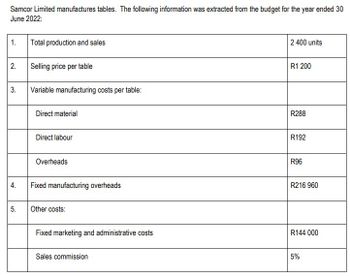

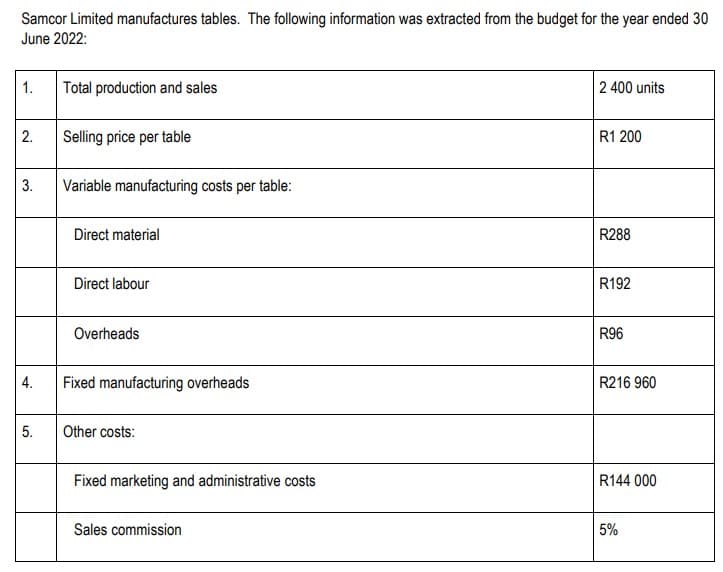

Samcor Limited manufactures tables. The following information was extracted from the budget for the year ended 30 June 2022: 1. 2. 3. 4. 5. Total production and sales Selling price per table Variable manufacturing costs per table: Direct material Direct labour Overheads Fixed manufacturing overheads Other costs: Fixed marketing and administrative costs Sales commission 2 400 units R1 200 R288 R192 R96 R216 960 R144 000 5%

Study the information given below and answer each of the following questions independently:

3.1 Calculate the total Marginal Income and Net

3.2 Use the marginal income ratio to calculate the break-even value.

3.3 Calculate the new total Marginal Income and Net Profit/Loss, if an increase in advertising expense

by R100 000 is expected to increase sales by 400 units.

3.4 How many units must be sold if the company wishes to earn a net profit of R298 920.

3.5 Based on the expected sales volume of 2 400 units, determine the sales price per unit (expressed

in rands and cents) that will enable the company to break even.

Step by step

Solved in 2 steps

1. How many units must be sold if the company wishes to earn a net profit of R298 920.

2. Based on the expected sales volume of 2 400 units, determine the sales price per unit (expressed

in rands and cents) that will enable the company to break even.