Cash Accounts receivable Inventory Prepaid rent Equipment Accumulated depreciation-equipment Total assets Accounts payable Income tax payable Long-term loans payable Common shares Retained earnings Total liabilities and shareholders' equity $58,374 58,100 42,800 6,200 168,000 (34,000) $299,474 $50,950 4,000 60,000 126,550 57,974 $299,474 $53,800 51,800 72,500 4,000 129,000 (25,900) $285,200 $35,000 6,200 70,000 126,550 47,450 $285,200

Cash Accounts receivable Inventory Prepaid rent Equipment Accumulated depreciation-equipment Total assets Accounts payable Income tax payable Long-term loans payable Common shares Retained earnings Total liabilities and shareholders' equity $58,374 58,100 42,800 6,200 168,000 (34,000) $299,474 $50,950 4,000 60,000 126,550 57,974 $299,474 $53,800 51,800 72,500 4,000 129,000 (25,900) $285,200 $35,000 6,200 70,000 126,550 47,450 $285,200

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 54CE

Related questions

Question

prepare a statement of cash flows using the indirect method.

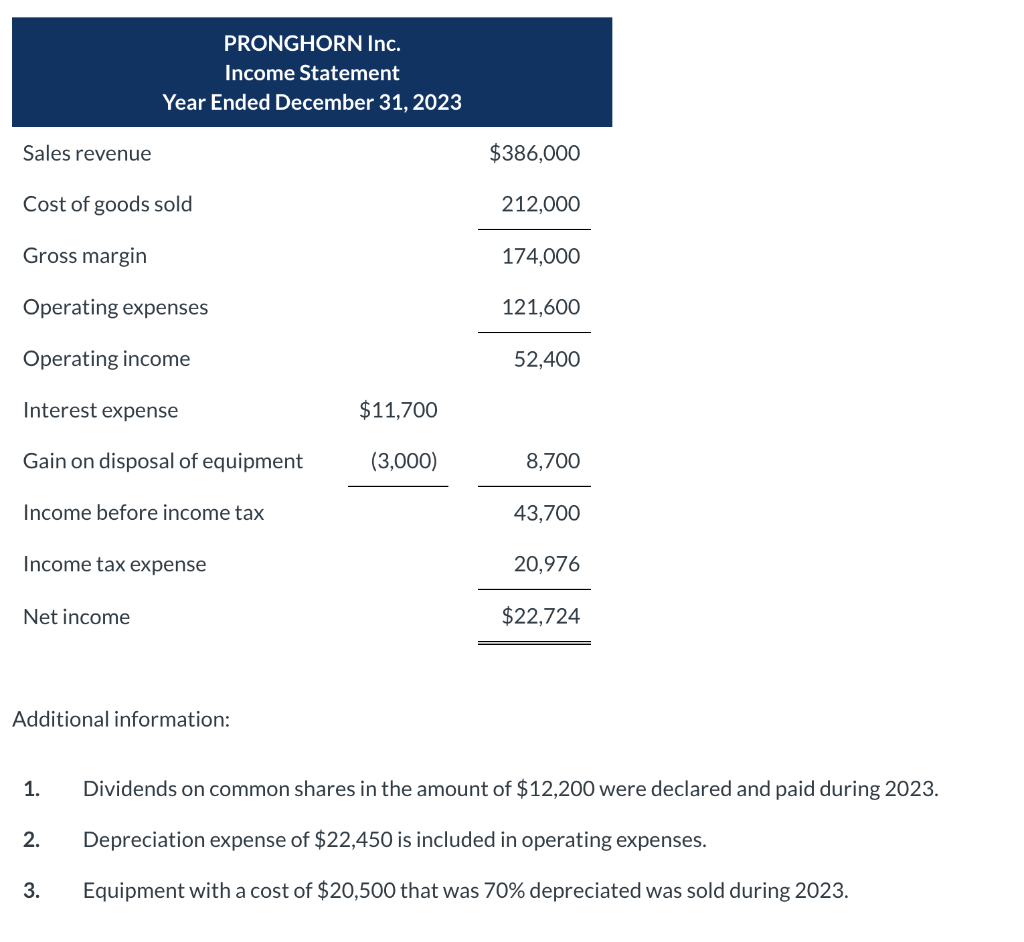

Transcribed Image Text:Sales revenue

Cost of goods sold

Gross margin

Operating expenses

Operating income

Interest expense

Gain on disposal of equipment

Income before income tax

Income tax expense

Net income

PRONGHORN Inc.

Income Statement

Year Ended December 31, 2023

Additional information:

1.

2.

3.

$11,700

(3,000)

$386,000

212,000

174,000

121,600

52,400

8,700

43,700

20,976

$22,724

Dividends on common shares in the amount of $12,200 were declared and paid during 2023.

Depreciation expense of $22,450 is included in operating expenses.

Equipment with a cost of $20,500 that was 70% depreciated was sold during 2023.

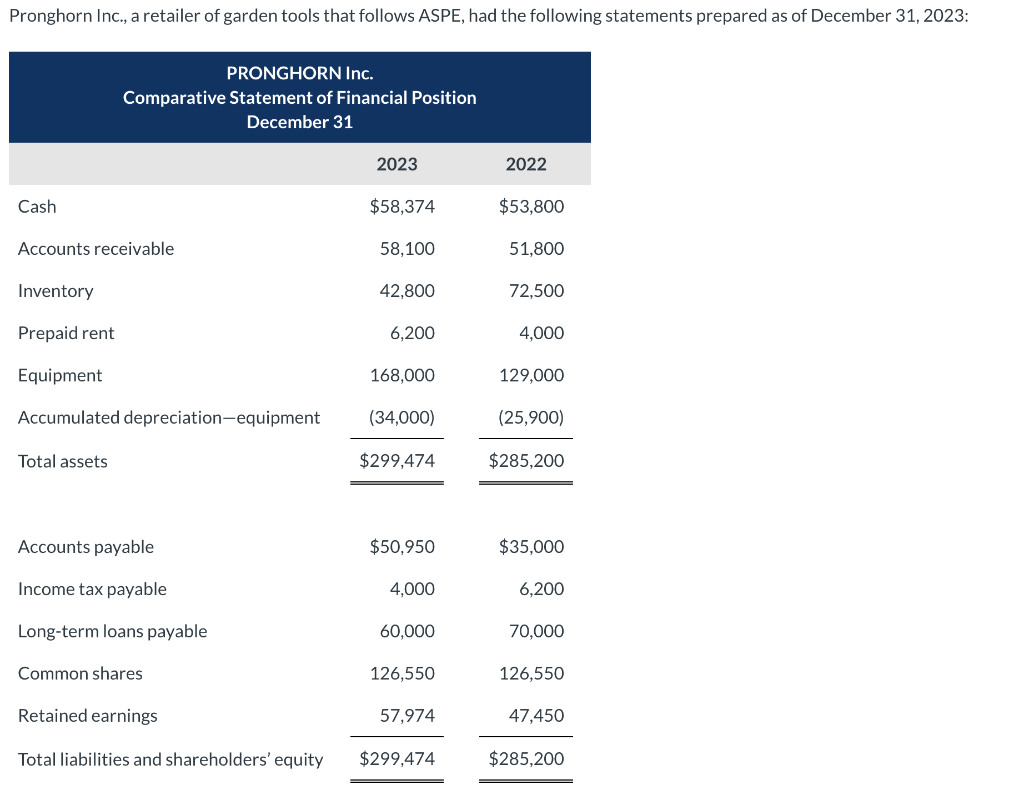

Transcribed Image Text:Pronghorn Inc., a retailer of garden tools that follows ASPE, had the following statements prepared as of December 31, 2023:

Cash

PRONGHORN Inc.

Comparative Statement of Financial Position

December 31

Accounts receivable

Total assets

2023

Accounts payable

Income tax payable

Long-term loans payable

Common shares

Retained earnings

Total liabilities and shareholders' equity

$58,374

58,100

Inventory

Prepaid rent

Equipment

168,000

Accumulated depreciation-equipment (34,000)

$299,474

42,800

6,200

$50,950

4,000

60,000

126,550

57,974

$299,474

2022

$53,800

51,800

72,500

4,000

129,000

(25,900)

$285,200

$35,000

6,200

70,000

126,550

47,450

$285,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning