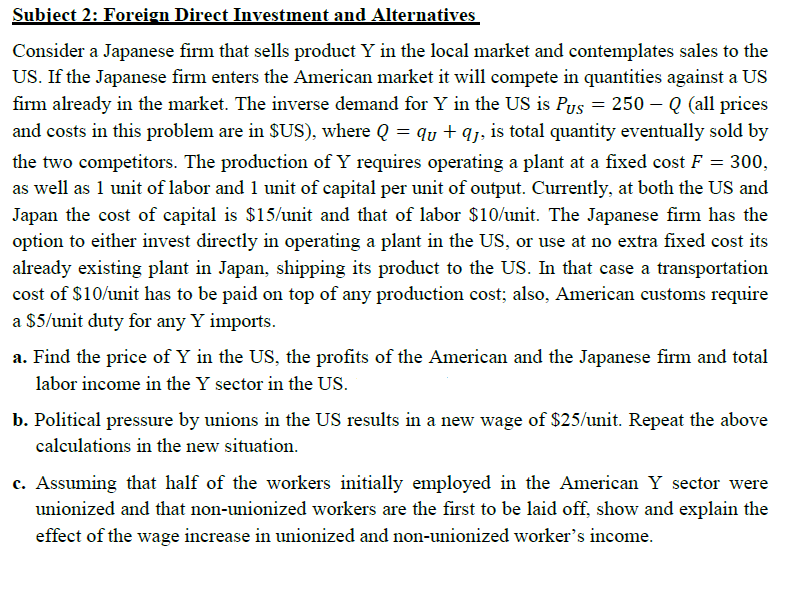

Consider a Japanese firm that sells product Y in the local market and contemplates sales to the US. If the Japanese firm enters the American market it will compete in quantities against a US firm already in the market. The inverse demand for Y in the US is Pus = 250 - Q (all prices and costs in this problem are in $US), where Q = qu + q1, is total quantity eventually sold by the two competitors. The production of Y requires operating a plant at a fixed cost F = 300, as well as 1 unit of labor and 1 unit of capital per unit of output. Currently, at both the US and Japan the cost of capital is $15/unit and that of labor $10/unit. The Japanese firm has the option to either invest directly in operating a plant in the US, or use at no extra fixed cost its already existing plant in Japan, shipping its product to the US. In that case a transportation cost of $10/unit has to be paid on top of any production cost; also, American customs require a $5/unit duty for any Y imports.

Consider a Japanese firm that sells product Y in the local market and contemplates sales to the US. If the Japanese firm enters the American market it will compete in quantities against a US firm already in the market. The inverse demand for Y in the US is Pus = 250 - Q (all prices and costs in this problem are in $US), where Q = qu + q1, is total quantity eventually sold by the two competitors. The production of Y requires operating a plant at a fixed cost F = 300, as well as 1 unit of labor and 1 unit of capital per unit of output. Currently, at both the US and Japan the cost of capital is $15/unit and that of labor $10/unit. The Japanese firm has the option to either invest directly in operating a plant in the US, or use at no extra fixed cost its already existing plant in Japan, shipping its product to the US. In that case a transportation cost of $10/unit has to be paid on top of any production cost; also, American customs require a $5/unit duty for any Y imports.

Chapter15: Imperfect Competition

Section: Chapter Questions

Problem 15.10P: Inverse elasticity rule Use the first-order condition (Equation 15.2 ) for a Cournot firm to show...

Related questions

Question

Transcribed Image Text:Subject 2: Foreign Direct Investment and Alternatives

Consider a Japanese firm that sells product Y in the local market and contemplates sales to the

US. If the Japanese firm enters the American market it will compete in quantities against a US

firm already in the market. The inverse demand for Y in the US is Pus = 250 – Q (all prices

and costs in this problem are in $US), where Q = qy + qj, is total quantity eventually sold by

the two competitors. The production of Y requires operating a plant at a fixed cost F = 300,

as well as 1 unit of labor and 1 unit of capital per unit of output. Currently, at both the US and

Japan the cost of capital is $15/unit and that of labor $10/unit. The Japanese firm has the

option to either invest directly in operating a plant in the US, or use at no extra fixed cost its

already existing plant in Japan, shipping its product to the US. In that case a transportation

cost of $10/unit has to be paid on top of any production cost; also, American customs require

a $5/unit duty for any Y imports.

a. Find the price of Y in the US, the profits of the American and the Japanese firm and total

labor income in the Y sector in the US.

b. Political pressure by unions in the US results in a new wage of $25/unit. Repeat the above

calculations in the new situation.

c. Assuming that half of the workers initially employed in the American Y sector were

unionized and that non-unionized workers are the first to be laid off, show and explain the

effect of the wage increase in unionized and non-unionized worker's income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning