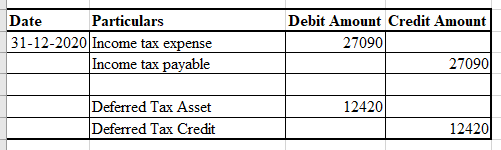

Required: А. Calculate taxable income for 2020. В. Prepare the journal entry necessary to record income taxes at the end of 2020. С. How would any deferred tax amounts be reported on a classified balance sheet?

Required: А. Calculate taxable income for 2020. В. Prepare the journal entry necessary to record income taxes at the end of 2020. С. How would any deferred tax amounts be reported on a classified balance sheet?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 20E: Balance Sheet Presentation Thiel Company reports the following deferred tax items at the end of...

Related questions

Question

Transcribed Image Text:Required:

А.

Calculate taxable income for 2020.

В.

Prepare the journal entry necessary to record income taxes at the end of 2020.

С.

How would any deferred tax amounts be reported on a classified balance sheet?

Expert Solution

Step 1

Part A)

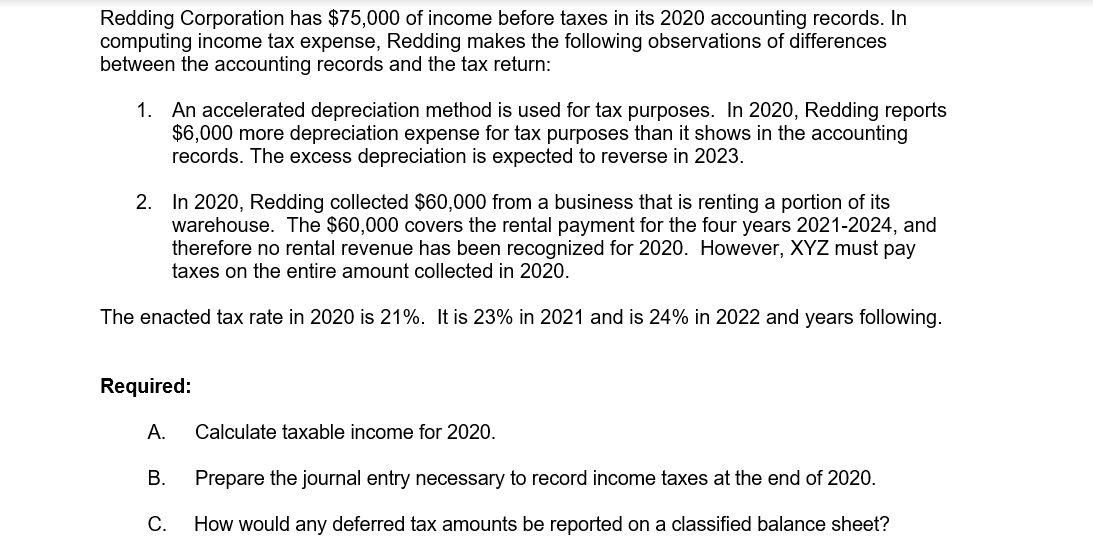

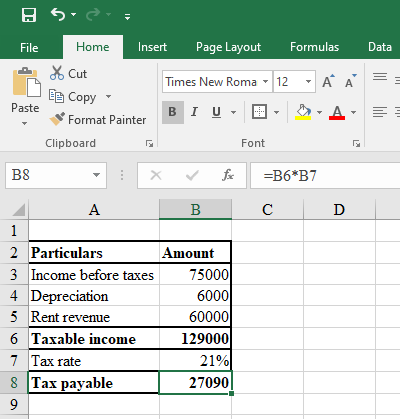

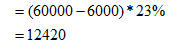

Calculation of taxable income for 2020

A formulation for the above-

Step 2

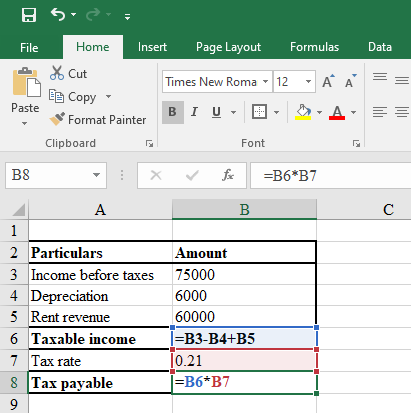

Part B)

Journal entries-

Note-

Deferred tax asset = Difference between the income calculated as per companies books of accounts and income calculated by the authorities of tax.

Therefore Rental Revenue – Depreciation Expenses * Tax Rate

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning