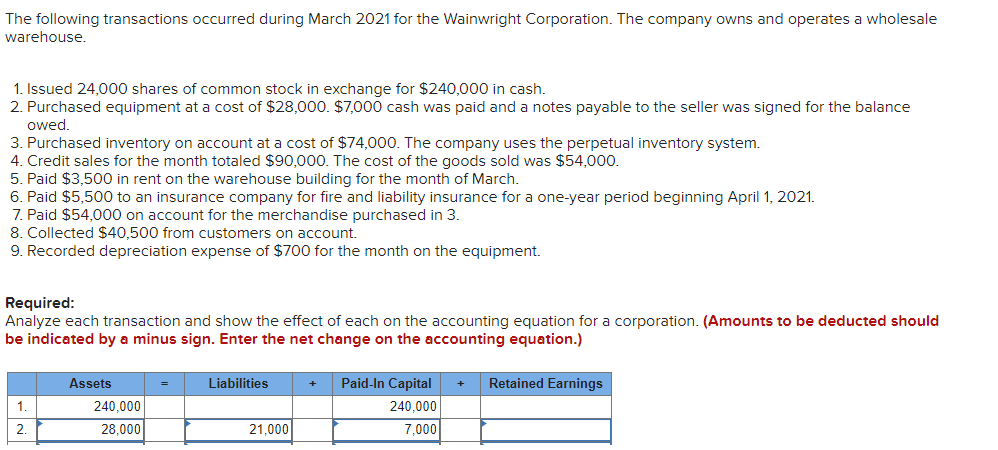

The following transactions occurred during March 2021 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. 1. Issued 24,000 shares of common stock in exchange for $240,000 in cash. 2. Purchased equipment at a cost of $28,00O. $7,000 cash was paid and a notes payable to the seller was signed for the balance owed, 3. Purchased inventory on account at a cost of $74,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $90,00O. The cost of the goods sold was $54,000. 5. Paid $3,500 in rent on the warehouse building for the month of March. 6. Paid $5,500 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2021. 7. Paid $54,000 on account for the merchandise purchased in 3. 8. Collected $40,500 from customers on account. 9. Recorded depreciation expense of $700 for the month on the equipment.

Q: The Wyndham Wholesale Company began operations on August 1, 2021. The following transactions occur…

A: 1.

Q: The following transactions occurred during March 2016 for the Wainwright Corporation. The company…

A: Rules of debit and credit for journal entry:

Q: Crispin Santos started a retail merchandise business on January 1, 2021. During the year ended…

A: Purchases means where the goods has been purchased for the resale purpose. Gross purchases means…

Q: entered into the following transactions in May 2010: May 1- The Western Wear Company was organized…

A: In this question we journalize the following transaction of Western wear company.

Q: The following are ledger balances extracted from the books of Forte Enterprise at 31 December 2019.…

A:

Q: Topaz Unlimited, Incorporated, is a manufacturer of steel products for customers such as Home Depot,…

A: The cash flow statement is prepared at the end of the accounting period by the management. It…

Q: Federal Hill Corporation had the following transactions occurred during March 2024. Federal Hill…

A: Double entry system becomes the base for the preparation of Accounting Equation. Expanded form of…

Q: Coleman Motors, Inc., was formed on January 1,2018. The following transactions occurred during…

A: 1. Income statement:

Q: Described below are certain transactions of Pharoah Company for 2021: On May 10, the company…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: The Marchetti Soup Company entered into the following transactions during the month of June: (1)…

A: Accounting Equation in business depends on double entry system of accounting. It means for every…

Q: The following trial balance was taken from the books of Venus Corporation at December 31, 2020:…

A: Journal is a place where journal entries are recorded in the book keeping system before ledger…

Q: The following transactions occurred during March 2018 for the Wainwright Corporation. The company…

A: 1. Analyze each transaction by indicating the cash effect and classify each as financing,…

Q: Santos started a retail merchandise business on January 1, 2021. During the year ended December 31,…

A: Inventory purchases can be computed by Adding payments to trade creditor and account payable balance…

Q: The following selected accounts and their current balances appear in the ledger of Clairemont Co.…

A: The balance sheet, statement of stockholders' equity, and income statement are all included in the…

Q: The following selected accounts and their current balances appear in the ledger of Clairemont Co.…

A: Financial Statements: Financial Statements represent a formal record of the financial activities of…

Q: [The following Information applies to the questions displayed below.] DurIng January, Central…

A: solution : cash Beg.…

Q: The following transactions occurred during the month of June 2021 for the Stridewell Corporation.…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: The following balance sheet was prepared by the bookkeeper for Strawberry Company as of December 31,…

A: Current assets are the resources held and owned by an entity for a year or less.

Q: The following account balances were taken from the 2021 post-closing trial balance of the Bowler…

A: Balance sheet is a statement of assets and liabilities of an organization on a date. It is a part of…

Q: Presented below is the trial balance of Muscat Corporation on December 31, 2019 Accounts Debit…

A: The following computations are done for Muscat Company for the particular year.

Q: The following trial balance was taken from the books of Venus Corporation at December 31, 2020:…

A: Trial Balance: Trial balance is a statement in which closing balance of all ledger accounts are…

Q: Prepare journal entries for each of the transactions listed in BE 2–1.

A: Journal entry: Journal is the book of original entry whereby all the financial transactions are…

Q: he following transactions occurred during the month of June 2021 for the Stridewell Corporation. The…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: The following is a partial trial balance for General Lighting Corporation as of December 31, 2021:…

A: A single step income statement is a basic financial statement format that lists all expenses…

Q: Marriage Company’s trial balance reflected the following account balances on December 31, 2021:…

A: Current assets: Current assets are all those assets that are expected to be sold or used as a result…

Q: On January 1, 2021, the general ledger of Tripley Company included the following account balances:…

A: Record journal entries for the transactions as shown below:

Q: Credit sales P6,000,000 Cash sales 1,000,000 Collection from customers 5,600,000 Cash purchases…

A: Purchases under the cash basis is purchases that have been paid for during the year It includes cash…

Q: ion and Statement of changes in equity on Excel.

A: Income statement refers to a statement which shows the revenue and expense of the company of a…

Q: Presented below is the trial balance of Muscat Corporation at December 31, 2019 Accounts Debit…

A: Non-current asset: It can be defined as an asset that is acquired by the company for long term…

Q: The following transactions occurred during the month of June 2016 for the Stridewell Corporation.…

A: Journal entry:

Q: Presented below is a partial trial balance for the Messenger Corporation at December 31, 2021.…

A: Working capital is calculated by deducting the current liabilities from the current assets.

Q: The following transactions occurred during March 2016 for the Wainwright Corporation. The company…

A: Accounting transaction:

Q: On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:…

A: • Journal entries record the usual transactions of the business.• Adjusting entries record the…

Q: During Year 1, Cowboy Ice Cream Company purchased $25,000 of inventory on account. COC sold…

A: Transaction horizontal analysis is usually done by the company to determine the effect of the…

Q: Crispin Santos started a retail merchandise business on January 1, 2021. During the year ended…

A: A purchase is the practice of obtaining possession of a specific asset, property, item, or right by…

Q: During 2018, its first year of operations as a delivery service, Carla Vista Corp. entered into the…

A: In Accounting Equation, the Balance of Assets will always equal to the balances of Liabilities and…

Q: If this information was used to prepare a statement of financial position, Total Assets should be:…

A: The resources held by the business organization for the generation of revenue and conducting the…

Q: he following is a partial trial balance for General Lighting Corporation as of December 31, 2021:…

A: Here in this question, we are required to prepare single step income statement and multiple step…

Q: Permai Bhd is one of the main manufacturers and suppliers of industrial chemical products and…

A: Calculation of Depreciation and Capital allowances: Amount in RM Year Depreciation…

Q: On January 1, 2010, the capital of Delta Company was P1,700,000 and on December 31, 2010, the…

A: Statements of changes in equity is the summary showing beginning and ending balances of share…

Q: Permai Bhd is one of the main manufacturers and suppliers of industrial chemical products and…

A: Calculation of Depreciation and Capital allowances: Amount in RM Year Depreciation…

Q: Samantha Company had the following account balances at the end of May of the current year: Cash…

A: There are three important elements of the accounting equation of business. These are assets,…

Q: Permai Bhd is one of the main manufacturers and suppliers of industrial chemical products and…

A: Amount in RM Year Depreciation Capital Allowances 2015 356000*10%=35600 356000*20%=71200…

Q: Jung Corporation has the following account balances at April 30, 2020. Using this information,…

A:

Q: On December 1, 2020, Sheridan Distributing Company had the following account balances. Debit…

A: Journal entry is a record of financial transaction in the books of accounts maintained by an…

Q: REQUIRED: a) Determine the tax base of asset and liabilities for Permai Bhd and calculate the…

A:

Q: During 2018, its first year of operations as a delivery service, Carla Vista Corp. entered into the…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: On January 1, 2018, Grand Corp. purchased Minor Co., paying $250,000 cash and issuing a $50,000 note…

A:

Q: The following transactions occurred during March 2018 for the Wainwright Corporation. The company…

A: The accounting equation is the equation that describes the transaction in accounting form. The…

Q: The partial trial balance of Rollins Inc. included the following accounts as of December 31, 2020:…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: The Western Wear Company, a wholesaler of western wear clothing, sells to retailers. The company…

A: Journal entries (JE) are those entries which are records in the original books of accounts and…

Q: BTS Corporation provided the following balances in its trial balance for the year ended December 31,…

A: Comprehensive Income - Comprehensive Income is income which is not earned, in other words unrealized…

Q: The following information applies to the questions displayed below.) on January 1, 2021, the general…

A: Journal Entry A journal entry is a record of the business transactions within the accounting books…

Q: The following trial balance was taken from the books of Venus Corporation at December 31, 2020:…

A: Journals represent the records prepared by the management for reporting the day-to-day business…

I need help with this question. The format of how to respond is below

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Analyzing Transactions. Using the analytical framework, indicate the effect of the following related transactions of a firm. a. January 1: Issued 10,000 shares of common stock for 50,000. b. January 1: Acquired a building costing 35,000, paying 5,000 in cash and borrowing the remainder from a bank. c. During the year: Acquired inventory costing 40,000 on account from various suppliers. d. During the year: Sold inventory costing 30,000 for 65,000 on account. e. During the year: Paid employees 15,000 as compensation for services rendered during the year. f. During the year: Collected 45,000 from customers related to sales on account. g. During the year: Paid merchandise suppliers 28,000 related to purchases on account. h. December 31: Recognized depreciation on the building of 7,000 for financial reporting. Depreciation expense for income tax purposes was 10,000. i. December 31: Recognized compensation for services rendered during the last week in December but not paid by year-end of 4,000. j. December 31: Recognized and paid interest on the bank loan in Part b of 2,400 for the year. k. Recognized income taxes on the net effect of the preceding transactions at an income tax rate of 40%. Assume that the firm pays cash immediately for any taxes currently due to the government.Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.

- The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?Krespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received customer payments of $965 B. supplies purchased on account $435 C. services worth $850 performed, 25% is paid in cash the rest will be billed D. corporation pays $275 for an ad in the newspaper E. bill is received for electricity used $235. F. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?

- Shaquille Corporation began the current year with inventory of 50,000. During the year, its purchases totaled 110,000. Shaquille paid freight charges of 8,500 for those purchases. At the end of the year, Shaquille had inventory of 47,800. Prepare a schedule to determine Shaquille's cost of goods sold for the current year.The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Uptons balance sheet as of December 31, 2019, is shown here (millions of dollars): Sales for 2019 were 350 million, and net income for the year was 10.5 million, so the firms profit margin was 3.0%. Upton paid dividends of 4.2 million to common stockholders, so its payout ratio was 40%. Its tax rate was 25%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2020. a. If sales are projected to increase by 70 million, or 20%, during 2020, use the AFN equation to determine Uptons projected external capital requirements. b. Using the AFN equation, determine Uptons self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ nonspontaneous external funds? c. Use the forecasted financial statement method to forecast Uptons balance sheet for December 31, 2020. Assume that all additional external capital is raised as a line of credit at the end of the year. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Assume Uptons profit margin and dividend payout ratio will be the same in 2020 as they were in 2019. What is the amount of the line of credit reported on the 2020 forecasted balance sheets? (Hint: You dont need to forecast the income statements because the line of credit is taken out on the last day of the year and you are given the projected sales, profit margin, and dividend payout ratio; these figures allow you to calculate the 2020 addition to retained earnings for the balance sheet without actually constructing a full income statement.)Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following transactions take place during the current year: A. On April 5, the company purchases 400 parts for $8.30 per part, on credit. Terms of the purchase are 4/ 10, n/30, invoice dated April 5. B. On May 5, Air Compressors does not pay the amount due and renegotiates with the supplier. The supplier agrees to $400 cash immediately as partial payment on note payable due, converting the debt owed into a short-term note, with a 7% annual interest rate, payable in three months from May 5. C. On August 5, Air Compressors pays its account in full. Record the journal entries to recognize the initial purchase, the conversion plus cash, and the payment.