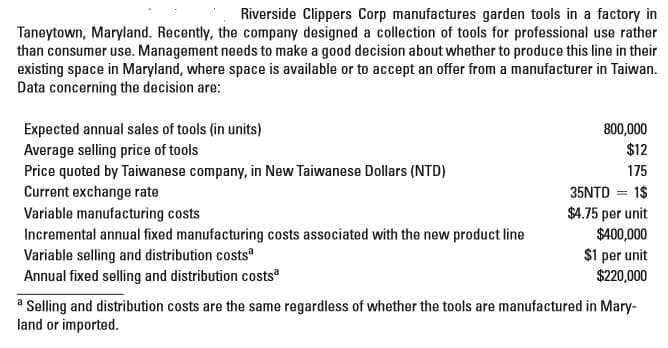

Riverside Clippers Corp manufactures garden tools in a factory in Taneytown, Maryland. Recently, the company designed a collection of tools for professional use rather than consumer use. Management needs to make a good decision about whether to produce this line in their existing space in Maryland, where space is available or to accept an offer from a manufacturer in Taiwan. Data concerning the decision are: 800,000 Expected annual sales of tools (in units) Average selling price of tools Price quoted by Taiwanese company, in New Taiwanese Dollars (NTD) Current exchange rate Variable manufacturing costs Incremental annual fixed manufacturing costs associated with the new product line Variable selling and distribution costsa Annual fixed selling and distribution costs $12 175 35NTD = 1$ $4.75 per unit $400,000 $1 per unit $220,000 a Selling and distribution costs are the same regardless of whether the tools are manufactured in Mary- land or imported.

Riverside Clippers Corp manufactures garden tools in a factory in Taneytown, Maryland. Recently, the company designed a collection of tools for professional use rather than consumer use. Management needs to make a good decision about whether to produce this line in their existing space in Maryland, where space is available or to accept an offer from a manufacturer in Taiwan. Data concerning the decision are: 800,000 Expected annual sales of tools (in units) Average selling price of tools Price quoted by Taiwanese company, in New Taiwanese Dollars (NTD) Current exchange rate Variable manufacturing costs Incremental annual fixed manufacturing costs associated with the new product line Variable selling and distribution costsa Annual fixed selling and distribution costs $12 175 35NTD = 1$ $4.75 per unit $400,000 $1 per unit $220,000 a Selling and distribution costs are the same regardless of whether the tools are manufactured in Mary- land or imported.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 26E: Ingles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other...

Related questions

Question

What are some of the qualitative factors that Riverside Clippers Corp should consider when deciding whether to outsource the garden tools manufacturing to Taiwan?

Transcribed Image Text:Riverside Clippers Corp manufactures garden tools in a factory in

Taneytown, Maryland. Recently, the company designed a collection of tools for professional use rather

than consumer use. Management needs to make a good decision about whether to produce this line in their

existing space in Maryland, where space is available or to accept an offer from a manufacturer in Taiwan.

Data concerning the decision are:

800,000

Expected annual sales of tools (in units)

Average selling price of tools

Price quoted by Taiwanese company, in New Taiwanese Dollars (NTD)

Current exchange rate

Variable manufacturing costs

Incremental annual fixed manufacturing costs associated with the new product line

Variable selling and distribution costsa

Annual fixed selling and distribution costs

$12

175

35NTD = 1$

$4.75 per unit

$400,000

$1 per unit

$220,000

a Selling and distribution costs are the same regardless of whether the tools are manufactured in Mary-

land or imported.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT