repare an unadjusted trial balance as of december 31 2020

Q: adjusting entry at the end of the year 2019

A: Interest accrued = Value of note * Rate of interest = $10000 * 6% = $600

Q: Instructions: a. Journalize the above transactions b. Post to ledger using the T-account format c.…

A: Journals, Ledgers and Unadjusted trial Balance are important for a company's accounting

Q: If on December 31, 2020, supplies on hand were P1,000, the adjusting entry would contain a A. Debit…

A: Adjusting entries are nothing but changes to journal entries that has already been recorded. Those…

Q: period return from Item No. 14 is required to be filed on or before July 15 June 15 September 15…

A: A short period of return refers to those returns which need to be filed for a taxable year of fewer…

Q: Prepare necessary adjusting entries at December 31, 2020 to record the admiss partner D and the…

A:

Q: Required: 1. Calculate Ingrid's balance in accounts receivable on December 31, 2019, prior to the…

A: Compute Ingrid’s balance in accounts receivable on December 31, 2019, prior to adjustment.

Q: 1. Prepare the trial balance as of 30 June 2019.

A: Trial balance is the summary form of financial statement prepared after balancing all the general…

Q: repare an adjusted trial balance. If an amount Ledger Accounts, Adjusting Entries, Financial…

A:

Q: Adjustin entry for January 31 of: On December 28, 2018, FTS received a payment from a customer in…

A: An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an…

Q: d) Prepare Columbus Ltd classified balance sheet at July 31, 2021. e) Prepare the closing entries f)…

A: Balance Sheet In the preparation of balance sheet it includes two sides one is Assets and another is…

Q: Part B Required 6. Prepare journal entries to record each of the following November transactions. 7.…

A: As per the honor code, we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit…

Q: Instructions: a. Journalize and post quarter transactions. b. Prepare December 31st, 2019 trail…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Prepare year-end adjusting entries for the following transactions. Omit explanation.

A: 1. In 3rd entry, adjustment entry will be passed for rent Expired which is ($36,000 - $…

Q: 1. On December 31, 2020, what is note received from Company AF

A: Note receivable: It is a written promise. The promise is for receiving specific amount of cash on…

Q: Required: For each of the above independent and unrelated errors, determ the effect on the 2020…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Prepare a balance sheet as at 30 June 2019.

A:

Q: Required: 1. Prepare journal entries to recognize revenue for 2018, 2019 and 2020. I

A: In Year 2018 Construction contract price: $8,360,000 %age completion= $2,120,000…

Q: Which of the following adjusting entries prepared on December 31, 2021 (without amounts and…

A: Adjusting journal entry: At year-end when the company finalizes its accounts then any unrecognized…

Q: scovered the

A: Here we will take one by one tranasction and first will…

Q: 33. As of Dec. 31, 2020, Unadjusted Interest Income account of Entity A was P5,000. It was learned…

A: Income that is not earned should be transferred to the Unearned income account. 1. journal entry to…

Q: How to solve this? Need to give adjusting entries on December 31, 2020... thank u...

A: Step 1 Adjusting entries are accounting journal entries that convert a company's accounting records…

Q: Before an adjusting entry on December 31, 2020, the fair value adjustment account contained a credit…

A: Net Fair value adjustment = $800 ( $1600 + $1000 - $1800) The adjusting entries to reflect the…

Q: prepare a classified balance sheet for year ended november 30 2020

A: A balance sheet is a statement which shows how much assets and liabilities of a company are having…

Q: Prepare the following: Adjusting entries – December 31,2015 Working papers

A: Adjusting entries: Entries that are used for the purpose of preparing adjusted trial balance and…

Q: Prepare adjusting entries assuming errors were discovered in (a) 2020, (b) 2021, and (c) 2022.

A: Adjusting entries refers to the journal entries in the general ledger of the company that occurs at…

Q: Beacon Signals Company maintains and repairs warning lights, such as those found on radio towers and…

A: Four closisng entries need to be passed:1. Revenues accounts are closed by debiting them and credit…

Q: ntry for Chri er 1-year fire

A: Every entity is formed as a going concern from an accounting perspective. However, the books of…

Q: Use the information to prepare adjusting entries as of December 31, 2019.

A: The formula:

Q: Please prepare the adjusting entries for December 31,2020. Answer b-d

A: Adjusting entries are those entries which are passed at the end of the period in order to accurately…

Q: REQU 1. Determine the correct amount of the following as of Dec. 31, 2019: a. Trade receivables,…

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: Prepare the adjusting entry to record the accrual of interest on December 31, 2021. (Credit account…

A: Answer:- when accrual interest is not received in current year, Then required adjusting entry at…

Q: Beacon Signals Company maintains and repairs warning lights, such as those found on radio towers and…

A: The Balance sheet is divided in to two parts. At one side, total of assets is taken. On the other…

Q: Examine the above Unadjusted- and Adjusted Trial Balances. Calculate and describe all Journal…

A: Adjusting entries are the entries that are recorded at the end of accounting period for making…

Q: Determine the following: 1. Record the adjusting entry for the year December 31, 2020 under the…

A: Adjusting entries are those journal entries which are passed at the end of the period for the…

Q: From the Trial Balance, Prepare the statement of comprehensive income for the year ended 31…

A: Statement of Comprehensive income is the statement which shows all income and expenses of the…

Q: Prepare the necessary adjusting journal entries on June 30, 2020. [Narrations are…

A: Trial Balance: Closing balance of ledger account are listed on a certain date. Trial Balance is a…

Q: Adjustment for Unearned Revenue On June 1, 2019, Herbal Co. received $51,190 for the rent of land…

A: Following is the adjusting journal entry of unearned rent:

Q: Saturday. Requirements: 1. Prepare the adjusting entries as of November 30,2019 2. Prepare the Dec.…

A: In the given case, adjusting entries are required on November 30, 2019

Q: UNADJUSTED TRIAL BALANCE DECEMEER S1, 2018 Adjusted Trial U'nadjusted Trial Balance Adjusting…

A: Trial balance is a statement showing the summary of accounts and their balances. It has equal total…

Q: Prepare the post adjustment trial balance of Musketeer Traders on 30 September 2019.

A: Trail balance: The statement which shows closing balance of all the ledger account is stated as…

Q: Prepare the Adjusted Trial balance for the period ending June 30, 2020

A: Depreciation - Furniture and Fixtures = 800,000-160,00010…

Q: Journalize reversing entries on October 1, 2020, if applicable journalize closing entries on…

A: Reversing Journal entries are passed to reverse the adjustment entries passed before the closing of…

Q: Beacon Signals Company maintains and repairs warning lights, such as those found on radio towers and…

A: After closing revevnues, expenses and Drawings account. The net result transferred to Capital…

Q: (c) Examine the above Unadjusted- and Adjusted Trial Balances. Calculate and describe all Journal…

A: Adjusting entries: These are the journal entries that are passed by an accountant to match or…

Q: Requirements 1. Journalize Lima's transactions during August 2024, assuming Lima uses the direct…

A: Journal is the book where day-to-day business transactions are originally recorded. Journal entry is…

Q: Required to prepare : A) Trading and profit and loss appropriation account for the year ended 31…

A: Statement of income shows all the income(s) earned by the organization. There are certain ways for…

Q: Prepare the general journal entries required to account for the above transactions and events for…

A: A journal entry is an act of maintaining or making statistics of any transactions both monetary or…

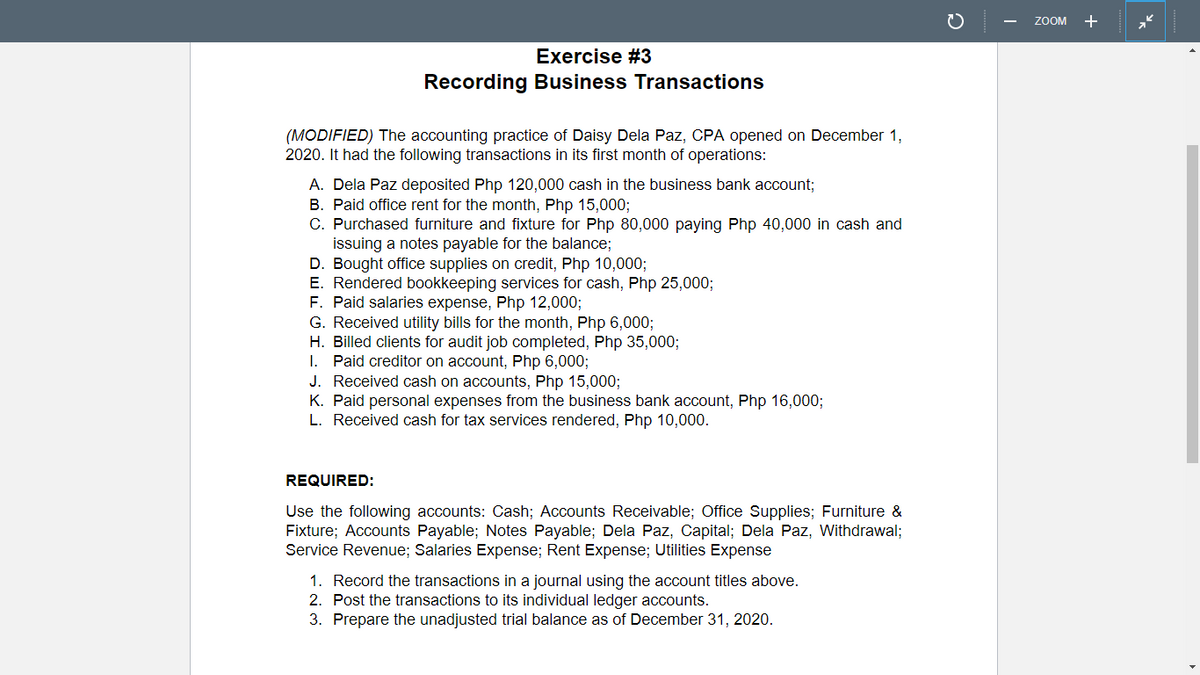

Prepare an unadjusted

Step by step

Solved in 5 steps with 5 images

- Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Recorded services provided on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, 750. 17. Recorded cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Recorded services provided on account for the period May 1620, 4,820. 25. Recorded cash from cash clients for fees earned for the period May 1723, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks' salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Recorded cash from cash clients for fees earned for the period May 2631, 3,300. 31. Recorded services provided on account for the remainder of May, 2,650. 31. Kelly withdrew 10,500 for personal use. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two-column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account #33 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.Brief Exercise 2-32 Journalize Transactions Galle Inc. entered into the following transactions during January. January, 1: Borrowed $50,000 from First Street Bank by signing a note payable. January, 4: Purchased $25,000 of equipment for cash. January, 6: Paid $500 to landlord for rent for January. January, 15: Performed services for customers on account. $10,000. January, 25: Collected $3,000 from customers for services performed in Transaction d. January, 30: Paid salaries of $2,500 for the current month. Required: Prepare journal entries for the transactions.Problem 2-56A Analyzing Transactions Luis Madero, after working for several years with a large public accounting firm decided to open his own accounting service. The business is operated as a corporation under the name Madero Accounting Services. The following captions and amounts summarize Maderos balance sheet at July 31, 2019. The following events occurred during August 2019. Issued common stock to Ms. Garriz in exchange for $15,000 cash. Paid $850 for first months rent on office space. Purchased supplies of $2,250 on credit. Borrowed $8,000 from the bank. Paid $1,080 on account for supplies purchased earlier on credit. Paid secretarys salary for August of $2,150. Performed amounting services for clients who paid cash upon completion of the service in the total amount of $4,700. Used $3,180 of the supplies on hand. Perfumed accounting services for clients on credit in the total amount of $1,920. Purchased $500 in supplies for cash. Collected $1,290 cash from clients for whom services were performed on credit. Paid $1,000 dividend to stockholders. Required: Record the effects of the transactions listed above on the accounting equation. Use the format given in the problem, starting with the totals at July 31, 20l9. Prepare the trial balance at August 31, 2019.

- The transactions completed by PS Music during June 2016 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: July 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2016. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2016. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2016 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2016, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2016.Exercise 2-43 Transaction Analysis Goal Systems, a business consulting firm, engaged in the following transactions: Issued common stock for $75,000 cash. Borrowed $35,000 from a bank. Purchased equipment for $12,000 cash. Prepaid rent on office space for 6 months in the amount of $7.800. Performed consulting services in exchange for $6,300 cash. Perfumed consulting services on credit in the amount of $18,750. Incurred and paid wage expense of $9,500. Collected $10,200 of the receivable arising from Transaction f. Purchased supplies for $1,800 on credit. Used $1,200 of the supplies purchased in Transaction i. Paid for all of the supplies purchased in Transaction i. Required: For each transaction described above. indicate the effects on assets, liabilities, and stockholders equity using the format below.Problem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to firms too Email to own their own computing equipment. Mulberry had the following amounts and amount balances as of January 1, 2019: During 2019, the following transactions occurred (the events described below are aggregations of many individual events): During 2019, Mulberry sold $690,000 of computing services, all on credit. Mulberry collected $570,000 from the credit sales in Transaction a and an additional $129,000 from the accounts receivable outstanding at the beginning of the year. Mulberry paid the interest payable of $8,000. A Wages of $379,000 were paid in cash. Repairs and maintenance of $9,000 were incurred and paid. The prepaid rent at the beginning of the year was used in 2019. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end. Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end. Advertising expense of $26,000 was incurred and paid. Income tax of $10,300 was incurred and paid in 2019. Interest of $5,000 was paid on the long-term loan. (Continued) Required: Establish a T-account for the accounts listed above and enter the beginning balances. Use a chart of accounts to order the T-accounts. Analyze each transaction; Journalize as appropriate. (Note: Ignore the date because these events are aggregations of individual events.) Post your journal entries to the T-accounts. Add additional T-accounts when needed. Use the ending balances in the T-accounts to prepare a trial balance.

- Continuing Problem 4.Total of Debit column: 40,750 The transactions completed by PS Music during June 20Y5 were described .it the end of Chapter 1. The following transactions were completed during July, the second month of businesss operations: July 1. Peyton Smith made an additional investment k PS Music in exchange for common stock by depositing 5,000 in PS Mu wet checking account. 1.Instead of continuing to share office space with a local real estate agency. Peyton decided to rent office space near a local musk store, Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft and fire. The policy covers a one year period. 2.Received 1,000 on account 3. On behalf of PS Musk, Peyton signed a contract with a local radio station. KXMD, to provide guest spots for the next three months. The contract requires PS Musk to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 2SO on account 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart. 7,500. 8.Paid for a newspaper advertisement 200. 11.Received 1.000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Pane 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account 850 21.Paid 620 to Upload Musk for use of its current musk demos in making various musk sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500 Received 750, with the remainder due August 4.20YS. 27.Paid electric Ml 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500, Received S00 with the remainder due on August 9. 20Y5. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1.400 royalties (musk expense) to National Musk Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 20Y5 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts Receivable 1,000 14 Supplies 170 15 Prepaid Insurance 17 Office Equipment 21 Accounts Payable 250 23 Unearned Revenue 31 Common Stock 4.000 33 Dividends 500 41 Fees Earned 6,200 50 Wages Expense 400 51 Office Rent Expense 800 52 Equipment Rent Expense 67S 53 Utilities Expense 300 54 Music Expense 1.590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 20Y5, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 20Y5.Comprehensive Problem 1 8 Net income. 31,425 Kelly Pitney began her consulting business. Kelly Consulting, on April 1, 20Y8. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter During May, Kelly Consulting entered into the following transactions: May 3.Received cash from clients as an advance payment for services to be provided and recorded it as unearned tree 4,500 5.Received cash from clients on account 2,450. 9.Paid cash for a newspaper advertisement 225. 13.Raid Office Station Co for part of the debt incurred on April , 640. 15.Recorded services provided on account for the period May 1-15, 9,180. 16 Paid part-time receptionist for two weeks salary including the amount owed on April 30, 750. 17.Recorded cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the Journal 20.Purchased support on account 735. 21.Recorded services provided on account for the period May 1620. 4,820 25.Recorded cash from cash clients for fees earned for the period May 1723, 7,900 27.Received cash from clients on account 9,520. 28.Paid part-time receptionist for two weeks salary. 7S0. 30.Raid telephone bill for May. 260 31.Paid electricity bill for May, 810. 31.Recorded cash from cash clients tor lees earned for the period May 2031. 3,300. 31.Recorded services provided on account for the remainder of May, 2,650. 31.Paid dividends 10,500 Instructions 1.The chart of accounts foe Kelly Consulting is shown us Exhibit 9. and the post-closing trial balance as of April 30, 20Y8, is shown in Exhibit 17. for each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1. 20Y8. and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two-column journal starting cm Page of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 5.Prepare an unadjusted trial balance. 4.At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). (a)Insurance expired during May is 275. (b)Supplies on hand on May II are 715. (c)Depreciation of office equipment for May is 330. (d)Accrued receptionist salary on May 31 is 325. (e)Rent expired during May is 1600. (f)Unearned fees on May 31 are 3,210 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of stockholders equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.COMPREHENSIVE PROBLEM 1, PERIOD 2: The Accounting Cycle During the month of May 20--, The Generals Favorite Fishing Hole engaged in the following transactions. These transactions required an expansion of the chart of accounts as shown below. Assets Revenues 101 Cash 401 Registration Fees 122 Accounts Receivable 404 Vending Commission Revenue 142 Office Supplies 144 Food Supplies Expenses 145 Prepaid Insurance 511 Wages Expense 146 Prepaid Subscriptions 512 Advertising Expense 161 Land 521 Rent Expense 171 Buildings 523 Office Supplies Expense 171.1 Accum. Depr.Buildings 524 Food Supplies Expense 181 Fishing Boats 525 Phone Expense 181.1 Accum. Depr.Fishing Boats 533 Utilities Expense 182 Surround Sound System 535 Insurance Expense 182.1 Accum. Depr.Surround Sound Sys. 536 Postage Expense 183 Big Screen TV 537 Repair Expense 183.1 Accum. Depr.Big Screen TV 540 Depr. Exp.Buildings 541 Depr. Exp.Surround Sound Sys. Liabilities 202 Accounts Payable 542 Depr. Exp.Fishing Boats 219 Wages Payable 543 Depr. Exp.Big Screen TV 546 Satellite Programming Exp. Owners Equity 548 Subscriptions Expense 311 Bob Night, Capital 312 Bob Night, Drawing 313 Income Summary May 1 In order to provide snacks for guests on a 24-hour basis, Night signed a contract with Snack Attack. Snack Attack will install vending machines with food and drinks and pay a 10% commission on all sales. Estimated payments are made at the beginning of each month. Night received a check for 200, the estimated commission on sales for May. 2 Night purchased a surround sound system and big screen TV with a digital satellite system for the guest lounge. The surround sound system cost 3,600 and has an estimated useful life of five years and no salvage value. The TV cost 8,000, has an estimated useful life of eight years, and has a salvage value of 800. Night paid cash for both items. 2 Paid for Mays programming on the new digital satellite system, 125. May 3 Nights office manager returned 100 worth of office supplies to Gordon Office Supply. Night received a 100 reduction on the account. 3 Deposited registration fees, 52,700. 3 Paid rent for lodge and campgrounds for the month of May, 40,000. 3 In preparation for the purchase of a nearby campground, Night invested an additional 600,000. 4 Paid Gordon Office Supply on account, 400. 4 Purchased the assets of a competing business and paid cash for the following: land, 100,000; lodge, 530,000; and fishing boats, 9,000. The lodge has a remaining useful life of 50 years and a 50,000 salvage value. The boats have remaining lives of five years and no salvage value. 5 Paid Mays insurance premium for the new camp, 1,000. (See above transaction.) 5 Purchased food supplies from Acme Super Market on account, 22,950. 5 Purchased office supplies from Gordon Office Supplies on account, 1,200. 7 Night paid 40 each for one-year subscriptions to Fishing Illustrated, Fishing Unlimited, and Fish Master. The magazines are published monthly. 10 Deposited registration fees, 62,750. 13 Paid wages to fishing guides, 30,000. (Dont forget wages payable from prior month.) 14 A guest became ill and was unable to stay for the entire week. A refund was issued in the amount of 1,000. 17 Deposited registration fees, 63,000. 19 Purchased food supplies from Acme Super Market on account, 18,400. 21 Deposited registration fees, 63,400. 23 Paid 2,500 for Mays advertising spots on National Sports Talk Radio. 25 Paid repair fee for damaged boat, 850. 27 Paid wages to fishing guides, 30,000. 28 Paid 1,800 for Mays advertising spots on billboards. 29 Purchased food supplies from Acme Super Market on account, 14,325. 30 Paid utilities bill, 3,300. 30 Paid phone bill, 1,800. 30 Paid Acme Super Market on account, 47,350. 31 Bob Night withdrew cash for personal use, 7,500. Adjustment information at the end of May is provided below. (a) Total vending machine sales were 2,300 for the month of May. A 10% commission is earned on these sales. (b) Straight-line depreciation is used for the 10 boats purchased on April 2 for 60,000. The useful life for these assets is five years and there is no salvage value. A full months depreciation was taken in April on these boats. Straight-line depreciation is also used for the two boats purchased in May. Make one adjusting entry for all depreciation on the boats. (c) Straight-line depreciation is used to depreciate the surround sound system. (d) Straight-line depreciation is used to depreciate the big screen TV. (e) Straight-line depreciation is used for the building purchased in May. (f) On April 2, Night paid 9,000 for insurance during the six-month camping season. Mays portion of this premium was used up during this month. (g) Night received his May issues of Fishing Illustrated, Fishing Unlimited, and Fish Master. (h) Office supplies remaining on hand, 150. (i) Food supplies remaining on hand, 5,925. (j) Wages earned, but not yet paid, at the end of May, 6,000. REQUIRED 1. Enter the transactions in a general journal. Enter transactions from May 14 on page 7, May 528 on page 8, and the remaining entries on page 9. To save time and space, dont enter descriptions for the journal entries. 2. Post the entries to the general ledger. (If you are not using the working papers that accompany this text, you will need to enter the account titles, account numbers, and balances from April 30 in the general ledger accounts.) 3. Prepare a trial balance on a work sheet. 4. Complete the work sheet. 5. Journalize the adjusting entries on page 10 of the general journal. 6. Post the adjusting entries to the general ledger. 7. Prepare the income statement. 8. Prepare the statement of owners equity. 9. Prepare the balance sheet. 10. Journalize the closing entries on page 11 of the general journal. 11. Post the closing entries to the general ledger. 12. Prepare a post-closing trial balance.

- Exercise 2-38 Events and Transactions The following economic events related to K the bill need not be paid until March 1, 2019. On February, 15, Kqualify and does not qualify. indicate whether each of the above events would qualify as a transaction and be recognized and recorded in the accounting system on the date indicated. 2. CONCEPTUAL CONNECTION For any events that did not qualify as a transaction to be recognized and recorded, explain why it does not qualify.Problem 3-70B Comprehensive Problem: Reviewing the Accounting Cycle Wilburton Riding Stables provides stables, care for animals, and grounds for riding and showing horses. The account balances at the beginning of 2019 were: During 2019, the following transactions occurred: Wilburton provided animal care services, all on credit, for $210,300. Wilburton rented stables to customers for $20,500 cash. Wilburton rented its grounds to individual riders, groups, and show organizations for $41,800 cash. There remains $15,600 of accounts receivable to be collected at December 31, 2019. Feed in the amount of $62,900 was purchased on credit and debited to the supplies Straw was purchased for $7,400 cash and debited to the supplies account. Wages payable at the beginning of 2019 were paid early in 2019. Wages were earned and paid during 2019 in the amount of $12,000. The income taxes payable at the beginning of 2019 were paid early in 2019. Payments of $73,000 were made to creditors for supplies previously purchased on credit. One years interest at 9% was paid on the note payable on July 1, 2019. During 2019, Jon Wilburton, a principal stockholder, purchased a horse for his Wife, Jennifer, to ride. The horse cost $7,000, and Wilburton used his personal credit to purchase it. The horse is stabled at the Wilburton home rather than at the riding stables. Property taxes were paid on the land and buildings in the amount of S17,000. Dividends were declared and paid in the amount Of The following data are available for adjusting entries: • Supplies (feed and straw) in the amount of $30,400 remained at year end. • Annual depreciation on the buildings is $6,000. • Annual depreciation on the equipment is • Wages of $4,000 were unrecorded and unpaid at year end. • Interest for 6 months at 9% per year on the note is unpaid and unrecorded at year end. • Income taxes of $16,500 were unpaid and unrecorded at year end. Required: Post the 2019 beginning balances to T-accounts. Prepare journal entries for Transactions a through k and post the journal entries to T-accounts, adding any new T-accounts you need. Prepare the adjustments and post the adjustments to the T-accounts, adding any new T-accounts you need. Prepare an income statement. Prepare a retained earnings statement. Prepare a classified balance sheet. Prepare closing entries. CONCEPTUAL CONNECTION Did you include Transaction i among Wilburtons 2019 journal entries? Why or why not?Problem 3-70B Comprehensive Problem: Reviewing the Accounting Cycle Wilburton Riding Stables provides stables, care for animals, and grounds for riding and showing horses. The account balances at the beginning of 2019 were: During 2019, the following transactions occurred: Wilburton provided animal care services, all on credit, for $210,300. Wilburton rented stables to customers for $20,500 cash. Wilburton rented its grounds to individual riders, groups, and show organizations for $41,800 cash. There remains $15,600 of accounts receivable to be collected at December 31, 2019. Feed in the amount of $62,900 was purchased on credit and debited to the supplies Straw was purchased for $7,400 cash and debited to the supplies account. Wages payable at the beginning of 2019 were paid early in 2019. Wages were earned and paid during 2019 in the amount of $12,000. The income taxes payable at the beginning of 2019 were paid early in 2019. Payments of $73,000 were made to creditors for supplies previously purchased on credit. One years interest at 9% was paid on the note payable on July 1, 2019. During 2019, Jon Wilburton, a principal stockholder, purchased a horse for his Wife, Jennifer, to ride. The horse cost $7,000, and Wilburton used his personal credit to purchase it. The horse is stabled at the Wilburton home rather than at the riding stables. Property taxes were paid on the land and buildings in the amount of S17,000. Dividends were declared and paid in the amount Of The following data are available for adjusting entries: • Supplies (feed and straw) in the amount of $30,400 remained at year end. • Annual depreciation on the buildings is $6,000. • Annual depreciation on the equipment is • Wages of $4,000 were unrecorded and unpaid at year end. • Interest for 6 months at 9% per year on the note is unpaid and unrecorded at year end. • Income taxes of $16,500 were unpaid and unrecorded at year end. Required: Post the 2019 beginning balances to T-accounts. Prepare journal entries for Transactions a through j and post the journal entries to T-accounts, adding any new T-accounts you need. Prepare the adjustments and post the adjustments to the T-accounts, adding any new T-accounts you need. Prepare an income statement. Prepare a retained earnings statement. Prepare a classified balance sheet Prepare closing entries. CONCEPTUAL CONNECTION Did you include Transaction g among Tarkingtons 2019 journal entries? Why or why not?