Concept explainers

a)

To determine: The decision table for the decision.

Introduction: Decision table is formats or visual representations were data is expressed arranged, determined and calculated to make a effective decision making. A decision table is a tabular representation that is used to analyze decision alternatives and states of nature.

b.

To determine: Maximax decision

Introduction:

Maximax is the decision making method which come decision making under uncertainty. This method finds an alternative that maximizes the maximum outcome of each alternative or we can say that calculating the maximum outcome within every alternatives.

c.

To determine: The minimax decision.

Introduction

Maximin is the decision making method which makes decision making under uncertainty. This method will find an alternative that maximizes the minimum outcome of every alternative or we can say that calculating the minimum outcome within the each alternative.

d.

To determine: Equally likely decision

Introduction

Equally likely is the decision method which come decision making under uncertainty. Under this condition, equal probability is assigned under each uncertainty state of nature.

e.

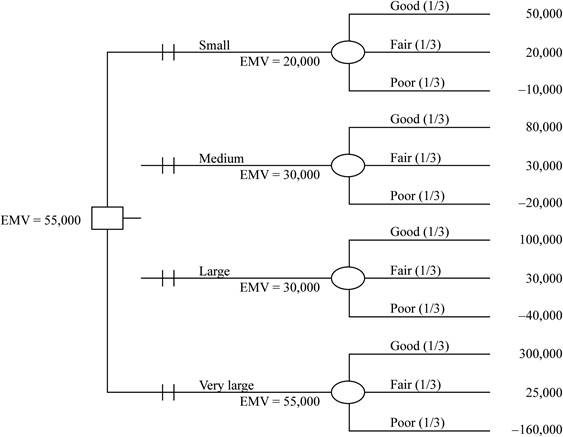

To draw: Decision tree. Assume each outcome is equally likely, and find the highest EMV.

Introduction:

Decision tree is graphical representation of decision making process which has state of nature, alternative, payoffs and their probabilities of outcomes.

EMV: It is expected value or payout that has different possible state of nature, each with their associated possibilities.

Formula:

Here probabilities are equal likely in each case. So probabilities of the be 1/3= 0.3333

Want to see the full answer?

Check out a sample textbook solution

Chapter A Solutions

Operations Management: Sustainability And Supply Chain Management, Global Edition

- Seas Beginning sells clothing by mail order. An important question is when to strike a customer from the companys mailing list. At present, the company strikes a customer from its mailing list if a customer fails to order from six consecutive catalogs. The company wants to know whether striking a customer from its list after a customer fails to order from four consecutive catalogs results in a higher profit per customer. The following data are available: If a customer placed an order the last time she received a catalog, then there is a 20% chance she will order from the next catalog. If a customer last placed an order one catalog ago, there is a 16% chance she will order from the next catalog she receives. If a customer last placed an order two catalogs ago, there is a 12% chance she will order from the next catalog she receives. If a customer last placed an order three catalogs ago, there is an 8% chance she will order from the next catalog she receives. If a customer last placed an order four catalogs ago, there is a 4% chance she will order from the next catalog she receives. If a customer last placed an order five catalogs ago, there is a 2% chance she will order from the next catalog she receives. It costs 2 to send a catalog, and the average profit per order is 30. Assume a customer has just placed an order. To maximize expected profit per customer, would Seas Beginning make more money canceling such a customer after six nonorders or four nonorders?arrow_forwardThis problem is based on Motorolas online method for choosing suppliers. Suppose Motorola solicits bids from five suppliers for eight products. The list price for each product and the quantity of each product that Motorola needs to purchase during the next year are listed in the file P06_93.xlsx. Each supplier has submitted the percentage discount it will offer on each product. These percentages are also listed in the file. For example, supplier 1 offers a 7% discount on product 1 and a 30% discount on product 2. The following considerations also apply: There is an administrative cost of 5000 associated with setting up a suppliers account. For example, if Motorola uses three suppliers, it incurs an administrative cost of 15,000. To ensure reliability, no supplier can supply more than 80% of Motorolas demand for any product. A supplier must supply an integer amount of each product it supplies. Develop a linear integer model to help Motorola minimize the sum of its purchase and administrative costs.arrow_forwardSolve Problem 1 with the extra assumption that the investments can be grouped naturally as follows: 14, 58, 912, 1316, and 1720. a. Find the optimal investments when at most one investment from each group can be selected. b. Find the optimal investments when at least one investment from each group must be selected. (If the budget isnt large enough to permit this, increase the budget to a larger value.)arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,