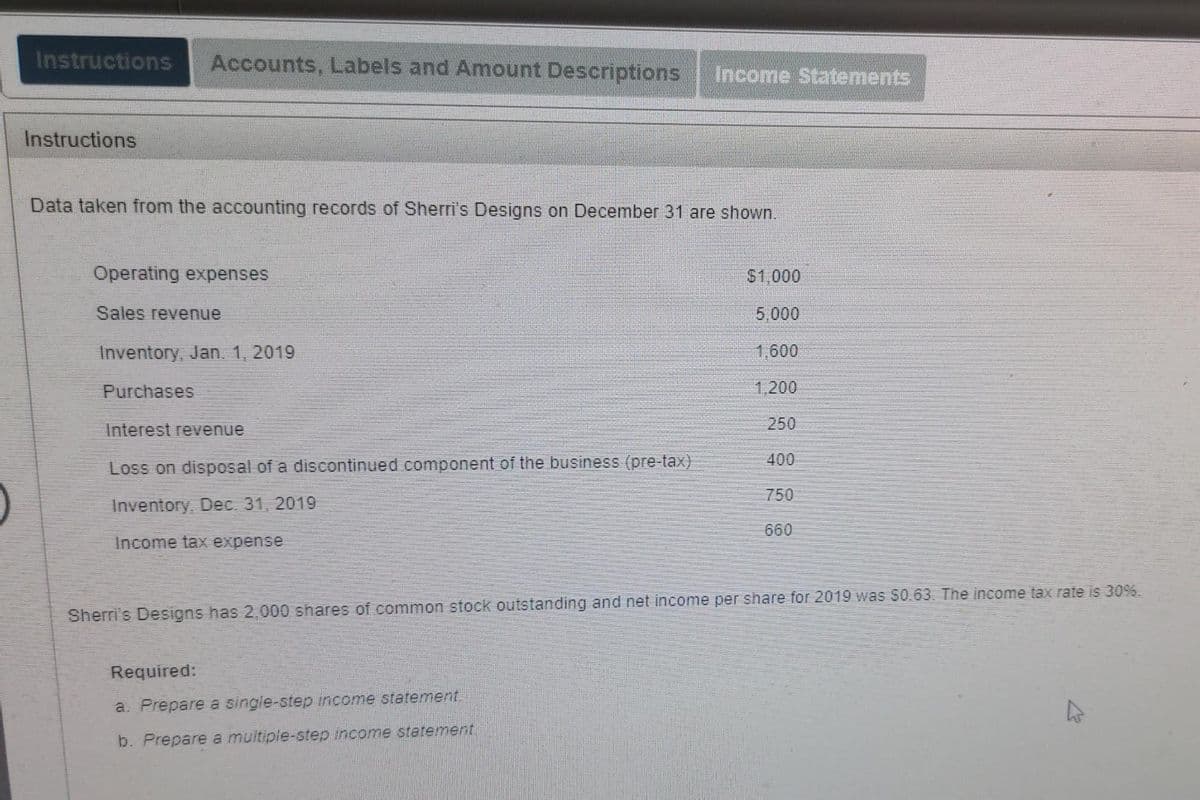

Instructions Data taken from the accounting records of Sherri's Designs on December 31 are shown. Operating expenses $1,000 Sales revenue 5,000 Inventory, Jan. 1, 2019 1,600 Purchases 1,200 Interest revenue 250 400 Loss on disposal of a discontinued component of the business (pre-tax) 750 Inventory, Dec. 31, 2019 660 Income tax expense Sherri's Designs has 2,000 shares of common stock outstanding and net income per share for 2019 was S0.63. The income tax rate is 30%. Required: a. Prepare a single-step income statement. b. Prepare a multiple-step income statement

Instructions Data taken from the accounting records of Sherri's Designs on December 31 are shown. Operating expenses $1,000 Sales revenue 5,000 Inventory, Jan. 1, 2019 1,600 Purchases 1,200 Interest revenue 250 400 Loss on disposal of a discontinued component of the business (pre-tax) 750 Inventory, Dec. 31, 2019 660 Income tax expense Sherri's Designs has 2,000 shares of common stock outstanding and net income per share for 2019 was S0.63. The income tax rate is 30%. Required: a. Prepare a single-step income statement. b. Prepare a multiple-step income statement

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 8E: Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives...

Related questions

Topic Video

Question

Transcribed Image Text:Instructions

Accounts, Labels and Amount Descriptions

Income Statements

Instructions

Data taken from the accounting records of Sherri's Designs on December 31 are shown.

Operating expenses

$1,000

Sales revenue

5,000

Inventory, Jan. 1, 2019

1,600

Purchases

1,200

Interest revenue

250

400

Loss on disposal of a discontinued component of the business (pre-tax)

750

Inventory, Dec. 31, 2019

660

Income tax expense

Sherri's Designs has 2,000 shares of common stock outstanding and net income per share for 2019 was S0.63. The income tax rate is 30%.

Required:

a. Prepare a single-step income statement.

b. Prepare a multiple-step income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage