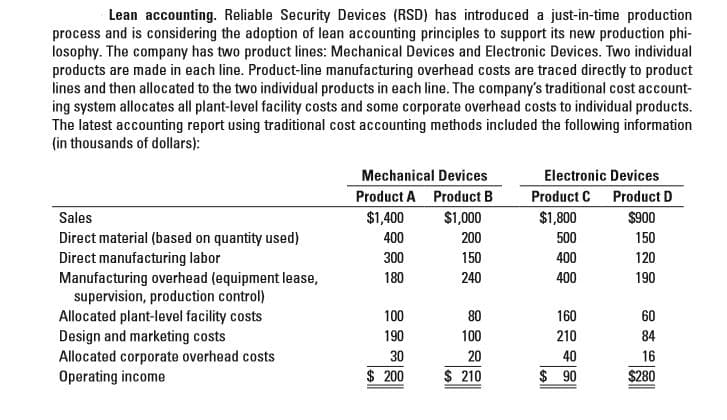

Lean accounting. Reliable Security Devices (RSD) has introduced a just-in-time production process and is considering the adoption of lean accounting principles to support its new production phi- losophy. The company has two product lines: Mechanical Devices and Electronic Devices. Two individual products are made in each line. Product-line manufacturing overhead costs are traced directly to product lines and then allocated to the two individual products in each line. The company's traditional cost account- ing system allocates all plant-level facility costs and some corporate overhead costs to individual products. The latest accounting report using traditional cost accounting methods included the following information (in thousands of dollars): Mechanical Devices Electronic Devices Product A Product B Product C Product D Sales $1,400 $1,000 $1,800 $900 150 Direct material (based on quantity used) Direct manufacturing labor Manufacturing overhead (equipment lease, supervision, production control) Allocated plant-level facility costs Design and marketing costs Allocated corporate overhead costs Operating income 400 200 500 300 150 400 120 180 240 400 190 100 80 160 60 190 100 210 84 30 20 40 16 $ 200 $ 210 $ 90 $280 RSD has determined that each of the two product lines represents a distinct value stream. It has also deter- mined that out of the $400,000 ($100,000 + $80,000 + $160,000 + $60,000) plant-level facility costs, prod- uct A occupies 22% of the plant's square footage, product B occupies 18%, product C occupies 36%, and product D occupies 14%. The remaining 10% of square footage is not being used. Finally, RSD has decided that in order to identify inefficiencies, direct material should be expensed in the period it is purchased, rather than when the material is used. According to purchasing records, direct material purchase costs during the period were as follows: Mechanical Devices Electronic Devices Product A Product B Product C Product D Direct material (purchases) $420 $240 $500 $180

Lean accounting. Reliable Security Devices (RSD) has introduced a just-in-time production process and is considering the adoption of lean accounting principles to support its new production phi- losophy. The company has two product lines: Mechanical Devices and Electronic Devices. Two individual products are made in each line. Product-line manufacturing overhead costs are traced directly to product lines and then allocated to the two individual products in each line. The company's traditional cost account- ing system allocates all plant-level facility costs and some corporate overhead costs to individual products. The latest accounting report using traditional cost accounting methods included the following information (in thousands of dollars): Mechanical Devices Electronic Devices Product A Product B Product C Product D Sales $1,400 $1,000 $1,800 $900 150 Direct material (based on quantity used) Direct manufacturing labor Manufacturing overhead (equipment lease, supervision, production control) Allocated plant-level facility costs Design and marketing costs Allocated corporate overhead costs Operating income 400 200 500 300 150 400 120 180 240 400 190 100 80 160 60 190 100 210 84 30 20 40 16 $ 200 $ 210 $ 90 $280 RSD has determined that each of the two product lines represents a distinct value stream. It has also deter- mined that out of the $400,000 ($100,000 + $80,000 + $160,000 + $60,000) plant-level facility costs, prod- uct A occupies 22% of the plant's square footage, product B occupies 18%, product C occupies 36%, and product D occupies 14%. The remaining 10% of square footage is not being used. Finally, RSD has decided that in order to identify inefficiencies, direct material should be expensed in the period it is purchased, rather than when the material is used. According to purchasing records, direct material purchase costs during the period were as follows: Mechanical Devices Electronic Devices Product A Product B Product C Product D Direct material (purchases) $420 $240 $500 $180

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter18: Activity-based Costing

Section: Chapter Questions

Problem 3CMA: Young Company is beginning operations and is considering three alternatives to allocate...

Related questions

Question

What are the cost objects in RSD’s lean accounting system?

Transcribed Image Text:Lean accounting. Reliable Security Devices (RSD) has introduced a just-in-time production

process and is considering the adoption of lean accounting principles to support its new production phi-

losophy. The company has two product lines: Mechanical Devices and Electronic Devices. Two individual

products are made in each line. Product-line manufacturing overhead costs are traced directly to product

lines and then allocated to the two individual products in each line. The company's traditional cost account-

ing system allocates all plant-level facility costs and some corporate overhead costs to individual products.

The latest accounting report using traditional cost accounting methods included the following information

(in thousands of dollars):

Mechanical Devices

Electronic Devices

Product A Product B

Product C

Product D

Sales

$1,400

$1,000

$1,800

$900

150

Direct material (based on quantity used)

Direct manufacturing labor

Manufacturing overhead (equipment lease,

supervision, production control)

Allocated plant-level facility costs

Design and marketing costs

Allocated corporate overhead costs

Operating income

400

200

500

300

150

400

120

180

240

400

190

100

80

160

60

190

100

210

84

30

20

40

16

$ 200

$ 210

$ 90

$280

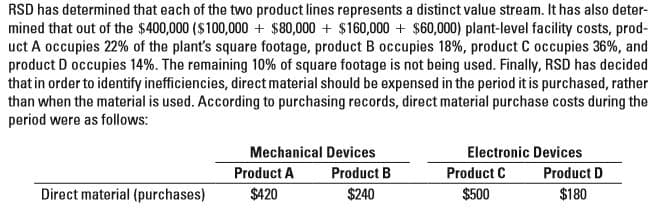

Transcribed Image Text:RSD has determined that each of the two product lines represents a distinct value stream. It has also deter-

mined that out of the $400,000 ($100,000 + $80,000 + $160,000 + $60,000) plant-level facility costs, prod-

uct A occupies 22% of the plant's square footage, product B occupies 18%, product C occupies 36%, and

product D occupies 14%. The remaining 10% of square footage is not being used. Finally, RSD has decided

that in order to identify inefficiencies, direct material should be expensed in the period it is purchased, rather

than when the material is used. According to purchasing records, direct material purchase costs during the

period were as follows:

Mechanical Devices

Electronic Devices

Product A

Product B

Product C

Product D

Direct material (purchases)

$420

$240

$500

$180

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College