Determining the Impact of Various Transactions on Investment Turnover, ROI, Residual Income, and Profit Margin

Poseidon Corporation manufactures a variety of gear for water sports. Poseidon has three divisions: Lake, River, and Ocean. Each division is managed as an investment center. During the current year, the Ocean division experienced the following transactions:

a. A special order was accepted at a selling price significantly less than the ordinary selling price. The sale will not impact other sales because this was a one-time order and Ocean has excess capacity. The selling price was in excess of total variable costs.

b. One of three production managers in the Ocean Division submitted his resignation. The position will not be filled due to current efficiencies experienced in the production department.

c. Due to the popularity of open-ocean swimming during the Olympics, the company experienced a surge in sales during the summer months. Sales returned to their normal level for the remainder of the year.

d. Equipment costing $500,000 was purchased to replace fully

e. The company’s after-tax cost of capital increased from 8 percent to 10 percent, with no effect on the minimum required

f. The company’s effective tax rate decreased from 35 percent to 30 percent.

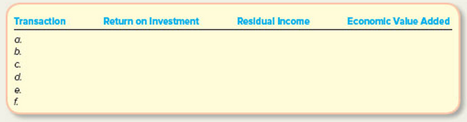

Required:

For each transaction listed in this exercise, determine the impact on investment turnover, return on investment, residual income, and economic value added. Use the following table to organize your answers. Use (I) for increase, (D) for decrease, (N) for no effect, or a question mark (?) if you’re unable to determine the impact of the transaction. Each transaction should be treated independently.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Connect 1-Semester Access Card for Managerial Accounting

- The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forwardNavarre Energy Research specializes in developing and commercializing new products. It is organized into two divisions, which are based on the products they produce. Canal Division is smaller, and the lives of the products it produces tend to be shorter than those produced by the larger Lake Division. Selected financial data for the past year are shown in the following table. Divisional investment is as of the beginning of the year. Navarre uses an 8 percent cost of capital and beginning-of-the-year investment when computing ROI and residual income. Ignore income taxes. Division Canal ($000) Lake ($000) Allocated corporate overhead $ 4,100 $ 9,600 Cost of goods sold 20,000 30,000 Divisional investment 60,100 400,000 R&D 12,000 32,000 Sales 50,000 100,000 Selling, general and administrative (excluding R&D) 4,500 8,000 Required: Compute divisional income for the two divisions. Calculate the operating margin, which is equivalent to the return on sales,…arrow_forwardNavarre Energy Research specializes in developing and commercializing new products. It is organized into two divisions, which are based on the products they produce. Canal Division is smaller, and the lives of the products it produces tend to be shorter than those produced by the larger Lake Division. Selected financial data for the past year are shown in the following table. Divisional investment is as of the beginning of the year. Navarre uses an 8 percent cost of capital and beginning-of-the-year investment when computing ROI and residual income. Ignore income taxes. Division Canal ($000) Lake ($000) Allocated corporate overhead $ 4,100 $ 9,600 Cost of goods sold 20,000 30,000 Divisional investment 60,100 400,000 R&D 12,000 32,000 Sales 50,000 100,000 Selling, general and administrative (excluding R&D) 4,500 8,000 R&D is assumed to have a three-year life in Canal Division and an eight-year life in Lake Division. All R&D expenditures are spent…arrow_forward

- This exercise parallels the machine-purchase decision for the Mendoza Company that is discussed in the body of the chapter. Assume that Mendoza is exploring whether to enter a complementary line of business. The existing business line generates annual cash revenues of approximately $5,000,000 and cash expenses of $3,600,000, one-third of which are labor costs. The current level of investment in this existing division is $12,000,000. (Sales and costs of this division are not affected by the investment decision regarding the complementary line.)Mendoza estimates that incremental (noncash) net working capital of $30,000 will be needed to support the new business line. No additional facilities-level costs would be needed to support the new line—there is currently sufficient excess capacity. However, the new line would require additional cash expenses (overhead costs) of $400,000 per year. Raw materials costs associated with the new line are expected to be $1,200,000 per year, while the…arrow_forwardThis exercise parallels the machine-purchase decision for the Mendoza Company that is discussed in the body of the chapter. Assume that Mendoza is exploring whether to enter a complementary line of business. The existing business line generates annual cash revenues of approximately $5,000,000 and cash expenses of $3,600,000, one-third of which are labor costs. The current level of investment in this existing division is $12,000,000. (Sales and costs of this division are not affected by the investment decision regarding the complementary line.)Mendoza estimates that incremental (noncash) net working capital of $30,000 will be needed to support the new business line. No additional facilities-level costs would be needed to support the new line—there is currently sufficient excess capacity. However, the new line would require additional cash expenses (overhead costs) of $400,000 per year. Raw materials costs associated with the new line are expected to be $1,200,000 per year, while the…arrow_forwardThis exercise parallels the machine-purchase decision for the Mendoza Company that is discussed in the body of the chapter. Assume that Mendoza is exploring whether to enter a complementary line of business. The existing business line generates annual cash revenues of approximately $5,000,000 and cash expenses of $3,600,000, one-third of which are labor costs. The current level of investment in this existing division is $12,000,000. (Sales and costs of this division are not affected by the investment decision regarding the complementary line.)Mendoza estimates that incremental (noncash) net working capital of $30,000 will be needed to support the new business line. No additional facilities-level costs would be needed to support the new line—there is currently sufficient excess capacity. However, the new line would require additional cash expenses (overhead costs) of $400,000 per year. Raw materials costs associated with the new line are expected to be $1,200,000 per year, while the…arrow_forward

- Using ROI and RI to evaluate investment centers Zims, a national manufacturer of lawn-mowing and snow-blowing equipment, segments its business according to customer type: professional and residential. The following divisional information was available for the past year: Management has 21 26% target rate of return for each division. Requirements Calculate each division’s ROI. Round all of your answers to four decimal places. Calculate each division’s profit margin ratio. Interpret your results. Calculate each division’s asset turnover ratio. Interpret your results. Use the expanded ROI formula to confirm your results from Requirement 1. What can you conclude.arrow_forwardProfit Margin, Investment Turnover, and Return on Investment The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales $508,000 Cost of goods sold (228,600) Gross profit $279,400 Administrative expenses (127,000) Operating income $152,400 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,270,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Return on investment fill in the blank 3 % b. If expenses could be reduced by $25,400 without decreasing sales, what would be the impact on the…arrow_forwardProfit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $82,500,000 Cost of goods sold 53,625,000 Gross profit $ 28,875,000 Administrative expenses 15,675,000 Income from operations $ 13,200,000 The manager of the Consumer Products Division is considering ways to increase the return on investment a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $55,000,000 of assets have been invested in the Consumer Products Division. If required, round the investment turnover to one decimal place. Profit margin fill in the blank 1% Investment turnover fill in the blank 2 Rate of return on investment fill in the blank 3% b. If expenses could be reduced by $1,650,000 without decreasing sales,…arrow_forward

- Compute the Return on Investment (ROI) Alyeska Services Company, a division of a major oil company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below: Required: 1. Compute the margin for Alyeska Services Company. 2. Compute the turnover for Alyeska Services Company. 3. Compute the return on investment (ROI) for Alyeska Services Company.arrow_forwardEffects of Changes in Profits and Assets on Return on Investment (ROI) Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company’s Springfield Club reported the following results for the past year: Required: The following questions are to be considered independently. Carry out all computations to two decimal places. 1. Compute the Springfield club’s return on investment (ROI). 2. Assume that the manager of the club is able to increase sales by $70,000 and that, as a result, net operating income increases by $18,200. Further assume that this is possible without any increase in average operating assets. What would be the club’s return on investment (ROI)? 3. Assume that the manager of the club is able to reduce expenses by $14,000 without any change in sales or average operating assets. What would be the club’s return on investment (ROI)? 4.…arrow_forwardrofit Margin, Investment Turnover, and Return on Investment The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales $230,000,000 Cost of goods sold (126,500,000) Gross profit $103,500,000 Administrative expenses (64,400,000) Operating income $39,100,000 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $143,750,000 of assets have been invested in the Consumer Products Division. If required, round your answers to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Return on investment fill in the blank 3 % b. If expenses could be reduced by $3,450,000 without decreasing sales, what…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub