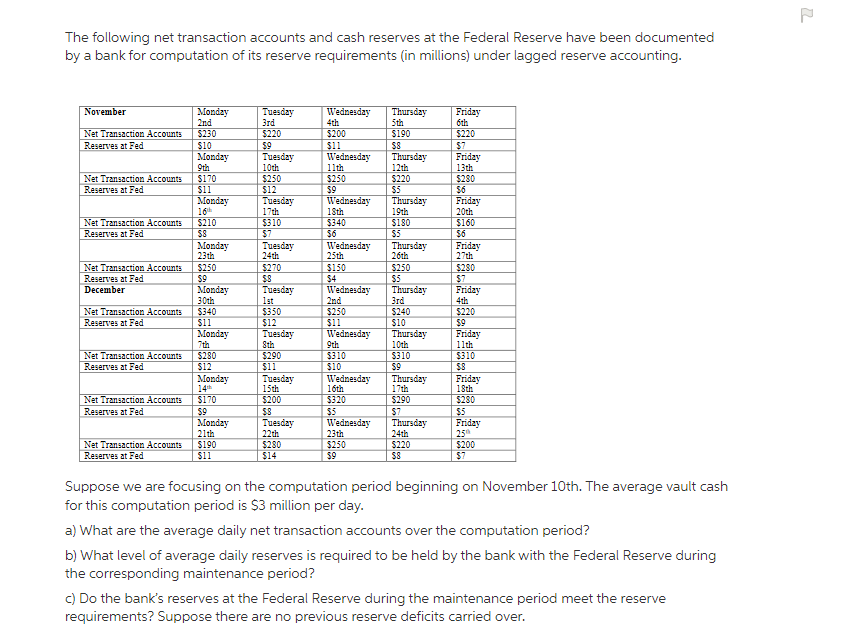

The following net transaction accounts and cash reserves at the Federal Reserve have been documented by a bank for computation of its reserve requirements (in millions) under lagged reserve accounting. November Monday Tuesday Wednesday Thursday 5th Friday 6th 2nd 3rd 4th $220 $9 Tuesday 10th $250 $12 Tuesday 17th $220 $7 Friday 13th $280 $6 Fridzy 20th Net Transaction Accounts $230 $200 $11 Wednesday 11th $250 $9 Wednesday 1sth $190 Reserves at Fed S10 Monday 9th $170 S8 Thursday 12th $220 Net Transaction Accounts Reserves at Fed $5 Thursday Mondzy 16 $210 19th Net Transaction Accounts $310 $7 Tuesday 24th $340 $6 Wednesday $180 $160 $6 Friday 27th Reserves at Fed $5 Monday 23th Thursday 26th 25th Net Transaction Accounts $270 $8 Tuesday Ist $350 $12 Tuesday $150 $4 Wednesday 2nd $250 $1 Wednesday $250 $9 $250 S5 $280 $7 Reserves at Fed December Monday 30th $340 Thursday 3rd $240 Friday 4th $220 $9 Friday 1lth Net Transaction Accounts Reserves at Fed $1 $10 Monday Thursday 10th 7th Sth 9th Net Transaction Accounts Reserves at Fed $310 $10 Wednesday $310 $8 Friday 18th $280 $290 $11 Tuesday $310 $9 Thursday 17th $12 Mondzy 14th 15th 16th $200 $320 Net Transaction Accounts Reserves at Fed $170 $290 $280 $5 Friday 25 $200 $7 S9 $8 Tuesday 22th $5 S7 Monday 21th $190 Wednesday 23th Thursday 24th Net Transaction Accounts $280 $14 $250 $9 $220 Reserves at Fed $11 Suppose we are focusing on the computation period beginning on November 10th. The average vault cash for this computation period is $3 million per day. a) What are the average daily net transaction accounts over the computation period? b) What level of average daily reserves is required to be held by the bank with the Federal Reserve during the corresponding maintenance period? C) Do the bank's reserves at the Federal Reserve during the maintenance period meet the reserve requirements? Suppose there are no previous reserve deficits carried over.

The following net transaction accounts and cash reserves at the Federal Reserve have been documented by a bank for computation of its reserve requirements (in millions) under lagged reserve accounting. November Monday Tuesday Wednesday Thursday 5th Friday 6th 2nd 3rd 4th $220 $9 Tuesday 10th $250 $12 Tuesday 17th $220 $7 Friday 13th $280 $6 Fridzy 20th Net Transaction Accounts $230 $200 $11 Wednesday 11th $250 $9 Wednesday 1sth $190 Reserves at Fed S10 Monday 9th $170 S8 Thursday 12th $220 Net Transaction Accounts Reserves at Fed $5 Thursday Mondzy 16 $210 19th Net Transaction Accounts $310 $7 Tuesday 24th $340 $6 Wednesday $180 $160 $6 Friday 27th Reserves at Fed $5 Monday 23th Thursday 26th 25th Net Transaction Accounts $270 $8 Tuesday Ist $350 $12 Tuesday $150 $4 Wednesday 2nd $250 $1 Wednesday $250 $9 $250 S5 $280 $7 Reserves at Fed December Monday 30th $340 Thursday 3rd $240 Friday 4th $220 $9 Friday 1lth Net Transaction Accounts Reserves at Fed $1 $10 Monday Thursday 10th 7th Sth 9th Net Transaction Accounts Reserves at Fed $310 $10 Wednesday $310 $8 Friday 18th $280 $290 $11 Tuesday $310 $9 Thursday 17th $12 Mondzy 14th 15th 16th $200 $320 Net Transaction Accounts Reserves at Fed $170 $290 $280 $5 Friday 25 $200 $7 S9 $8 Tuesday 22th $5 S7 Monday 21th $190 Wednesday 23th Thursday 24th Net Transaction Accounts $280 $14 $250 $9 $220 Reserves at Fed $11 Suppose we are focusing on the computation period beginning on November 10th. The average vault cash for this computation period is $3 million per day. a) What are the average daily net transaction accounts over the computation period? b) What level of average daily reserves is required to be held by the bank with the Federal Reserve during the corresponding maintenance period? C) Do the bank's reserves at the Federal Reserve during the maintenance period meet the reserve requirements? Suppose there are no previous reserve deficits carried over.

Chapter25: Money, Banking, And The Federal Reserve System

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:The following net transaction accounts and cash reserves at the Federal Reserve have been documented

by a bank for computation of its reserve requirements (in millions) under lagged reserve accounting.

November

Monday

Tuesday

Wednesday

Thursday

5th

Friday

6th

2nd

3rd

4th

$220

$9

Tuesday

10th

$250

$12

Tuesday

17th

$220

$7

Friday

13th

$280

$6

Fridzy

20th

Net Transaction Accounts

$230

$200

$11

Wednesday

11th

$250

$9

Wednesday

1sth

$190

Reserves at Fed

S10

Monday

9th

$170

S8

Thursday

12th

$220

Net Transaction Accounts

Reserves at Fed

$5

Thursday

Mondzy

16

$210

19th

Net Transaction Accounts

$310

$7

Tuesday

24th

$340

$6

Wednesday

$180

$160

$6

Friday

27th

Reserves at Fed

$5

Monday

23th

Thursday

26th

25th

Net Transaction Accounts

$270

$8

Tuesday

Ist

$350

$12

Tuesday

$150

$4

Wednesday

2nd

$250

$1

Wednesday

$250

$9

$250

S5

$280

$7

Reserves at Fed

December

Monday

30th

$340

Thursday

3rd

$240

Friday

4th

$220

$9

Friday

1lth

Net Transaction Accounts

Reserves at Fed

$1

$10

Monday

Thursday

10th

7th

Sth

9th

Net Transaction Accounts

Reserves at Fed

$310

$10

Wednesday

$310

$8

Friday

18th

$280

$290

$11

Tuesday

$310

$9

Thursday

17th

$12

Mondzy

14th

15th

16th

$200

$320

Net Transaction Accounts

Reserves at Fed

$170

$290

$280

$5

Friday

25

$200

$7

S9

$8

Tuesday

22th

$5

S7

Monday

21th

$190

Wednesday

23th

Thursday

24th

Net Transaction Accounts

$280

$14

$250

$9

$220

Reserves at Fed

$11

Suppose we are focusing on the computation period beginning on November 10th. The average vault cash

for this computation period is $3 million per day.

a) What are the average daily net transaction accounts over the computation period?

b) What level of average daily reserves is required to be held by the bank with the Federal Reserve during

the corresponding maintenance period?

C) Do the bank's reserves at the Federal Reserve during the maintenance period meet the reserve

requirements? Suppose there are no previous reserve deficits carried over.

Expert Solution

Step 1

a. The average is calculated by summing up the net transaction and dividing it by the number of days. It is $255.88 millions per day.

b. Under the rule of 2004, the reserve required is

0*6+(42.1-6)*(0.03)+(255.88-42.1)*(0.10)=22.461 M

subtracting the 3M cash in vault, the bank needed (22.461-3)=19.461M in reserves in Fed.

c. The average reserves in fed during the period is 8.32 M.

So the bank is short by 11.141M

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc