EP FINANCIAL+MANAGERIAL ACCT. >CUSTOM<

5th Edition

ISBN: 9781323590287

Author: *ST.LEO UNIV.

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter C, Problem 23E

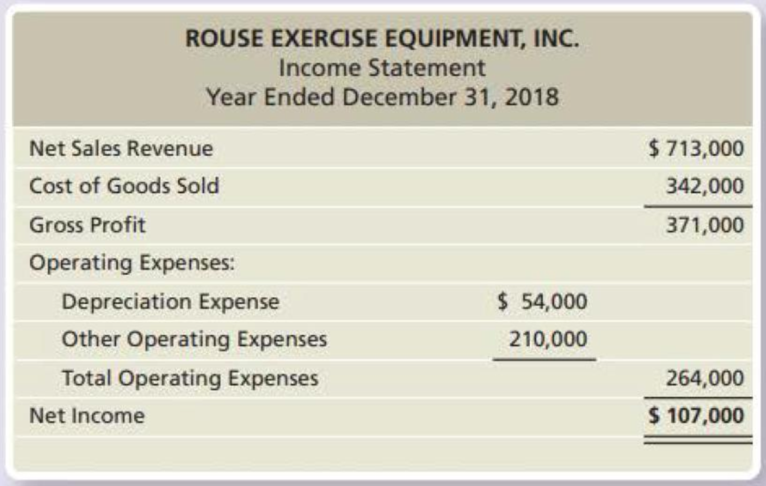

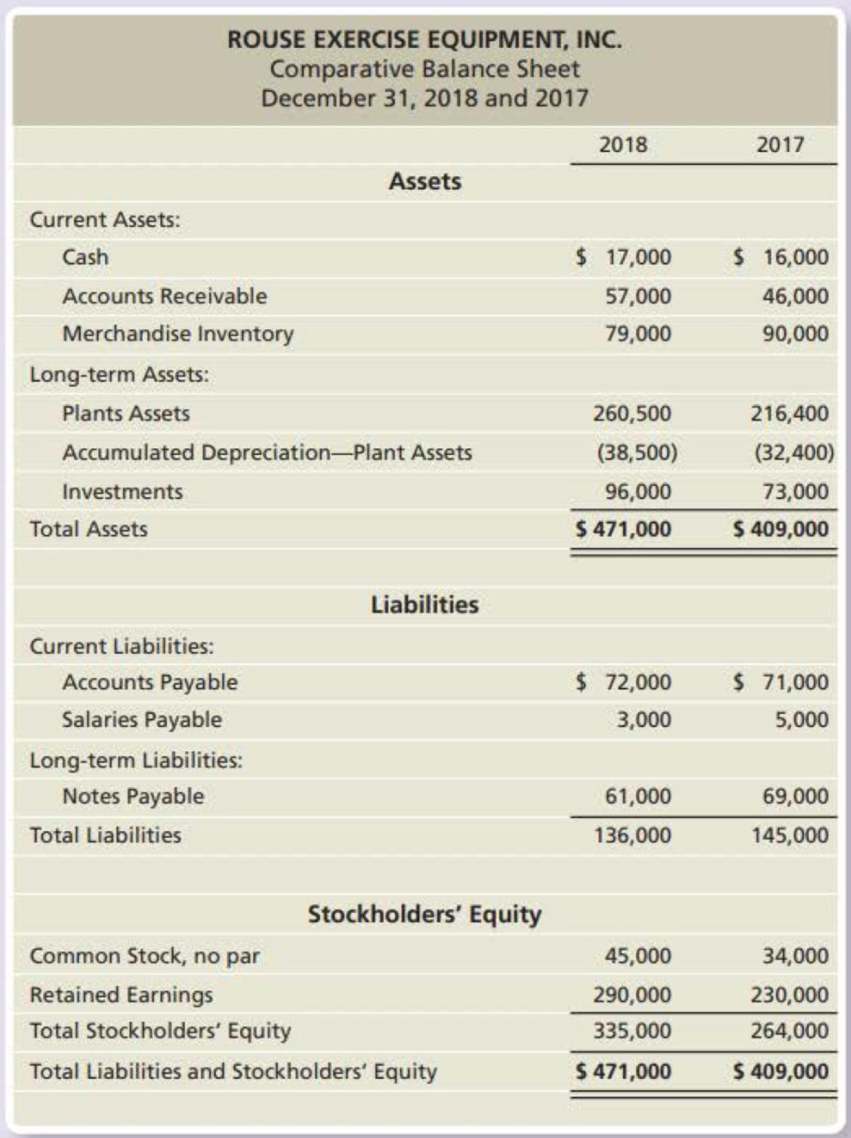

Rouse Exercise Equipment, Inc. reported the following financial statements for 2018:

Requirements

- 1. Compute the amount of Rouse Exercise’s acquisition of plant assets. Assume the acquisition was for cash. Rouse Exercise disposed of plant assets at book value. The cost and accumulated

depreciation of the disposed asset was $47,900. No cash was received upon disposal. - 2. Compute new borrowing or payment of long-term notes payable, with Rouse Exercise having only one long-term notes payable transaction during the year.

- 3. Compute the issuance of common stock with Rouse Exercise having only one common stock transaction during the year.

- 4. Compute the payment of cash dividends.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please answer all the parts of the below question:

At December 31, 2017, Sheffield Corporation reported the following plant assets.

Land

$ 3,798,000

Buildings

$26,660,000

Less: Accumulated depreciation—buildings

15,097,050

11,562,950

Equipment

50,640,000

Less: Accumulated depreciation—equipment

6,330,000

44,310,000

Total plant assets

$59,670,950

During 2018, the following selected cash transactions occurred.

Apr.

1

Purchased land for $2,785,200.

May

1

Sold equipment that cost $759,600 when purchased on January 1, 2011. The equipment was sold for $215,220.

June

1

Sold land for $2,025,600. The land cost $1,266,000.

July

1

Purchased equipment for $1,392,600.

Dec.

31

Retired equipment that cost $886,200 when purchased on December 31, 2008. No salvage value was received.

Prepare a tabular summary that includes the plant asset accounts and…

The information that follows relates to equipment owned by Pearl Limited at December 31, 2017:

Cost

$7,560,000

Accumulated depreciation to date

840,000

Expected future net cash flows (undiscounted)

5,880,000

Expected future net cash flows (discounted, value in use)

5,334,000

Fair value

5,208,000

Costs to sell (costs of disposal)

42,000

Assume that Pearl will continue to use this asset in the future. As at December 31, 2017, the equipment has a remaining useful life of four years. Pearl uses the straight-line method of depreciation.

Assume that Pearl is a private company that follows ASPE.

1.

Prepare the journal entry at December 31, 2017, to record asset impairment, if any.

2.

Prepare the journal entry to record depreciation expense for 2018.

3.

The equipment’s fair value at December 31, 2018, is $5.46 million. Prepare the journal entry, if any, to record the increase in fair value.

Repeat the requirements in (a) above assuming that Pearl…

Barnum Company acquired several small companies at the end of 2018, and based On the acquisitions, reported the following intangible assets on its December 31, 2018, balance sheet.How much amortization expense should the company recognize on each intangible asset in 2019?

Chapter C Solutions

EP FINANCIAL+MANAGERIAL ACCT. >CUSTOM<

Ch. C - Identify each item as operating (O), investing...Ch. C - Identify each item as operating (O), investing...Ch. C - Identify each item as operating (O), investing...Ch. C - Identify each item as operating (O), investing...Ch. C - Identify each item as operating (O), investing...Ch. C - Prob. 6TICh. C - Prob. 7TICh. C - Prob. 8TICh. C - Muench Inc.s accountant has partially completed...Ch. C - Prob. 1QC

Ch. C - Prob. 2QCCh. C - Prob. 3QCCh. C - Prob. 4QCCh. C - Prob. 5QCCh. C - Prob. 6QCCh. C - Prob. 7QCCh. C - Prob. 8QCCh. C - Prob. 9QCCh. C - Prob. 10QCCh. C - Prob. 1RQCh. C - Prob. 2RQCh. C - Prob. 3RQCh. C - Prob. 4RQCh. C - Prob. 5RQCh. C - Prob. 6RQCh. C - Prob. 7RQCh. C - If a company experienced a loss on disposal of...Ch. C - Prob. 9RQCh. C - Prob. 10RQCh. C - Prob. 11RQCh. C - Prob. 12RQCh. C - Prob. 13RQCh. C - Prob. 14RQCh. C - How does the direct method differ from the...Ch. C - Prob. 16RQCh. C - Prob. 1SECh. C - Prob. 2SECh. C - Prob. 3SECh. C - DVR Equipment, Inc. reported the following data...Ch. C - Prob. 5SECh. C - Prob. 6SECh. C - Prob. 7SECh. C - Prob. 8SECh. C - Prob. 9SECh. C - Julie Lopez Company expects the following for...Ch. C - Prob. 11SECh. C - Prob. 12SECh. C - Prob. 13SECh. C - Prob. 14SECh. C - Prob. 15SECh. C - Prob. 16ECh. C - Prob. 17ECh. C - Prob. 18ECh. C - Prob. 19ECh. C - Prob. 20ECh. C - The income statement of Boost Plus, Inc. follows:...Ch. C - Prob. 22ECh. C - Rouse Exercise Equipment, Inc. reported the...Ch. C - Use the Rouse Exercise Equipment data in Exercise...Ch. C - Prob. 25ECh. C - Prob. 26ECh. C - Prob. 27ECh. C - Prob. 28ECh. C - Prob. 29ECh. C - Prob. 30ECh. C - Prob. 31ECh. C - American Rare Coins (ARC) was formed on January 1,...Ch. C - Prob. 33APCh. C - Prob. 34APCh. C - Prob. 35APCh. C - Boundary Rare Coins (BRC) was formed on January 1,...Ch. C - Use the Rolling Hills, Inc. data from Problem...Ch. C - Prob. 38APCh. C - Classic Rare Coins (CRC) was formed on January 1,...Ch. C - Accountants for Benson, Inc. have assembled the...Ch. C - Prob. 41BPCh. C - Prob. 42BPCh. C - Prob. 43BPCh. C - Use the Sweet Valley data from Problem P14-41B....Ch. C - Prob. 45BPCh. C - Prob. 47PCh. C - Before you begin this assignment, review the Tying...Ch. C - Prob. 1DCCh. C - Prob. 1EICh. C - Details about a companys cash flows appear in a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received $12,000,000 in net assets. In 2016, the market value of the goodwill obtained from Branta Corp. was valued at $4,000,000, but in 2017 it dropped to $2,000,000. Prepare the journal entry for the creation of goodwill and the entry to record any impairments to it in subsequent years.arrow_forwardOn December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions: Required: 1. Check the accuracy of the accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. 2. Prepare journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance.arrow_forwardAt December 31, 2022, Ayayai Corporation reported the following plant assets. Land $ 3,003,000 Buildings $26,510,000 Less: Accumulated depreciation—buildings 11,936,925 14,573,075 Equipment 40,040,000 Less: Accumulated depreciation—equipment 5,005,000 35,035,000 Total plant assets $52,611,075 During 2023, the following selected cash transactions occurred. Apr. 1 Purchased land for $2,202,200. May 1 Sold equipment that cost $600,600 when purchased on January 1, 2016. The equipment was sold for $170,170. June 1 Sold land for $1,601,600. The land cost $1,001,000. July 1 Purchased equipment for $1,101,100. Dec. 31 Retired equipment that cost $700,700 when purchased on December 31, 2013. No salvage value was received. Journalize the transactions. Ayayai uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no salvage…arrow_forward

- On January 1, 2021, Bambi Ltd. purchased equipment for $728,000. The equipment was assumed to have an 8-year useful life and no residual value and was to be depreciated using the straight-line method. On January 1, 2023, Bambi's management became concernedthat the equipment may have become obsolete. Management calculated that the undiscounted future net cash flows from the equipment was $523,250, the discounted future net cash flows was $464,100, and the current fair value of the equipment less cost ofdisposal (of $1,800 ) was $455,000. (a)Assuming that Bambi is a private Canadian company following ASPE, identify which model should be used to test for impairment. b) Record the journal entry to record the impairment loss, if any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and…arrow_forwardOn January 1, 2021, Bambi Ltd. purchased equipment for $728,000. The equipment was assumed to have an 8-year useful life and no residual value and was to be depreciated using the straight-line method. On January 1, 2023, Bambi's management became concernedthat the equipment may have become obsolete. Management calculated that the undiscounted future net cash flows from the equipment was $523,250, the discounted future net cash flows was $464,100, and the current fair value of the equipment less cost ofdisposal (of $1,800 ) was $455,000. c) Assuming that Bambi is a public Canadian company, identify which model should be used to test for impairment. d) Record the journal entry to record the impairment loss, if any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit…arrow_forwardSEAT Inc. acquired the following assets in January of 2015. Equipment, estimated service life, 5 years; salvage value, $16,200 $503,700 Building, estimated service life, 30 years; no salvage value $648,000 The equipment has been depreciated using the sum-of-the-years’-digits method for the first 3 years for financial reporting purposes. In 2018, the company decided to change the method of computing depreciation to the straight-line method for the equipment, but no change was made in the estimated service life or salvage value. It was also decided to change the total estimated service life of the building from 30 years to 40 years, with no change in the estimated salvage value. The building is depreciated on the straight-line method. (a) Prepare the journal entry to record depreciation expense for the equipment in 2018. (b) Prepare the journal entry to record depreciation expense for the building in 2018.arrow_forward

- In January 1, 2015, Fun company purchased Company A for $40,000 in cash and paid immediately. Fun company assumed all of Company A's assets and assumed Company A's liabilities. company A has assets valued at $60,000 and liabilities valued at $50,000. Question 2: in 2016, fun company must test for the impairment of goodwill. Assume the only goodwill on fun company's books is from the acquisition of company A. Fun company determined that the goodwill has an estimated future cash flow of $25,000 and a fair market value of $20,000. Does fun company have to recognize an impairment? Why or why not? If an impairment must be recognized, compute the impairment loss and record the journal entry. ACTUAL QUESTION: suppose that the estimated future cash flow of goodwill in question #2 is $32,000, while the fair market value continues to be $20,000. Does fun company have to recognize an impairment? Why or why not? If an impairment must be recognized, compute the impairment loss and record the…arrow_forwardOn December 31, 2019, the statement of financial position of Twitter Corporation showed the following property and equipment after charging depreciation: Building P3,000,000 Accumulated depreciation (1,000,000) P2,000,000 Equipment 1,200,000 Accumulated depreciation (400,000) 800,000 The company has adopted the revaluation model for the valuation of property and equipment. This has resulted in the recognition in prior periods of an asset revaluation surplus for the building of P140,000. The company does not make a transfer to retained earnings in respect of realized revaluation surplus. On December 31, 2019, an independent valuer assessed the fair value of the building to be P1,600,000 and the equipment to be P900,000. The building and equipment had remaining useful lives of 25 years and 4 years, respectively, as of that date. The revaluation surplus as of December 31 2020 is a. 0 b. 75000 c. 14000 d. 100000arrow_forwardOn December 31, 2019, the statement of financial position of Twitter Corporation showed the following property and equipment after charging depreciation: Building P3,000,000 Accumulated depreciation (1,000,000) P2,000,000 Equipment 1,200,000 Accumulated depreciation (400,000) 800,000 The company has adopted the revaluation model for the valuation of property and equipment. This has resulted in the recognition in prior periods of an asset revaluation surplus for the building of P140,000. The company does not make a transfer to retained earnings in respect of realized revaluation surplus. On December 31, 2019, an independent valuer assessed the fair value of the building to be P1,600,000 and the equipment to be P900,000. The building and equipment had remaining useful lives of 25 years and 4 years, respectively, as of that date. The amount to be recognized in profit or loss for 2019 related to the revaluation of property and…arrow_forward

- On December 31, 2019, the statement of financial position of Twitter Corporation showed the following property and equipment after charging depreciation: Building P3,000,000 Accumulated depreciation (1,000,000) P2,000,000 Equipment 1,200,000 Accumulated depreciation (400,000) 800,000 The company has adopted the revaluation model for the valuation of property and equipment. This has resulted in the recognition in prior periods of an asset revaluation surplus for the building of P140,000. The company does not make a transfer to retained earnings in respect of realized revaluation surplus. On December 31, 2019, an independent valuer assessed the fair value of the building to be P1,600,000 and the equipment to be P900,000. The building and equipment had remaining useful lives of 25 years and 4 years, respectively, as of that date. The revaluation surplus as of December 31, 2020 is Group of answer choices P140,000 P100,000…arrow_forwardBramble Company, organized in 2020, has the following transactions related to intangible assets. 1/2/20 Purchased patent (6-year life) $474,000 4/1/20 Goodwill purchased (indefinite life) 360,000 7/1/20 14-year franchise 588,000 9/1/20 Research and development costs 166,000 (a1) Prepare the necessary entries to record these intangibles. All costs incurred were for cash. Make the adjusting entries as of December 31, 2020, recording any necessary amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) date Account title and explanation debit CREDITarrow_forwardPoe Company disclosed that the depreciation policy on machinery is as follows: - A full year depreciation is taken in the year of acquisition. - No depreciation in the year of disposition. - The estimated useful life is five years. - The straight line method is used. On June 30, 2018, the entity sold for P 2 300 000 a machine acquired in 2015 for P 4 200 000. The residual value was P 600 000. What amount of the gain on the disposal should be recorded in 2018?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License