Sunshine Marketing Comparative Statement of Financial Position For the years 2018 and 2019 2018 2019 Current Assets P235,374 P361,312 Property, Plant & Equipment, net 962,508 899,300 Other Assets 188,918 236,788 Total Assets P1,386,800 P1,497,400 Total Current liabilities P220,590 P258,902 Long-term Debt Owner's Capital Total Liabilities & Equity 498,998 473,500 667,212 P1,386,800 764,998 P1,497,400 Sunshine Marketing Comparative Statement of Financial Position For the years 2018 and 2019 2018 2019 Revenue P1,875,000 P2,368,900 Cost of Goods sold 1,098,000 777,000 1,468,718 Gross profit Selling& Administrative Expense Other Expenses 900,182 467,875 25,500 595,000 25,500 Net Income P283,625 P279,682

Sunshine Marketing Comparative Statement of Financial Position For the years 2018 and 2019 2018 2019 Current Assets P235,374 P361,312 Property, Plant & Equipment, net 962,508 899,300 Other Assets 188,918 236,788 Total Assets P1,386,800 P1,497,400 Total Current liabilities P220,590 P258,902 Long-term Debt Owner's Capital Total Liabilities & Equity 498,998 473,500 667,212 P1,386,800 764,998 P1,497,400 Sunshine Marketing Comparative Statement of Financial Position For the years 2018 and 2019 2018 2019 Revenue P1,875,000 P2,368,900 Cost of Goods sold 1,098,000 777,000 1,468,718 Gross profit Selling& Administrative Expense Other Expenses 900,182 467,875 25,500 595,000 25,500 Net Income P283,625 P279,682

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 1MP

Related questions

Question

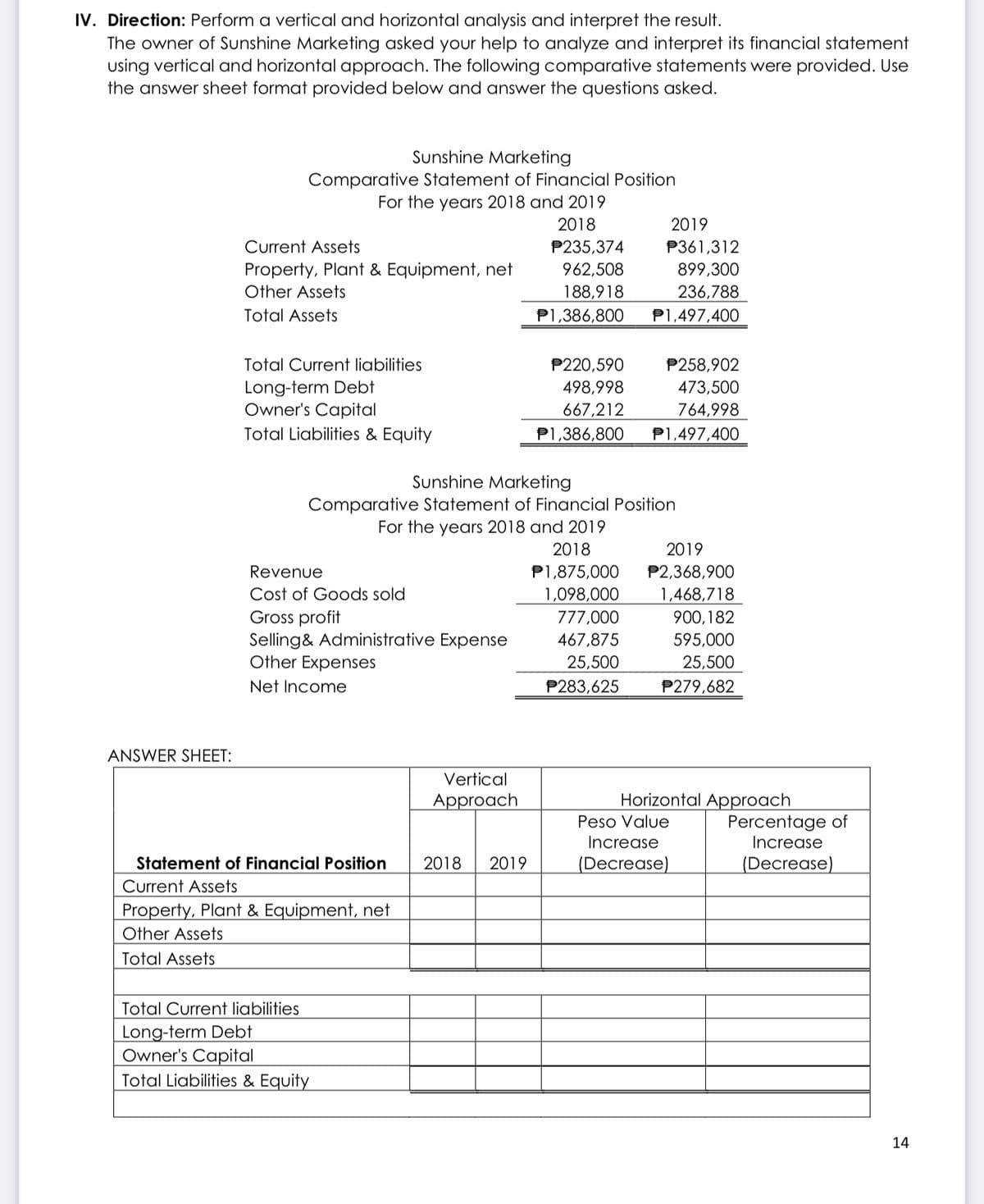

Transcribed Image Text:IV. Direction: Perform a vertical and horizontal analysis and interpret the result.

The owner of Sunshine Marketing asked your help to analyze and interpret its financial statement

using vertical and horizontal approach. The following comparative statements were provided. Use

the answer sheet format provided below and answer the questions asked.

Sunshine Marketing

Comparative Statement of Financial Position

For the years 2018 and 2019

2018

2019

Current Assets

P235,374

P361,312

899,300

236,788

Property, Plant & Equipment, net

962,508

Other Assets

188,918

P1,386,800

Total Assets

P1,497,400

Total Current liabilities

P220,590

P258,902

Long-term Debt

Owner's Capital

498,998

473,500

667,212

P1,386,800

764,998

Total Liabilities & Equity

P1,497,400

Sunshine Marketing

Comparative Statement of Financial Position

For the years 2018 and 2019

2018

2019

Revenue

P1,875,000

P2,368,900

Cost of Goods sold

Gross profit

Selling& Administrative Expense

Other Expenses

1,098,000

1,468,718

900,182

777,000

467,875

595,000

25,500

P279,682

25,500

Net Income

P283,625

ANSWER SHEET:

Vertical

Approach

Horizontal Approach

Percentage of

Increase

Peso Value

Increase

Statement of Financial Position

2018

2019

(Decrease)

(Decrease)

Current Assets

Property, Plant & Equipment, net

Other Assets

Total Assets

Total Current liabilities

Long-term Debt

Owner's Capital

Total Liabilities & Equity

14

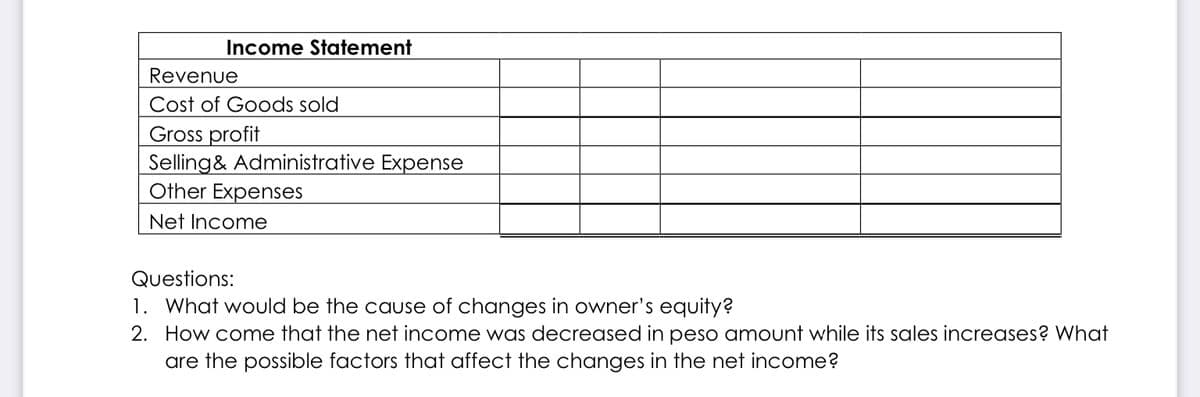

Transcribed Image Text:Income Statement

Revenue

Cost of Goods sold

Gross profit

Selling& Administrative Expense

Other Expenses

Net Income

Questions:

1. What would be the cause of changes in owner's equity?

2. How come that the net income was decreased in peso amount while its sales increases? What

are the possible factors that affect the choanges in the net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning