Concept explainers

Problem 3-70B Comprehensive Problem: Reviewing the Accounting Cycle

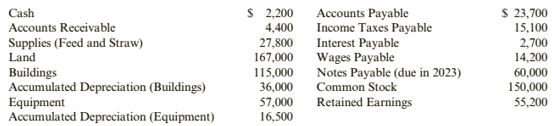

Wilburton Riding Stables provides stables, care for animals, and grounds for riding and showing horses. The account balances at the beginning of 2019 were:

During 2019, the following transactions occurred:

- Wilburton provided animal care services, all on credit, for $210,300. Wilburton rented stables to customers for $20,500 cash. Wilburton rented its grounds to individual riders, groups, and show organizations for $41,800 cash.

- There remains $15,600 of accounts receivable to be collected at December 31, 2019.

- Feed in the amount of $62,900 was purchased on credit and debited to the supplies

- Straw was purchased for $7,400 cash and debited to the supplies account.

- Wages payable at the beginning of 2019 were paid early in 2019. Wages were earned and paid during 2019 in the amount of $12,000.

- The income taxes payable at the beginning of 2019 were paid early in 2019.

- Payments of $73,000 were made to creditors for supplies previously purchased on credit.

- One year’s interest at 9% was paid on the note payable on July 1, 2019.

- During 2019, Jon Wilburton, a principal stockholder, purchased a horse for his Wife, Jennifer, to ride. The horse cost $7,000, and Wilburton used his personal credit to purchase it. The horse is stabled at the Wilburton home rather than at the riding stables.

- Property taxes were paid on the land and buildings in the amount of S17,000.

- Dividends were declared and paid in the amount Of

The following data are available for

• Supplies (feed and straw) in the amount of $30,400 remained at year end.

• Annual

• Annual depreciation on the equipment is

• Wages of $4,000 were unrecorded and unpaid at year end.

• Interest for 6 months at 9% per year on the note is unpaid and unrecorded at year end.

• Income taxes of $16,500 were unpaid and unrecorded at year end.

Required:

- Post the 2019 beginning balances to T-accounts. Prepare

journal entries for Transactions a through j andpost the journal entries to T-accounts, adding any new T-accounts you need. - Prepare the adjustments and post the adjustments to the T-accounts, adding any new T-accounts you need.

- Prepare an income statement.

- Prepare a

retained earnings statement. - Prepare a classified balance sheet

- Prepare closing entries.

- CONCEPTUAL CONNECTION Did you include Transaction g among Tarkington’s 2019 journal entries? Why or why not?

1.

To record:Journal entries and prepare T accounts to post those entries.

Introduction: Journal entries provide a record of the financial activities undertaken within an organization. Journal entries helps in preparation of financial statements of a company.

Explanation of Solution

Journalizing:

Journalizing is the process of recording the transactions of an organization in a chronological order. Based on these journal entries recorded, the accounts are posted to the relevant ledger accounts.

Accounting rules for journal entries:

- To increase balance of the account: Debit assets, expenses, losses and credit all liabilities, capital, revenue and gains.

- To decrease balance of the account: Credit assets, expenses, losses and debit all liabilities, capital, revenue and gains.

Recording service revenue:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Cash | 686,838 | |||

| Accounts receivables | 2,256,700 | |||

| Service revenue | 2,943,538 | |||

| (to recordservice revenue) |

Table (1)

- Since cash is an asset, asset is increased. Hence, cashaccount is debited.

- Since accounts receivables is anasset, asset is increased. Hence, accounts receivablesaccount is debited.

- Since service revenue is an income, income is increased. Hence, service revenue account is credited.

Recording receipt from accounts receivables:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Cash | 286,172 | |||

| Accounts receivable | 286,172 | |||

| (to record receipt of accounts receivables) |

Table (2)

- Since cash is an asset, asset is increased. Hence, cashaccount is debited.

- Since accounts receivables is anasset and it decreased. Hence, accounts receivablesaccount is credited.

Recording prepaid advertising:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Prepaid advertising | 138,100 | |||

| Cash | 138,100 | |||

| (to record unearned income) |

Table (3)

- Since prepaid advertising is an asset, asset is increased. Hence, prepaid advertisingaccount is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording purchase of supplies:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Supplies | 27,200 | |||

| Accounts payable | 27,200 | |||

| (to record purchase of supplies) |

Table (4)

- Since supplies is an asset, asset is increased. Hence, suppliesaccount is debited.

- Since accounts payable is aliability, liability is increased. Hence, accounts payable account is credited.

Recording repayment of accounts payable:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Accounts payable

| 12,000 | |||

| Cash | 12,000 | |||

| (to record repayment of accounts payable) |

Table (5)

- Since accounts payable is aliability, liability is decreased. Hence, accounts payableaccount is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording cash paid for wages:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Wages payable | 30,200 | |||

| Wages expense | 666,142 | |||

| Cash | 696,342 | |||

| (to record payment of wages) |

Table (6)

- Since wages payable is aliability, liability is decreased. Hence, wages payableaccount is debited.

- Since wages expense is an expense, expense is increased. Hence, wages expenseaccount is credited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording withdrawal of cash for personal purposes:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Drawings | 42,000 | |||

| Cash | 42,000 | |||

| (to record drawing) |

Table (7)

- Since drawing is capital, capital is decreased. Hence, drawingaccount is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording interest expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Interest expense | 30,000 | |||

| Cash | 30,000 | |||

| (to record interest expense) |

Table (8)

- Since interest expense is an expense, expense is decreased. Hence, interest expenseaccount is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording property taxes:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Property taxes | 170,000 | |||

| Cash | 170,000 | |||

| (to record property taxes) |

Table (9)

- Since property taxes is an expense, expense is increased. Hence, property taxes account is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording dividend payment:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Dividend | 25,000 | |||

| Cash | 25,000 | |||

| (to record dividend payment) |

Table (10)

- Since dividend is an expense, expense is increased. Hence, dividend account is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Working Notes:

Computation of interest payable:

Preparation of cash account in general ledger:

| Cash | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 92,100 | 92,100 | |||

| Service revenue | 686,838 | 778,938 | |||

| Accounts receivable | 286,172 | 1,065,110 | |||

| Prepaid advertisement | 138,100 | 927,010 | |||

| Accounts payable | 12,000 | 915,010 | |||

| Wages payable | 30,200 | 884,810 | |||

| Wages expenses | 666,142 | 218,668 | |||

| Drawings | 42,000 | 176,668 | |||

| Interest expense | 30,000 | 146,668 | |||

| Property tax | 1,70,000 | (23332) | |||

| Dividend | 25,000 | (48,332) | |||

Table (11)

Preparation of accounts receivable account in general ledger:

| Accounts receivable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 361,500 | 361,500 | |||

| Service revenue | 2,256,700 | 2,618,200 | |||

| Cash | 286,172 | 2,332,028 | |||

Table (12)

Preparation of supplies account in general ledger:

| Supplies | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 24,600 | 24,600 | |||

| Accounts payable | 27,200 | 51,800 | |||

Table (13)

Preparation of prepaid advertising account in general ledger:

| Prepaid advertising | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 2,000 | 2,000 | |||

| Cash | 138,100 | 140,100 | |||

Table (14)

Preparation of building account in general ledger:

| Building | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 2,190,000 | 2,190,000 | |||

Table (15)

Preparation of accumulated depreciation account in general ledger:

| Accumulated depreciation-Building | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 280,000 | ||||

Table (16)

Preparation of equipment account in general ledger:

| Equipment | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 795,000 | 795,000 | |||

Table (17)

Preparation of accumulated depreciation account in general ledger:

| Accumulated depreciation-Equipment | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 580,000 | ||||

Table (18)

Preparation of land account in general ledger:

| Land | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 304,975 | 304.975 | |||

Table (19)

Preparation of accounts payable account in general ledger:

| Accounts payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 17,600 | 17,600 | |||

| Supplies | 27,200 | 44,800 | |||

| Cash | 12,000 | 32,800 | |||

Table (20)

Preparation of wages payable account in general ledger:

| Wages payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 30,200 | ||||

| Cash | 30,200 | 0 | |||

Table (21)

Preparation of notes payable account in general ledger:

| Notes payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 1,000,000 | ||||

Table (22)

Preparation of common stock account in general ledger:

| Common stock | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 1,400,000 | ||||

Table (23)

Preparation of retained earnings account in general ledger:

| Retained earnings | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 462,375 | ||||

Table (24)

Preparation of service revenue account in general ledger:

| Service revenue | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Accounts receivable | 2,256,700 | ||||

| Cash | 686,838 | ||||

Table (25)

Preparation of wages expense account in general ledger:

| Wages expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 666,142 | 666,142 | |||

Table (26)

Preparation of drawing account in general ledger:

| Drawing | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 42,000 | 42,000 | |||

Table (27)

Preparation of interest expense account in general ledger:

| Interest expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 30,000 | 30,000 | |||

Table (28)

Preparation of property tax account in general ledger:

| Property tax expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 170,000 | 170,000 | |||

Table (29)

Preparation of dividend account in general ledger:

| Dividend expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 25,000 | 25,000 | |||

Table (30)

2.

To record:Adjusting entries. Also, post the adjustment entries in the respective T accounts.

Introduction: Adjusting entries are made at the end of reporting period at the time of preparation of financial statements. Adjusting entries are recorded to reflect the correct picture of financial position of the organization in the financial statements.

Explanation of Solution

Recording adjustment of supplies:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Supplies Expense

| 38,115 | |||

| Supplies | 38,115 | |||

| (to record adjustment of supplies) |

Table (31)

- Since supplies expense is an expense, expense is increased. Hence, supplies expense account is debited.

- Since supplies is an asset, asset is decreased. Hence, supplies account is credited.

Recording depreciation expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Depreciation -Building | 70,000 | |||

| Accumulated depreciation-Building | 70,000 | |||

| (to record depreciation expense) |

Table (32)

- Since depreciation is an expense, expense is increased. Hence, depreciation-Building account is debited.

- Since accumulated depreciation is a contra asset, contra asset is increased. Hence, accumulated depreciation-Building account is credited.

Recording depreciation expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Depreciation -Equipment | 145,000 | |||

| Accumulated depreciation-Equipment | 145,000 | |||

| (to record depreciation expense) |

Table (33)

- Since depreciation is an expense, expense is increased. Hence, depreciation-Equipment account is debited.

- Since accumulated depreciation is a contra asset, contra asset is increased. Hence, accumulated depreciation-Equipment account is credited.

Recording wages payable:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Wages expense | 60,558 | |||

| Wages payable | 60,558 | |||

| (to record wages expense) |

Table (34)

- Since wages expense is an expense, expense is increased. Hence, wages expense account is debited.

- Since wages payable is a liability, liability is increased. Hence, wages payable account is credited.

Recording interest expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Interest expense | 30,000 | |||

| Interest Payable | 30,000 | |||

| (to record interest expense) |

Table (35)

- Since interestexpense is an expense, expense is increased. Hence, interestexpense account is debited.

- Since interest payable is a liability, liability is increased. Hence, interest payable account is credited.

Recording adjustment of prepaid advertisement:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Advertising Expense

| 125,226 | |||

| Prepaid advertising | 125,226 | |||

| (to record advertising adjustment) |

Table (36)

- Sinceadvertising expense is an expense, expense is increased. Hence, advertising expense account is debited.

- Since prepaid advertising is an asset, asset is decreased. Hence, prepaid advertising account is credited.

Recording income tax expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Income tax expense | 482,549 | |||

| Income tax payable | 482,549 | |||

| (to record income tax expense) |

Table (37)

- Since income tax is an expense, expense is increased. Hence, income tax account is debited.

- Since income tax payable is a liability, liability is increased. Hence, income tax payable account is credited.

Preparation of cash account in general ledger:

| Cash | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 92,100 | 92,100 | |||

| Service revenue | 686,838 | 778,938 | |||

| Accounts receivable | 286,172 | 1,065,110 | |||

| Prepaid advertisement | 138,100 | 927,010 | |||

| Accounts payable | 12,000 | 915,010 | |||

| Wages payable | 30,200 | 884,810 | |||

| Wages expenses | 666,142 | 218,668 | |||

| Drawings | 42,000 | 176,668 | |||

| Interest expense | 30,000 | 146,668 | |||

| Property tax | 1,70,000 | (23332) | |||

| Dividend | 25,000 | (48,332) | |||

Table (38)

Preparation of accounts receivable account in general ledger:

| Accounts receivable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 361,500 | 361,500 | |||

| Service revenue | 2,256,700 | 2,618,200 | |||

| Cash | 286,172 | 2,332,028 | |||

Table (39)

Preparation of supplies account in general ledger:

| Supplies | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 24,600 | 24,600 | |||

| Accounts payable | 27,200 | 51,800 | |||

| Supplies expense | 38,115 | 13,685 | |||

Table (40)

Preparation of prepaid advertising account in general ledger:

| Prepaid advertising | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 2,000 | 2,000 | |||

| Cash | 138,100 | 140,100 | |||

| Advertising expense | 125,226 | 14,874 | |||

Table (41)

Preparation of building account in general ledger:

| Building | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 2,190,000 | 2,190,000 | |||

Table (42)

Preparation of accumulated depreciation account in general ledger:

| Accumulated depreciation-Building | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 280,000 | ||||

| Depreciation | 70,000 | ||||

Table (43)

Preparation of equipment account in general ledger:

| Equipment | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 795,000 | 795,000 | |||

Table (44)

Preparation of accumulated depreciation account in general ledger:

| Accumulated depreciation-Equipment | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 580,000 | ||||

| Depreciation | 145,000 | ||||

Table (45)

Preparation of land account in general ledger:

| Land | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 304,975 | 304.975 | |||

Table (46)

Preparation of accounts payable account in general ledger:

| Accounts payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 17,600 | ||||

| Supplies | 27,200 | ||||

| Cash | 12,000 | ||||

Table (47)

Preparation of interest payable account in general ledger:

| Interest payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Interest expense | 30,000 | ||||

Table (48)

Preparation of wages payable account in general ledger:

| Wages payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 30,200 | ||||

| Cash | 30,200 | 0 | |||

| Wages expense | 60,558 | ||||

Table (49)

Preparation of income tax payable account in general ledger:

| Income tax payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Income tax expense | 482,549 | ||||

Table (50)

Preparation of notes payable account in general ledger:

| Notes payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 1,000,000 | ||||

Table (51)

Preparation of common stock account in general ledger:

| Common stock | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 1,400,000 | ||||

Table (52)

Preparation of retained earnings account in general ledger:

| Retained earnings | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 462,375 | ||||

Table (53)

Preparation of service revenue account in general ledger:

| Service revenue | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Accounts receivable | 2,256,700 | ||||

| Cash | 686,838 | ||||

Table (54)

Preparation of wages expense account in general ledger:

| Wages expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 666,142 | 666,142 | |||

| Wages payable | 60,558 | 726,700 | |||

Table (55)

Preparation of drawing account in general ledger:

| Drawing | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 42,000 | 42,000 | |||

Table (56)

Preparation of interest expense account in general ledger:

| Interest expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 30,000 | 30,000 | |||

| Interest payable | 30,000 | 60,000 | |||

Table (57)

Preparation of property tax account in general ledger:

| Property tax expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 170,000 | 170,000 | |||

Table (58)

Preparation of dividend account in general ledger:

| Dividend expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 25,000 | 25,000 | |||

Table (59)

Preparation of supplies expense in general ledger:

| Supplies expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Supplies | 38,115 | 38,115 | |||

Table (60)

Preparation of depreciation expense account in general ledger:

| Depreciation-building expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Accumulated depreciation | 70,000 | 70,000 | |||

Table (61)

Preparation of depreciation expense account in general ledger:

| Depreciation-equipment expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Accumulated depreciation | 145,000 | 145,000 | |||

Table (62)

Preparation of advertising expense in general ledger:

| Advertising expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Prepaid advertising | 125,226 | 125,226 | |||

Table (63)

Preparation of income tax expense in general ledger:

| Income tax expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Income tax payable | 482,549 | 482,549 | |||

Table (64)

3.

To prepare:Income statement.

Introduction: Income statement is prepared to ascertain net income of a company for a period. Net income shows operating efficiency of a company.

Explanation of Solution

Preparation of income statement for the year ending 31st December,2019:

| CompanyA | |||||

| Income Statement | |||||

| Amount ($) | Amount ($) | ||||

| Revenues: | |||||

| Service revenue | 2,943,538 | ||||

| Total Revenue | 2,943,538 | ||||

| Expenses: | |||||

| Wages expense | 726,700 | ||||

| Advertising expense | 125,226 | ||||

| Interest expense | 60,000 | ||||

| Supplies expense | 38,115 | ||||

| Property tax | 170,000 | ||||

| Depreciation-building expense | 70,000 | ||||

| Depreciation-equipment expense | 145,000 | ||||

| Income tax expense | 482,549 | ||||

| Total Expenses | 1,817,590 | ||||

| Net Income | 1,125,948 | ||||

Table (65)

4.

To prepare:Statement of retained earnings.

Introduction: Statement of retained earnings shows the net impact on retained earnings of the company, in a given period.

Explanation of Solution

Preparation of statement of retained earnings as on 31st December,2019:

| Company A | ||

| Statement of Retained Earning | ||

| Amount($) | Amount($) | |

| Owner’s Equity opening balance | 462,375 | |

| Add: Capital introduced by owner | ||

| Add: Net income | 1,125,948 | |

| Total: | 1,588,323 | |

| Less: Withdrawals | ||

| Less: Dividend | ||

| Closing Balance | 1,521,323 | |

Table (66)

5.

To prepare:Balance sheet of the company at the end of the accounting period.

Introduction: Balance sheet shows the status of assets and liabilities of the company, in which total assets equates with total liabilities and equity.

Explanation of Solution

Preparation of balance sheet as on 31st December,2019:

| Company A | |||||

| Balance Sheet | |||||

| Amount ($) | Amount($) | ||||

| Liabilities and Owners Equity | |||||

| Current Liabilities | |||||

| Accounts Payable | 32,800 | ||||

| Wages Payable | 60,558 | ||||

| Interest Payable | 30,000 | ||||

| Income tax payable | 482,549 | ||||

| Total Current Liabilities | 605,907 | ||||

| Non-Current Liabilities | |||||

| Note Payable (due in 2023) | 1,000,000 | ||||

| Total Non-Current Liabilities | 1,000,000 | ||||

| Total Liabilities | |||||

| Common Stock | 1,400,000 | ||||

| Retained Earnings | 1,521,323 | 2,921,323 | |||

| Total Liabilities and Owner’s Equity | 4,527,230 | ||||

| Current Assets | |||||

| Cash | (48,332) | ||||

| Accounts Receivable | 2,332,028 | ||||

| Supplies | 13,685 | ||||

| Prepaid advertising | 14,874 | ||||

| Total Current Assets | 2,312,255 | ||||

| Property, Plant and Equipment | |||||

| Building | 2,190,000 | ||||

| Less: accumulated depreciation | |||||

| Equipment | 795,000 | ||||

| Less: accumulated depreciation | |||||

| Land | 304975 | ||||

| Total Property, Plant and Equipment | 2,214,975 | ||||

| Total Assets | 4,527,230 | ||||

Table (67)

6.

To record:closing journal entries.

Introduction: Closing entries are posted to close all the temporary accounts of the accounting books. Closing entries zeros the balances of income statement items, drawings, and dividends.

Explanation of Solution

Recording closing entry for expense accounts:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Income summary | 1,817,590 | |||

| Wages expense | 726,700 | |||

| Interest expense | 60,000 | |||

| Propert tax expense | 170,000 | |||

| Supplies expense | 38,115 | |||

| Depreciation-building expense | 70,000 | |||

| Depreciation-equipment expense | 145,000 | |||

| Advertising expense | 125,226 | |||

| Income tax expense | 482,549 | |||

| (to record closing of expense accounts) |

Table (68)

- Since income summary is a temporary income account, temporary income is decreased. Hence, income summary account is debited.

- Since wages expense is an expense, expense is decreased. Hence, wagesexpenseaccount is credited.

- Since interest expense is an expense, expense is decreased. Hence, interestexpense account is credited.

- Since property tax is an expense, expense is decreased. Hence, property tax account is credited.

- Since supplies expense is an expense, expense is decreased. Hence, suppliesexpenseaccount is credited.

- Since depreceiation expense is an expense, expense is decreased. Hence, depreceiation -building expenseaccount is credited.

- Since depreceiation expense is an expense, expense is decreased. Hence, depreceiation-equipmentexpenseaccount is credited.

- Since advertising expense is an expense, expense is decreased. Hence, advertisingexpenseaccount is credited.

- Since income tax is an expense, expense is decreased. Hence, income tax account is credited.

Recording closing entry for revenue accounts:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Sales revenue | 2,943,538 | |||

| Income summary | 2,943,538 | |||

| (to record closing of revenue account) |

Table (69)

- Since sales revenue is an income, income is decreased. Hence, sales revenue account is debited.

- Since income summary is a temporary income account, temporary income is increased. Hence, income summary account is credited.

Recording transfer of income summary account:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Income summary | 1,125,948 | |||

| Retained earnings | 1,125,948 | |||

| (to record closing entry) |

Table (70)

- Since income summary is a temporary income account, temporary income is decreased. Hence, income summary account is debited.

- Since retained earnings is areserve, reserve is increased. Hence, retained earnings account is credited.

Transfering drawings and dividends to retained earnings:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Retained earnings | 67,000 | |||

| Drawings | 42,000 | |||

| Dividend | 25,000 | |||

| (to record closing entry) |

Table (71)

- Since retained earnings is areserve, reserve is decreased. Hence, retained earnings account is debited.

- Since drawings is capital, capital is increased. Hence, drawingss account is credited.

- Since dividends is expense, expense is decreased. Hence, dividends account is credited.

7.

Whether the given transaction relating to personal expense should be recorded in the books or not.

Introduction:Personal expenses are incurred by the owners for their personal useby utilizing the cash held within the company.

Explanation of Solution

Personal expenses should also be recorded in the books of the company because these expenses are incurred by using the cash of company. In case, such expenses are not included in the books then , cash account would not show the correct balance.

Personal expenses are shown as drawings by the owners. It is reduced from the equity component of the balance sheet by reducing the retained earnings.

Want to see more full solutions like this?

Chapter 3 Solutions

Cornerstones of Financial Accounting

- Exercise 3-40 Revenue and Expense Recognition Electronic Repair Company repaired a high-definition television for Sarah Merrifield in December 2019. Sarah paid $80 at the time of the repair and agreed to pay Electronic Repair $80 each month for 5 months beginning on January 15, 2020. Electronic Repair used $120 of supplies, which were purchased in November 2020, to repair the television. Assume that Electronic Repair uses accrual-basis accounting. Required: In what month or months should revenue from this service be recorded by Electronic Repaid? In what month or months should the expense related to the repair of the television be recorded by Electronic Repair? CONCEPTUAL CONNECTION Describe the accounting principles used to answer the above questions.arrow_forwardExercise 2-38 Events and Transactions The following economic events related to K the bill need not be paid until March 1, 2019. On February, 15, Kqualify and does not qualify. indicate whether each of the above events would qualify as a transaction and be recognized and recorded in the accounting system on the date indicated. 2. CONCEPTUAL CONNECTION For any events that did not qualify as a transaction to be recognized and recorded, explain why it does not qualify.arrow_forwardExercise 3-43 Recognizing Expenses Treadway Dental Services gives each of its patients a toothbrush with the name and phone number of the dentist office and a logo imprinted on the brush. Treadway purchased 15,000 of the toothbrushes in October 2019 for $3,130. The toothbrushes were delivered in November and paid for in December 2019. Treadway began to give the patients the toothbrushes in February 2020. By the end of 2020, 4,500 of the toothbrushes remained in the supplies account. Required: How much expense should be recorded for the toothbrushes in 2019 and 2020 to properly match expenses with revenues? Describe how the 4,500 toothbrushes that remain in the supplies account will handled in 2021.arrow_forward

- Exercise 3-47 Revenue Adjustments Sentry Transport Inc. of Atlanta provides in-town parcel delivery services in addition to a full range of passenger services. Sentry engaged in the following activities during the current year: Sentry received $5,000 cash in advance from Richs Department Store for an estimated 250 deliveries during December 2019 and January and February of 2020. The entire amount was recorded as unearned revenue when received. During December 2019, 110 deliveries were made for Richs. Sentry operates several small buses that take commuters from suburban communities to the central downtown area of Atlanta. The commuters purchase, in advance, tickets for 50 one-way rides. Each So-ride ticket costs S500. At the time of purchase, Sentry credits the cash received to unearned revenue. At year end, Sentry determines that 10,160 one-way rides have been taken. Sentry operates buses that provide transportation for the clients of a social agency in Atlanta. Sentry bills the agency quarterly at the end of January, April, July, and October for the that quarter. The contract price is S7,500 per quarter. Sentry follows the practice of recognizing revenue from this contract in the in which the service is On December 23, Delta Airlines chartered a bus to transport its marketing group to a meeting at a resort in southern Georgia. The meeting will be held during the last week in January 2020, and Delta agrees to pay for the entire trip on the day the bus departs. At year end, none Of these arrangements have been recorded by Sentry. Required: Prepare adjusting entries at December 31 for these four activities. CONCEPTUAL CONNECTION What would be the effect on revenue if the adjusting entries were not made?arrow_forwardProblem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to firms too Email to own their own computing equipment. Mulberry had the following amounts and amount balances as of January 1, 2019: During 2019, the following transactions occurred (the events described below are aggregations of many individual events): During 2019, Mulberry sold $690,000 of computing services, all on credit. Mulberry collected $570,000 from the credit sales in Transaction a and an additional $129,000 from the accounts receivable outstanding at the beginning of the year. Mulberry paid the interest payable of $8,000. A Wages of $379,000 were paid in cash. Repairs and maintenance of $9,000 were incurred and paid. The prepaid rent at the beginning of the year was used in 2019. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end. Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end. Advertising expense of $26,000 was incurred and paid. Income tax of $10,300 was incurred and paid in 2019. Interest of $5,000 was paid on the long-term loan. (Continued) Required: 1. Establish a ledger for the accounts listed above and enter the beginning balances. Use a chart of accounts to order the ledger accounts. 2. Analyze each transaction, Journalize as appropriate. (Note: Ignore the date because these events are aggregations of individual events.) 3. Post your journal entries to T-accounts, Add additional T-accounts when needed. 4. Use the ending balances in the T-accounts to prepare a trial balancearrow_forwardExpense Adjustments Faraday Electronic Service repairs stereos and DVD players. During 2019, Faraday engaged in the following activities: On September 1, Faraday paid Wausau Insurance $4,860 for its liability insurance for the next 12 months. The full amount of the prepayment was debited to prepaid insurance. At December 31, Faraday estimates that $1,520 of utility costs are unrecorded and unpaid. Faraday rents its testing equipment from JVC. Equipment rent in the amount of $1,440 is unpaid and unrecorded at December 31. In late October, Faraday agreed to become the sponsor for the sports segment of the evening news program on a local television station. The station billed Faraday $4,350 for 3 months' sponsorship-November 2019, December 2019, and January 2020-in advance. When these payments were made, Faraday debited prepaid advertising. At December 31, 2 months' advertising has been and I month remains unused. Required: Prepare adjusting entries at December 31 for these four activities. CONCEPTUAL CONNECTION What would be the effect on expenses if the adjusting entries were not made?arrow_forward

- Problem 3-64B Identification and Preparation of Entries Morgan Dance Inc. provides ballet, tap, and jazz dancing instruction to promising young dancers. Morgan began operations in January 2020 and is preparing its monthly financial statements. The following items describe Morgans transactions in January 2020: Morgan requires that dance instruction be paid in advance-either monthly or quarterly. On January 1, Morgan received $4,125 for dance instruction to be provided during 2020. On January 31, Morgan noted that $825 of dance instruction revenue is still unearned. On January 20, Morgans hourly employees were paid $1,415 for work performed in January. Morgans insurance policy requires semiannual premium payments. Morgan paid the $3,000 insurance policy which covered the first half of 2020 in December 2019. When there are no scheduled dance classes, Morgan rents its dance studio for birthday parties for $100 per two-hour party. Four birthday parties were held during January. Morgan will not bill the parents until February. Morgan purchased $350 of office supplies on January 10. On January 31, Morgan determined that Office supplies of $770 were unused. Morgan received a January utility bill for S770. The bill will not be paid until it is due in February. Required: Identify whether each transaction is an adjusting entry or a regular journal entry. If the entry is an adjusting entry, identify it as an accrued revenue, accrued expense, deferred revenue, or deferred expense. Prepare the entries necessary to record the transactions above and on the previous page.arrow_forwardProblem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to firms too Email to own their own computing equipment. Mulberry had the following amounts and amount balances as of January 1, 2019: During 2019, the following transactions occurred (the events described below are aggregations of many individual events): During 2019, Mulberry sold $690,000 of computing services, all on credit. Mulberry collected $570,000 from the credit sales in Transaction a and an additional $129,000 from the accounts receivable outstanding at the beginning of the year. Mulberry paid the interest payable of $8,000. A Wages of $379,000 were paid in cash. Repairs and maintenance of $9,000 were incurred and paid. The prepaid rent at the beginning of the year was used in 2019. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end. Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end. Advertising expense of $26,000 was incurred and paid. Income tax of $10,300 was incurred and paid in 2019. Interest of $5,000 was paid on the long-term loan. (Continued) Required: Establish a T-account for the accounts listed above and enter the beginning balances. Use a chart of accounts to order the T-accounts. Analyze each transaction; Journalize as appropriate. (Note: Ignore the date because these events are aggregations of individual events.) Post your journal entries to the T-accounts. Add additional T-accounts when needed. Use the ending balances in the T-accounts to prepare a trial balance.arrow_forwardExercise 3-44 Revenue Expense and Recognition Carrico Advertising Inc. performs advertising services for several Fortune 500 companies. The following information describes Carricos activities during 2019. At the beginning of 2019, customers owed Carrico $45,800 for advertising services formed during 2018. During 2019, Carrico performed an additional $695,100 of advertising services on account. Carrico collected $708,700 cash from customers during 2019. At the beginning of 2019, Carrico had $13,350 of supplies on hand for which it owed suppliers SS, 150. During 2019, Carrico purchased an additional $14,600 of supplies on account. Carrico also paid $19,300 cash owed to suppliers for goods previously purchased on credit. Carrico had of supplies on hand at the end of 2019. Carricos 2019 operating and interest were $437 and $133,400, respectively. Required: Calculate Carricos 2019 income before taxes. Calculate the ending balance of receivable, the supplies used, and the ending balance of accounts payable. CONCEPTUAL CONNECTION Explain the underlying principles behind why the three accounts computed in Requirement 2 exist.arrow_forward

- Case 2-68 Accounting for Partially Completed Events: 3 Prelude to Chapter 3 Ehrlich Smith. the owner of The Shoe Bone has asked you to help him understand the proper way to account for certain accounting items as he prepares his 2019 financial statements. Smith has provided the following information and observations: (Continued) a. A 3-year fire insurance policy was purchased on 2019, for $2,400. Smith believes that a part of the cost of the insurance policy should be allocated to each period that benefits from its coverage. b. The store building was purchased for 580,000 in January 2011. Smith expected then (as he does now) that the building will be serviceable as a shoe store for 20 years from the date of purchase. In 2011, Smith estimated that he could sell the property for $6,000 at the end of its serviceable life. He feels that each period should bear some portion of the cost of this long-lived asset that is slowly being consumed. c. The Shoe Box borrowed 520300 on a 1-year, 8% note that is due on September 1 next year) Smith notes that $21,600 cash will be required to repay the note at maturity. The $1,600 difference is, he feels, a cost of using the loaned funds and should be spread over the periods that benefit from the use of' the loan funds; Required: Explain what Smith is trying to accomplish with the three items. Are his objectives supported by the concepts that underlie accounting?arrow_forwardProblem 3-65B Preparation of Adjusting Entries West Beach Resort operates a resort complex that specializes in hosting small business and professional meetings. West Beach closes its fiscal year on January 31, a time when it has few meetings under way. At January 31, 2020, the following data are available: A training meeting is under way for 16 individuals from Fashion Design. Fashion Design paid $4,500 in advance for each attending the 10-day training session. The meeting began on January 28 and will end on February 6. Twenty-one people from Northern Publishing are attending a sales meeting. The daily fee for each person attending the meeting is $280 (charged for each night a stays at the resort). The meeting began on January 29, and guests will depart on February 2. Northern will be billed at the end of the meeting. Depreciation on the golf carts used to transport the guests' luggage to and from their rooms is $11,250 for the year. West Beach records depreciation yearly. At January 31, Friedrich Catering is owed $1,795 for food provided for guests through that date. This amount is unrecorded. West Beach classifies the cost of food as an other expense on the income statement. An examination indicates that the cost of office supplies on hand at January 31 is $189. During the year, $850 of office supplies was purchased from Supply Depot. The cost of supplies purchased was debited to Office Supplies Inventory. No office supplies were on hand on January 31, 2019. Required: Prepare adjusting entries at January 31 for each of these items. CONCEPTUAL CONNECTION By how much would net income be overstated or understated if the accountant failed to make the adjusting entries?arrow_forwardProblem 3-71 A Preparing a Worksheet (Appendix 3A) Marsteller Properties Inc. owns apartments that it rents to university students. At December 31, 2019, the following unadjusted account balances were available: The following information is available for adjusting entries: An analysis of apartment rental contracts indicates that S3,800 of apartment rent is unbilled and unrecorded at year end. A physical count Of supplies reveals that $1,400 of supplies are on hand at December 31 , 2019. Annual depreciation on the buildings is $204,250. An examination of insurance policies indicates that $12,000 Of the prepaid insurance applies to coverage for 2019. Six months' interest at 9% is unrecorded and unpaid on the notes payable.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning