Concept explainers

Integrating Case 9–3

FIFO and lower of cost or net realizable value

• LO9–1

York Co. sells one product, which it purchases from various suppliers. York’s

| Sales (33,000 units @ $16) | $528,000 |

| Sales discounts | 7,500 |

| Purchases | 368,900 |

| Purchase discounts | 18,000 |

| Freight-in | 5,000 |

| Freight-out | 11,000 |

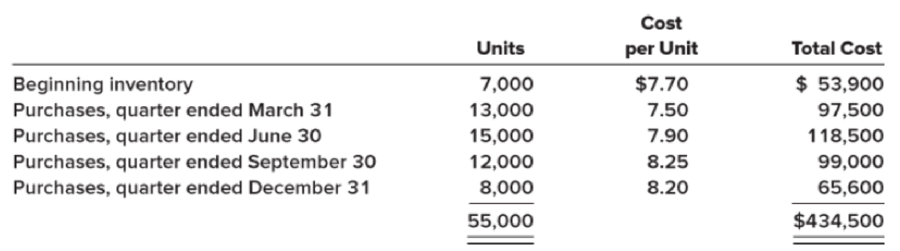

York Co.’s inventory purchases during 2018 were as follows:

Additional Information:

a. York’s accounting policy is to report inventory in its financial statements at the lower of cost or net realizable value, applied to total inventory. Cost is determined under the first-in, first-out (FIFO) method.

b. York has determined that, at December 31, 2018, the net realizable value was $8.00 per unit.

Required:

1. Prepare York’s schedule of cost of goods sold, with a supporting schedule of ending inventory. York includes inventory write-down losses in cost of goods sold.

2. Explain the rule of lower of cost or net realizable value and its application in this situation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

INTERMEDIATE ACCT.(LL)-W/CODE >CUSTOM<

- EA10. LO 6.4Record the journal entries for the following sales transactions of Apache Industries. Nov. 7Sold 10 computers on credit for $870 per computer. Terms of the sale are 5/10, n/60, invoice dated November 7. The cost per computer to Apache is $560. Nov. 14The customer returned 2 computers for a full refund from Apache. Apache returns the computers to their inventory at full cost of $560 per computer. Nov. 21The customer paid their account in full from the November 7 sale.arrow_forwardMF2 9 Purchased merchandise from Keene Co. for $9,100 under credit terms of 2/15, n/60, FOB destination. Analysis Component: As the senior purchaser for Belton Company, you are concerned that the purchase discounts you have negotiated are not being taken advantage of by the accounts payable department. Calculate the cost of the lost discount regarding the July 9 purchase. Assume a 6% interest rate. (Do not round intermediate calculations. Round your final answer to 2 decimal places. Assume 365 days a year.)arrow_forwardShark, Inc. was organized on January 1, 2022. On December 31, 2023, the company lost most of its inventory in a warehouse fire just before the year-end count of inventory was to take place. The company records disclosed the following data: Inventory, January 1 Purchases 2022 PO 860,000 2023 P 204,000 692,000arrow_forward

- QUESTION 1 a. Kpogo Ltd has the following products in inventory at the end of 2019: Units Cost per unit GH¢ XYZ (completed) 540 22 ABC (part complete) 280 26 Each product normally sells at GH¢34 per unit. Due to the difficult trading conditions, Kpogo Ltd intends to offer a discount of 15% per unit and expects to incur GH¢4 per unit in selling costs. GH¢10 per unit is expected to be incurred to complete each unit of ABC. Required: In accordance with IAS 2 Inventories, at what amount should inventory be stated in the financial statements of Kpogo Ltd as at 31 December 2019? b. According to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, an entity must select and apply its accounting policies consistently from one period to the next and among various items in the financial statements. However, an entity may change its accounting policies under certain conditions. Required: Identify the circumstances under which it may be appropriate to change accounting policy in…arrow_forwardBeg Inv @ cost $11,160 Net Additional markups $600 Sales $94,056 Purchases @ retail $92,400 Freight-in $840 Beg Inv @ retail $18,000 Purchases @ cost $54,600 Net markdowns $1,144 9. What would the cost ratio be for the LCM Conventional Retail Method be if (new assumption) the company had experienced normal breakage (cost) $1,714 (retail during the period? Thank you Brendaarrow_forwardQ ENG 1141: Session 13 Discussion Board Instructions - E... Sales-Related and Purchase-Related Transactions Using Perpetual Inventory System Instructions Chart of Accounts Journal Instructions Nov. The following were selected from among the transactions completed by Harrison Company during November of the current year: 23 3 24 28 30 4 6 13 14 15 v2.cengagenow.com 5 My Home 8 Sold merchandise on account to Quinn Co., $15,010 with terms n/15. The cost of the merchandise sold was $10,190. Paid Moonlight Co. on account for purchase of November 3, less return of November 6. Sold merchandise on VISA, $231,570. The cost of the merchandise sold was $142,060. Paid Papoose Creek Co. on account for purchase of November 5. Received cash on account from sale of November 8 to Quinn Co. Purchased merchandise on account from Moonlight Co., list price $89,000, trade discount 30%, terms FOB destination, 2/10, n/30. Sold merchandise for cash, $38,210. The cost of the merchandise sold was $20,810.…arrow_forward

- Account Company X Company Y Company Z Cost of goods sold $4,270,000 $8,972,500 $6,778, 000 Inventory $ 504,000 $ 747,000 $ 633,600 What is the average number of days to sell inventory for Company Y? Note: Do not round your intermediate calculations. Use 365 days in a year. Multiple Choice 43.1 30.4 34.1 12.0arrow_forwardsh16 Abbey Co. sold merchandise to Gomez Co. on account, $34,000, terms 2/15, n/45. The cost of the goods sold was $14,693. Abbey Co. issued a credit memo for $4,100 for merchandise returned that originally cost $1,189. What is the amount of gross profit earned by Abbey Co. on these transactions? a.$13,504 b.$19,816 c.$16,396 d.$4,100arrow_forwardStyles Edit 2.131 4.15.1* 6.7.181 91 10. I 11 1 12.1 131 141 15 I PART (B): The following were selected from among the transactions completed by Fulah Design during December of the current year. Dec 3. Purchased merchandise on account from Jati Enterprise, list price RM22,000, trade discount 25%, term FOB shipping point, 2/10, n30, with prepaid transportation cost of RM660 added to the invoice. 5. Purchased merchandise on account from Ts ofa Enterprise, RM20,250, terms FOB destination, 2/10, n30. 6. Sold merchandise on account to Melati Wholesale, list price RM1 8,000, trade discount 35%, terms 2/10, n30. The cost of merchandise sold was RMS,250. 7. Returned RM2,800 of merchandise purchased on 5 December from Tsofa Enterprise. 13. Paid Jati Enterprise on account for purchase of 3 December, less discount. 15. Paid Tsofa Enterprise on account for purchase of 5 December, less return of December 7 and discount. 16. Received cash on account from sale of 6 December to Melati Wholes ale, less…arrow_forward

- Required information Problem 5-1A (Algo) Perpetual: Alternative cost flows LO P3 [The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 March 9 March 18. March 25 March 29 Gross Margin Sales Less: Cost of goods sold Gross profit Beginning inventory Purchase Sales Purchase Purchase. Activities Sales Totals $ $ FIFO Problem 5-1A (Algo) Part 4 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 120 units from beginning inventory, 250 units from the March 5 purchase, 100 units from the March 18 purchase, and 140 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest whole dollar.) 40,570 $ 25.220 15,350 $ Units Acquired at Cost 210 units @ $53.20 per unit 280 units $58.20 per unit LIFO…arrow_forwardes Required information Problem 6-2AA (Algo) Periodic: Alternative cost flows LO P3 [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 Activities Beginning inventory Purchase March 9 Sales March 18 March 25 March 29 Purchase Purchase Sales Units Acquired at Cost 125 units @ $60 per unit 425 units @ $65 per unit 170 units @ $70 per unit 250 units @ $72 per unit Units Sold at Retail 445 units @ $95 per.unit Totals 970 units 210 units @ $105 per unit 655 units For specific identification, units sold include 80 units from beginning inventory, 365 units from the March 5 purchase, 65 units from the March 18 purchase, and 145 units from the March 25 purchase. Problem 6-2AA (Algo) Part 3 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. Note: Round…arrow_forwardUnits Unit cost/Selling price P4.00 Aug. 1. Beginning Purchase Purchase 20,000 10,000 20,000 15,000 15,000 40,000 3,000 7 4.20 10 4.30 12 Sale 7,80 Purchase Sale Sales return 16 4.60 20 8.10 28 ? The sale return relates to the August 20 sale. 4. If the FIFO cost flow method is used, the sales return would be costed back into inventory at what total amount?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning