Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 26E

The Candle Shop experienced the following events during its first year of operations, 2018:

- 1. Acquired cash by issuing common stock.

- 2. Paid a cash dividend to the stockholders.

- 3. Paid cash for operating expenses.

- 4. Borrowed cash from a bank.

- 5. Provided services and collected cash.

- 6. Purchased land with cash.

- 7. Determined that the market value of the land is higher than the historical cost.

Required

- a. Indicate whether each event is an asset source, use, or exchange transaction.

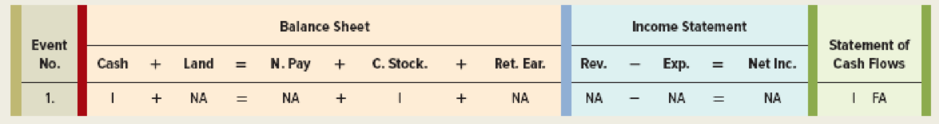

- b. Use a horizontal statements model to show how each event affects the

balance sheet , income statement, and statement of cash flows. Indicate whether the event increases (I), decreases (D), or does not affect (NA) each element of the financial statements. Also, in the Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). The first transaction is shown as an example.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

All-Star Automotive Company experienced the following accounting events during 2018:

Performed services for $14,200 cash.

Purchased land for $7,200 cash.

Hired an accountant to keep the books.

Received $32,000 cash from the issue of common stock.

Borrowed $8,400 cash from State Bank.

Paid $4,200 cash for salary expense.

Sold land for $8,400 cash.

Paid $3,200 cash on the loan from State Bank.

Paid $4,400 cash for utilities expense.

Paid a cash dividend of $1,200 to the stockholders.

Prepare a statement of cash flows for 2018. Assume All-Star Automotive company had a beginning cash balance of $9,200 on January 1, 2018.

Upon organizing the new business, one of the owners invested Cash of $12,000 and Machinery valued at $11,300 receiving Common stock in exchange for those assets. The journal entry the business will make to record this transaction should include:

A. Debiting Common stock for $23,300 and Crediting Cash for $12,000 and Machinery for $11,300

B. Debiting Cash for $12,000 and Crediting Machinery for $11,300 and Common stock for $700

C. Debiting Cash for $12,000 and Machinery for $11,300 and Crediting Common stock for $23,300.

D. Debiting Machinery for $11,300 and Common stock for $700 and Crediting Cash for $12,000

The following transactions were completed by the company

a. The owner (Alex Carr) invested $16,800 cash in the company

b. The company purchased supplies for $950 cash

c. The owner (Alex Carr) invested $10,900 of equipment in the company

d. The company purchased $290 of additional supplies on credit

e. The company purchased land for $9,900 cash

Required:

Enter the impact of each transaction on individual items of the accounting equation (Enter decreases to account balances with a minus sign)

Assets

=

Liabilities

+

Equity

Cash

+

Supplies

+

Equipment

+

Land

=

Accounts Payable

+

A. Carr, Capital

−

A. Carr, Withdrawals

+

Revenue

−

Expenses

a.

+

+

+

=

+

−

+

−

b.

+

+

+

=

+

−

+

−

Bal.

0

+

0

+

0

+

0

=

0

+

0

−

0

+

0

−

0

c.

+

+

+

=

+

−

+

−

Bal.

0

+

0

+

0

+

0

=

0

+

0

−

0

+

0

−

0

d.

+

+

+

=

+

−

+

−

Bal.

0

+

0

+

0

+

0

=

0

+

0

−

0

+

0

−

0

e.

+

+

+

=

+

−

+

−…

Chapter 1 Solutions

Survey Of Accounting

Ch. 1 - Prob. 1QCh. 1 - Prob. 2QCh. 1 - Prob. 3QCh. 1 - 4. In a business context, what does the term...Ch. 1 - 5. What market trilogy components are involved in...Ch. 1 - 6. Give an example of a financial resource, a...Ch. 1 - Prob. 7QCh. 1 - 8. How do financial and managerial accounting...Ch. 1 - Prob. 9QCh. 1 - Prob. 10Q

Ch. 1 - Prob. 11QCh. 1 - 12. Distinguish between elements of financial...Ch. 1 - Prob. 13QCh. 1 - 14. To whom do the assets of a business belong?Ch. 1 - 15. Describe the differences between creditors and...Ch. 1 - Prob. 16QCh. 1 - Prob. 17QCh. 1 - Prob. 18QCh. 1 - 19. What does a double-entry bookkeeping system...Ch. 1 - 22. How does acquiring capital from owners affect...Ch. 1 - Prob. 21QCh. 1 - Prob. 22QCh. 1 - 25. What are the three primary sources of assets?Ch. 1 - 26. What is the source of retained earnings?Ch. 1 - 27. How does distributing assets (paying...Ch. 1 - 28. What are the similarities and differences...Ch. 1 - Prob. 27QCh. 1 - 30. Which of the general-purpose financial...Ch. 1 - 31. What causes a net loss?Ch. 1 - 35. What three categories of cash receipts and...Ch. 1 - Prob. 31QCh. 1 - 37. Discuss the term articulation as it relates to...Ch. 1 - 38. How do temporary accounts differ from...Ch. 1 - Prob. 34QCh. 1 - 41. Identify the three types of accounting...Ch. 1 - Prob. 36QCh. 1 - Prob. 37QCh. 1 - Prob. 1ECh. 1 - Prob. 2ECh. 1 - Exercise 1-3A Identifying the reporting entities...Ch. 1 - Exercise 1-4A Define Terms and Identify Missing...Ch. 1 - Exercise 1-5 Effect of events on the accounting...Ch. 1 - Exercise 1-6 Effect of transactions on general...Ch. 1 - Exercise 1-7 Missing information and recording...Ch. 1 - Prob. 8ECh. 1 - Exercise 1-9A Record events and interpret...Ch. 1 - Exercise 1-10 Interpreting the accounting equation...Ch. 1 - Prob. 11ECh. 1 - Exercise 1-12A Differences between interest and...Ch. 1 - Exercise 1-13A Classifying events as asset source,...Ch. 1 - Prob. 14ECh. 1 - Exercise 1-15 Preparing an income statement and a...Ch. 1 - Prob. 16ECh. 1 - Prob. 17ECh. 1 - Prob. 18ECh. 1 - Prob. 19ECh. 1 - Riley Company paid 60,000 cash to purchase land...Ch. 1 - Prob. 21ECh. 1 - As of January 1, 2018, Room Designs, Inc. had a...Ch. 1 - As of December 31, 2018, Flowers Company had total...Ch. 1 - Prob. 24ECh. 1 - Critz Company was started on January 1, 2018....Ch. 1 - The Candle Shop experienced the following events...Ch. 1 - Prob. 27ECh. 1 - Prob. 28PCh. 1 - Prob. 29PCh. 1 - Match the terms (identified as a through r) with...Ch. 1 - Problem 1-30A Classifying events as asset source,...Ch. 1 - Problem 1-31A Relating titles and accounts to...Ch. 1 - Marks Consulting experienced the following...Ch. 1 - Prat Corp. started the 2018 accounting period with...Ch. 1 - Maben Company was started on January 1, 2018, and...Ch. 1 - Required Use the Target Corporations Form 10-K to...Ch. 1 - ATC 1-5 Writing Assignment Elements of financial...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In which section of the statement of cash flows would each of the following transactions be included? For each, identify the appropriate section of the statement of cash flows as operating (O), investing (I), financing (F), or none (N). (Note: some transactions might involve two sections.) A. borrowed from the bank for business loan B. declared dividends, to be paid next year C. purchased treasury stock D. purchased a two-year insurance policy E. purchased plant assetsarrow_forwardWhich of the following assets held by a cash basis accounting firm is a §1231 asset? Group of answer choices a. An investment in Orange Company common stock. b. An account receivable from a client. c. A computer used in the business and held for 11 months. d. A desk used in the business and held more than one year.arrow_forwardThe following transaction took place in ABC company for the month of January 2018 Transaction a. the owner contributed cash of 80,000 b. purchased a new equipment for 75,000 c.sold old furniture for cash 6,000 d. repaid loan 1,500 e. owner withdrew cash 5,000 for personal use Required classify and prepare a statement of cash flow from the above transactionsarrow_forward

- For each of the following situations write the principle, assumption, or concept that justifies or explains what occurred. A) Land is purchased for $205,000 cash; the land is reported on the balance sheet of the purchaser at $205,000.B)A company records the expenses incurred to generate the revenues reported. C)When preparing financials for a company, the owner makes sure that the expense transactions are kept separate from expenses of the other company that he owns. *arrow_forwardDirection: Read the following case study and answer the question: During the period, the business acquires an equipment costing P150,000 in cash. The owner of the business is questioning why you as his accountant, did not include the P150,000 equipment as one of the items of operating expense in the income statement which resulted in a higher income tax of the business?arrow_forwardThe accounting records of Tama Co. show the following assets and liabilities as of December 31, 2018 and 2019. 1. Prepare balance sheets for the business as of December 31, 2018 and 2019. Hint: Report only total equity on the balance sheet and remember that total equity equals the difference between assets and liabilities. 2. Compute net income for 2019 by comparing total equity amounts for these two years and using thefollowing information: During 2019, the owner invested $5,000 additional cash in the business and withdrew $3,000 cash for personal use. 3. Compute the December 31, 2019, debt ratio (in percent and rounded to one decimal).arrow_forward

- Listed below are eight transactions the Foster Corporation made during November:a. Issued stock in exchange for cash.b. Purchased land. Made partial payment with cash and issued a note payable for the remainingbalance.c. Recorded utilities expense for November. Payment is due in mid-December.d. Purchased office supplies with cash.e. Paid outstanding salaries payable owed to employees for wages earned in October.f. Declared a cash dividend that will not be paid until late December.g. Sold land for cash at an amount equal to the land’s historical cost.h. Collected cash on account from customers for services provided in September and October.Indicate the effects of the above transactions on each of the financial statement elements shownin the column headings below. Use the following symbols: I Increase, D Decrease, andNE no effect. Transaction Net Income Assets Liabilities Equitya.b.c.d.e.f.g.h.Transaction Net Income Assets Liabilities Equitya.b.c.d.e.f.g.h.Transactionarrow_forwardTransactions Interstate Delivery Service is owned and operated by Katie Wyer. The following selected transactions were completed by Interstate Delivery Service during May: Select the accounting equation elements (Assets, Liabilities, Owner's Equity) affected by the transaction. Then, in the "Direction" column, select the impact ("Increases" or "Decreases") on the accounting equation element. Lastly, select the specific account within the accounting equation element that is affected. To illustrate, the answer to (1) follows: (1) Asset (Cash) increases by $18,000; Owner's Equity (Katie Wyer, Capital) increases by $18,000. Element Direction Item 1. Received cash from owner as additionalinvestment, $18,000. AssetOwner's Equity IncreasesIncreases CashKatie Wyer, Capital 2. Paid advertising expense, $4,850. 3. Purchased supplies on account, $2,100. 4. Billed customers for delivery services on account, $14,700.…arrow_forwardDuring March 2020, ABC engaged in the following transactions: a. ABC received cash of $50,000 from David R. and issued common stock to David. b. The business paid $20,000 cash to acquire a truck. c. The business purchased supplies costing $1,800 on account. d. The business painted a house for a client and received $3,000 cash. e. The business painted a house for a client for $4,000. The client agreed to pay next week. f. The business paid $900 cash toward the supplies purchased in transaction c. g. The business paid employee salaries of $1,000 in cash. h. The business paid cash dividends of $1,500. i. The business collected $2,600 from the client in transaction e. j. David paid $200 cash for personal groceries. Required Record transaction in journal formarrow_forward

- Austin Land Company sold land for $59,930 in cash. The land was originally purchased for $34,230. At the time of the sale, $12,300 was still owed to Regions Bank. After the sale, Austin Land Company paid off the loan. Explain the effect of the sale and the payoff of the loan on the accounting equation. Enter all dollar amounts as positive numbers. Line Item Description Effect Amount Total assets Total liabilities Stockholders' equityarrow_forwardQUESTION 4 Samuels Company prepares its statement of cash flows using the direct method and engaged in the following transactions during 2017: Transaction 1. Samuels purchased inventory on account.Transaction 2. Samuels collected open accounts receivable.Transaction 3. Samuels exchanged a building for land and realized a gain.Transaction 4. Samuels issued 75,000 shares of preferred stock.Transaction 5. Samuels purchased a three-year fire insurance policy. Which of these transactions or parts of these transactions would be included in the financing activity section of the statement of cash flows? Transaction 3 only Transaction 4 only Transactions 3 and 4 None of these transactions would be found in the financing activity section.arrow_forwardClassifying Transactions Below are certain events that took place at Hazzard, Inc., last year: a. Collected cash from customers. b. Paid cash to repurchase its own stock. c. Borrowed money from a creditor. d. Paid suppliers for inventory purchases. e. Repaid the principal amount of a debt. f. Paid interest to lenders. g. Paid a cash dividend to stockholders. h. Sold common stock. i. Loaned money to another entity. j. Paid taxes to the government. k. Paid wages and salaries to employees. I. Purchased equipment with cash. m. Paid bills to insurers and utility providers. Required: Prepare an answer sheet with the following headings: Enter the cash inflows and outflows above on your answer sheet and indicate how each of them would be classified on a statement of cash flows. Place an X in the Operating. Investing, or Financing column as appropriate.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License