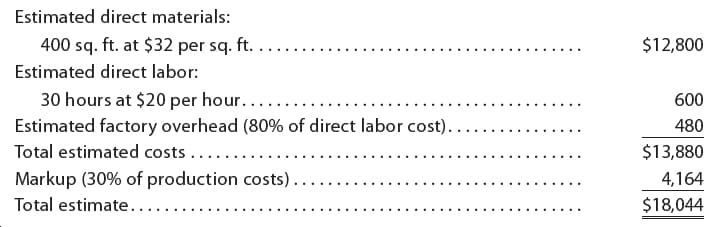

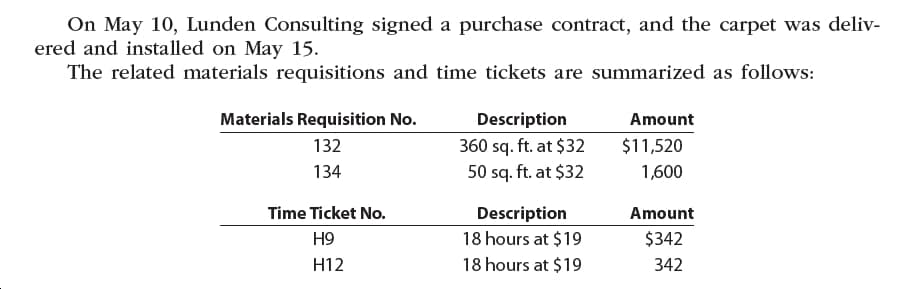

Estimated direct materials: 400 sq. ft. at $32 per sq. ft. $12,800 Estimated direct labor: 30 hours at $20 per hour..... Estimated factory overhead (80% of direct labor cost)... 600 480 Total estimated costs ... $13,880 Markup (30% of production costs). 4,164 Total estimate.... $18,044 On May 10, Lunden Consulting signed a purchase contract, and the carpet was deliv- ered and installed on May 15. The related materials requisitions and time tickets are summarized as follows: Materials Requisition No. Description Amount 360 sq. ft. at $32 50 sq. ft. at $32 $11,520 132 134 1,600 Time Ticket No. Description Amount 18 hours at $19 $342 Н9 18 hours at $19 Н12 342

Stretch and Trim Carpet Company sells and installs commercial carpeting for office buildings. Stretch and Trim Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered

See attachment

Instructions

1. Complete that portion of the job order cost sheet that would be prepared when the estimate is given to the customer. Round factory

2. Record the costs incurred and prepare a job order cost sheet. Comment on the reasons for the variances between actual costs and estimated costs. For this purpose, assume that the additional square feet of material used in the job were spoiled, the factory overhead rate has proven to be satisfactory, and an inexperienced employee performed the work.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images