| Totals | $384,500 | $384,500 |

During January 2018, the following transactions occur.

January 1 Borrow $100,000 from Captive Credit Corporation. The installment note bears interest at 7% annually and matures in 5 years. Payments of $1,980 are required at the end of each month for 60 months.

January 4 Receive $31,000 from customers on accounts receivable.

January 10 Pay cash on accounts payable, $11,000.

January 15 Pay cash for salaries, $28,900.

January 30 Firework sales for the month total $195,000. Sales include $65,000 for cash and $130,000 on account. The cost of the units sold is $112,500.

January 31 Pay the first monthly installment of $1,980 related to the $100,000 borrowed on January 1. Round your interest calculation to the nearest dollar.

Required:

1. Record each of the transactions listed above.

2. Record

a. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of 10 wars and a residual value of $24,000.

b. At the end of January, $3,000 of accounts receivable are past due, and the company estimates that 50% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 2% will not be collected. No accounts were written off as uncollectible in January.

c. Unpaid salaries at the end of January are $26,100.

d. Accrued income taxes at the end of January are $8,000.

3. Prepare an adjusted

4. Prepare a multiple-step income statement for the period ended January 31, 2018.

5. Prepare a classified balance sheet as of January 31, 2018. (Hint: The carrying value of notes payable on January 31, 2018 is $98,603; $17,411 is reported as notes payable in the current liabilities section and $81,192 is reported as notes payable in the long-term liabilities section ($17, 411 + $81,192 = $98,603).

6. Record closing entries.

7. Analyze the following for Freedom Fireworks:

a. Calculate the debt to equity ratio. If the average debt to equity ratio for the industry is 1.0, is Freedom Fireworks more or less leveraged than other companies in the same industry?

b. Calculate the times interest earned ratio. If the average times interest earned ratio for the industry is 20 times, is the company more or less able to meet interest payments than other companies in the same industry?

c. Based on the ratios calculated in (a) and (b), would Freedom Fireworks be more likely to receive a higher or lower interest rate than the average borrowing rate in the industry?

1.

To record: The journal entries for given transactions.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The journal entries for given transactions of FF are as follows:

| Date | Account titles and Explanation | Debit | Credit |

| January 1 | Cash | $100,000 | |

| Notes payable | $100,000 | ||

| (To record issuance of notes payable) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 4 | Cash | $31,000 | |

| Accounts receivable | $31,000 | ||

| (To record cash received on account) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 11 | Accounts payable | $11,000 | |

| Cash | $11,000 | ||

| (To record cash payment made on account) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 15 | Salaries expense | $28,900 | |

| Cash | $28,900 | ||

| (To record cash payment made for salaries) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 30 | Cash | $65,000 | |

| Accounts receivable | $130,000 | ||

| Sales revenue | $195,000 | ||

| (To record inventory sold for cash and an account) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 30 | Cost of goods sold | $112,500 | |

| Inventory | $112,500 | ||

| (To record cost of merchandise inventory sold) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Interest expense | $583 | |

| Notes payable | $1,397 | ||

| Cash | $1,980 | ||

| (To record payment of monthly installment note) |

Table (1)

2.

To record: The given adjusting entries of FF.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Adjusting entries of FF are as follows:

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Depreciation expenses (1) | $800 | |

| Accumulated depreciation | $800 | ||

| (To record Depreciation expense) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Bad debt expense | $2,300 | |

| Allowance for uncollectible Accounts | $2,300 | ||

| (To record uncollectible accounts) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Salaries expense | $26,100 | |

| Salaries payable | $26,100 | ||

| (To record salaries payable) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31 | Income tax expense | $8,000 | |

| Income tax payable | $8,000 | ||

| (To record income tax expenses) |

Table (2)

Working Notes:

a.

Calculate the depreciation on the equipment.

b.

Calculate the bad debt expense.

3.

To Prepare: Adjusted trial balance for the month January 31, 2018.

Explanation of Solution

| Adjusted Trail Balance | ||

| January 31, 2018 | ||

| Accounts | Debit | Credit |

| Cash | $165,320 | |

| Accounts receivable | $133,000 | |

| Allowance for uncollectible accounts | $4,100 | |

| Inventory | $39,500 | |

| Land | $67,300 | |

| Buildings | $120,000 | |

| Accumulated depreciation | $10,400 | |

| Accounts payable | $6,700 | |

| Salaries payable | $26,100 | |

| Income tax payable | $8,000 | |

| Notes payable | $98,603 | |

| Common stock | $200,000 | |

| Retained earnings | $155,400 | |

| Sales revenue | $195,000 | |

| Cost of goods sold | $112,500 | |

| Salaries expense | $55,000 | |

| Bad debt expense | $2,300 | |

| Depreciation expense | $800 | |

| Interest expense | $583 | |

| Income tax expense | $8,000 | |

| Total | $704,303 | $704,303 |

Table (3)

Calculation of adjusted trial balance of FF for the month January:

| Accounts | Ending Balance |

| |

| Cash | $165,320 | = |

|

| Accounts Receivable | $133,000 | = |

|

| Allowance for uncollectible accounts | $4,100 | = |

|

| Inventory | $39,500 | = |

|

| Land | $67,300 | = | $67,300 |

| Buildings | $120,000 | = | $120,000 |

| Accumulated Depreciation | $10,400 | = |

|

| Accounts Payable | $6,700 | = |

|

| Salaries payable | $26,100 | = |

|

| Income Tax Payable | $8,000 | = | $8,000 |

| Notes Payable | $98,603 | = |

|

| Common Stock | $200,000 | = | $200,000 |

| Retained Earnings | $155,400 | = | $155,400 |

| Sales Revenue | $195,000 | = |

|

| Cost of Goods Sold | $112,500 | = |

|

| Salaries Expense | $55,000 | = |

|

| Bad Debt Expense | $2,300 | = | $2,300 |

| Depreciation Expense | $800 | = | $800 |

| Interest Expense | $583 | = | $583 |

| Income Tax Expense | $8,000 | = | $8,000 |

(Table 4)

4.

To Prepare: the multiple income statement for the period ended January 31, 2018.

Explanation of Solution

| FF | ||

| Multiple - Step Income Statement | ||

| For the Year month ended January 31, 2018 | ||

| Sales revenue | $195,000 | |

| Less: Cost of goods sold | $112,500 | |

| Gross profit | $82,500 | |

| Less: Operating expenses: | ||

| Salaries expenses | $55,000 | |

| Bad debt expenses | $2,300 | |

| Depreciation expenses | $800 | |

| Total operating expenses | $58,100 | |

| Operating income | $24,400 | |

| Less: Interest expenses | $583 | |

| Income before taxes | $23,817 | |

| Less: Income tax expense | $8,000 | |

| Net income | $15,817 | |

Table (5)

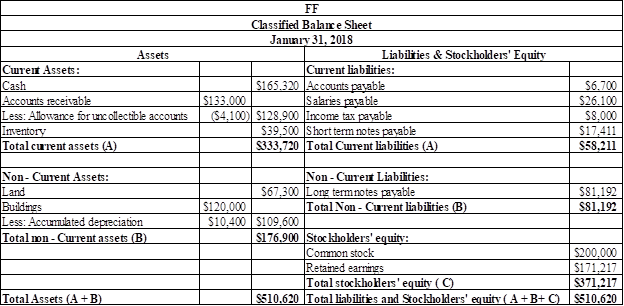

5.

To Prepare: classified balance sheet as on January 31, 2018.

Explanation of Solution

Figure (1)

Working Notes:

6.

To Record: the closing entries.

Explanation of Solution

| Date | Account titles and Explanation | Debit | Credit |

| January 31, 2018 | Sales revenue | $195,000 | |

| Retained earnings | $195,000 | ||

| (To record the closing revenue accounts) | |||

| Date | Account titles and Explanation | Debit | Credit |

| January 31, 2018 | Retained earnings | $179,183 | |

| Cost of goods sold | $112,500 | ||

| Salaries expense | $55,000 | ||

| Bad debt expense | $2,300 | ||

| Depreciation expense | $800 | ||

| Interest expense | $583 | ||

| Income tax expense | $8,000 | ||

| (To record the closing expenses accounts) |

Table (6)

7. a

To Calculate: the debt to equity ratio at the end of January.

Explanation of Solution

Calculate the debt to equity ratio at the end of January.

FF has liquidity less than the average level required by industry. They have low portion of total liabilities to meet out their total stockholders ‘equity which is comparatively lesser than the industry average of 1.0.

b.

To Calculate: the times interest earned ratio at the end of January.

Explanation of Solution

Calculate the times interest earned ratio at the end of January.

FF has more able to meet interest payments than other companies in the same industry, since, FF has (41.9 times) more than the industry average of (20 times).

c.

To Indicate: whether the revised ratio would increase, decrease or remain unchanged compared to the requirement a and b.

Explanation of Solution

Based on the debt to equity ratio and times interest earned ratio, FF would likely receive lesser interest rate than the average borrowing rate in the industry. Because, FF conveys lesser debt than the industry average and is capable to meet interest payments than the average company in the industry.

Want to see more full solutions like this?

Chapter 9 Solutions

FINANCIAL ACCT LL W/ACCESS

- 5. AA Company prepared an aging of its accounts receivable at December 31, 2022 and determined that the net realizable value of the receivables was P350,000. Additional information is available as follows: Allowance for uncollectible accounts at 1/1/22 – credit balance,P34,000 Accounts written off as uncollectible during 2022, P23,000 Accounts receivable at 12/31/22, P375,000 Uncollectible accounts recovered during 2022, P5,000 Total provisions made during 2022, P12,000 Statement 1: The amount of bad debts expense in 2022 is P9,000. Statement 2: The ending balance of the allowance for uncollectible accounts is P25,000. Group of answer choices Only statement 1 is true Both statements are true Only statement 2 is true Both statements are falsearrow_forwardJD Company decided on January 2, 2022 to effect the change in accounting policies in relation to bad debts as follows: Bad debt percentage rom 2% to 10% of accounts receivable. JD Company's receivable balance at December 31, 2022 was 960,000, and the allowance for bad debt account has a debit balance of P7,000. What is the 2022 carrying value of the accounts receivable? a. 857,000 b. 960,000 c. 878,000 d. 864,000arrow_forward9. How much was Sasha Novikov’s adjusted accounts receivable on December 31, 2022? - 1,481,250 10. How much was the adjusted balance of Sasha Novikov’s allowance for bad debts on December 31, 2022? - 95,491 How much was the adjustment to bad debts expense? (Indicate before the answer if debit or credit: Eg. “Debit 50,000” or “Credit 50,000”) - Credit 267,009 How much was the unadjusted balance of allowance for bad debts?arrow_forward

- E7.9 (LO3) (Computing Bad Debts and Preparing Journal Entries) The trial balance before adjustment of Estefan Inc. shows the following balances. Accounts Receivable $80.000 (D) Allowance for Doubtful Accounts $1.750 (D) Sales Revenue (net, all on credit) $580.000 (K) Instructions Give the entry for estimated bad debts assuming that the allowance is to providefor doubtful accounts on the basis of (a) 4% of gross accounts receivable and (b)5% of gross, accounts receivables and allowance for Doubtful accounts has a$1,700 credit balance.arrow_forwardAN Jensen Company's general ledger included the following selected accounts (in thousands) at December 31, 2021: Accounts payable $1,077.3 Accounts receivable 590.4 Accumulated depreciation—equipment 858.7 Allowance for doubtful accounts 35.4 Bad debt expense 91.3 Cash 395.6 Cost of goods sold 660.4 Equipment 1,732.8 Interest revenue 19.7 Merchandise inventory 630.9 Notes receivable—due in 2022 96.0 Notes receivable—due in 2025 191.1 Prepaid expenses 20.1 Sales 4,565.5 Sales discounts 31.3 Short-term investments 194.9 Supplies 21.7 Unearned revenue 56.3 Additional information: 1.On December 31, 2020, Accounts Receivable was $611.1 thousand and the Allowance for Doubtful Accounts was $36.6 thousand. 2.The receivables turnover was 8.3 the previous year. Instructions a. Prepare the assets section of the balance sheet. b. Calculate the receivables turnover and average collection period. Compare these results with the previous year's results and comment on any trendsarrow_forwardE8-3 Recording, Reporting, and Evaluating a Bad Debt Estimate Using the Percentage of Credit Sales Method During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $170,000, of which $85,000 was on credit. At the start of 2021, Accounts Receivable showed a $10,000 debit balance and the Allowance for Doubtful Accounts showed a $600 credit balance. Collections of accounts receivable during 2021 amounted to $68,000. Data during 2021 follow: a.On December 10, a customer balance of $1,500 from a prior year was determined to be uncol- , so it was written off. lectible b. December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. b. On Required: 1. Give the required journal entries for the two events in December. 2.Show how the amounts related to Accounts Receivable and Bad Debt Expense would be reported on the balance sheet and income statement for 2021. 13 On the basis of the data…arrow_forward

- PA4. Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. Record the year-end adjusting entry for 2018 bad debt using the income statement method. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward46. CPA Company had the following information relating to its accounts receivable: · Accounts receivable, 12/31/2020- P780,000· Credit sales during 2021- P3,290,000· Collections from customers during 2021 (excluding recovery of P20,000)- P3,640,000· Accounts written off during 2021- P85,000· Collection of accounts written off in prior years- P20,000· Estimated uncollectible accounts per aging at 12/31/2021- P63,000 At December 31, 2021, CPA Company's accounts receivable before allowance for uncollectible accounts should bearrow_forward9. How much was Sasha Novikov’s adjusted accounts receivable on December 31, 2022? - 1,481,250 10. How much was the adjusted balance of Sasha Novikov’s allowance for bad debts on December 31, 2022? - 40,920 How much was the adjustment to bad debts expense? (Indicate before the answer if debit or credit: Eg. “Debit 50,000” or “Credit 50,000”) Please answerarrow_forward

- What are the balances of accounts receivable, related allowance account, and bad debts expense on December 31, 2021? A. P7,092,000, P1,110,130, and P756,130 B. P9,616,000, P1,653,370, and P756,130 C. P9,616,000, P1,791,610, and P1,437,610 D. P9,104,000, P1,653,370, and P1,299,370arrow_forwardExcercises E7.8 (LO3) (Recording Bad Debts) At the end of 2019, Sorter plc has accountsreceivable of £900,000 and an allowance for doubtful accounts of £40,000. On January 16, 2020, Sorter determined that its receivable from Ordonez Orchards£8,000 will not be collected, and management authorized its write-off. Instructions Prepare the journal entry for Sorter plc to write off the Ordonez receivable. What is the cash realizable value of Sorter plc's accounts receivable beforethe write-off of the Ordonez receivable? What is the cash realizable value of Sorter plc's accounts receivable afterthe write-off of the Ordonez receivable? E7.9 (LO3) (Computing Bad Debts and Preparing Journal Entries) The trialbalance before adjustment of Estefan Inc. shows the following balances. Accounts Receivable $80.000 (D) Allowance for Doubtful Accounts $1.750 (D) Sales Revenue (net, all on credit) $580.000 (K) Instructions Give the entry for estimated bad debts assuming that the allowance is to…arrow_forwardAt the end of the fiscal year, Accounts Receivable has a balance of R100 000 and allowance for doubtful accounts has a balance of R7 000. The expected net realizable value of the accounts receivable is________. Select one: a. R107 000 b. R7 000 c. R93 000 d. R100 000arrow_forward