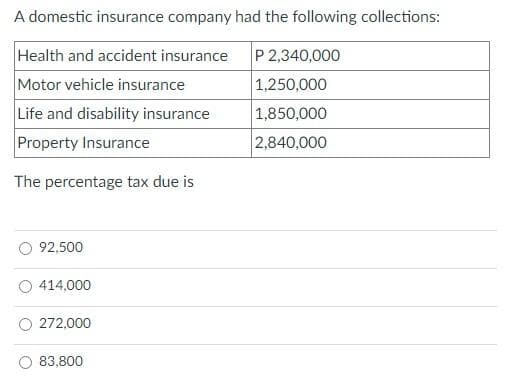

A domestic insurance company had the following collections: Health and accident insurance Motor vehicle insurance Life and disability insurance Property Insurance The percentage tax due is O 92,500 414,000 O 272,000 83,800 P 2,340,000 1,250,000 1,850,000 2,840,000

Q: 12. Government assistance is action by government designed to provide an economic benefit specific…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: 2. Consider the following international transactions, which together make up all the transaction of…

A: Balance of Payments (BoP) for an economy = Current A/c Balance (Trade in goods & services, etc.)…

Q: Susan Mills, Company B's chief accountant, has developed an automated costing system that helps…

A: Susan Mills, the chief accountant of Company B, observed that the new Costing system is able to…

Q: payable is Historical Maturity value Discounted cash-flow valuation at current effective rates…

A: The bond payable is considered to be liability for the firm and cooperations because they involve…

Q: Accounting Enjoy Limited is an education center that provides education services to students in Hong…

A: Solution Income statement is also called profit or loss statement that shows company's…

Q: KEW Enterprises began operations in January 20X1 to manufacture a hand sanitizer that promised to be…

A: Preparation of worksheet are as follows

Q: Your audit of Hemsworth Company’s accounts receivable and its related allowance for doubtful…

A: Introduction A provision for doubtful accounts is a response asset since it affects the value of an…

Q: Restoring balance to the nitrogen cycle is one of the challenges facing engineers. Improving the…

A: Concept of Discounted Cash flow:- This is the concept related to discounted cash flow. The…

Q: Olabisi operates a lawn care service in southeastern Missouri. Olabisi incurs $63,000 of expenses…

A: This statement is FALSE.

Q: Check order TOTAL Adjusted Balance 689.45 2043 Adjusted Balance 23.45 848.48 What are the two errors…

A: Bank Reconciliation Statement Statements of bank reconciliation confirm that cash receipts have been…

Q: Question 3. A small hazardous waste treatment plant is considering two processes bellow. The plant…

A: Net present value refers to the capital budgeting method widely used by large companies to determine…

Q: LO.2 Ed, an employee of the Natural Color Company, suffered from a rare disease that was very…

A: Gross income: - Gross income refers to the total income earned by an individual before any deduction…

Q: Account Name Cash M4 Engineering, Inc. Adjusted Trial Balance For the Year Ended December 31, 2020…

A: The financial statements of the business include the income statement and balance sheet. The…

Q: On January 1, 20x1, ABC Co. issued its 8%, ₱2,000,000 bonds. Principal is due on December 31, 20x3…

A: Effective Interest method: It is a method of bond amortization. This method takes into account two…

Q: 14 He rented an office space which was already fully furnished for a monthly rental of P15,000. Gave…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: entory on cost 35, Tems. balance to Crop Company on November 13. (Assume both companies use a…

A: The journal entries are prepared to record the transactions on regular basis. Using perpetual…

Q: Please answer with reason for all why the option is correct and why the other options are incorrect…

A: Independence in Auditing Independent auditors are chartered or certified public accountants who look…

Q: Crown Co. can produce two types of lamps, the Enlightner and Foglighter. The data on the two lamp…

A: In order to determine the Breakeven point in dollars, the fixed cost are required to be divided by…

Q: 1. A partial listing of cost incurred during December at Gwapa Corp. appears below: Factory overhead…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: Required information [The following information applies to the questions displayed below.] Diego…

A: Answer : Variable cost = Direct material + Direct labor + Variable manufacturing overhead =…

Q: East Hill Home Healthcare Services was organized five years ago by four friends who each invested…

A: A Sole Proprietorship is a business that is owned or controlled by an individual. A Partnership is…

Q: 1. Accounting estimate are a specific principles, bases, conventions, rules and practices applied by…

A: Hi, as you have posted multiple sub parts, but as per the bartleby policy we only able to solve the…

Q: ts) A tornado recently destroyed all but $1,305,000 of Orr Corp.'s inventory. Beginning inventory…

A: Given, Inventory destroyed by tornado = $1,305,000. Opening inventory = $2,175,000. Inventory…

Q: What are the ways to escape financial fraud? And why is it important to prevent it?

A: Any type of misrepresentation, forgery and mislead which harms the financial health of an…

Q: Calculate the taxable value of the benefit for Jenny's employer for provision of the motor vehicle…

A: According to the given question, we are required to compute the taxable value of the benefit.…

Q: how people use debt, the tax deductions for debt, the loan process, application of debt, 0 %…

A: ANSWER FOR FIRST EXAMPLE:- Debt repayment tenure If a debt is for $100,000 and the tenure is for 20…

Q: Margaret's Maid Service began the year with total assets of $133000 and stockholders' equity of…

A: Stockholders' equity: Stockholders' equity means the net assets available to shareholders after…

Q: Describe the accounting for intangible assets, such as patents, copyrights, and goodwill.

A: Fixed assets are the resources acquired for earning economical benefits for more than a year. These…

Q: The dividen rate of taxation for a higher tax bracker earler is: a. 12.5% Ob. 32.5% O c. 38.1% Od.…

A: According to the given question, we are required to find out the correct option from the available…

Q: 2. What journal entry must Lowe’s make when a customer purchases and pays for, but does not yet use,…

A: The gift card is one of the incentives to customer for boosting the sales of the…

Q: E3.4 (LO 1), C The following independent situations require professional judgment for determining…

A: A generally accepted accounting principle (GAAP) called revenue recognition specifies the particular…

Q: You are to buy a new machine for building a new type of rockets for Wiley Coyote. You have two…

A: The question is based on the concept of Financial Management. Net present worth is the difference…

Q: QUESTIONS: Based on the above date and result of the audit, compute the following: Dividend revenue…

A: An unrealized gain or loss is paper trading where no stock is actually sold. It is to be done by…

Q: Jayden now has $500. How much would he have after 5 years if he leaves it invested at 6.1% with…

A: calculation of amount after 5 years are as follows

Q: Two Sisters is a partnership that owns and operates a farm. During the current year, the partnership…

A: The amount realized by two sisters from exchange= $30,000 (in terms of young horse value) Cost of…

Q: answer numbers 12-15 with complete solution. incomplete answer will be given down vote

A: 12.Prevention cost: Quality engineering P65000 Quality circles…

Q: Does someone need to start a business from scratch to be called an entrepreneur?Disscuss

A: Yes someone need to start a business from scratch to be called an entrepreneur. Most people envision…

Q: nts) Which of the following accounts should be credited each time a sale on account is made if the…

A: Perpetual inventory system: It is a method of inventory management that records real time…

Q: he budget director of Gourmet Grill Company requests estimates of sales, production, and other…

A: Preparation of sales budget and production budget of Gourmet grill company are as follows Sales…

Q: Quality Cut Steak Company uses a perpetual inventory system. The records of Quality Cut Steak…

A: preparation of single step income statement and multi step income statement and other necessary…

Q: Data concerning a recent period’s activity in the Prep Department, the first processing department…

A: Process costing is used in an organization where a similar kind of product is produced and goods are…

Q: Record the journal entries necessary to correct each of the errors mentioned above. Narrations are…

A: I) Record the journal entries necessary to correct each of the errors mentioned above. Narrations…

Q: Compound Interest Applications Use the TVM Calculator to solve the following compound interest…

A: The question is based on the concept of Financial Management. Using the excel for the required…

Q: B C 1 Cash and book breakeven calculation example 2 A company has $2.1 million of sales today, SG&A…

A:

Q: End of Chapter: Merchandising Options E-F:5-24 Journalizing purchase and sales transactions…

A: Introduction: A transaction is a business event that has a monetary effect on a company's financial…

Q: X-1 Corp's total assets at the end of last year were $450,000 and its EBIT was $55,000. What was its…

A: Introduction: The Basic Earning Power Ratio (BEP) measures how well a firm generates earnings in…

Q: P Ltd owns 55% of the shares of S Ltd. Each share entitles the holder to one vote at the AGM. The…

A: A subsidiary in the business sector is a business that is a part of another business, which is…

Q: Product Costs using Activity Rates Nozama.com Inc. sells consumer electronics over the Internet. Fo…

A: Activity-based costing is a technique where the total cost of manufacturing a product is determined.…

Q: provide the cost of good sold statement of jan 2022 from the beginning balances and journal entries…

A: Statement showing the Cost of goods sold : Direct material used: Material, January 1.…

Q: What is a POS System? A system has 5 main components, what are Who are the primary stakeholders in…

A: We will answer the first three parts of the multi-part question you have here for free. Please…

Step by step

Solved in 2 steps

- PLEASE USE THIS INFORMATION TO FILL OUT FORM 1040 Gross Income: Salary $38,000 Alimony received $14,400 Rental receipts $50,000 Disability insurance payments $1,200 Interest income from corporate bonds $2,200 Interest income from municipal bonds $0 (1) Gross income $105,800 Deductions for AGI: Expenses for rental property $19,500 (2) Total for AGI deductions $19,500 (3) AGI $86,300 From AGI deductions: Medical expenses $4,358 State income taxes $6,590 Charitable contributions $14,240 (4) Total itemized deductions $25,188 (5) Standard deduction $18,800 (6) Greater of itemized deductions or standard deductionselected answer correct $25,188 (7) Taxable income $61,112 (8) Tax on taxable income $7,741 (9) Credits $(685) (10) Tax prepayments $11,380 Tax refundselected answer correct $(4,324)2. Nix Company had the following balances in its general ledger before the entries for requirement (1) were made: Employee federal income tax payable $2,500 Social Security tax payable 2,008 Medicare tax payable 470 FUTA tax payable 520 SUTA tax payable 4,510 a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--.An employee earned $45, 800 during the year working for an employer when the maximum limit for Social Security was 5137,700. The Federal Insurance Contributions Act (FICA) tax rate for Social Security is 6.2% and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45%. The employee's annual Federal Insurance Contributions Act (FICA) taxes amount is: Multiple Choice $6,343 30 53,503.70 $7,007.4056,343.30. S 3,503.70. ο $7,007.40. Ο $2,839.60. $664.10.

- Nix Company had the following balances in its general ledger before the entries for requirement (1) were made: Employee federal income tax payable $2,500 Social Security tax payable 2,008 Medicare tax payable 470 FUTA tax payable 520 SUTA tax payable 4,510 a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--. b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--. c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.A property/casualty insurer sold a one-year insurance policy for $480 on July 1. The insurer incurred $144 in underwriting expenses for the policy. Disregarding losses, what is the insurer's pre-tax net income from this policy in the year the policy was written under statutory accounting rules? A-$144 B $ 96 C $168 D $236The following information pertains to Cherry City’s liability for claims and judgments:Current liability at January 1, 2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . $200,000Claims paid during 2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . 900,000Current liability at December 31, 2018 . . . . . . . . . . . . . . . . . . . .. . . . . 240,000Noncurrent liability at December 31, 2018 . . . . . . . . . . . . . . . .. . . . . 200,000What amount should Cherry report for 2018 claims and judgment expenditures?a. $1,140,000b. $940,000c. $840,000d. $900,000

- 1. for 2021, Forrway corporation, an accrual basis calendar year corporation, had net income per books of $ 111,550 and the following transactions: premiums on life insurance policy on its key employees-$6000 excess capital losses $2000 excess tax depreciation $9000 life insurance proceeds on life of its key employees $55000 rent income received in 2021 $40000 ( $30000 is prepaid and related to 2021) tax exempt interest income $8000 federal income tax liability for 2021 $15450 prepaid rent received and properly taxed in 2020 ( but not earned for financial accounting purpose until 2021) $15000 interest expense on tax exempt interest income item $2000 The taxable income for Forrway corporation for the tax year of 2021 is ( as computed in its schedule M-1 reconciliation) $90000 $100000 $80000 $70000 23. for 2021, Forrway corporation, an accrual basis calendar year corporation, had net income per books of $ 111,550 and the following transactions: premiums on life insurance policy on its…As of January 31, Hammond Auto Supply's general ledger balances, listed in alphabetical order of accounts, are as follows: Accounts Balance Accounts Payable $4,738.00 Accounts Receivable 5,486.00 Cash 17,172.64 Employees' Federal Income Tax Payable 876.00 Equipment 3,650.00 Federal Unemployment Tax Payable 50.88 FICA Social Security Tax Payable 788.64 FICA Medicare Tax Payable 184.44 Freight In 251.00 J. Hammond, Capital 38,451.00 J. Hammond, Drawing 980.00 Merchandise Inventory 20,564.00 Miscellaneous Expense 232.00 Payroll Tax Expense 880.86 Prepaid Insurance 385.00 Purchases 7,781.00 Purchases Discounts 70.70 Purchases Returns and Allowances 366.00 Rent Expense 761.00 Salary Expense 6,360.00 Sales 19,395.30 Sales Discounts 32.90 Sales Returns and Allowances 48.00 State Unemployment Tax Payable 343.44 Supplies 680.00 Prepare a trial balance as of January 31, 20--. List all the accounts in the proper order as described and…In EB13, you prepared the journal entries for Janet Evanovich, an employee of Marc Associates. You have now been given the following additional information: June is the first pay period for this employee. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to the employee. FICA Social Security and FICA Medicare match employee deductions. The employer is responsible for 60% of the health insurance premium. The employer matches 50% of employee pension plan contributions. Using the information from EB13 and the additional information provided: A. Record the employer payroll for the month of June, dated June 30, 2017. B. Record the payment in cash of all employer liabilities only on July 1.

- According to a summary of the payroll of Sinclair Company, $505,000 was subject to the 6.0% social security tax and $545,000 was subject to the 1.5% Medicare tax. Also, $10,000 was subject to state and federal unemployment taxes. Question Content Area Required: a. Compute the employer's payroll taxes using the following rates: State unemployment, 4.2%; Federal unemployment, 0.8%.$ fill in the blank bdfee804ffc2f82_1 Question Content Area b. Journalize the entry for the employer's payroll tax expense. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select -The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable — 212 Social Security Tax Payable $16,302 213 Medicare Tax Payable 4,290 214 Employees Federal Income Tax Payable 26,455 215 Employees State Income Tax Payable 25,740 216 State Unemployment Tax Payable 2,717 217 Federal Unemployment Tax Payable 858 218 U.S. Saving Bond Deductions Payable 6,000 219 Medical Insurance Payable 49,800 411 Operations Salaries Expense 1,732,000 511 Officers Salaries Expense 1,130,000 512 Office Salaries Expense 287,000 519 Payroll Tax Expense 245,960 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2 Issued Check No. 410 for $6,000 to Jay Bank to purchase U.S. savings bonds for employees. Dec. 2 Issued Check No. 411 to Jay Bank for $47,047 in payment of $16,302 of social security tax, $4,290 of Medicare tax, and…[The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,000 $ 1,500 b. 2,000 2,100 c. 132,900 9,500 Exercise 11-9 (Algo) Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer’s September 30 journal entry to record the employer’s payroll taxes expense and its related liabilities. Record the employer's September 30 payroll taxes expense and its related liabilities. Note: Enter debits before credits. Date General Journal Debit Credit September 30 Payroll taxes expense FICA—Social security taxes payable FICA—Medicare taxes payable Federal…