Computing missing information using accounting knowledge

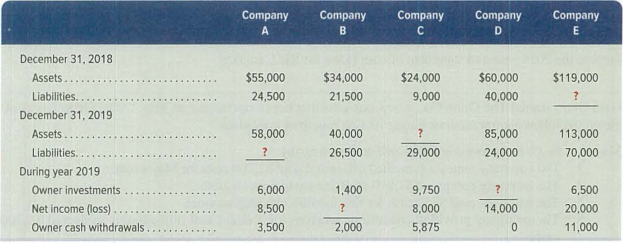

The following financial statement information is from five separate companies.

Required

1. Answer the following questions about Company A.

a. What is the amount of equity on December 31, 2018?

b. What is the amount of equity on December 31, 2019?

c. What is the amount of liabilities on December 3 I, 2019?

2. Answer the following questions about Company B.

a. What is the amount of equity on December 31, 2018?

b. What is the amount of equity on December 31, 2019?

c. What is net income for year 2019?

3. Compute the amount of assets for Company Con December 31,2019.

4. Compute the amount of owner investments for Company D during year 2019.

5. Compute the amount of liabilities for Company Eon December 31, 20 I 8.

1)

Calculate (a) the value of equity on December 31, 2018 (b) value of equity on December 31, 2019 (c) value of liabilities on December 31, 2019 for Company A.

Explanation of Solution

Liabilities:

Liabilities are an obligation of the business to pay to the creditors in future for the goods and services purchased on account or any for other financial benefit received. It can be current liabilities or a non-current liabilities depending upon the time period in which it is paid.

(a)

Calculate the value of equity on December 31, 2018.

Therefore, the value of equity as on December 31, 2018 is $30,500.

(b)

Calculate the value of equity on December 31, 2019.

Therefore, the value of equity as on December 31, 2019 is $41,500.

(c)

Calculate the value of liabilities on December 31, 2019.

Therefore, the value of liabilities as on December 31, 2019 is $16,500.

2)

Calculate (a) the value of equity on December 31, 2018 (b) value of equity on December 31, 2019 (c) value of net income for the year 2019 for Company B.

Explanation of Solution

(a)

Calculate the value of equity on December 31, 2018.

Therefore, the value of equity as on December 31, 2018 is $12,500.

(b)

Calculate the value of equity on December 31, 2019.

Therefore, the value of equity as on December 31, 2019 is $13,500.

(c)

Calculate the value of net income for the year 2019 for Company B.

Therefore, net income of Company B reported an amount of $1,600 during the year 2019.

3)

Calculate (a) the value of assets on December 31, 2019 for Company C.

Explanation of Solution

Calculate the value of assets on December 31, 2019 for Company C.

Therefore, the value of assets as on December 31, 2019 is $55,875.

Working notes:

Calculate the value of equity on December 31, 2018 of Company C.

Calculate the ending balance of equity of Company C.

4)

Calculate the Value of stock issuance during the year 2019 for Company D.

Explanation of Solution

Calculate the value of stock issuance of Company D for the year 2019.

Therefore, stock issuance of Company D reported an amount of $27,000 during the year 2018.

Working notes:

Calculate the value of equity on December 31, 2018 of Company D.

Calculate the ending balance of equity of Company D.

5)

Calculate the value of liabilities for December 31, 2018 for Company E.

Explanation of Solution

Calculate the value of liabilities of Company E for December 31, 2016.

Therefore, the value of liabilities as on December 31, 2018 is $91,500.

Working notes:

Calculate the value of equity on December 31, 2019.

Calculate the ending balance of equity.

Want to see more full solutions like this?

Chapter 1 Solutions

Principles of Financial Accounting.

- Selected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2016, are presented in Problem 6-5A. Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 11. 2. Prepare a statement of owners equity. 3. Prepare an account form of balance sheet, assuming that the current portion of the note payable is 50,000. 4. Prepare closing entries as of May 31, 2016.arrow_forwardBrief Exercise 3-34 Preparing a Retained Earnings Statement Refer to the information presented in Brief Exercise 3-33 for Pelton Company. The balance in Retained Earnings of $12,200 represents the balance as of January 1, 2019. Required: Prepare a retained earnings statement for Pelton for 2019.arrow_forwardCornerstone Exercise 1-18 Balance Sheet An analysis of the transactions of Cavernous Homes Inc. yields the following totals at December 31, 2019: cash, $3,200; accounts receivable, $4,500; notes payable, $5,000; supplies, $8,100; common stock, $7,000; and retained earnings, 9,800. Required: Prepare a balance sheet for Cavernous Homes Inc. at December 31 , 2019.arrow_forward

- Financial information related to Udder Products Company, a proprietorship, for the month ended April 30, 2019, is as follows: a. Prepare a statement of owners equity for the month ended April 30, 2019. b. Why is the statement of owners equity prepared before the April 30, 2019, balance sheet?arrow_forwardIncome Statement, Statement of Retained Earnings, and Balance Sheet The following list, in alphabetical order, shows the various items that regularly appear on the financial statements of Sterns Audio Book Rental Corp. The amounts shown for balance sheet items are balances as of December 31, 2016 (with the exception of retained earnings, which is the balance on January 1, 2016), and the amounts shown for income statement items are balances for the year ended December 31, 2016. Required Prepare an income statement for the year ended December 31, 2016. Prepare a statement of retained earnings for the year ended December 31, 2016. Prepare a balance sheet at December 31, 2016. You have $1,000 to invest. On the basis of the statements you prepared, would you use it to buy stock in this company? Explain. What other information would you want before deciding?arrow_forwardPURPOSE OF ACCOUNTING Match the following users with the information needed. 1. Ownersa. Whether the firm can pay its bills on time 2. Managersb. Detailed, up-to-date information to measure business performance (and plan for future operations) 3. Creditorsc. To determine taxes to be paid and whether other regulations are met 4. Government agenciesd. The firms current financial conditionarrow_forward

- Identify the financial statement on which each of the following accounts would appear: the income statement (IS), the retained earnings statement (RE), or the Balance Sheet (BS). A. Insurance Expense B. Accounts Receivable C. Office Supplies D. Sales Revenue E. Common Stock F. Notes Payablearrow_forwardExercise 1-52 Relationships Among the Financial Statements The following information for Kellman Inc. is available at the end of 2019. Required: Calculate the amount of dividends reported on the retained earnings statement for 2019.arrow_forwardThe Accounting Equation Ginger Enterprises began the year with total assets of $500,000 and total liabilities of $250,000. Using this information and the accounting equation, answer each of the following independent questions. What was the amount of Gingers owners equity at the beginning of the year? If Gingers total assets increased by $100,000 and its total liabilities increased by $77,000 during the year, what was the amount of Gingers owners equity at the end of the year? If Gingers total liabilities increased by $33,000 and its owners equity decreased by $58,000 during the year, what was the amount of its total assets at the end of the year? If Gingers total assets doubled to $1,000,000 and its owners equity remained the same during the year, what was the amount of its total liabilities at the end of the year?arrow_forward

- Exercise 1-53 Relationships Among the Financial Statements During 2019, Moore Corporation paid $20,000 of dividends. Moores assets, liabilities, and common stock at the end 012018 and 2019 were: Required: Using the information provided. compute Moores net income for 2019.arrow_forwardAccrual basis of accounting Margie Van Epps established Health Services, P.C., a professional corporation, in March of the current year, Health Services offers healthy living advice to its clients. The effect of each transaction on the balance sheet and the balances after each transaction for March are as follows. Each increase or decrease in stockholders’ equity, except transaction (h), affects net income. a. Describe each transaction. b. What is the amount of the net income for March?arrow_forwardIdentify whether each of the following accounts would be considered a permanent account (yes/no) and which financial statement it would be reported on (Balance Sheet, Income Statement, or Retained Earnings Statement). A. Common Stock B. Dividends C. Dividends Payable D. Equipment E. Income Tax Expense F. Income Tax Payable G. Service Revenue H. Unearned Service Revenue I. Net Incomearrow_forward

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning