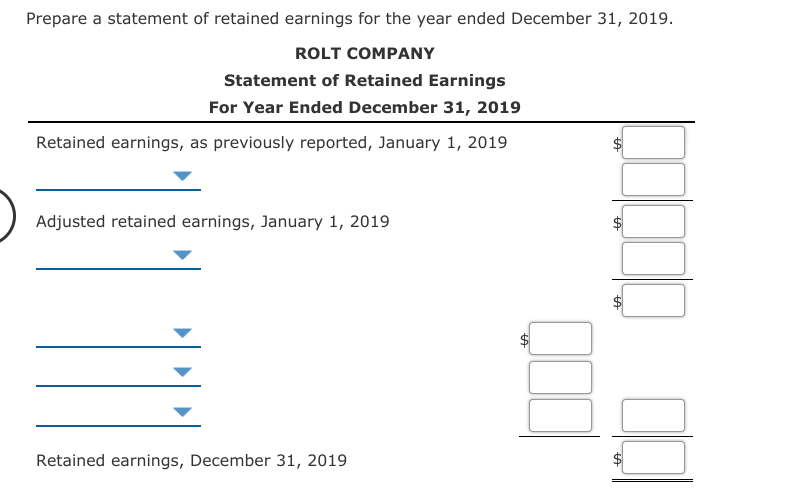

Rolt Company began 2019 with a $105,000 balance in retained earnings. During the year, the following events occurred: The company earned net income of $86,000. A material error in net income from a previous period was corrected. This error correction increased retained earnings by $9,590 after related income taxes of $4,110. Cash dividends totaling $12,000 and stock dividends totaling $18,500 were declared. One thousand shares of callable preferred stock that originally had been issued at $115 per share were recalled and retired at the beginning of 2019 for the call price of $125 per share. Treasury stock (common) was acquired at a cost of $19,000. State law requires a restriction of retained earnings in an equal amount. The company reports its retained earnings restrictions in a note to the financial statements. Required: Prepare a statement of retained earnings for the year ended December 31, 2019.

Rolt Company began 2019 with a $105,000 balance in retained earnings. During the year, the following events occurred:

- The company earned net income of $86,000.

- A material error in net income from a previous period was corrected. This error correction increased retained earnings by $9,590 after related income taxes of $4,110.

- Cash dividends totaling $12,000 and stock dividends totaling $18,500 were declared.

- One thousand shares of callable

preferred stock that originally had been issued at $115 per share were recalled and retired at the beginning of 2019 for the call price of $125 per share. Treasury stock (common) was acquired at a cost of $19,000. State law requires a restriction of retained earnings in an equal amount. The company reports its retained earnings restrictions in a note to the financial statements.

Required:

Prepare a statement of retained earnings for the year ended December 31, 2019.

options for first blue arrow pull down menu

(Retained earnings, as previously reported, Jan 1, 2019):

Add: Cash

Add: correction due to understatement of previous income

Add: dividends payable

Add: reduction due to retirement of preferred stock

Less: correction due to understatement of previous income

Less: reduction due to retirement of preferred stock

options for second blue arrow pull down menu

(adjusted Retained earnings, Jan 1, 2019):

Add: Cash

Add: net income

Add: reduction due to retirement of preferred stock

Less: correction due to understatement of previous income

Less: net income

Less: reduction due to retirement of preferred stock

options for third blue arrow pull down menu:

add: cash dividends

add: net income

add: reduction due to retirement of preferred stock

add: stock dividends

less: cash dividends

less: net income

options for fourth blue arrow pull down menu:

add: cash dividends

add: net income

add: reduction due to retirement of preferred stock

add: stock dividends

less: net income

less: stock dividends

options for fifth blue arrow pull down menu:

add: cash dividends

add: correction due to understatement of previous income

add: reduction due to retirement of preferred stock

add: stock dividends

less: correction due to understatement of previous income

less: reduction due to retirement of preferred stock

Trending now

This is a popular solution!

Step by step

Solved in 2 steps