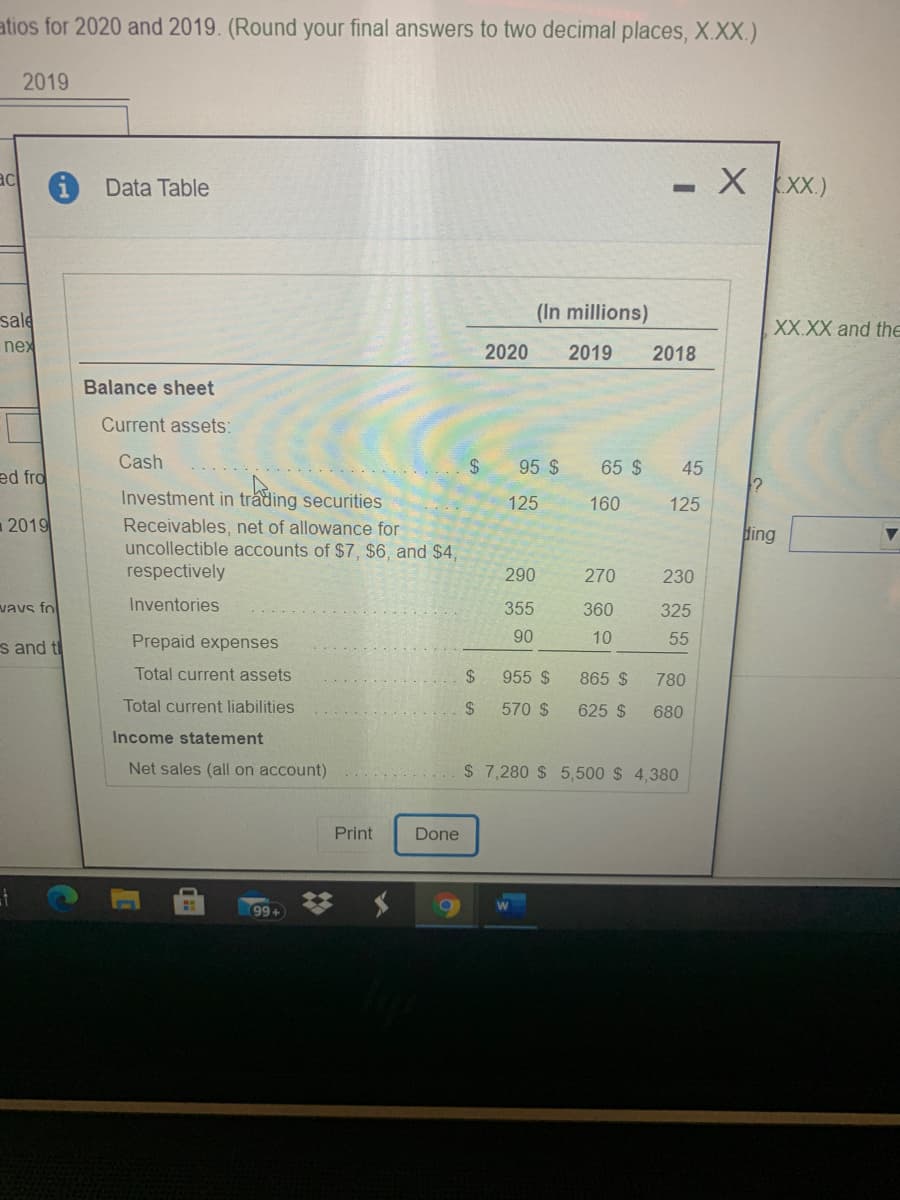

sale XX.XX nex 2020 2019 2018 Balance sheet Current assets: Cash 95 $ 65 $ 45 ed fro Investment in trading securities 125 160 125 2019 Receivables, net of allowance for uncollectible accounts of $7, $6, and $4, respectively ding 290 270 230 vavs fo Inventories 355 360 325 s and t Prepaid expenses 90 10 55 Total current assets 955 $ 865 $ 780 Total current liabilities 570 $ 625 $ 680 Income statement Net sales (all on account) $ 7,280 $ 5,500 $ 4,380 Print Done %24 %24 %24

sale XX.XX nex 2020 2019 2018 Balance sheet Current assets: Cash 95 $ 65 $ 45 ed fro Investment in trading securities 125 160 125 2019 Receivables, net of allowance for uncollectible accounts of $7, $6, and $4, respectively ding 290 270 230 vavs fo Inventories 355 360 325 s and t Prepaid expenses 90 10 55 Total current assets 955 $ 865 $ 780 Total current liabilities 570 $ 625 $ 680 Income statement Net sales (all on account) $ 7,280 $ 5,500 $ 4,380 Print Done %24 %24 %24

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 2MCQ

Related questions

Question

Please fill in blanks

Transcribed Image Text:atios for 2020 and 2019. (Round your final answers to two decimal places, X.XX.)

2019

-X XX.)

ac

Data Table

sale

(In millions)

XX.XX and the

nex

2020

2019

2018

Balance sheet

Current assets:

Cash

24

95 $

65 $

45

ed fro

Investment in trading securities

125

160

125

2019

Receivables, net of allowance for

uncollectible accounts of $7, $6, and $4,

respectively

ding

290

270

230

vavs fol

Inventories

355

360

325

s and t

Prepaid expenses

90

10

55

Total current assets

24

955 $

865 $

780

Total current liabilities

2$

570 $

625 $

680

Income statement

Net sales (all on account)

$ 7,280 $ 5,500 $ 4,380

Print

Done

99+

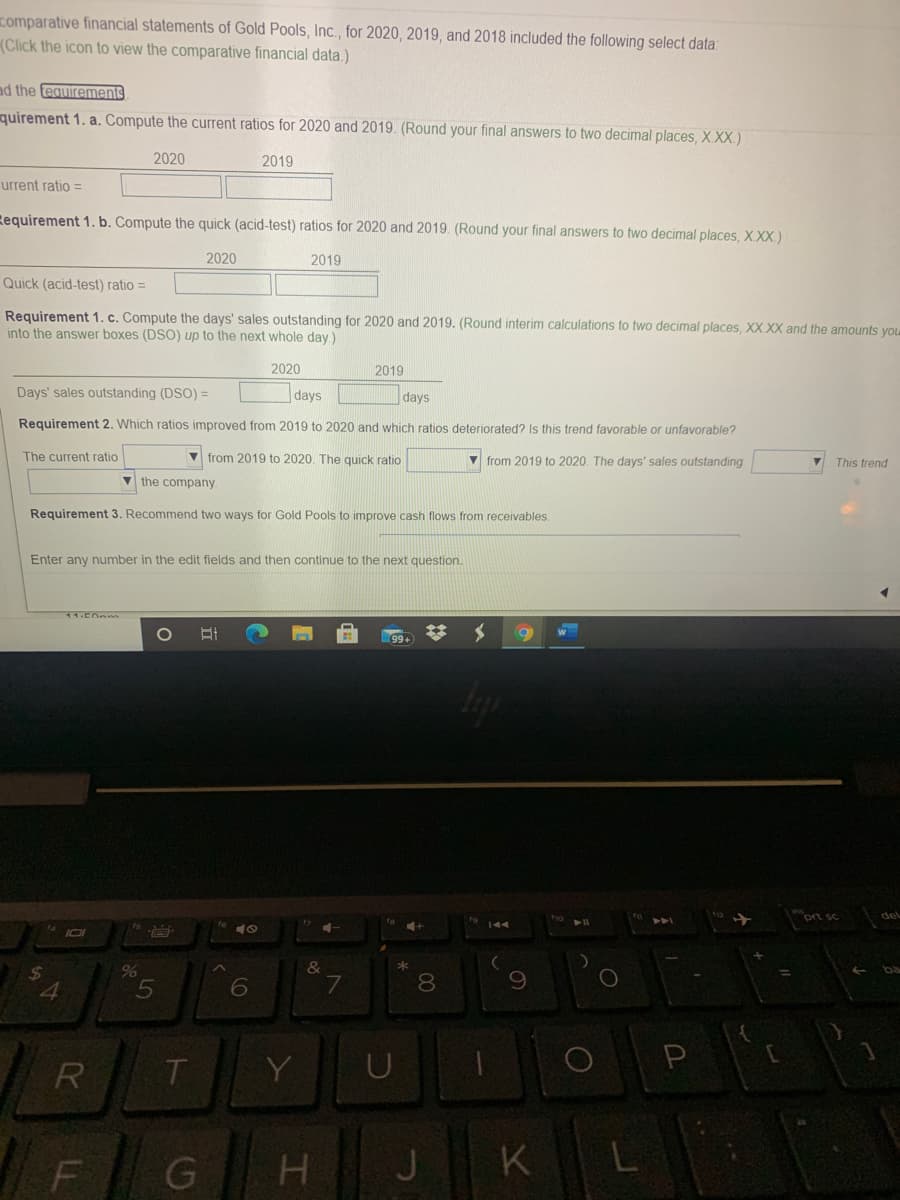

Transcribed Image Text:comparative financial statements of Gold Pools, Inc., for 2020, 2019, and 2018 included the following select data:

(Click the icon to view the comparative financial data.)

ad the equirements

quirement 1. a. Compute the current ratios for 2020 and 2019. (Round your final answers to two decimal places, X.XX.)

2020

2019

urrent ratio =

Requirement 1. b. Compute the quick (acid-test) ratios for 2020 and 2019. (Round your final answers to two decimal places, X.XX.)

2020

2019

Quick (acid-test) ratio =

Requirement 1. c. Compute the days' sales outstanding for 2020 and 2019. (Round interim calculations to two decimal places, XX XX and the amounts you

into the answer boxes (DSO) up to the next whole day.)

2020

2019

Days' sales outstanding (DSO) =

days

days

Requirement 2. Which ratios improved from 2019 to 2020 and which ratios deteriorated? Is this trend favorable or unfavorable?

The current ratio

V from 2019 to 2020. The quick ratio

v from 2019 to 2020. The days' sales outstanding

This trend

V the company.

Requirement 3. Recommend two ways for Gold Pools to improve cash flows from receivables.

Enter any number in the edit fields and then continue to the next question.

del

&

7

*

24

%

ba

8.

R

Y

H.

J

K

L

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning