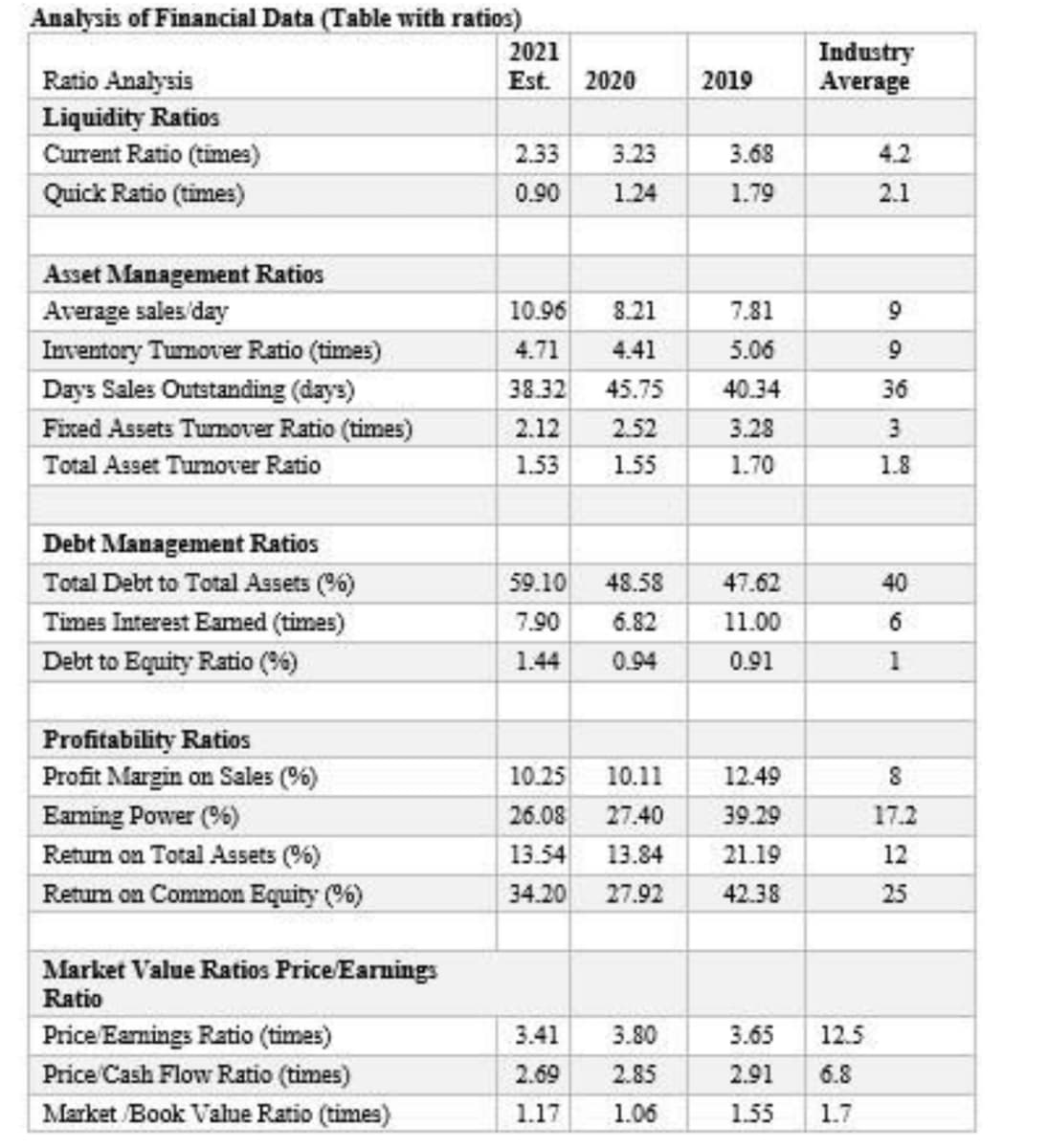

Analysis of Financial Data (Table with ratios) 2021 Est. 2020 Industry Average Ratio Analysis Liquidity Ratios Current Ratio (times) 2019 2.33 3.23 3.68 4.2 Quick Ratio (times) 0.90 1.24 1.79 2.1 Asset Management Ratios Average sales'day 10.96 8.21 7.81 Inventory Turnover Ratio (times) 4.71 4.41 5.06 9 Days Sales Outstanding (days) 38.32 45.75 40.34 36 Fixed Assets Turnover Ratio (times) 2.12 2.52 3.28 3 Total Asset Turmover Ratio 1.53 1.55 1.70 1.8 Debt Management Ratios Total Debt to Total Assets (%6) 59.10 48.58 47.62 40 Times Interest Eamed (times) 7.90 6.82 11.00 6 Debt to Equity Ratio (6) 1.44 0.94 0.91 Profitability Ratios Profit Margin on Sales (%) 10.25 10.11 12.49 Eaming Power (%) 26.08 27.40 39.29 17.2 Retum on Total Assets (%) 13.54 13.84 21.19 12 Retum on Common Equity (6) 34.20 27.92 42.38 25 Market Value Ratios Price/Earnings Ratio 3.80 12.5 Price Eamings Ratio (times) Price Cash Flow Ratio (times) 3.41 3.65 2.69 2.85 2.91 6.8 Market /Book Value Ratio (times) 1.17 1.06 1.55 1.7

Analysis of Financial Data (Table with ratios) 2021 Est. 2020 Industry Average Ratio Analysis Liquidity Ratios Current Ratio (times) 2019 2.33 3.23 3.68 4.2 Quick Ratio (times) 0.90 1.24 1.79 2.1 Asset Management Ratios Average sales'day 10.96 8.21 7.81 Inventory Turnover Ratio (times) 4.71 4.41 5.06 9 Days Sales Outstanding (days) 38.32 45.75 40.34 36 Fixed Assets Turnover Ratio (times) 2.12 2.52 3.28 3 Total Asset Turmover Ratio 1.53 1.55 1.70 1.8 Debt Management Ratios Total Debt to Total Assets (%6) 59.10 48.58 47.62 40 Times Interest Eamed (times) 7.90 6.82 11.00 6 Debt to Equity Ratio (6) 1.44 0.94 0.91 Profitability Ratios Profit Margin on Sales (%) 10.25 10.11 12.49 Eaming Power (%) 26.08 27.40 39.29 17.2 Retum on Total Assets (%) 13.54 13.84 21.19 12 Retum on Common Equity (6) 34.20 27.92 42.38 25 Market Value Ratios Price/Earnings Ratio 3.80 12.5 Price Eamings Ratio (times) Price Cash Flow Ratio (times) 3.41 3.65 2.69 2.85 2.91 6.8 Market /Book Value Ratio (times) 1.17 1.06 1.55 1.7

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 87BPSB

Related questions

Question

include and explain any other ratios in your analysis table which will assist in strengthening your position for application for applying for loan from a bank

Transcribed Image Text:Analysis of Financial Data (Table with ratios)

Industry

Average

2021

2019

Ratio Analysis

Liquidity Ratios

Current Ratio (times)

Est.

2020

2.33

3.23

3.68

4.2

Quick Ratio (times)

0.90

1.24

1.79

2.1

Asset Management Ratios

Average sales day

10.96

8.21

7.81

Inventory Turnover Ratio (times)

4.71

4.41

5.06

9

Days Sales Outstanding (days)

38.32

45.75

40.34

36

2.52

3.28

Fixed Assets Turnover Ratio (times)

Total Asset Tumover Ratio

2.12

3

1.53

1.55

1.70

1.8

Debt Management Ratios

59.10

Total Debt to Total Assets (%)

Times Interest Eamed (times)

48.58

47.62

40

7.90

6.82

11.00

6

Debt to Equity Ratio (%)

1.44

0.94

0.91

1

Profitability Ratios

Profit Margin on Sales (%)

10.25

10.11

12.49

Eaming Power (%)

Retum on Total Assets (%)

26.08

27.40

39.29

17.2

13.54

13.84

21.19

12

Retum on Common Equity (6)

34.20

27.92

42.38

25

Market Value Ratios Price/Earnings

Ratio

Price Eamings Ratio (times)

3.41

3.80

3.65

12.5

Price Cash Flow Ratio (times)

2.69

2.85

2.91

6.8

Market Book Value Ratio (times)

1.17

1.06

1.55

1.7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,