MANAGERIAL ACCT (LL) W/ ACCESS CODE >C

4th Edition

ISBN: 9781323478684

Author: Braun

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.65BP

Problems Group B

P9-65B Comprehensive budgeting problem (Learning Objectives 2 & 3)

Conrad Manufacturing is preparing its

| Current assets as of December 31 (prior year): | |

| Cash | $ 4.460 |

| Accounts receivable, net | $ 49,000 |

| Inventory | $ 15,600 |

| Property, plant, and equipment, net | $121,500 |

| Accounts payable | $ 43,000 |

| Capital stock | $127,000 |

| $ 22,800 |

- a. Actual sales in December were $76,000. Selling price per unit is projected to remain stable at $9 per unit throughout the budget period. Sales for the first five months of the upcoming year are budgeted to be as follows:

| January | $80,100 |

| February | $89,100 |

| March | $82,800 |

| April | $85,500 |

| May | $77,400 |

- b. Sales are 30% cash and 70% credit. All credit sales are collected in the month following the sale.

- c. Conrad Manufacturing has a policy stating that each month’s ending inventory of finished goods should be 10% of the following month’s sales (in units).

- d. Of each month’s direct materials purchases, 20% are paid for in the month of purchase, while the remainder is paid for in the month following purchase. Two pounds of direct material is needed per unit at $1.50 per pound. Ending inventory of direct materials should be 20% of next month’s production needs.

- e. Most of the labor at the manufacturing facility is indirect, but there is some direct labor incurred. The direct labor hours per unit is 0.03. The direct labor rate per hour is $13 per hour. All direct labor is paid for in the month in which the work is performed. The direct labor total cost for each of the upcoming three months is as follows:

| January | $3,510 |

| February | $3,834 |

| March | $3,600 |

- f. Monthly manufacturing overhead costs are $6,500 for factory rent, $2,900 for other fixed manufacturing expenses, and $1.40 per unit for variable manufacturing overhead. No

depreciation is included in these figures. All expenses are paid in the month in which they are incurred. - g. Computer equipment for the administrative offices will be purchased in the upcoming quarter. In January, the company will purchase equipment for $5,800 (cash), while February’s cash expenditure will be $11,600 and March’s cash expenditure will be $15,800.

- h. Operating expenses are budgeted to be $1.20 per unit sold plus fixed operating expenses of $1,400 per month. All operating expenses are paid in the month in which they are incurred. No depreciation is included in these figures.

- i. Depreciation on the building and equipment for the general and administrative offices is budgeted to be $4,900 for the entire quarter, which includes depreciation on new acquisitions.

- j. Conrad Manufacturing has a policy that the ending cash balance in each month must be at least $4,400. The company has a line of credit with a local bank. It can borrow in increments of $1,000 at the beginning of each month, up to a total outstanding loan balance of $160,000. The interest rate on these loans is 1% per month simple interest (not compounded). The company would pay down on the line of credit balance in increments of $1,000 if it has excess funds at the end of the quarter. The company would also pay the accumulated interest at the end of the quarter on the funds borrowed during the quarter.

- k. The company’s income tax rate is projected to be 30% of operating income less interest expense. The company pays $10,800 cash at the end of February in estimated taxes.

Requirements

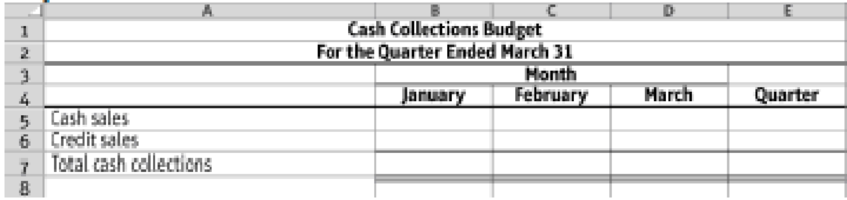

- 1. Prepare a schedule of cash collections for January, February, and March, and for the quarter in total.

9.5-60 Full Alternative Text

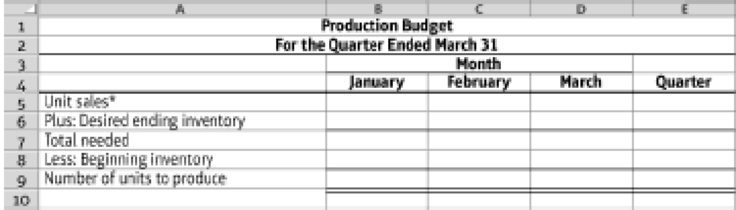

- 2. Prepare a production budget.

9.5-61 Full Alternative Text

*Hint: Unit sales = Sales in dollars/Selling price per unit

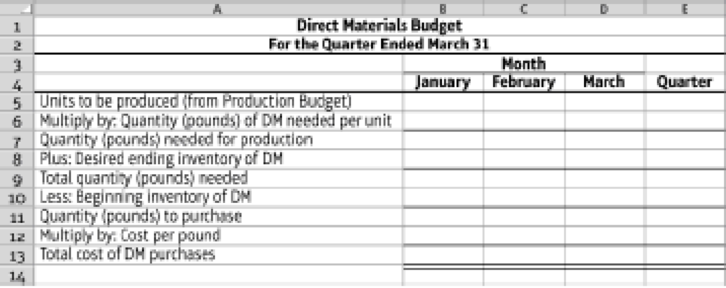

- 3. Prepare a direct materials budget.

9.5-62 Full Alternative Text

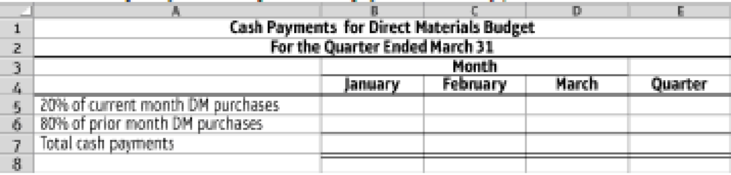

- 4. Prepare a cash payments budget for the direct material purchases from Requirement 3, using the following format. (Use the accounts payable balance at December 31 of prior year for the prior month payment in January.)

9.5-63 Full Alternative Text

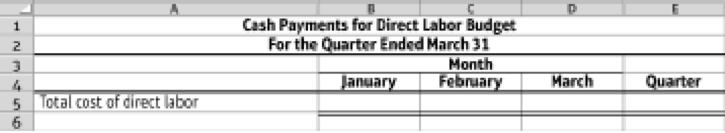

- 5. Prepare a cash payments budget for direct labor, using the following format:

9.5-64 Full Alternative Text

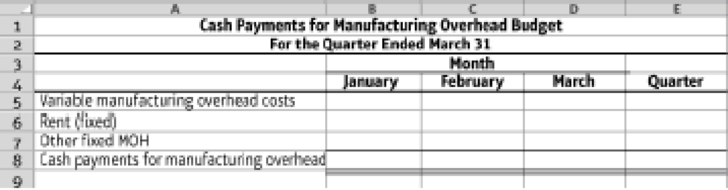

- 6. Prepare a cash payments budget for manufacturing overhead costs.

9.5-65 Full Alternative Text

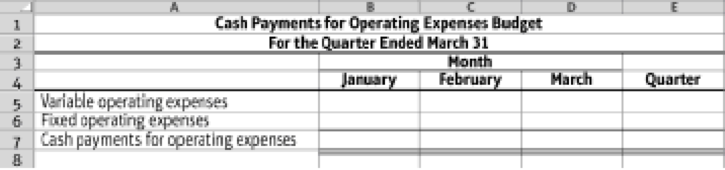

- 7. Prepare a cash payments budget for operating expenses.

9.5-66 Full Alternative Text

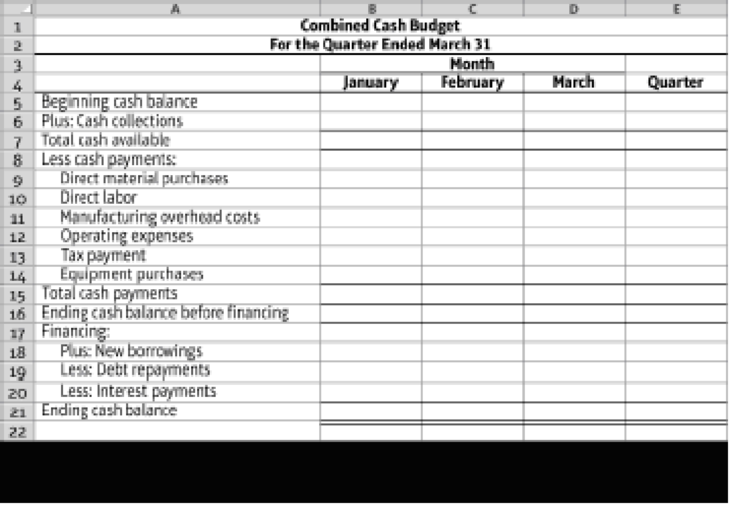

- 8. Prepare a combined

cash budget .

9.5-67 Full Alternative Text

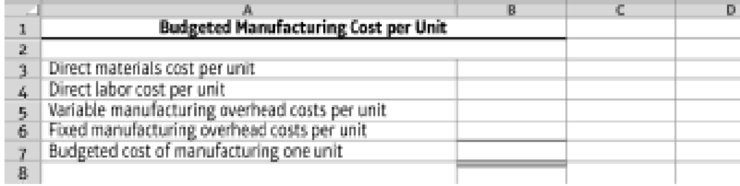

- 9. Calculate the budgeted

manufacturing cost per unit (assume that fixed manufacturing overhead is budgeted to be $0.70 per unit for the year).

9.5-68 Full Alternative Text

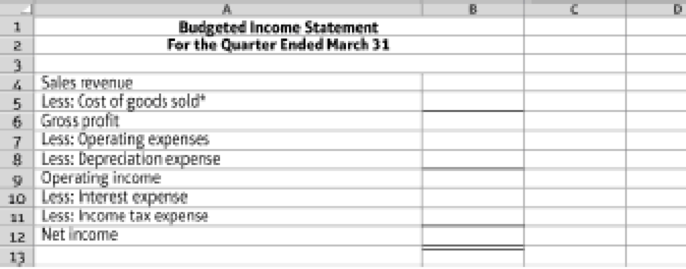

- 10. Prepare a

budgeted income statement for the quarter ending March 31.

9.5-69 Full Alternative Text

*Hint: Cost of goods sold = Budgeted cost of manufacturing one unit x Number of units sold

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Learning Objective 2

Product Costs and Product Profitability Reports, using a Single Plantwide Factory Overhead Rate

Isaac Engines Inc. produces three products-pistons, valves, and cams-for the heavy equipment

industry. Isaac Engines has a very simple production process and product line and uses a single

plantwide factory overhead rate to allocate overhead to the three products. The factory overhead

rate is based on direct labor hours. Information about the three products for 20Y2 is as follows:

Pistons

Valves

Cams

Budgeted

Volume

(Units)

6,000

13,000

1,000

Pistons

Direct Labor

Hours Per Unit

Valves

Cams

If required, round all per unit answers to the nearest cent.

a. Determine the plantwide factory overhead rate.

$

28 ✔per dlh

0.30

0.50

0.10

0.3 ✔ dlh

The estimated direct labor rate is $20 per direct labor hour. Beginning and ending inventories are

negligible and are, thus, assumed to be zero. The budgeted factory overhead for Isaac Engines is

$235,200.

0.5 dlh

0.1 ✓dlh

Price Per

Unit…

In Organizational Development (OD), each area of OD has its own budget to maintain. Please create a

spreadsheet indicating the following purchases for the different OD areas and the remaining balance for

each department based on the beginning budget and purchases as indicated.

The Center for the Advancement of Teaching

and Learning

Beginning Budget $60,000

Speaker

Books

Speaker Gifts

$2,000

100 @ $22.50 each

$200.00

Leadership Development

Beginning Budget $40,000

Retreat Location Rental

Retreat Lunch

Conference

Awards

$8,000

$11.00 each for 72

attendees

$9,000

$8,800

Creative and Strategic Initiatives

Beginning Budget $25,000

Camera

Software

Digital subscriptions

$7,000

$2,000

$550.00

E9-26A Budgeted income statement (Learning Objective 2)

Delta Labs performs a specialty lab test for local companies for $45 per test. For the

upcoming quarter, Delta Labs is projecting the following sales:

January

February

March

Number of lab tests

5,600

4,900

5,700

The budgeted cost of performing each test is $21. Operating expenses are projected to

be $59,000 in January, $57,000 in February, and $58,000 in March. Delta Labs is subject

to a corporate tax rate of 30%.

Requirement

Prepare a budgeted income statement for the first quarter, with a column for each month

and for the quarter.

Chapter 9 Solutions

MANAGERIAL ACCT (LL) W/ ACCESS CODE >C

Ch. 9 - (Learning Objective 1) Which term describes the...Ch. 9 - (Learning Objective 1) Benefits of budgeting...Ch. 9 - Prob. 3QCCh. 9 - Prob. 4QCCh. 9 - Prob. 5QCCh. 9 - Prob. 6QCCh. 9 - Prob. 7QCCh. 9 - Prob. 8QCCh. 9 - Prob. 9QCCh. 9 - Prob. 10QC

Ch. 9 - Short Exercises S9-1 Order of preparation and...Ch. 9 - Explain why companies use zero-based budgeting...Ch. 9 - Understanding key terms and definitions (Learning...Ch. 9 - Sales Budget (Learning Objective 2) Jefferson...Ch. 9 - Production budget (Learning Objective 2) Nichols...Ch. 9 - Direct materials budget (Learning Objective 2)...Ch. 9 - Prob. 9.7SECh. 9 - Prob. 9.8SECh. 9 - Prob. 9.9SECh. 9 - Prob. 9.10SECh. 9 - Prob. 9.11SECh. 9 - Cash payments budget (Learning Objective 3) Finley...Ch. 9 - Cash budget (Learning Objective 3) SaveCo...Ch. 9 - Prob. 9.14SECh. 9 - Prob. 9.15SECh. 9 - Identify ethical standards violated (Learning...Ch. 9 - Prob. 9.17AECh. 9 - Sales budget for a retail organization (Learning...Ch. 9 - Prob. 9.19AECh. 9 - Production budget (Learning Objective 2) Hoffman...Ch. 9 - Direct materials budget (Learning Objective 2)...Ch. 9 - Production and direct materials budgets (Learning...Ch. 9 - Direct labor budget (Learning Objective 2)...Ch. 9 - Manufacturing overhead budget (Learning Objective...Ch. 9 - Operating expenses budget and an income statement...Ch. 9 - Budgeted income statement (Learning Objective 2)...Ch. 9 - Prob. 9.27AECh. 9 - Cash collections budget (Learning Objective 3)...Ch. 9 - Cash payments budget (Learning Objective 3) The...Ch. 9 - Prob. 9.30AECh. 9 - Prob. 9.31AECh. 9 - Budgeted balance sheet (Learning Objective 3) Use...Ch. 9 - Prob. 9.33AECh. 9 - Prob. 9.34AECh. 9 - Cost of goods sold, inventory, and purchases...Ch. 9 - Cost of goods sold, inventory, and purchases...Ch. 9 - Prob. 9.37BECh. 9 - Prob. 9.38BECh. 9 - Prob. 9.39BECh. 9 - Prob. 9.40BECh. 9 - Direct materials budget (Learning Objective 2) Moe...Ch. 9 - Prob. 9.42BECh. 9 - Prob. 9.43BECh. 9 - Manufacturing overhead budget (Learning Objective...Ch. 9 - Prob. 9.45BECh. 9 - Prob. 9.46BECh. 9 - Prob. 9.47BECh. 9 - Prob. 9.48BECh. 9 - Prob. 9.49BECh. 9 - Combined cash budget (Learning Objective 3)...Ch. 9 - Sales and cash collections budgets (Learning...Ch. 9 - Prob. 9.52BECh. 9 - Prob. 9.53BECh. 9 - Prob. 9.54BECh. 9 - Prob. 9.55BECh. 9 - Prob. 9.56BECh. 9 - Comprehensive budgeting problem (Learning...Ch. 9 - Cash budgets under two alternatives (Learning...Ch. 9 - Comprehensive summary problem (Learning Objectives...Ch. 9 - Prob. 9.60APCh. 9 - Cash budgets (Learning Objective 3) Elis...Ch. 9 - Prob. 9.62APCh. 9 - Cost of goods sold, inventory, and purchases...Ch. 9 - Prob. 9.64APCh. 9 - Problems Group B P9-65B Comprehensive budgeting...Ch. 9 - Cash budgets under two alternatives (Learning...Ch. 9 - Comprehensive summary problem (Learning Objectives...Ch. 9 - Prob. 9.68BPCh. 9 - Cash budgets (Learning Objective 3) Ivans...Ch. 9 - Combined cash budget and a budgeted balance sheet...Ch. 9 - Prob. 9.71BPCh. 9 - Prepare comprehensive budgets for a retailer...Ch. 9 - Prob. 9.73SCCh. 9 - Discussion Questions 1. The sales budget is the...Ch. 9 - Budgeting for a Single Product In this activity,...Ch. 9 - Ethics and budgetary slack (Learning Objectives 1,...Ch. 9 - Prob. 9.77ACT

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare Hilton goods sold computations. 2. Prepare a combined cash budget similar to exhibits in the chapter. If no financing ac- P9-61A Cash budgets (Learning Objective 3) and cash disbursements: are as follows: Budgeted Sales Revenue $62,000 January $70,000 February. b. Actual purchases of direct materials in December were $24,500. The companye purchases of direct materials in January are budgeted to be $24,000 and $26.000 i February. All purchases are paid 40% in the month of purchase and 60% the follow month. c. Salaries and sales commissions are also paid half in the month earned and half the next month. Actual salaries were $8,000 in December. Budgeted salaries in Janu- ary are $9,000 and February budgeted salaries are $10,500. Sales commissions each month are 8% of that month's sales. d. Rent expense is $3,500 per month. e. Depreciation is $2,100 per month. f. Estimated income tax payments are made at the end of January. The estimated tax payment is projected to be $12,500. g.…arrow_forwardManagement Accounting Course Project – Part 1, B Group The Terranova Company is preparing information to complete its master budget for the quarter ending December 31, 2020. The company intends to make unit sales in the related months as follows: September 5,000 October 9,750 November 11,700 December 14,625 Units are to be sold for $10 each. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following the sale. *Required: 1) Prepare a sales budget for Terranova for the quarter ending December 31, 2020. Show activity by month and in total. (Hint: a quarter = 3 months.) 2) Complete a schedule of expected cash collections for the quarter ending December 31, 2020. Show activity by month and in total.arrow_forwardes The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the following data to use in preparing its budgeted balance sheet for next year: Cash Accounts receivable Supplies inventory Equipment Accumulated depreciation Accounts payable Common stock Retained earnings Ending Balances ? $ 9,200 $ 2,800 $ 39,500 $ 16,000 Current assets: $ 2,900 $ 5,000 ? The beginning balance of retained earnings was $28,000, net income is budgeted to be $17,800, and dividends are budgeted to be $3,700. Required: Prepare the company's budgeted balance sheet. (Amounts to be deducted should be indicated by a minus sign.) Mecca Copy Budgeted Balance Sheet Assetsarrow_forward

- Relevant data from the operating budget of The Framers are: Other data: Capital assets were sold in quarter 1 and $8,000 was collected in quarter 1 and $500 collected in quarter 2. Dividends of $500 will be paid in May The beginning cash balance was $50,000 and a required minimum cash balance is $10,000. Prepare a cash budget for the first two quarters of the year.arrow_forwardRelevant data from the Poster Companys operating budgets are: Additional data: Capital assets were sold in January for $10,000 and $4,500 in May. Dividends of $4,500 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the yeararrow_forwardMecca Copy, a photocopying center located on University Avenue, provided the following data to prepare a budgeted balance sheet for next year: Ending Balances eBook Hint Print Cash Accounts receivable Supplies inventory Equipment Accumulated depreciation Accounts payable Common stock Retained earnings ? $ 8,100 $ 3,200 $ 34,000 $ 16,000 $ 1,800 $ 5,000 ? The beginning balance of retained earnings was $28,000, budgeted net income is $11,500, and budgeted dividends are $4,800. Required: Prepare the company's budgeted balance sheet. Note: Amounts to be deducted should be indicated by a minus sign.arrow_forward

- Completing a comprehensive budgeting problem—merchandising Company Alliance Printing Supply of Baltimore has applied for a loan. Its bank has requested a budgeted income statement for April 2018 and a balance sheet at April 30, 2018. The March 31, 2018, balance sheet follows: As Alliance Printing Supply’s controller, you have assembled the following additional information: April dividends of $7,000 were declared and paid. April capital expenditures of $16,300 budgeted for cash purchase of equipment. April depreciation expense, $1,000. Cost of goods sold, 40% of sales. Desired ending inventory for April is $22,400. April selling and administrative expenses include salaries of $37,000, 30% of which will be paid in cash and the remainder paid next month. Additional April selling and administrative expenses also include miscellaneous expenses of 10% of sales, all paid in April. April budgeted sales, $89,000, 80% collected in April and 20°/0 in May. April cash payments of March 31…arrow_forwardApplying Excel: Master Budgeting Beech Corporation is a master budget for the 3rd quarter of the calendar year. The company’s balance sheet is shown below: June Corporation Balance Sheet June 30 Assets Cash $ 90,000 Accounts receivable 136,000 Inventory 62,000 Building + equipment, net of depreciation 210,000 Total assets $498,000 Liability and Stockholder’s Equity Accounts payable $ 71,100 Common stock 327,000 Retained earnings 99,900 Total liability and stockholder’s equity $498,000 Beech’s managers have made the following assumptions and estimates: Estimated sales for July, August, September, and October will be $210,000, $230,000, $220,000, and $240,000 respectively. All sales are credit and all credit sales are collected. (Note: there are no cash sales). Thirty-five percent (35%) the month’s credit sales are collected in the month the sales are made, and the remaining 65% is collected the…arrow_forwardRequired Information TES-417 Inc. is a retaller. Its accountants are preparing the company's 2nd quarter master budget. The company has the following balance sheet as of March 31. TES-417 Inc. Balance Sheet March 31 Assets Accounts receivable Inventory 129,880 52, see 217,000 Plant and equipment, net of depreciation. Total assets $ 480.500 Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings 55, see Total liabilities and stockholders' equity $ 480.500 TES-417 accountants have made the following estimates: 1. Sales for April, May, June, and July will be $280,000, $300,000, $290,000, and $310,000, respectively. 2. All sales are on credit. Each month's credit sales are collected 35% in the month of sale and 65% in the month following the sale. All of the accounts receivable at March 31 will be collected in April. 3. Each month's ending inventory must equal 25% of next month's cost of goods sold. The cost of goods sold is 75% of sales. The company pays for…arrow_forward

- Relevant data from the Poster Company’s operating budgets are: Quarter 1 Quarter 2 Sales $208,480 $211,540 Direct material purchases 115,300 120,832 Direct labor 75,205 73,298 Manufacturing overhead 25,300 25,400 Selling and administrative expenses 33,400 33,500 Depreciation included in selling and administrative 1,500 900 Collections from customers 215,392 240,154 Cash payments for purchases 114,290 119,254 Additional data:Capital assets were sold in January for $10,000 and $4,400 in May.Dividends of $4,600 were paid in February. The beginning cash balance was $60,360 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the year: If an amount box does not require an entry, leave it blank. The Poster CompanyCash BudgetFor the First Two Quarters Quarter 1 Quarter 2 $Beginning Cash Balance $Beginning Cash Balance Add: Cash Receipts Collections from Customers…arrow_forwardCheck my work The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the following data to use in preparing its budgeted balance sheet for next year: Ending Balances ? $ 8,100 Cash Accounts receivable Supplies inventory Equipment $ 3,200 $ 34,000 Accumulated depreciation $ 16,000 $ 1,800 $ 5,000 ? Accounts payable Common stock Retained earnings The beginning balance of retained earnings was $28,000, net income is budgeted to be $11,500, and dividends are budgeted to be $4,800. Required: Prepare the company's budgeted balance sheet. (Amounts to be deducted should be indicated by a minus sign.) Mecca Copy Budgeted Balance Sheet Assets Current assets: Total current assetsarrow_forwardSELF-DEVELOPMENT E-LIBRARY ZAIN HANDBOOKS Morgan Manufacturing is preparing its cash budget for the second quarter. The following amounts are budgeted for materials purchases: April $62.880 May $44,960 June $47.360 Morgan pays for 20% of its purchases in the month of purchase, 60% in the month following purchase, and 20% in the second month after purchase. What are Morgan's budgeted cash payments for purchases in June? O a. $93,120 Ob. $9,472 Oc. $39,552 O d. $49.024 Help Navt nan 10:06 AM РОСОРНONЕ 11/3/202 SHOT ON POCOPHONE F1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY