MANGERIAL ACC.(LOOSE)W/CONNECT CUST.>IC

16th Edition

ISBN: 9781260636864

Author: Garrison

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter IE, Problem 3IE

INTEGRATION EXERCISE 3 Absorption Costing. Variable Costing. Cost-Volume-Profit-Relationships LO5-4, LO5-5, LO5-7, LO6-1, LO6-2

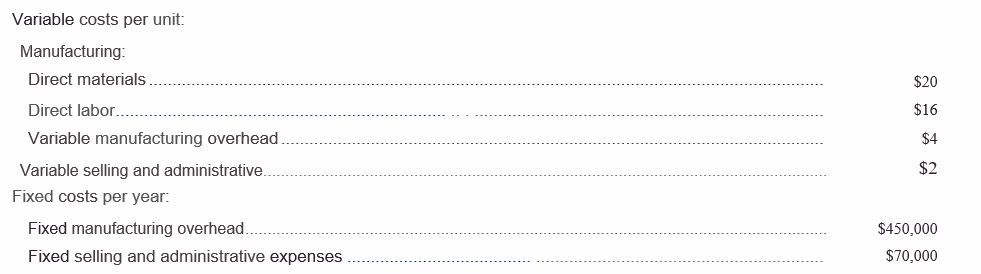

Newton Company manufactures and sells one product The companyassembled the following projections for its first year of operations:

During its first year of operations Newton expects to produce 25,000 units and sell 20,000 units. The budgeted selling price of the company's only product is $66 per unit.

Required(answer each question independently by referring to the original data):

- Assuming that Newton’s projections are accurate, what will be its absorption costing net operating income in its first year of operations?

- Newton is considering investing in a higher quality raw material that will increase its direct materials cost by $1per unit.Itestimates that the higher quality raw material will increase sales by1,000 units. What will be the company’s revised absorption costing net operating income if it invests in the higher quality raw material and continues to produce25,000 units?

- Newton is considering raising its selling price by $1.00 per unit with an expectation that it will lower unit sales by 1,500 units. What wall be the company’s revised absorption costing net operating income if itraises its price by $1.00 and continues to produce 25,000 units?

- Assuming that Newton’s projections are accurate, what will be its variable costing net operating income in its first year ofoperations?

- Newton is considering investing in a higher quality raw material that will increase its direct materials cost by $1 per unit. It estimates that the higher quality raw material will increase sales by1,000 units. What will be the company’s revised variable costing net operating income if it invests in the higher quality raw material and continues to produce25,000 units?

- Newton is considering raising its selling price by $1.00 per unit with an expectation that it will lower unit sales by 1,500 units. What will be the company’s revised variable costing net operating income if it raises its price by $1.00 andcontinues to produce 25,000 units? 7. What is Newton's break-even point in unit sales? What is its break-even point in dollar sales?

8. Whatis the company’s projected margin of safety in its first year of operations?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter IE Solutions

MANGERIAL ACC.(LOOSE)W/CONNECT CUST.>IC

Ch. IE - Prob. 10IECh. IE -

INTEGRATION EXERCISE 11 Financial Statement Ratio...Ch. IE - INTEGRATION EXERCISE 12 Cost-Volume-Profit...Ch. IE - INTEGRATION EXERCISE 13 Master Budgeting,...Ch. IE - Prob. 1IECh. IE - Prob. 2IECh. IE - INTEGRATION EXERCISE 3 Absorption Costing....Ch. IE - Prob. 4IECh. IE - Prob. 5IECh. IE - Prob. 6IE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY