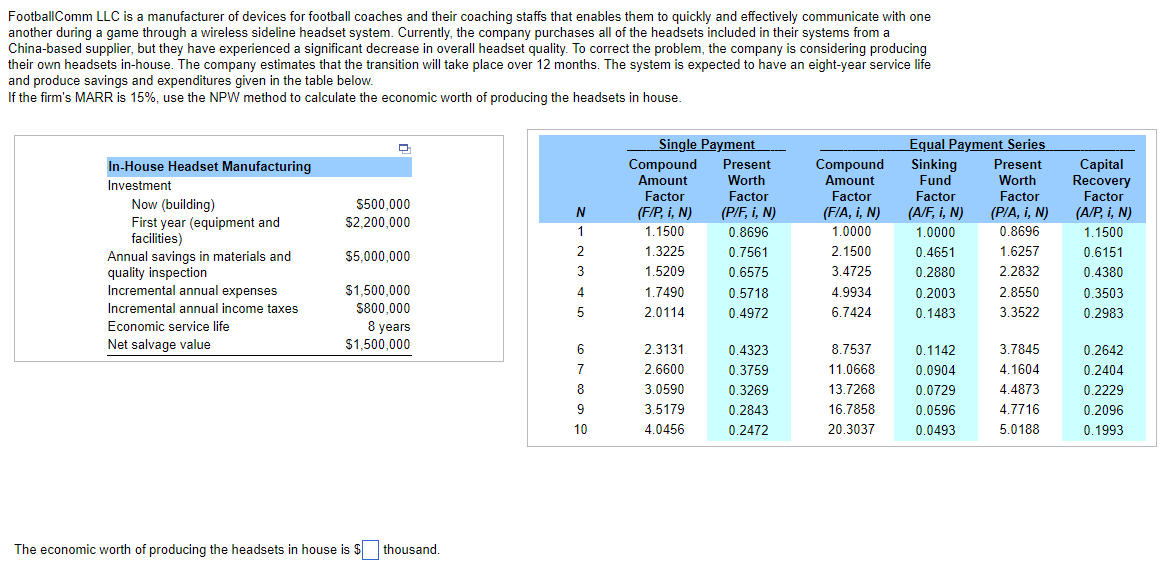

FootballComm LLC is a manufacturer of devices for football coaches and their coaching staffs that enables them to quickly and effectively communicate with one another during a game through a wireless sideline headset system. Currently, the company purchases all of the headsets included in their systems from a China-based supplier, but they have experienced a significant decrease in overall headset quality. To correct the problem, the company is considering producing their own headsets in-house. The company estimates that the transition will take place over 12 months. The system is expected to have an eight-year service life and produce savings and expenditures given in the table below. If the firm's MARR is 15%, use the NPW method to calculate the economic worth of producing the headsets in house. D In-House Headset Manufacturing Investment Worth Factor Compound Amount Factor (F/A, i, N) Now (building) Single Payment Compound Present Amount Factor (F/P, i, N) 1.1500 1.3225 1.5209 $500,000 $2,200,000 (P/F, i, N) First year (equipment and facilities) 0.8696 1.0000 2.1500 0.7561 $5,000,000 Annual savings in materials and quality inspection 0.6575 3.4725 Incremental annual expenses $1,500,000 1.7490 0.5718 4.9934 2.0114 Incremental annual income taxes Economic service life 0.4972 $800,000 8 years 6.7424 Net salvage value $1,500,000 2.3131 0.4323 8.7537 2.6600 0.3759 11.0668 3.0590 0.3269 13.7268 3.5179 0.2843 16.7858 4.0456 0.2472 20.3037 2123 N 4 5 6 7 8 9 10 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, i, N) 0.8696 1.0000 0.4651 1.6257 0.2880 2.2832 0.2003 2.8550 0.1483 3.3522 0.1142 3.7845 0.0904 4.1604 0.0729 4.4873 0.0596 4.7716 0.0493 5.0188 Capital Recovery Factor (A/P, i, N) 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993

FootballComm LLC is a manufacturer of devices for football coaches and their coaching staffs that enables them to quickly and effectively communicate with one another during a game through a wireless sideline headset system. Currently, the company purchases all of the headsets included in their systems from a China-based supplier, but they have experienced a significant decrease in overall headset quality. To correct the problem, the company is considering producing their own headsets in-house. The company estimates that the transition will take place over 12 months. The system is expected to have an eight-year service life and produce savings and expenditures given in the table below. If the firm's MARR is 15%, use the NPW method to calculate the economic worth of producing the headsets in house. D In-House Headset Manufacturing Investment Worth Factor Compound Amount Factor (F/A, i, N) Now (building) Single Payment Compound Present Amount Factor (F/P, i, N) 1.1500 1.3225 1.5209 $500,000 $2,200,000 (P/F, i, N) First year (equipment and facilities) 0.8696 1.0000 2.1500 0.7561 $5,000,000 Annual savings in materials and quality inspection 0.6575 3.4725 Incremental annual expenses $1,500,000 1.7490 0.5718 4.9934 2.0114 Incremental annual income taxes Economic service life 0.4972 $800,000 8 years 6.7424 Net salvage value $1,500,000 2.3131 0.4323 8.7537 2.6600 0.3759 11.0668 3.0590 0.3269 13.7268 3.5179 0.2843 16.7858 4.0456 0.2472 20.3037 2123 N 4 5 6 7 8 9 10 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, i, N) 0.8696 1.0000 0.4651 1.6257 0.2880 2.2832 0.2003 2.8550 0.1483 3.3522 0.1142 3.7845 0.0904 4.1604 0.0729 4.4873 0.0596 4.7716 0.0493 5.0188 Capital Recovery Factor (A/P, i, N) 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:FootballComm LLC is a manufacturer of devices for football coaches and their coaching staffs that enables them to quickly and effectively communicate with one

another during a game through a wireless sideline headset system. Currently, the company purchases all of the headsets included in their systems from a

China-based supplier, but they have experienced a significant decrease in overall headset quality. To correct the problem, the company is considering producing

their own headsets in-house. The company estimates that the transition will take place over 12 months. The system is expected to have an eight-year service life

and produce savings and expenditures given in the table below.

If the firm's MARR is 15%, use the NPW method to calculate the economic worth of producing the headsets in house.

In-House Headset Manufacturing

Single Payment

Compound Present

Amount

Investment

Worth

Factor

Compound

Amount

Factor

(F/A, i, N)

Factor

Now (building)

$500,000

$2,200,000

(F/P, i, N)

(P/F, i, N)

First year (equipment and

facilities)

1.1500

0.8696

1.0000

1.3225

2.1500

0.7561

Annual savings in materials and

$5,000,000

1.5209

quality inspection

0.6575

3.4725

Incremental annual expenses

$1,500,000

1.7490

0.5718

4.9934

Incremental annual income taxes

$800,000

2.0114

0.4972

6.7424

Economic service life

8 years

$1,500,000

Net salvage value

2.3131

0.4323

8.7537

2.6600

0.3759

11.0668

3.0590

0.3269

13.7268

3.5179

0.2843

16.7858

4.0456

0.2472

20.3037

The economic worth of producing the headsets in house is $ thousand.

•WN-Z

4

5

6

7

8

9

10

Equal Payment Series

Sinking Present

Fund

Worth

Factor

Factor

(A/F, i, N)

(P/A, i, N)

0.8696

1.0000

0.4651

1.6257

0.2880

2.2832

0.2003

2.8550

0.1483

3.3522

0.1142

3.7845

0.0904

4.1604

0.0729

4.4873

0.0596

4.7716

0.0493

5.0188

Capital

Recovery

Factor

(A/P, i, N)

1.1500

0.6151

0.4380

0.3503

0.2983

0.2642

0.2404

0.2229

0.2096

0.1993

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,