Concept explainers

Lower of cost or net realizable value

• LO9–1

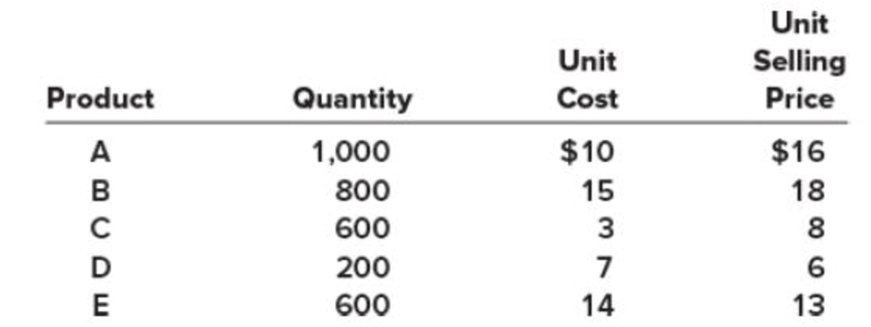

Decker Company has five products in its inventory. Information about the December 31, 2018, inventory follows.

The cost to sell for each product consists of a 15 percent sales commission.

Required:

- 1. Determine the carrying value of inventory at December 31, 2018, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products.

- 2. Determine the carrying value of inventory at December 31, 2018, assuming the LCNRV rule is applied to the entire inventory. Also, assuming inventory write-downs are usual business practice for Decker, record any necessary year-end

adjusting entry.

1.

LCM (Lower of Cost or Market) approach: It is an approach that values the inventory at historical cost or lesser than the market replacement cost. The replacement cost refers to the amount that could be realized from the sale of the inventory.

NRV (Net Realizable Value): It refers to an estimated selling price that a company expects to collect in the form of cash from the customers by the sale of inventory. The value is reduced by the expected cost of completion, disposal and transportation. Sales commission and shipping costs also included in the predictable cost.

To Calculate: The carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV.

Explanation of Solution

The following table shows the carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV.

| Lower of Cost or NRV | |||||

| Product | Units | Unit Cost ($) | Cost ($) | NRV ($) | Inventory value ($) |

| (A) | (B) | (A) × (B) | |||

| A | 1,000 | 10 | 10,000 | 13,600 (1) | 10,000 |

| B | 800 | 15 | 12,000 | 12,240 (2) | 12,000 |

| C | 600 | 3 | 1,800 | 4,080 (3) | 1,800 |

| D | 200 | 7 | 1,400 | 1,020 (4) | 1,020 |

| E | 600 | 14 | 8,400 | 6,630 (5) | 6,630 |

| Total | 33,600 | 37,570 | 31,450 | ||

Table (1)

Working Notes:

Calculate the amount of NRV for product A.

Calculate the amount of NRV for product B.

Calculate the amount of NRV for product C.

Calculate the amount of NRV for product D.

Calculate the amount of NRV for product E.

Therefore, the carrying value of inventory at December 31, 2018 by using the rule of LCM and NRV is $31,450.

2.

Explanation of Solution

The total aggregate inventory cost and aggregate inventory net realizable value is $33,600 and $37,570 respectively. Therefore, the carrying value of inventory at December 31, 2018, using the LCNRV rule applied for entire inventory is $33,600. There is no inventory write-downs as the LCNRV is already recorded at cost.

Want to see more full solutions like this?

Chapter 9 Solutions

INTERMEDIATE ACCOUNTING +ACCLL

- 13. One of the following is not a purchase cost of inventoriesa. non-refundable taxes b. trade discounts c. import duties d. handling cost 14. A markup of 40% on cost is equivalent to what markup on selling price?a. 29%b. 40%c. 31%d. 25% PLEASE ANSWER IMMEDIATELYarrow_forwardHW 5 Q8 Lightening Bulk Company is a moving company specializing in transporting large items worldwide. The firm has an 85% on-time delivery rate. Thirteen percent of the items are misplaced and the remaining 2% are lost in shipping. On average, the firm incurs an additional $67 per item to track down and deliver misplaced items. Lost items cost the firm about $340 per item. Last year, the firm shipped 6,720 items with an average freight bill of $224 per item shipped. The firm’s manager is considering investing in a new scheduling and tracking system costing $152,000 per year. The new system is expected to reduce misplaced items to 1% and lost items to 0.50%. Furthermore, the firm expects total sales to increase by 10% with the improved service. The average contribution margin ratio on any increased sales volume, after cost savings associated with a reduction in misplaced and lost items, is expected to be 37.5%. 3. Upon further investigation, the manager discovered that…arrow_forwardQ.13 coronado industries sells its product for $80 per unit…arrow_forward

- Q.10 During the last accounting period, Carla vista corporation sold 96000 units at $45 each…arrow_forwardMay I ask for an explanation and solution to the question for a better understanding. Thank you! 8. Pierce Corporation has the following gross profits for 2018 and 2019: Sales = 2019 - P810,000; 2018 - P792,000. Cost of sales = 2019 - 480,000; 2018 - 464,000. Gross profit = 2019 - P330,000; 2018 - P328,000. Sales price was 10% lower during 2019. The percent of increase (decrease) in cost price must be: a. 8.97% b(8.97%) c. 9.85% d. (9.85%)arrow_forwardEA5. LO 12.3During the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000,000. What is the sales margin?arrow_forward

- 9. Assuming the management chooses the first option, which amount the product lines will be eliminated?a. La-Lisab. Jenniec. Jisood. Rose_____ 10. Assuming the management chooses to discontinue the unprofitable product line, what is the net impact to the Company’s overall profit?a. P 7,000b. P 17,000c. P 13,000d. P 23,000arrow_forwardMay I ask for an explanation and solution to the question for a better understanding. Thank you! 6. Pierce Corporation has the following gross profits for 2018 and 2019: Sales = 2019 - P810,000; 2018 - P792,000. Cost of sales = 2019 - 480,000; 2018 - 464,000. Gross profit = 2019 - P330,000; 2018 - P328,000. Sales price was 10% lower during 2019. The change in gross profit due to change in cost price must be: a. P39,680 F b. P47,290 F c. P47,290 U d. P63,290 F e. P63,290 Uarrow_forwardQ.15 Crane company sells its product for $7100 per unit…arrow_forward

- CH7-Q50: Hi I have asked this question before, but i haven't received explanation on requirement # 3. Also, last question was not answered. Please answer #6 (last question) and fully explain # 3. thanks! Jellico Inc.'s projected operating income (based on sales of 450,000 units) for the coming year is as follows: Total Sales $ 12,150,000 Total variable cost 7,533,000 Contribution margin $ 4,617,000 Total fixed cost 2,875,878 Operating income $ 1,741,122 Required: 1(a). Compute variable cost per unit. Enter your answer to the nearest cent.$per unit 1(b). Compute contribution margin per unit. Enter your answer to the nearest cent.$per unit 1(c). Compute contribution margin ratio. % 1(d). Compute break-even point in units. units 1(e). Compute break-even point in sales dollars.$ 2. How many units must be sold to earn operating income of $376,542? units 3. Compute the additional operating income that Jellico would earn if sales were $50,000 more than expected.$ 4. For…arrow_forward61 2021 2020 Sales P2,080,000 P2,000,000 Cost of sales 1,755,000 1,500,000 Gross margin 325,000 500,000 Unit selling price decreased 20% at the start of 2019. The net change in gross profit in 2021 due to quantity factor is: Group of answer choices P600,000 increase P150,000 increase P400,000 increase P80,000 increasearrow_forward36-Since the selling price of a good sold with 20% profit is 144 TL, what is the cost of it?A) 120B) 110C) 105D) 100E) 115arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT