ADVANCED ACCOUNTING CHAPTERS 15-19

12th Edition

ISBN: 9781337046251

Author: FISCHER

Publisher: CENGAGE C

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.1AC

(Note: The use 01 a financial calculator or Excel is suggested for this case.)

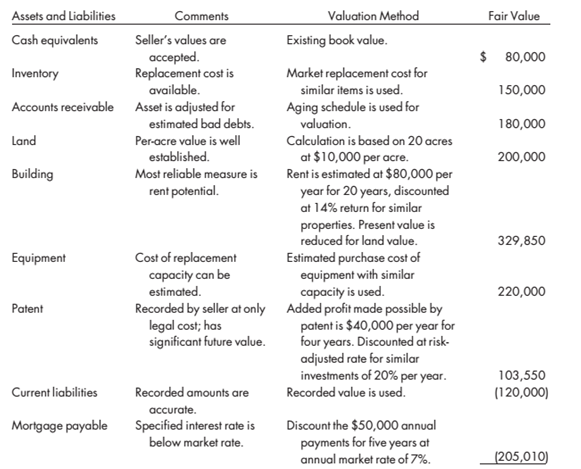

Modern Company acquires the net assets of Frontier Company for $1,300,000 on January 11, 2015. A business valuation consultant arrives at the price and deems it to be a good value.

Part A. The following list of fair values is provided to you by the consultant:

Using the information in the preceding table, contra the accuracy of the present value cal Required collations mode for the building, patent, and mortgage payable.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Lion Company is considering the acquisition of Tiger Company, Inc. early in 2018. To assess the amount it might be willing to pay, Lion Company makes the following computations and assumptions.

Tiger Company incomes in the year of 2014 to 2017 were OMR 180,000, OMR 180,000, OMR 200,000, OMR 250,000 and total income of the year’s OMR 810,000 respectively. Lion Company believes that an average of these earnings represents a fair estimate of annual earnings for the indefinite future. Depreciation on Office buildings and Plant and equipment each year OMR 350,000 and 150,000. Extraordinary gain of the Company in the year of 2016 OMR 100,000 and Extraordinary loss of the Company in the year of 2018 OMR 350,000.

Lion Company has identifiable assets with a total fair value of OMR 25,000,000 and Creditors OMR 700,000 and Account payable OMR 200,000. The assets include office equipment with a fair value approximating book value, office building with a fair value 25% higher than book value and…

On September 1, 2012, Ramos Inc. approved a plan to dispose of a segment of its business. Ramos expected that the sale would occur on March 31, 2013, at an estimated gain of $375,500. The segment had actual and estimated operating profits (losses as follows):

Please prepare answers to the following questions. Assume a marginal tax rate of 35%

Realized loss from 1/1/12 to 8/31/12 …….... $ 200,000

Realized loss from 9/1/12 to 12/31/12 ……...$ 135,000

Expected profit from 1/1/13 to 3/31/13. ….... $ 475,000

What should Ramos report as profit or loss from discontinued operations (net of tax effects) in its 2012 income statement?

Calculate the amount of income that should be shown on the 2013 income statement as a result of the operating profit and the gain on disposal (net of tax). Please include details to support your response.

A. MacPro Property Bhd acquired an investment property on 1 January 2015 and measured it using the cost model. On 1 January 2018, MacPro Property Bhd changed the accounting policy and used the fair value model to measure investment property. The acquisition cost of the property was RM70 million and the estimated useful life was 35 years.

The fair values of the property were measured as below:

Date

RM (in million)

31/12/2015

72

31/12/2016

74

31/12/2017

78

31/12/2018

83

Profit after depreciation on investment property but before tax for 2017 and 2018 were RM80 million and RM95 million, respectively. Retained earnings brought forward on 1 January 2017 and 2018, were RM150 million and RM210 million, respectively. Assume that tax rate for 2017 and 2018 was 25%.

REQUIRED:

Discuss the accounting treatment of the above transaction in accordance to MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors.

Prepare the comparative financial…

Chapter 1 Solutions

ADVANCED ACCOUNTING CHAPTERS 15-19

Ch. 1 - Prob. 1UTICh. 1 - Prob. 3UTICh. 1 - Prob. 4UTICh. 1 - Prob. 5UTICh. 1 - Prob. 6UTICh. 1 - Prob. 7UTICh. 1 - Prob. 8UTICh. 1 - Prob. 9UTICh. 1 - Prob. 10UTICh. 1 - Prob. 1.1E

Ch. 1 - Prob. 1.2ECh. 1 - Prob. 1.3ECh. 1 - Prob. 2ECh. 1 - Prob. 5.1ECh. 1 - Prob. 5.2ECh. 1 - Prob. 6ECh. 1 - Lake craft Company has the following balance...Ch. 1 - Prob. 8.2ECh. 1 - Prob. 8.3ECh. 1 - Prob. 9.1ECh. 1 - Prob. 9.2ECh. 1 - Prob. 1A.1.1AECh. 1 - Prob. 1A.1.2AECh. 1 - Prob. 1.2PCh. 1 - Prob. 1.3.1PCh. 1 - Prob. 1.4PCh. 1 - Jack Company is a Corporation that was organized...Ch. 1 - Prob. 1.6PCh. 1 - Prob. 1.7.1PCh. 1 - Prob. 1.7.2PCh. 1 - Prob. 1.8PCh. 1 - Prob. 1.10.A1PCh. 1 - Prob. 1.11PCh. 1 - Prob. 1.12PCh. 1 - Prob. 1.13.2PCh. 1 - Prob. 1A.1.1APCh. 1 - Prob. 1A.1.2APCh. 1 - (Note: The use 01 a financial calculator or Excel...Ch. 1 - Frontier does not have publicly traded stock. You...Ch. 1 - Frontier does not have publicly traded stock. You...Ch. 1 - Prob. 1.1B.3CCh. 1 - Prob. 1.1CCCh. 1 - Prob. 1.2.1CCh. 1 - Prob. 1.2.2CCh. 1 - Case 1-2 Disney Acquires Marvel Entertainment On...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You were engaged to audit the financial statements of the Philippines Refining Company for the year ended December 31, 2021 with comparative figures for the year ended December 31, 2020. One of your concern regarding material risk is on their long-term liabilities related to the acquisition of machinery. Your examination of their books revealed that on December 31, 2019, Philippines Refining Companypurchased machinery having a cash selling price of P85,933.75. The company paid P10,000 down and agreed to finance the remainder by making four equal payments each December 31 at the implicit interest rate of 12%. The accountant prepared a table of payment below for their long-term financing for you to test for the accuracy of their presentation and payment. Date Total Payment Interest Payment Principal Payment Carrying Value 12/31/19 10,000.00 75,933.75 12/31/20 28,095.49 9,112.05 18,983.44 56,950.31 12/31/21 25,817.48…arrow_forwardMacPro Property Bhd acquired an investment property on 1 January 2015 and measured it using the cost model. On 1 January 2018, MacPro Property Bhd changed the accounting policy and used the fair value model to measure investment property. The acquisition cost of the property was RM70 million and the estimated useful life was 35 years. The fair values of the property were measured as below: Date RM (in million) 31/12/2015 72 31/12/2016 74 31/12/2017 78 31/12/2018 83 Profit after depreciation on investment property but before tax for 2017 and 2018 were RM80 million and RM95 million, respectively. Retained earnings brought forward on 1 January 2017 and 2018, were RM150 million and RM210 million, respectively. Assume that tax rate for 2017 and 2018 was 25%. REQUIRED: Discuss the accounting treatment of the above transaction in accordance to MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors. Prepare the comparative…arrow_forward1.In February 2019, Wall Corp decided to sell its entire Plant division. The Plant division was a major part of Wall Corp's business and the sale will result in a strategic change in direction for the company. The sale was completed in January 2020 and resulted in a gain on disposal of P500,000. In 2019 Plant's net losses were P350,000 and P20,000 in 2020 up until the date of sale. Excluding taxation, what should the net gain/(loss) to be reported in the income statements of Wall Corp for its Plant division? A.2019 (P350,000) / 2020 P500,000 B. 2019 (P350,000) / 2020 P480,000 C. 2019 P230,000 / 2020 P0 D. 2019 P0 / 2020 P230,000arrow_forward

- Morley Manufacturing has notes receivable that have a fair value of P810,000 and a carrying amount of P620,000. Morley decides on December 31, 2021, to use the fair value option for these recently-acquired receivables. Which of the following statements is correct regarding the election of the fair value option by Morley? a. Morley can elect to use the fair value option or amortized cost at each statement of financial position date. b. Morley reports the receivables at fair value, with any unrealized holding gains and losses reported as a separate component of comprehensive income. c. The unrealized holding gain is the difference between the fair value and the carrying amount. d. All of the choices are correct regarding the fair value option.arrow_forwardParaiso company’s accounting policy with respect to investment properties is to measure them at fair value at the end of each reporting period. One of the investment properties was measured at 12,000,000 on Dec. 31, 2015. The property had been acquired on January 1, 2015 for a total of 11,400,000, made up of 10,350,000 paid to the vendor, 450,000 paid to the local authority as a property transfer tax and 600,000 paid to professional advisers. The useful life of the property is 40 years. What is the gain to be recognized for the year ended December 31, 2015 in respect of the investment property?arrow_forwardYou were engaged to audit the financial statements of the Philippine Refining Company for the year ended December 31, 2021 with comparative figures for the year ended December 31, 2020. One of your concern regarding material risk is on their long-term liabilities related to the acquisition of machinery. Your examination of their books revealed that on December 31, 2019, Philippine Refining Company purchased machinery having a cash selling price of P85,933.75. The company paid P10,000 down and agreed to finance the remainder by making four equal payments each December 31 at the implicit interest rate of 12%. The accountant prepared a table of payment below for their long-term financing for you to test for the accuracy of their presentation and payment. Date Total Payment Interest Payment Principal Payment Carrying Valu 12/31/1910,000.00 75.933.75 12/31/20 28.095.49 9.112.05 18,983.44 $6.950.31 12/31/21 25.817.48 6.834,04 18,983.44 137.966.87 12/31/22/23.519.46 4,556,02 18.983.44…arrow_forward

- On July 2014, Thunder Company is committed to a plan to sell a disposal group that represents a significant portion of its regulated operations. The sale requires regulatory approval, which could extend the period required to complete the sale beyond one year. Actions necessary to obtain that approval cannot be initiated until after a buyer is known and a firm purchase commitment is obtained. However, a firm purchase commitment is highly probable within one year. The noncurrent assets of disposal group have a carrying value of P4,000,000 and liabilities of P1,000,000. The total fair market value as of December 31, 2014 of the disposal group is P4,800,000. If the sale is completed within one year, the estimated cost to sell is P200,000, but if the sale will extend beyond one year, the present value of the estimated cost to sell is P180,000. If the sale will extend beyond one year, what amount of gain or loss should the company report in its 2014 profit or loss?arrow_forwardou are working with an accounting firm. Sussie, who is representing Suss Co, needs advice about depreciating assets. She asks; what are depreciating assets? What are the different ways to calculate the declining value of depreciating assets? Furthermore, Suss Co has aggregated turnover of $ 2 billion. In December 2021, Suss Co purchased a machine for $4m, which was commenced immediately for an income-producing purpose. What tax does the Suss Co claim?arrow_forwardOn October 01,2019, the Tomoe Co. acquired 100% of the Nanami Co. when the fair value of Nanami's net assets as Php116M and their carrying amount was Php120M. The consideration transferred comprised Php200M in cash transferred at the acquisition date, plus another Php60M in cash to be transferred 11 months after the acquisition date if a specified profit target was met by Nanami. At the acquisition date, there was only a low probability of the profit target being met, so the fair value of the additional consideration liability was Php10M. In the event, the profit target was met and the Php60M cash was transferred. Provide the Journal Entries for the business combination until the measurement periodarrow_forward

- On December 31, 2024, the end of the fiscal year, California Microtech Corporation held its semiconductor business for sale at year-end. The estimated fair value of the segment’s assets, less costs to sell, on December 31 was $13 million. The semiconductor business segment qualifies as a component of the entity according to GAAP. Consider the following additional information: The book value of the assets of the segment at the time of the sale was $16 million. The loss from operations of the segment during 2024 was $4.4 million. Pretax income from other continuing operations for the year totaled $7.6 million. The income tax rate is 25%. Prepare the lower portion of the 2024 income statement beginning with income from continuing operations before income taxes. Note: Loss amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions. For example, $4,000,000 rather than $4.arrow_forwardIn February 2019, Wall Corp decided to sell its entire Plant division. The Plant division was a major part of Wall Corp’s business and the sale will result in a strategic change in direction for the company. The sale was completed in January 2020 and resulted in a gain on disposal of P500,000. In 2019 Plant’s net losses were P350,000 and P20,000 in 2020 up until the date of sale. Excluding taxation, what should the net gain/(loss) to be reported in the income statements of Wall Corp for its Plant division?2 points A.2019 (P350,000) / 2020 P500,000B. 2019 (P350,000) / 2020 P480,000C. 2019 P230,000 / 2020 P0D. 2019 P0 / 2020 P230,000arrow_forwardIn February 2019, Walley Corp decided to sell its entire Plant division. The Plant division was a major part of Walley Corp’s business and the sale will result in a strategic change in direction for the company. The sale was completed in January 2020 and resulted in a gain on disposal of P500,000. In 2019 Plant’s net losses were P350,000 and P20,000 in 2020 up until the date of sale. Excluding taxation, what should the net gain/(loss) to be reported in the income statements of Walley Corp for its Plant division? Select one: a. 2019 P 230,000 / 2020 P 0 b. 2019 (P 350,000) / 2020 P 480,000 c. 2019 P 0 / 2020 P 230,000 d. 2019 (P 350,000) / 2020 P 500,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Property, Plant and Equipment (PP&E) - Introduction to PPE; Author: Gleim Accounting;https://www.youtube.com/watch?v=e_Hx-e-h9M4;License: Standard Youtube License