Value Chain Analysis and Financial Statement Relations. Exhibit 1.25 (page 68) presents common-size income statements and balance sheets for seven firms that operate at various stages in the value chain for the pharmaceutical industry. These common-size statements express all amounts as a percentage of sales revenue. Exhibit 1.25 also shows the cash flow from operations to capital expenditures ratios for each firm. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the seven companies and a brief description of their activities follow.

- A. Wyeth: Engages in the development, manufacture, and sale of ethical drugs (that is, drugs requiring a prescription). Wyeth’s drugs represent primarily mixtures of chemical compounds. Ethical-drug companies must obtain approval of new drugs from the U.S. Food and Drug Administration (FDA). Patents protect such drugs from competition until other drug companies develop more effective substitutes or the patent expires.

- B. Amgen: Engages in the development, manufacture, and sale of drugs based on biotechnology research. Biotechnology drugs must obtain approval from the FDA and enjoy patent protection similar to that for chemical-based drugs. The biotechnology segment is less mature than the ethical-drug industry, with relatively few products having received FDA approval.

- C. Mylan Laboratories: Engages in the development, manufacture, and sale of generic drugs. Generic drugs have the same chemical compositions as drugs that had previously benefited from patent protection but for which the patent has expired. Generic-drug companies have benefited in recent years from the patent expiration of several major ethical drugs. However, the major ethical-drug companies have increasingly offered generic versions of their ethical drugs to compete against the generic-drug companies.

- D. Johnson & Johnson: Engages in the development, manufacture, and sale of over-thecounter health care products. Such products do not require a prescription and often benefit from brand recognition.

- E. Covance: Offers product development and laboratory testing services for biotechnology and pharmaceutical drugs. It also offers commercialization

services and market access services. Cost of goods sold for this company represents the salaries of personnel conducting the laboratory testing and drug approval services. - F. Cardinal Health: Distributes drugs as a wholesaler to drugstores, hospitals, and mass erchandisers. Also offers pharmaceutical benefit management services in which it provides customized databases designed to help customers order more efficiently, contain costs, and monitor their purchases. Cost of goods sold for Cardinal Health includes the cost of drugs sold plus the salaries of personnel providing pharmaceutical benefit management services.

- G. Walgreens: Operates a chain of drugstores nationwide. The data in Exhibit 1.25 for Walgreens include the recognition of operating lease commitments for retail space.

REQUIRED

Use the ratios to match the companies in Exhibit 1.25 with the firms listed above.

Trending nowThis is a popular solution!

Chapter 1 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

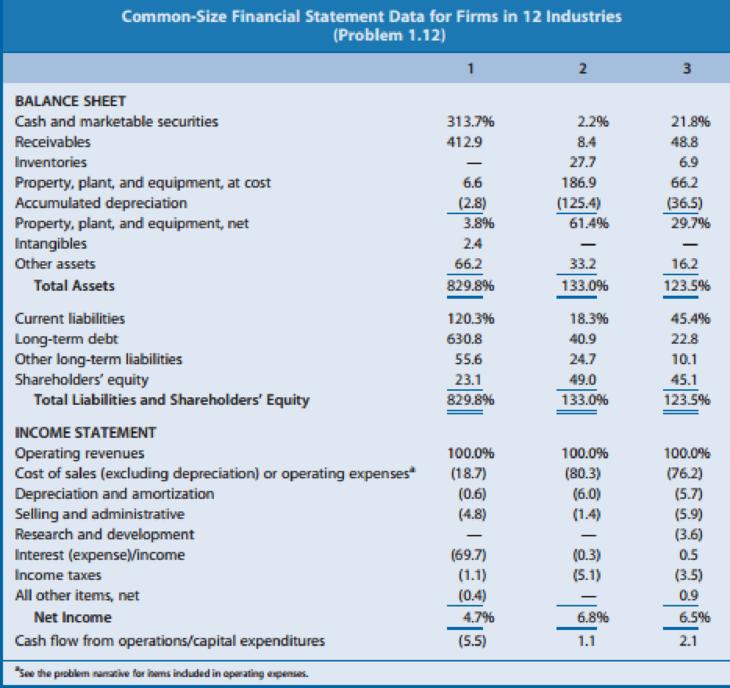

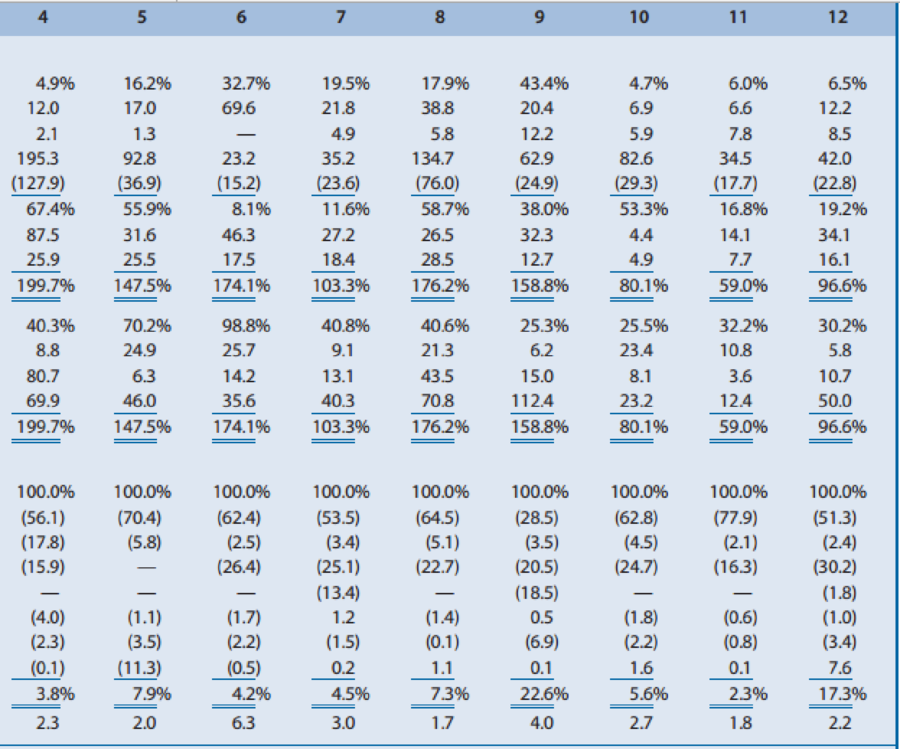

- Effect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.22 (pages 6061) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) Exhibit 1.22 also shows the ratio of cash flow from operations to capital expenditures. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large enough for the firm to disclose it. Amounts that are not meaningful are shown as n.m. A list of the 12 companies and a brief description of their activities follow. A. Amazon.com: Operates websites to sell a wide variety of products online. The firm operated at a net loss in all years prior to that reported in Exhibit 1.22. B. Carnival Corporation: Owns and operates cruise ships. C. Cisco Systems: Manufactures and sells computer networking and communications products. D. Citigroup: Offers a wide range of financial services in the commercial banking, insurance, and securities business. Operating expenses represent the compensation of employees. E. eBay: Operates an online trading platform for buyers to purchase and sellers to sell a variety of goods. The firm has grown in part by acquiring other companies to enhance or support its online trading platform. F. Goldman Sachs: Offers brokerage and investment banking services. Operating expenses represent the compensation of employees. G. Johnson Johnson: Develops, manufactures, and sells pharmaceutical products, medical equipment, and branded over-the-counter consumer personal care products. H. Kelloggs: Manufactures and distributes cereal and other food products. The firm acquired other branded food companies in recent years. I. MGM Mirage: Owns and operates hotels, casinos, and golf courses. J. Molson Coors: Manufactures and distributes beer. Molson Coors has made minority ownership investments in other beer manufacturers in recent years. K. Verizon: Maintains a telecommunications network and offers telecommunications services. Operating expenses represent the compensation of employees. Verizon has made minority investments in other cellular and wireless providers. L. Yum! Brands: Operates chains of name-brand restaurants, including Taco Bell, KFC, and Pizza Hut. REQUIRED Use the ratios to match the companies in Exhibit 1.22 with the firms listed above.arrow_forwardEffect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.23 (pages 6263) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) Exhibit 1.23 also shows the ratio of cash flow from operations to capital expenditures. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the 12 companies and a brief description of their activities follow. A. Abercrombie Fitch: Sells retail apparel primarily through stores to the fashionconscious young adult and has established itself as a trendy, popular player in the specialty retailing apparel industry. B. Allstate Insurance: Sells property and casualty insurance, primarily on buildings and automobiles. Operating revenues include insurance premiums from customers and revenues earned from investments made with cash received from customers before Allstate pays customers claims. Operating expenses include amounts actually paid or expected to be paid in the future on insurance coverage outstanding during the year. C. Best Buy: Operates a chain of retail stores selling consumer electronic and entertainment equipment at competitively low prices. D. E. I. du Pont de Nemours: Manufactures chemical and electronics products. E. Hewlett-Packard: Develops, manufactures, and sells computer hardware. The firm outsources manufacturing of many of its computer components. F. HSBC Finance: Lends money to consumers for periods ranging from several months to several years. Operating expenses include provisions for estimated uncollectible loans (bad debts expense). G. Kelly Services: Provides temporary office services to businesses and other firms. Operating revenues represent amounts billed to customers for temporary help services, and operating expenses include amounts paid to the temporary help employees of Kelly. H. McDonalds: Operates fast-food restaurants worldwide. A large percentage of McDonalds restaurants are owned and operated by franchisees. McDonalds frequently owns the restaurant buildings of franchisees and leases them to franchisees under long-term leases. I. Merck: A leading research-driven pharmaceutical products and services company. Merck discovers, develops, manufactures, and markets a broad range of products to improve human and animal health directly and through its joint ventures. J. Omnicom Group: Creates advertising copy for clients and is the largest marketing services firm in the world. Omnicom purchases advertising time and space from various media and sells it to clients. Operating revenues represent commissions and fees earned by creating advertising copy and selling media time and space. Operating expenses includes employee compensation. K. Pacific Gas Electric: Generates and sells power to customers in the western United States. L. Procter Gamble: Manufactures and markets a broad line of branded consumer products. REQUIRED Use the ratios to match the companies in Exhibit 1.23 with the firms listed above.arrow_forwardYou are asked to briefly answer the following questions:Profitability ratios are a set of ratios that indicate how profits relate to sales and the size of a company's capital, and this category includes various ratios such as: Gross Profit Margin Ratio, Net Profit Margin Ratio, Return on Assets Ratio and Return on Equity Ratio of funds. One of the top executives at the company where you work is asking for your help in understanding the following:1. How the above efficiency indicators are calculated.2. The company decided to pay cash to suppliers to achieve better purchase prices. What is the effect of this fact on the value of the aforementioned efficiency indicators?3. Could (beyond the above fact) be affected in any way positively the figures in question for the company where you work?arrow_forward

- Carson Electronics’ management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheet and income statements for the two firms are as follows: Calculate the following ratios for both Carson and BGT: a)Total asset turnover: b) Operating profit margin: c) Operating return on assets:arrow_forwardHere you will find some income statements and balance sheets for Sears Holdings (SHLD) and Taget Corp (TGT). Assume that you are a financial manager at Sear and want to compare your firm’s situation with that of Target. Calculate represenatative ratios for liquidity, asset management efficiency, financial leverage (capital structure), and profitability for both Sears and Target. How would you summarize the financial performance of Sears compared to target (its benchmark firm)? Include Sears and Targets current ratio, acid-test ratio, average collection period, accounts receivable turnover, inventory turnover, debt ratio, timed interest earned, total asset turnover, fixed asset turnover, gross profit margin, operating profit margin, net profit margin, operating return on assets, and return on equity.arrow_forwardSuppose you want to compare Palfinger AG to another heavy equipment manufacture, Caterpillar, Inc. To compare the companies, complete the table below and calculate common-sized numbers. To common-size balance sheet numbers, divide by total assets abd to common-size income statement numbers, divide by net sales. Comment on the trends over time and levels across companies.arrow_forward

- Ratios are mostly calculated using data drawn from the financial statements of a firm. However, another group of ratios, called market value ratios, relate to a firm’s observable market value, stock prices, and book values, integrating information from both the market and the firm’s financial statements. Consider the case of Blue Hamster Manufacturing Inc.: Blue Hamster Manufacturing Inc. just reported earnings after tax (also called net income) of $8,000,000 and a current stock price of $17.50 per share. The company is forecasting an increase of 25% for its after-tax income next year, but it also expects it will have to issue 1,500,000 new shares of stock (raising its shares outstanding from 5,500,000 to 7,000,000). If Blue Hamster’s forecast turns out to be correct and its price/earnings (P/E) ratio does not change, what does the company’s management expect its stock price to be one year from now? (Round any P/E ratio calculation to four decimal places.) $17.26 per share…arrow_forwardRatios are mostly calculated using data drawn from the financial statements of a firm. However, another group of ratios, called market value ratios, relate to a firm’s observable market value, stock prices, and book values, integrating information from both the market and the firm’s financial statements. Consider the case of Blue Hamster Manufacturing Inc.: Blue Hamster Manufacturing Inc. just reported earnings after tax (also called net income) of $8,000,000 and a current stock price of $17.50 per share. The company is forecasting an increase of 25% for its after-tax income next year, but it also expects it will have to issue 1,500,000 new shares of stock (raising its shares outstanding from 5,500,000 to 7,000,000). If Blue Hamster’s forecast turns out to be correct and its price/earnings (P/E) ratio does not change, what does the company’s management expect its stock price to be one year from now? (Round any P/E ratio calculation to four decimal places.) $17.26 per share…arrow_forwardWhat is the difference between a horizontal analysis of an Income Statement and Balance Sheet and a vertical analysis of an Income Statement and Balance Sheet? What are the pros and cons of each? What are some of the strengths, weaknesses or developing problems one can identify from a horizontal analysis of an Income Statement and Balance Sheet of a company over the last two years? What are some of the strengths, weaknesses or developing problems one can identify from a vertical analysis of an Income Statement and Balance Sheet of a company over the last two years?arrow_forward

- Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Spandust Industries Inc. and make comments on its second-year performance as compared with its first-year performance. The following shows Spandust Industries Inc.’s income statement for the last two years. The company had assets of $7,050 million in the first year and $11,278 million in the second year. Common equity was equal to $3,750 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Spandust Industries Inc. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 Net Sales 3,810 3,000 Operating costs except depreciation and amortization 1,855 1,723…arrow_forwardThe person in charge of the finances of the company MGT, SA wants to know the company's situation concerning the industrial sector to which it belongs. For this, it has the following information regarding the industry: The general liquidity ratio is 1.55; the acid test is 1.20, and the ratio between the available and the current liabilities is 0.95. The debt ratio stands at 1.25. The margin on sales is 21%. The investment rotation is 1.45 times. Economic profitability is around 23%, and financial profitability is 29% The data referred to the company (in thousands of €) are the following: Assets Liability and net equity Non-current assets (Net) 170 Equity 125 Stocks of finished products 45 Reservations 25 Clients 65 External resources 105 Banks 70 Loans 65 Suppliers 30 Total Assets 350 Total Net Equity 350 In addition, it is known that: Sales are € 250,000 and its direct cost of € 105,000.…arrow_forwardIdentify the ratio that is relevant to answering each of the following questions.a. How much net income does the company earn from each dollar of sales?b. Is the company financed primarily by debt or equity?c. How many dollars of sales were generated for each dollar invested in fixed assets?d. How many days, on average, does it take the company to collect on credit sales made tocustomers?e. How much net income does the company earn for each dollar owners have invested in it?f. Does the company have sufficient assets to convert into cash for paying liabilities as theycome due in the upcoming year?arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT