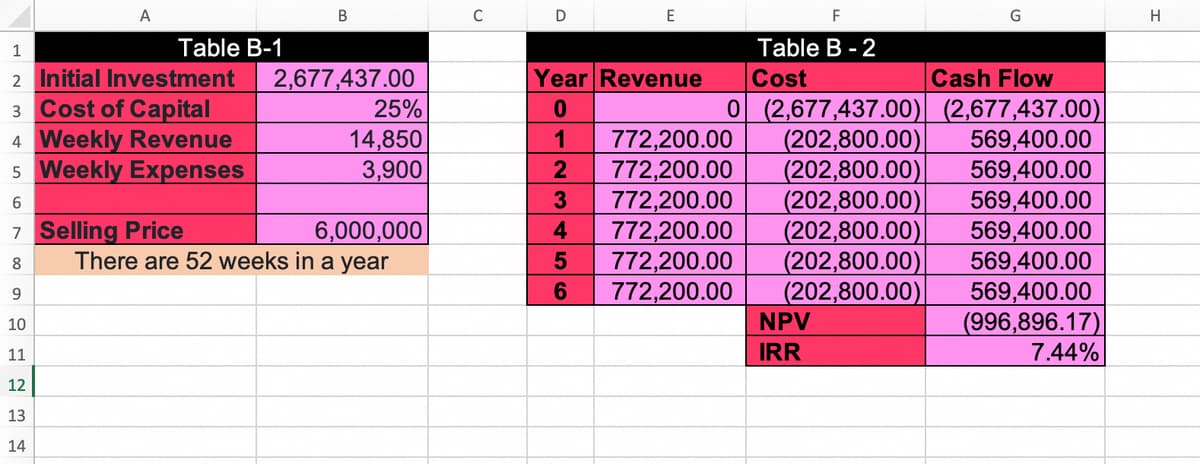

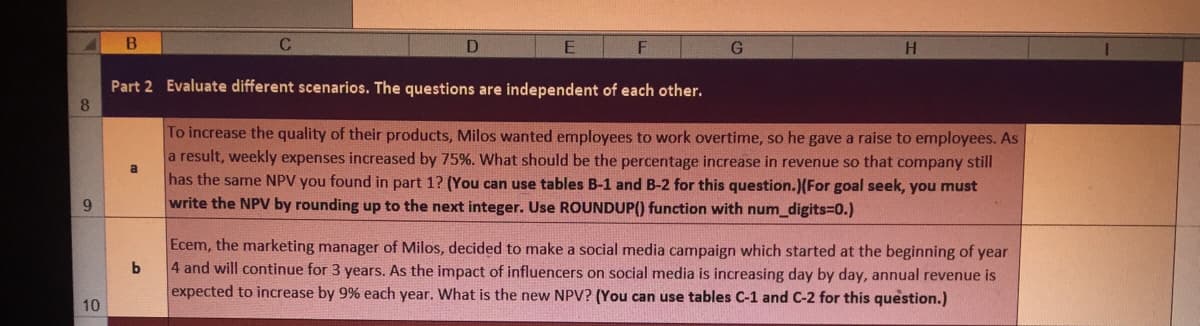

Part 2 Evaluate different scenarios. The questions are independent of each other. To increase the quality of their products, Milos wanted employees to work overtime, so he gave a raise to employees. As a result, weekly expenses increased by 75%. What should be the percentage increase in revenue so that company still has the same NPV you found in part 1? (You can use tables B-1 and B-2 for this question.)(For goal seek, you must write the NPV by rounding up to the next integer. Use ROUNDUP() function with num_digits3D0.) a Ecem, the marketing manager of Milos, decided to make a social media campaign which started at the beginning of year 4 and will continue for 3 years. As the impact of influencers on social media is increasing day by day, annual revenue is expected to increase by 9% each year. What is the new NPV? (You can use tables C-1 and C-2 for this question.)

Part 2 Evaluate different scenarios. The questions are independent of each other. To increase the quality of their products, Milos wanted employees to work overtime, so he gave a raise to employees. As a result, weekly expenses increased by 75%. What should be the percentage increase in revenue so that company still has the same NPV you found in part 1? (You can use tables B-1 and B-2 for this question.)(For goal seek, you must write the NPV by rounding up to the next integer. Use ROUNDUP() function with num_digits3D0.) a Ecem, the marketing manager of Milos, decided to make a social media campaign which started at the beginning of year 4 and will continue for 3 years. As the impact of influencers on social media is increasing day by day, annual revenue is expected to increase by 9% each year. What is the new NPV? (You can use tables C-1 and C-2 for this question.)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.1AP

Related questions

Question

100%

Show formula used for answers.

Note table B in the picture is the same table as table C.

Transcribed Image Text:A

В

C D

E

F

G

H

1

Table B-1

Table B - 2

2 Initial Investment

3 Cost of Capital

4 Weekly Revenue

5 Weekly Expenses

Year Revenue

Cost

0 (2,677,437.00) (2,677,437.00)

(202,800.00)

(202,800.00)

(202,800.00)

(202,800.00)

(202,800.00)

(202,800.00)

NPV

2,677,437.00

25%

14,850

3,900

Cash Flow

772,200.00

772,200.00

772,200.00

772,200.00

772,200.00

772,200.00

569,400.00

569,400.00

569,400.00

569,400.00

569,400.00

569,400.00

(996,896.17)

7.44%

1

6

7 Selling Price

There are 52 weeks in a year

6,000,000

4

8

6.

10

11

IRR

12

13

14

Transcribed Image Text:G

Part 2 Evaluate different scenarios. The questions are independent of each other.

8.

To increase the quality of their products, Milos wanted employees to work overtime, so he gave a raise to employees. As

a result, weekly expenses increased by 75%. What should be the percentage increase in revenue so that company still

has the same NPV you found in part 1? (You can use tables B-1 and B-2 for this question.)(For goal seek, you must

write the NPV by rounding up to the next integer. Use ROUNDUP() function with num_digits30.)

9

Ecem, the marketing manager of Milos, decided to make a social media campaign which started at the beginning of year

4 and will continue for 3 years. As the impact of influencers on social media is increasing day by day, annual revenue is

expected to increase by 9% each year. What is the new NPV? (You can use tables C-1 and C-2 for this question.)

b

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning