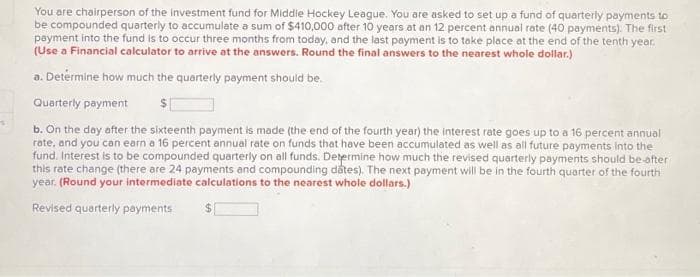

You are chairperson of the investment fund for Middle Hockey League. You are asked to set up a fund of quarterly payments to be compounded quarterly to accumulate a sum of $410,000 after 10 years at an 12 percent annual rate (40 payments). The first payment into the fund is to occur three months from today, and the last payment is to take place at the end of the tenth year. (Use a Financial calculator to arrive at the answers. Round the final answers to the nearest whole dollar.) a. Determine how much the quarterly payment should be. Quarterly payment b. On the day after the sixteenth payment is made (the end of the fourth year) the interest rate goes up to a 16 percent annual rate, and you can earn a 16 percent annual rate on funds that have been accumulated as well as all future payments into the fund. Interest is to be compounded quarterly on all funds. Determine how much the revised quarterly payments should be-after this rate change (there are 24 payments and compounding dates). The next payment will be in the fourth quarter of the fourth year. (Round your intermediate calculations to the nearest whole dollars.) Revised quarterly payments $

You are chairperson of the investment fund for Middle Hockey League. You are asked to set up a fund of quarterly payments to be compounded quarterly to accumulate a sum of $410,000 after 10 years at an 12 percent annual rate (40 payments). The first payment into the fund is to occur three months from today, and the last payment is to take place at the end of the tenth year. (Use a Financial calculator to arrive at the answers. Round the final answers to the nearest whole dollar.) a. Determine how much the quarterly payment should be. Quarterly payment b. On the day after the sixteenth payment is made (the end of the fourth year) the interest rate goes up to a 16 percent annual rate, and you can earn a 16 percent annual rate on funds that have been accumulated as well as all future payments into the fund. Interest is to be compounded quarterly on all funds. Determine how much the revised quarterly payments should be-after this rate change (there are 24 payments and compounding dates). The next payment will be in the fourth quarter of the fourth year. (Round your intermediate calculations to the nearest whole dollars.) Revised quarterly payments $

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 34P

Related questions

Question

Dd.90.

Transcribed Image Text:s

You are chairperson of the investment fund for Middle Hockey League. You are asked to set up a fund of quarterly payments to

be compounded quarterly to accumulate a sum of $410,000 after 10 years at an 12 percent annual rate (40 payments). The first

payment into the fund is to occur three months from today, and the last payment is to take place at the end of the tenth year.

(Use a Financial calculator to arrive at the answers. Round the final answers to the nearest whole dollar.)

a. Determine how much the quarterly payment should be.

Quarterly payment $

b. On the day after the sixteenth payment is made (the end of the fourth year) the interest rate goes up to a 16 percent annual

rate, and you can earn a 16 percent annual rate on funds that have been accumulated as well as all future payments into the

fund. Interest is to be compounded quarterly on all funds. Determine how much the revised quarterly payments should be-after

this rate change (there are 24 payments and compounding dates). The next payment will be in the fourth quarter of the fourth

year. (Round your intermediate calculations to the nearest whole dollars.)

Revised quarterly payments

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning