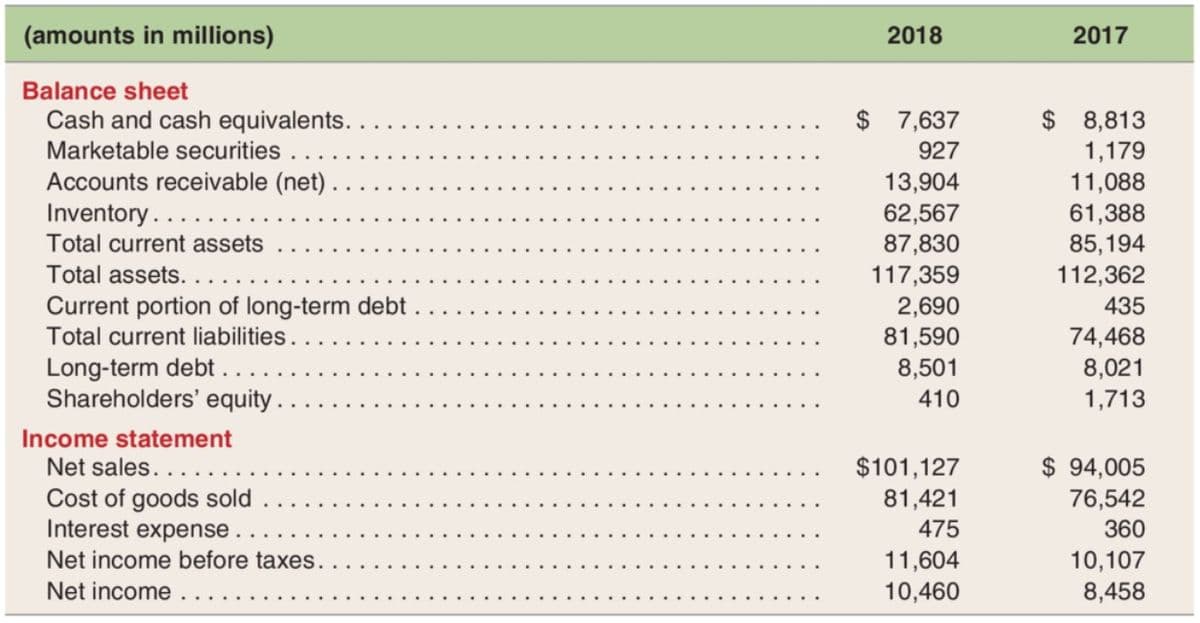

Calculate the following financial ratios for The Boeing Company. If not Applicable write N/A: Return on Shareholders’ Equity Return on Assets Return on Sales Gross profit margin ratio Receivable Turnover Receivable Ratio Period Inventory Turnover Inventory-on-hand period Asset Turnover Cash and marketable securities to total assets Quick ratio Current ratio Accounts payable turnover Days’ payable turnover Financial leverage Long-term debt to shareholders’ equity Interest coverage ratio

Calculate the following financial ratios for The Boeing Company. If not Applicable write N/A: Return on Shareholders’ Equity Return on Assets Return on Sales Gross profit margin ratio Receivable Turnover Receivable Ratio Period Inventory Turnover Inventory-on-hand period Asset Turnover Cash and marketable securities to total assets Quick ratio Current ratio Accounts payable turnover Days’ payable turnover Financial leverage Long-term debt to shareholders’ equity Interest coverage ratio

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 14GI: Dunn Company recognized a 5,000 unrealized holding gain on investment in Starbuckss long-term bonds...

Related questions

Question

Calculate the following financial ratios for The Boeing Company. If not Applicable write N/A:

Return on Shareholders’ Equity

Return on Assets

Return on Sales

Gross profit margin ratio

Receivable Turnover

Receivable Ratio Period

Inventory Turnover

Inventory-on-hand period

Asset Turnover

Cash and marketable securities to total assets

Quick ratio

Accounts payable turnover

Days’ payable turnover

Financial leverage

Long-term debt to shareholders’ equity

Interest coverage ratio

Transcribed Image Text:(amounts in millions)

2018

2017

Balance sheet

Cash and cash equivalents. .

$ 7,637

$ 8,813

1,179

11,088

Marketable securities

927

Accounts receivable (net)

Inventory....

Total current assets

13,904

62,567

87,830

61,388

85,194

Total assets. . . ..

Current portion of long-term debt .

Total current liabilities..

Long-term debt . ..

Shareholders' equity.

117,359

112,362

2,690

81,590

435

74,468

8,501

8,021

410

1,713

Income statement

Net sales..

Cost of goods sold

Interest expense

$101,127

81,421

$ 94,005

76,542

475

360

Net income before taxes.

11,604

10,107

Net income

10,460

8,458

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning