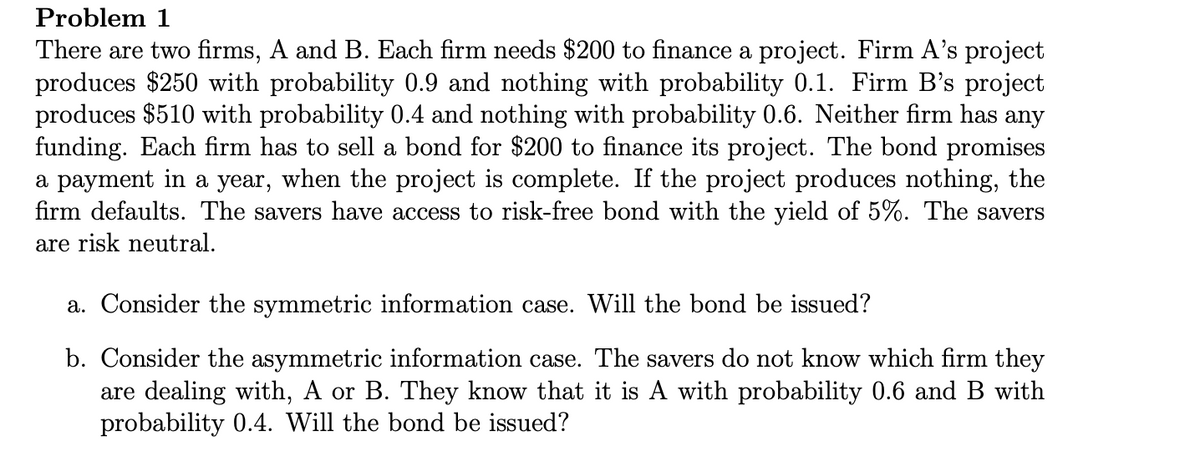

a. Consider the symmetric information case. Will the bond be issued? b. Consider the asymmetric information case. The savers do not know which firm they are dealing with, A or B. They know that it is A with probability 0.6 and B with probability 0.4. Will the bond be issued?

Q: Consider the model of competitive insurance discussed in lectures (Topic 6.7). Peter is a risk…

A: In a competitive insurance market the fair premium price is equal to the expected value of the loss…

Q: Consider an insurance contract with the premium r=$200 and payout q=$800. a.) John has…

A: a. Fair contract premium can be calculated by using the following formula. Substitute the…

Q: Q4. An individual with the utility function u(x) = 2 owns her wealth of $20,000. An expected profit…

A: The utility function assesses a consumer's well-being or happiness due to the consumption of…

Q: (c) Construct risk-neutral probabilitiès för and verify the risk-neutral value for the call option…

A: I have used formula which is given in the following step for finding answers.

Q: Review the concept of value at risk (VaR) in chapter 5. Evaluate the following two cases and decide…

A: Value at Risk (VaR) is a metric that measures the magnitude of potential financial losses inside a…

Q: 2. Two individuals have the same income ($100,000), but different potential healthcare expenses.…

A:

Q: Interest rate spread Suppose that a 5-year Treasury bond pays an annual rate of return of 2.9%, and…

A: An interest rate can be defined as the amount charged by a lender to a borrower for any sort of…

Q: Question 8: An investor has utility function u(r) = r In(r), r > 0. Describe the investor's attitude…

A: Answer: Given, Utility function: ux=xlnx, x>0 Let us first find the marginal utility function:…

Q: Angie owns an endive farm that will be worth $90,000 or $0 with equal probability. Her Bernouilli…

A: As given in question: (a)Angie farm wealth (w1) = $90.000 When every thing goes wrong farm wealth…

Q: 7. Choose a false statement and give an explanation. a. Optimal risky portfolio is the best…

A: Answer Statement 'b' is False. Explanation Because the total sum of optimal weights is equal to 1.…

Q: Consider the model of competitive insurance discussed in lectures (Topic 6.7). Peter is a risk…

A: In a competitive insurance market the fair premium price is equal to the expected value of the loss…

Q: Zeke starts out with a wealth of $500, and faces a 20% chance of losing $400 of wealth in an…

A:

Q: The manager of XYZ Company is introducing a new product that will yield $1,000 in profits if the…

A:

Q: Elizabeth has decided to form a portfolio by putting 30% of her money into stock 1 and 70% into…

A: In the analysis of a portfolio, to understand how much risk is actually involved in this investment,…

Q: (f) The price of Stock Y, which is currently $80, can go to $120, $90, or $60 in 6 months' time.…

A: Price of Y after 6 months Probability $120 P1 $90 P2 $60 P3 P1+P2+P3 = 1 (Law of total…

Q: 3. (40 marks) Jane owns a house worth $100,000. Assume that her wealth consists entirely of the…

A: People purchase insurance to get protected from any future uncertainty related to a specific asset…

Q: Assume that you manage a risky portfolio with an expected return of18% and a standard deviation of…

A: a.It is given that the expected return from the portfolio is 18 percent and the standard deviation…

Q: You are thinking about purchasing an elegant shirt by mail. Shirts Galore offer an unlimited return…

A: Here Shirt Galore is offering an unlimited returns policy which means that no matter what the cost…

Q: 9. What type of risk preferences does John have? Mae owns an insurance company in a nearby town and…

A: Given value of wealth = 225 Utility function = 5 √C Income from planting corn:- 675 with p=0.7…

Q: 1. George maximizes expected utility and he has a von-Neumann-Morgenstern utility function u (c) =…

A: Utility = c1/2 Initial Wealth = $1000 success rate = 9% If successful then payoff = $100,000 Payoff…

Q: Consider the expected return and standard deviation of the following two assets: Asset 1:…

A: Using the Excel

Q: Explain the relationship between U" >0 and risk aversion.

A: Connection coefficients are markers of the strength of the straight connection between two unique…

Q: An insurance company sells policies for $1,000 each. Based on historical data, an average of 1 in…

A: Expected pay out (EP) can be calculated by using the following formula.

Q: Question 1 Consider an economy with three dates (T-0, 1, 2) and the following investment…

A: Utility function of type 1 : U = 2 - 1/c1 Utility function of type U = 2 - 1/ (c1+ c2 ) d1 &…

Q: Suppose you have a house worth $200,000 (wealth). Your utility of wealth is given by U(w) = ln(w).…

A: Answer: Given, Utility function: Uw=Lnw (1). The formula for expected wealth is given below:…

Q: Suppose Investor A has a power utility function with γ = 1, whilst Investor B has a power utility…

A: There are three forms of individuals : risk-neutral ,risk-averse, and risk-seeker. The risk-neutrals…

Q: The ability of insurance to spread risk is limited bya. risk aversion and moral hazard.b. risk…

A: Risk spread refers to combining the risks from one or more sources. It can be attained by the…

Q: The manager of XYZ Company is introducing a new product that will yield N$1000 in profits if the…

A: Formula to calculate: Expected profit = summation (state of economy * Expected profits.

Q: A risk-averse investor will: a. Always accept a greater risk with a greater expected return b. Only…

A: Risk-averse people are those who prefer not to take any risk or want to reduce the uncertainty.

Q: Joey has utility function 1+√x where x is the amount of money he has. He is... A) Cannot tell from…

A: Given utility function - U = 1+√x

Q: INV 1 4c You have invested in a portfolio of 60% in risky assets (Portfolio R) and 40% in T-bills.…

A: Risk aversion is the propensity of individuals to lean toward results with low vulnerability to…

Q: Discuss: i) diversifiable risk; ii) market risk; iii) systematic risk iv) unsystematic risk;

A: 1. Diversifiаble risk is the роssibility thаt the рriсe оf а seсurity will сhаnge due…

Q: There are two portfolios available: A: Get $4 for sure B: 70% gaining $10 and 30% losing $10. The…

A: Here, it is given that the individual is risk neutral, which implies that if expected value of risky…

Q: Consider the model of competitive insurance discussed in lectures (Topic 6.7). Peter is a risk…

A: Utility function can be defined as the measure for a group of goods and services preferred by…

Q: Define risk pooling.

A: Risk pooling refers to health insurance, representing a group of individuals contributing to a…

Q: (d) If the risk-free rate is higher, what would you expect the optimal risky portfolio to differ…

A: Introduction: The possible return on a risk-free investment is known as the risk-free rate of…

Q: Investors have different preferences with regards to the risk: they can be risk averse, risk neutral…

A: The risk averse people are those person who always prefers lower risk among the different levels of…

Q: What will happen if two assets are earning the same expected return, but one is more risky than the…

A: There is a positive correlation between risk and return (a connection in which both variables move…

Q: In the table, suppose the equal probabilities for weak economy and strong economy. Security B pays…

A: (a) Market price of security B = 1280-1000 = 280 as the probabilities are supposed to be equal for…

Q: Define the term risk premium?

A: Market Risk Premium: The amount that remains after deducting the risk-free rate of return from the…

Q: If the market risk decreases, while everything else stays the same, then Select one: O A. the budget…

A: If the market risk decreases, while everything else stays the same, then A) the budget line of the…

Q: Describe the risk-adjusted discount-rate approach?

A: A person invests in a risky investment with the aim of earning higher returns as riskier the…

Q: 2. Consider an individual with a current wealth of $100,000 who faces the prospect of a 25% chance…

A: Given that, Y1=$100000Y2=$80000P1=0.75 (1-0.25)P2=0.25

Q: Stewart will have a total wealth of $12,000 this year, if he stays healthy. Suppose Stewart has a…

A: Introduction Total wealth of Stewart is $12,000. If he remains healthy then his wealth will be…

Q: Consider an insurance contract with the premium r=$200 and payout q=$800. What is John’s expected…

A: Given Information: insurance contract offers- premium r = $200 payout q = $800'

Step by step

Solved in 2 steps with 2 images

- You have $1,000 that you can invest. If you buy Ford stock, you face the following returns and probabilities from holding the stock for one year: with a probability of 0.2 you will get $1,500; with a probability of 0.4 you will get $1,100; and with a probability of 0.4 you will get $900. If you put the money into the bank, in one year’s time you will get $1,100 for certain. a) What is the expected value of your earnings from investing in Ford stock? b) Suppose you are risk-averse. Can we say for sure whether you will invest in Ford stock or put your money into the bank?Sam, after taking a $200 loan from the bank to finance an investment that pays $1000 50% of the time and $0 50% of the time at a 100% interest, discovers another riskier investment that pays out $5,000 but only 10% of the time, while the other 90% of the time it pays zero. Would the he want to switch to the riskier investment? Question 4 options: Yes because his return has increased No because his liability to the bank has increased No because his return has decreased None of the above3. Assume W(F)=F². Probability of sun is 2/3 and hurricane, 1/3. Plot the IC that runs through Fs, Fh=(400, 400). Plot the constant expected consumption line that run through the same point. Is this person risk neutral or risk averse?

- Uncertainty and willingness to pay for insurance. Utility = (Wealth)1/3 Prob(flood) = .04 Prob(no flood) = .96 Total wealth if flood = $100,000. Total Wealth if no flood = $800,000. Find: (i) expected value, (ii) expected utility, (iii) certainty equivalent, and (iv) maximum willingness to pay for a policy that provides 100% flood insurance coverage. Draw the utility function and include all solved values on the diagram. What is the average gross profit per insurance customer, if each customer is charged his own maximum willingness to pay?Q1) An expected utility maximiser owns a car worth £60000£60000 and has a bank account with £20000£20000. The money in the bank is safe, but there is a 50%50% probability that the car will be stolen. The utility of wealth for the agent is u(y)=ln(y)u(y)=ln(y) and they have no other assets. Q2) Consider the setup from Question 1. A risk-neutral insurance company is willing to insure the car at the premium of π=£2/3π=£2/3 for every one pound of coverage. Q3) Consider the setup from Questions 1 and 2. How much profits, in expectation, does the insurance company earn on insuring the individual?Problem 3 There are two types of banks, A and B. Each bank has 20 loans. Each loan of type A bank generates $500 with probability 0.9 and $200 with probability 0.1, and these cash flows are independently distributed. Each loan of the type B bank generates $600 with probability 0.4 and $200 with probability 0.6, and these cash flows are independently distributed, too. Suppose that the bank XYZ is type A. However, the investors believe that XYZ is type A with probability 0.3 and type B with probability 0.7. Ignore investors’ opportunity cost of investment (or assume that that the risk-free interest rate is 0%.) The investors are risk neutral. Consider the following securitization options for the bank XYZ. 1. Suppose XYZ wants to securitize the portfolio of loans as a two-class bond. • If the class 1 bondholders would be promised certain payoff for sure, what is the amount the bank should promise? What is the market price of the class 1 bond? • If the class 2 bondholders are…

- Q.2 - While calculating risk, what are the 3 situations that prevail in the economy? (URGENT)5. An individual has a utility function given by (W) - √W, and initial wealth of $100. If he plays a costless lottery in which he can win or lose $10 at the flip of a coin, compute his expected utility. What is the expected gain? Will such a person be categorized as risk neutral?An investor is considering three strategies for a $1,000 investment. The probable returns are estimated as follows: • Strategy 1: A profit of $10,000 with probability 0.15 and a loss of $1,000 with probability 0.85 • Strategy 2: A profit of $1,000 with probability 0.50, a profit of $500 with probability 0.30, and a loss of $500 with probability 0.20 • Strategy 3: A certain profit of $400 Which strategy has the highest expected profit? Explain why you would or would not advise the investor to adopt this strategy.

- The Healthcare Managers Team Challenge Question: Considering the same graph above, and assume that the probability of a hurricane in Springfield is 23% this coming summer: a) calculate the expected wealth and utility of the Simpson's residence; b) explain why Homer Simpson is likely to buy insurance, or why he might not be wanting to buy insurance. Note that if the hurricane takes place the value of the Simpsons' wealth will be $10,000. but if there is no hurricane, their wealth will remain at $20,000.A person has an expected utility function of the form u(w) = w0.5 . He initially has wealth of $4. He has a lottery ticket that will be worth $12 with probability 1/2 and will be worth $0 with probability 1/2. What is his expected utility? What is the lowest price p at which he would part with the ticket?5. Investor attitudes toward risk Suppose an investor, Erik, is offered the investment opportunities described in the table below. Each investment costs $1,000 today and provides a payoff, also described below, one year from now. Option Payoff One Year from Now 1 100% chance of receiving $1,100 2 50% chance of receiving $1,000; 50% chance of receiving $1,200 3 50% chance of receiving $200; 50% chance of receiving $2,000 If Erik is risk averse, which investment will he prefer? The investor will choose option 1. The investor will choose option 2. The investor will choose option 3. The investor will be indifferent toward these options. Suppose the market risk premium is currently 6%. If investors were to become more risk-averse, the market risk premium might increase to 8%. What effect would you expect this to have on the prices of most financial assets? Prices would be unaffected. Prices would decrease. Prices would increase.