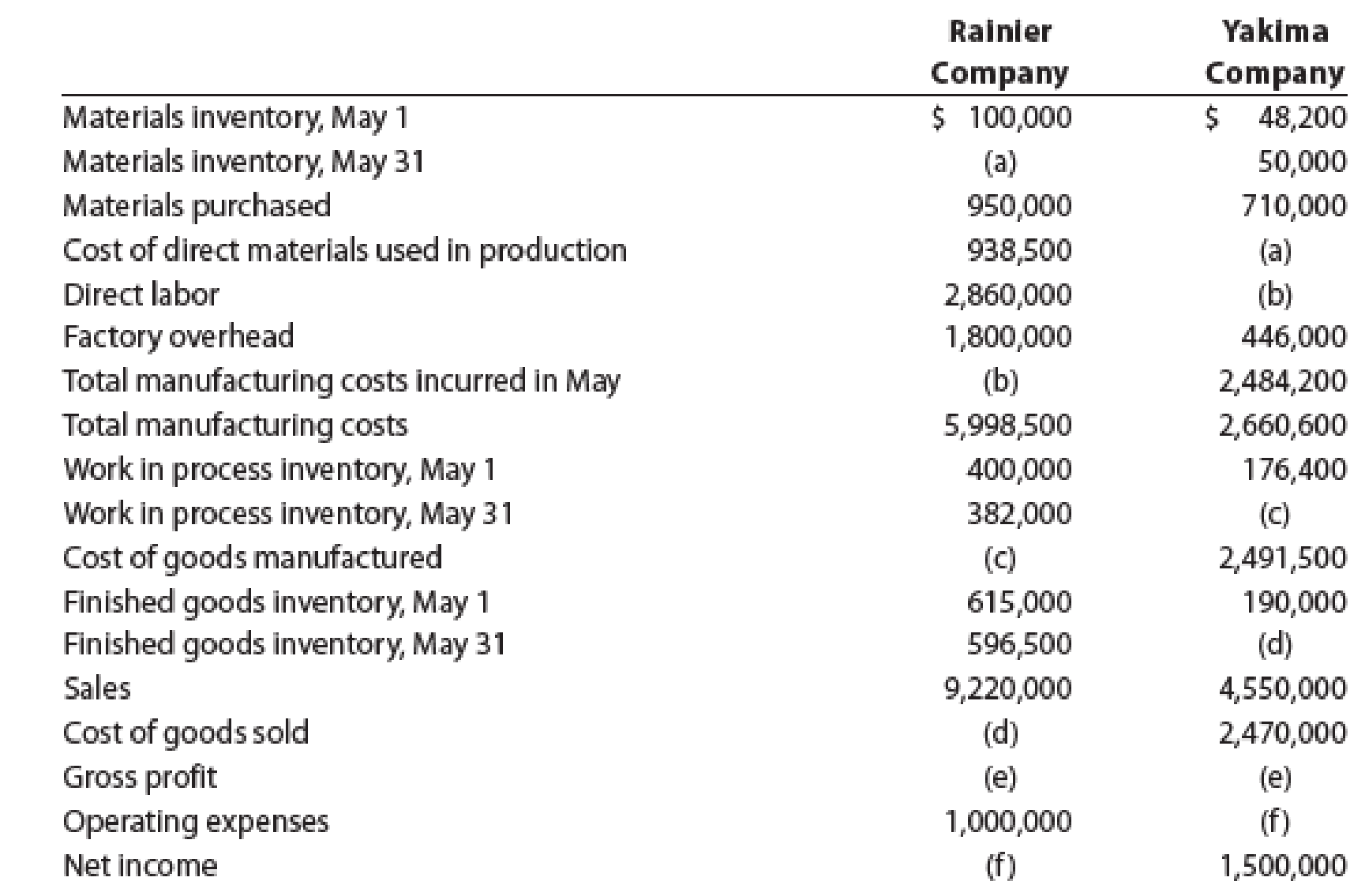

Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December:

Instructions

- 1. For both companies, determine the amounts of the missing items (a) through (f), identifying them by letter.

- 2. Prepare Yakima Company’s statement of cost of goods manufactured for December.

- 3. Prepare Yakima Company’s income statement for December.

1.

Calculate the amounts of the missing items (a) through (f).

Explanation of Solution

Cost of goods manufactured:

Cost of goods manufactured refers to the costs incurred for manufacturing the goods during the period. A statement of cost of goods manufactured is prepared in order to determine the cost of goods manufactured, which in turn is used to determine the cost of goods sold, and prepare the income statement.

Income statement:

The income statement is a financial statement that shows the net income earned or net loss suffered by a company through reporting all the revenues earned, and expenses incurred by the company over a specific period of time. An income statement is also known as an operation statement, an earning statement, a revenue statement, or a profit and loss statement. The net income is the excess of revenue over expenses.

Calculate the amounts of the missing items (a) through (f) as follows:

| Particulars | Company On | Company Off |

| Materials inventory, December 1 | $ 65,800 | $ 195,300 |

| Materials inventory, December 31 |

(a) 30,800 | 91,140 |

| Materials purchased | 282,800 |

(a) 581,560 |

| Cost of direct materials used in production | 317,800 |

(b) 685,720 |

| Direct labor | 387,800 | 577,220 |

| Factory overhead | 148,400 | 256,060 |

| Total manufacturing costs incurred during December |

(b) 854,000 | 1,519,000 |

| Total manufacturing costs | 973,000 | 1,727,320 |

| Work in process inventory, December 1 | 119,000 | 208,320 |

| Work in process inventory, December 31 | 172,200 |

(c) 195,300 |

| Cost of goods manufactured |

(c) 800,800 | 1,532,020 |

| Finished goods inventory, December 1 | 224,000 | 269,080 |

| Finished goods inventory, December 31 | 197,400 |

(d) 256,060 |

| Sales | 1,127,000 | 1,944,320 |

| Cost of goods sold |

(d) 827,400 | 1,545,040 |

| Gross profit |

(e) 299,600 |

(e) 399,280 |

| Operating expenses | 117,600 |

(f) 234,360 |

| Net income |

(f) 182,000 | 164,920 |

Table (1)

Working note (a):

Determine the amount of material inventory for Company On.

Determine the amount of materials purchased for Company Off.

Working note (b):

Determine the amount of total manufacturing cost incurred in December for Company On.

Determine the cost of direct materials used in production for Company Off.

Working note (c):

Determine the amount of work in process at the end of the December for Company Off.

Determine the cost of goods manufactured for Company On.

Working note (d):

Determine the amount of finished goods inventory for December 31 for Company Off.

Determine the cost of goods sold for Company On.

Working note (e):

Determine the amount of gross profit for Company On.

Determine the amount of gross profit for Company Off.

Working note (f):

Determine the amount of operating expense for Company Off.

Determine the amount of net income for Company On.

2.

Prepare Company On’s statement of cost of goods manufactured for December.

Explanation of Solution

Prepare Company On’s statement of cost of goods manufactured for December.

| Company On | |||

| Statement of Cost of Goods Manufactured | |||

| For the month ended December 31 | |||

| Particulars | $ | $ | $ |

| Work in process inventory, December 1 (A) | $ 119,000 | ||

| Direct materials: | |||

| Materials inventory, December 1 | $ 65,800 | ||

| Purchases | 282,800 | ||

| Cost of materials available for use | $348,600 | ||

| Less: Materials inventory, December 31 | 30,800 | ||

| Cost of direct materials used | $317,800 | ||

| Direct labor | 387,800 | ||

| Factory overhead | 148,400 | ||

| Total manufacturing costs incurred (B) | 854,000 | ||

| Total manufacturing costs | $973,000 | ||

| Less: Work in process inventory, December 31 | 172,200 | ||

| Cost of goods manufactured | $800,800 | ||

Table (2)

Therefore, the cost of goods manufactured of Company On for December is $800,800.

3.

Prepare Company On’s income statement for December.

Explanation of Solution

Prepare Company On’s income statement for December.

| Company On | ||

| Income Statement | ||

| For the month ended December 31 | ||

| Sales | $1,127,000 | |

| Cost of goods sold: | ||

| Finished goods inventory, December 1 | $224,000 | |

| Cost of goods manufactured | 800,800 | |

| Cost of finished goods available for sale | $1,024,800 | |

| Less: Finished goods inventory, December 31 | 197,400 | |

| Cost of goods sold | 827,400 | |

| Gross Profit | $299,600 | |

| Less: Operating expenses | 117,600 | |

| Net Income | $182,000 | |

Table (3)

Hence, the net income of Company On for the month of December is $182,000.

Want to see more full solutions like this?

Chapter 1 Solutions

Managerial Accounting, Loose-leaf Version

- The adjusted trial balance for Appleton Appliances, Ltd. on June 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 23,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for June. 2. Prepare an income statement for June. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of June 30. (Hint: Do not forget Retained Earnings.)arrow_forwardThe following data are taken from the general ledger and other records of Phoenix Products Co. on October 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forwardThe following data are taken from the general ledger and other records of Coral Park Production Co. on January 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forward

- Statement of cost of goods manufactured; income statement; balance sheet The adjusted trial balance for Rochester Electronics, Inc. on November 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 33,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of November. 2. Prepare an income statement for the month of November. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of November 30. (Hint: Do not forget Retained Earnings.)arrow_forwardThe following data were taken from the general ledger and other data of McDonough Manufacturing on July 31: Compute the cost of goods sold for the month of July.arrow_forwardStatement of cost of goods manufactured for a manufacturing company Cost data for Johnstone Manufacturing Company for the month ended March 31 are as follows: a. Prepare a cost of goods manufactured statement for March. b. Determine the cost of goods sold for March.arrow_forward

- Income statement for a manufacturing company Two items are omitted from each of the following three lists of cost of goods sold data from a manufacturing company income statement. Determine the amounts of the missing items, identifying them by letter.arrow_forwardOReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forwardThe following is selected information from Mars Corp. Compute net purchases, and cost of goods sold for the month of March.arrow_forward

- The records of Anderjak Corporation contain the following information for the month of January: The company has no beginning inventory. REQUIREMENT You have been asked to prepare a variable costing (direct costing) income statement and an absorption costing income statement for the month of January. Review the worksheet VARCOST that follows these requirements.arrow_forwardSeveral items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of May.Please see attachmentInstructions1. Determine the amounts of the missing items, identifying them by letter.2. Prepare Yakima Company’s statement of cost of goods manufactured for May.3. Prepare Yakima Company’s income statement for May.arrow_forwardManufacturing income statement, statement of cost of goods manufactured Several items are omitted from the income statement and cost of goodsmanufactured statement data for two different companies for the monthof May. Instructions1. Determine the amounts of the missing items, identifying them byletter. 2. Prepare Yakima Company's statement of cost of goods manufacturedfor May.S. Prepare Yakima Company's income statement for May.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College