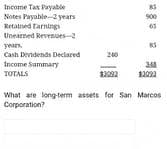

Income Tax Payatde Notes Payable years 900 Retalned Farnings Unearned Revenues2 yean Cash Devidends Deciared 240 Income Summary TOTALS What are long term assets for San Marcos Corporation?

Income Tax Payatde Notes Payable years 900 Retalned Farnings Unearned Revenues2 yean Cash Devidends Deciared 240 Income Summary TOTALS What are long term assets for San Marcos Corporation?

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 5AP

Related questions

Question

Transcribed Image Text:Income Tax Payable

Notes Payable-2 years

Retalned Tarnings

900

65

Unearned Revenues-2

years.

83

Cash Drvidends Deciared

200

Income Summary

TOTALS

What are long-term assets for San Marcos

Corporation?

Transcribed Image Text:QUESTION 3

Presented below are selected accounts for San

Marcos Corporation for December 31 of the

current year.

Debit

Credit

Accounts Recelvable

trade

$720

Building and Equipment

Cash in bank-operating

1000

Interest Recelvable

Installment Receivabies

Merchandise Inventory

35

25

Notes Receivable-long

term

Petty Cash

Prepaid Expenses-

current

32

Supplies

19

Patent

Accounts Payable-rade

Accumulated

Depreciation

225

Additional Pald-in Capltal

Allowance for

600

Uncollectible Accounts

Cash Diridends Payable

Common Seock-4i par

value

Income Tax Payable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning