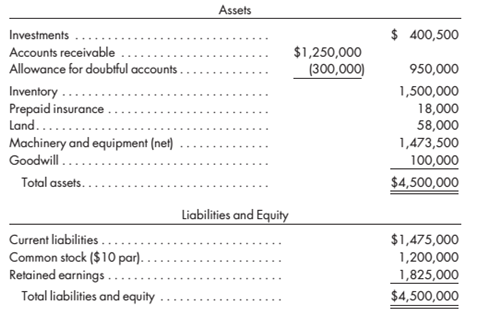

Jack Company is a Corporation that was organized on July 1, 2015. The June 30, 2020, balance sheet for Jack is as follows:

The experience of other corn panics over die last several years indicates that die machinery and equipment can be sold at 130% of its book value.

An analysis of the

Callaway Corpora ion plans to exchange 18.000 of its shares for the 120.000 Jack shares.

During June 2020, the lair value of a share of always Corporation is $270. Equations costs are $12,000.

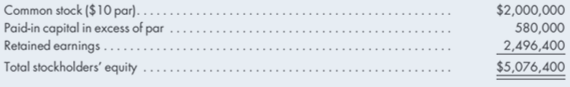

The stack holder’s equity account balances of always Corporation as of June 30. 2015, are as follows:

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

ADVANCED ACCOUNTING CHAPTERS 15-19

- The following information applies to the questions displayed below.] Bailey Delivery Company, Inc., was organized in 2018 in Wisconsin. The following transactions occurred during the year: Received cash from investors in exchange for 12,000 shares of stock (par value of $1.00 per share) with a market value of $6 per share. Purchased land in Wisconsin for $25,000, signing a one-year note (ignore interest). Bought two used delivery trucks for operating purposes at the start of the year at a cost of $14,000 each; paid $3,000 cash and signed a note due in three years for the rest (ignore interest). Paid $1,900 cash to a truck repair shop for a new motor for one of the trucks. (Increase the account you used to record the purchase of the trucks because the productive life of the truck has been improved) Sold one-fourth of the land for $6,250 to Pablo Development Corporation, which signed a six-month note. Stockholder Helen Bailey paid $27,700 cash for a vacant lot (land) in Canada for her…arrow_forwardBraxton Technologies, Inc., constructed a conveyor for A&G Warehousers that was completed and ready for use on January 1, 2016. A&G paid for the conveyor by issuing a $100,000, four-year note that specified 5% interest to be paid on December 31 of each year, and the note is to be repaid at the end of four years. The conveyor was custom-built for A&G, so its cash price was unknown. By comparison with similar transactions it was determined that a reasonable interest rate was 10%. Required: 1. Prepare the journal entry for A&G’s purchase of the conveyor on January 1, 2016. 2. Prepare an amortization schedule for the four-year term of the note. 3. Prepare the journal entry for A&G’s third interest payment on December 31, 2018. 4. If A&G’s note had been an installment note to be paid in four equal payments at the end of each year beginning December 31, 2016, what would be the amount of each installment? 5. Prepare an amortization schedule for the four-year term of…arrow_forward1. On December 31, 2018, the company posted an eding capital of 30 million. the following yer, the copany realized a net income after tax of 70 milion, but the owner withdrew 20 million frm the capital for persnal investments. by the end of 2019, how much is the ending capital of the company? 2. The following information can be found in Sanduc Merchandising Corporation's financial statement in 2019: cost of sales of 2,450,000; accumulated depreciation of 75,000; operating expenses of 1,050,000; corporate income tax of 32% sales of 4,800,000; 3-year bank loan of 1,000,000 that pays an interest rate of 8.5 per year. determine the net profit before tax of Sanducoarrow_forward

- Braxton Technologies, Inc., constructed a conveyor for A&G Warehousers that was completed and ready for useon January 1, 2018. A&G paid for the conveyor by issuing a $100,000, four-year note that specified 5% interestto be paid on December 31 of each year, and the note is to be repaid at the end of four years. The conveyor wascustom-built for A&G, so its cash price was unknown. By comparison with similar transactions it was determined that a reasonable interest rate was 10%.Required:1. Prepare the journal entry for A&G’s purchase of the conveyor on January 1, 2018.2. Prepare an amortization schedule for the four-year term of the note.3. Prepare the journal entry for A&G’s third interest payment on December 31, 2020.4. If A&G’s note had been an installment note to be paid in four equal payments at the end of each year beginning December 31, 2018, what would be the amount of each installment?5. Prepare an amortization schedule for the four-year term of the…arrow_forwardThe following information is for Ayayai Corporation as of December 31, 2017. Restricted Cash for Retirement of long- term debt $23,000 Additional Paid-in Capital $54,000 Equipment (cost) 111,000 Accounts Receivable 71,000 Inventory (work in process) 13,000 Inventory (raw materials) 59,000 Cash (unrestricted) 21,000 Supplies Expense 16,000 Inventory (finished goods) 32,000 Cost of Goods Sold 404,000 Equity Investments (cost) 8,000 Allowance for Doubtful Accounts 2,000 Customer Advances 11,000 Licenses 6,000 Unearned Service Revenue 35,000 Notes Receivable 16,000 Treasury Stock 12,000 The following additional information is available. 1. Inventories are valued at lower-of-cost-or-market using FIFO. 2. Treasury stock is recorded at cost. 3. Licenses are recorded net of accumulated amortization of $5,500. 4. Equipment is recorded at cost. Accumulated depreciation, computed on a straight-line…arrow_forwardHow to solve these? The following expenses were recognized by CBA Co., a retailer, during 2020: Interest expense: P120,000 Telephone expense: P95,000 Loss on sale of store equipment: P47,000 Legal fees: P74,000 Officers' salaries: P115,000. How much should CBA Co. report as general and administrative expenses for 2020? On May 1, 2020, GAL Co. purchased a short-term P2,000,000 face value, 9% debt instruments for P1,860,000 including the accrued interest and classified it as a trading security. The debt instruments mature on January 1, 2023, and pay interest semi-annually on January 1 and July 1. On December 31, 2020, the fair market value of the instruments is 98%. On March 2, 2021, GAL Co. sold the trading security for P1,980,000. How much will be recognized as income on the 2020 income statement? Selected data for ABC Co. for 2020 are as follows: Decrease in merchandise inventory: P20,000 increase in accounts payable: P50,000 Disbursements for purchases of merchandise: P580,000. How…arrow_forward

- Williams-Santana, Inc., is a manufacturer of high-tech industrial parts that was started in 2009 by two talented engineers with little business training. In 2021, the company was acquired by one of its major customers. As part of an internal audit, the following facts were discovered. The audit occurred during 2021 before any adjusting entries or closing entries were prepared. The income tax rate is 25% for all years. A five-year casualty insurance policy was purchased at the beginning of 2019 for $36,500. The full amount was debited to insurance expense at the time. Effective January 1, 2021, the company changed the salvage value used in calculating depreciation for its office building. The building cost $612,000 on December 29, 2010, and has been depreciated on a straight-line basis assuming a useful life of 40 years and a salvage value of $100,000. Declining real estate values in the area indicate that the salvage value will be no more than $25,000. On December 31, 2020,…arrow_forwardThe financial controller of McEwan Limited, a publishing company, noted thefollowing two items in a report to the finance director on the preliminary accountsfor the year ended December 31, 2021:• A copyright for a novel originally purchased for $100,000 in 2018 was beingamortized over ten years with an expected residual value of $10,000. However,due to poor sales and a scandal earlier this year involving the author, it is nowexpected that the book will only be commercially viable for another year and thecopyright will have no residual value.• An insurance premium of $1,500 was paid on November 1, 2020, for a one-yearpolicy. The payment was recorded as a debit to insurance expense in 2020.Required:a. Discuss the appropriate accounting treatment for two changes above.b. Assuming the books are closed for 2020 and open for 2021, provide the journalentries required to address the two changes. Ignore income tax effects. Show allworkingsarrow_forwardTasa Incorporated after having experienced financial difficulties in 2021, negotiated with a major creditor and arrived at an agreement to restructure a note payable on December 31, 2021. The creditor was owed a principal of P3,600,000 and interest of P400,000 but agreed to accept equipment worth 850,000 and a note receivable from Tasa's customer with carrying amount of P2,700,000. The equipment had an original cost of P900,000 and an accumulated depreciation of 300,000. a.What amount should be recognized as gain from extinguishment of debt on December 31, 2021?arrow_forward

- For the year ending December 31, 2016, Micron Corporation had income from continuing operations before taxes of $1,200,000 before considering the following transactions and events. All of the items described below are before taxes and the amounts should be considered material. 1. In November 2016, Micron sold its Waffle House restaurant chain that qualified as a component of an entity. The company had adopted a plan to sell the chain in May 2016. The income from operations of the chain from January 1, 2016, through November was $160,000 and the loss on sale of the chain’s assets was $300,000. 2. In 2016, Micron sold one of its six factories for $1,200,000. At the time of the sale, the factory had a book value of $1,100,000. The factory was not considered a component of the entity. 3. In 2014, Micron’s accountant omitted the annual adjustment for patent amortization expense of $120,000. The error was not discovered until December 2016. Required: Prepare Micron’s income statement,…arrow_forwardPrincess Town Insurance Inc., located in a country which has a capital gains tax, purchased a building in February 2018 for $26,000,000. In March 2019, they spent $1, 800,000 to install solar panels for electricity in the building. The building was sold for $39,000,000 in 2020. The annual maintenance cost was $500,000. The cost of advertising the sale of the building and the legal fees amounted to $1,950,000. Capital losses were as follows:2017 - $200,0002018 - $250,000 Required:Calculate the capital gains tax in 2020, assuming a capital gains tax of 20%arrow_forwardThe following information is for Blue Spruce Corporation as of December 31, 2017. Restricted Cash for Retirement of long- term debt $25,300 Additional Paid-in Capital $56,400 Equipment (cost) 111,000 Accounts Receivable 72,000 Inventory (work in process) 14,400 Inventory (raw materials) 59,800 Cash (unrestricted) 21,400 Supplies Expense 16,400 Inventory (finished goods) 33,300 Cost of Goods Sold 406,000 Equity Investments (cost) 9,200 Allowance for Doubtful Accounts 3,800 Customer Advances 11,300 Licenses 7,600 Unearned Service Revenue 35,000 Notes Receivable 25,600 Treasury Stock 13,000 The following additional information is available. 1. Inventories are valued at lower-of-cost-or-market using FIFO. 2. Treasury stock is recorded at cost. 3. Licenses are recorded net of accumulated amortization of $6,400. 4. Equipment is recorded at cost. Accumulated depreciation, computed on a…arrow_forward