Hint(s) Check My Work (All answers were generated using 1,000 trials and native Excel functionality.) The management of Madeira Computing is considering the introduction of a wearable electronic device with the functionality of a laptop computer and phone. The fixed cost to launch this new product is $300,000. The variable cost for the product is expected to be between $192 and $288, with a most likely value of $240 per unit. The product will sell for $360 per unit. Demand for the product is expected to range from 0 to approximately 20,000 units, with 4,000 units the most likely. (a) Develop a what-if spreadsheet model computing profit for this product in the base-case, worst-case, and best-case scenarios. If your answer is negative, use minus sign. Best-case profit Worst-case profit Base-case profit (b) Model the variable cost as a uniform random variable with a minimum of $192 and a maximum of $288. Model the product demand as 1,000 times the value of a gamma random variable with an alpha parameter of 3 and a beta parameter of 2. Construct a simulation model to estimate the average profit and the probability that the project will result in a loss. Round your answers to the nearest whole number. Average Profit Probability of a Loss (c) What is your recommendation regarding whether to launch the product? The average profit is fairly high and the probability of a loss is less than 25%. Thus, Madeira Computing may want to launch the product if they have low risk tolerance.

Hint(s) Check My Work (All answers were generated using 1,000 trials and native Excel functionality.) The management of Madeira Computing is considering the introduction of a wearable electronic device with the functionality of a laptop computer and phone. The fixed cost to launch this new product is $300,000. The variable cost for the product is expected to be between $192 and $288, with a most likely value of $240 per unit. The product will sell for $360 per unit. Demand for the product is expected to range from 0 to approximately 20,000 units, with 4,000 units the most likely. (a) Develop a what-if spreadsheet model computing profit for this product in the base-case, worst-case, and best-case scenarios. If your answer is negative, use minus sign. Best-case profit Worst-case profit Base-case profit (b) Model the variable cost as a uniform random variable with a minimum of $192 and a maximum of $288. Model the product demand as 1,000 times the value of a gamma random variable with an alpha parameter of 3 and a beta parameter of 2. Construct a simulation model to estimate the average profit and the probability that the project will result in a loss. Round your answers to the nearest whole number. Average Profit Probability of a Loss (c) What is your recommendation regarding whether to launch the product? The average profit is fairly high and the probability of a loss is less than 25%. Thus, Madeira Computing may want to launch the product if they have low risk tolerance.

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 5P: Hudson Corporation is considering three options for managing its data warehouse: continuing with its...

Related questions

Question

Transcribed Image Text:Hint(s) Check My Work

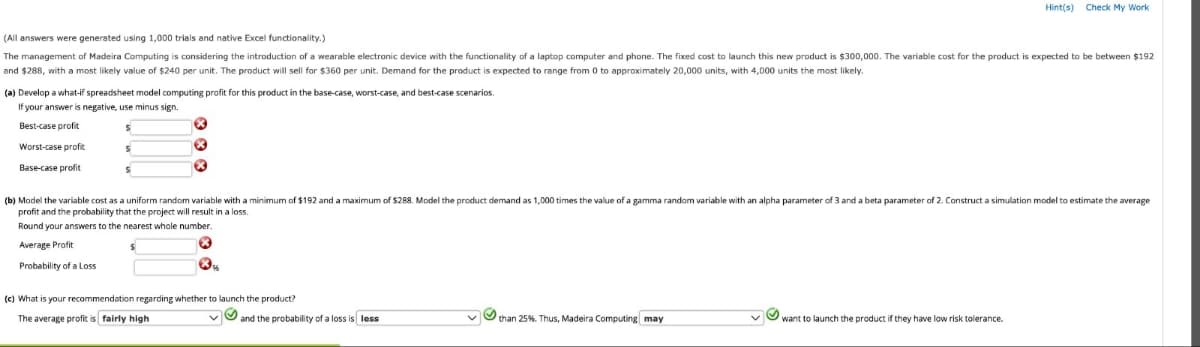

(All answers were generated using 1,000 trials and native Excel functionality.)

The management of Madeira Computing is considering the introduction of a wearable electronic device with the functionality of a laptop computer and phone. The fixed cost to launch this new product is $300,000. The variable cost for the product is expected to be between $192

and $288, with a most likely value of $240 per unit. The product will sell for $360 per unit. Demand for the product is expected to range from 0 to approximately 20,000 units, with 4,000 units the most likely.

(a) Develop a what-if spreadsheet model computing profit for this product in the base-case, worst-case, and best-case scenarios.

If your answer is negative, use minus sign.

Best-case profit

Worst-case profit

Base-case profit

(b) Model the variable cost as a uniform random variable with a minimum of $192 and a maximum of $288. Model the product demand as 1,000 times the value of a gamma random variable with an alpha parameter of 3 and a beta parameter of 2. Construct a simulation model to estimate the average

profit and the probability that the project will result in a loss.

Round your answers to the nearest whole number.

Average Profit

Probability of a Loss

(c) What is your recommendation regarding whether to launch the product?

The average profit is fairly high

and the probability of a loss is less

than 25%. Thus, Madeira Computing may

want to launch the product if they have low risk tolerance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning