Effects of Charges in Profits arid Assets on

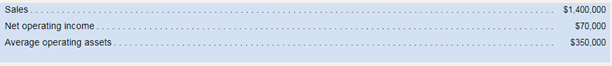

Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year:

Required:

The following questions are to be considered independently. Carry out all computations to two decimal places.

1. Compute the Springfield club's return on investment (ROI).

2. Assume that the manager of the club is able to increase sales by $70,000 and that as a result, net operating income increases by $18,200. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI)?

3. Assume that the manager of the club is able to reduce expenses by $14:000 without any change in sales or average operating assets. What would be the club's return on investment (ROI)?

4. Assume that the manager of the club is able to reduce average operating assets by $70:000 without any change in sales or net operating income. What would be the club's return on investment (ROI)?

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Introduction To Managerial Accounting

- Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year: Sales $ 940,000 Net operating income $ 36000 Average operating assets 100,000 The following questions are to be considered independently. 1- Assume that the manager of the club is able to reduce expenses by $3,760 without any change in sales or operating assets. What would be the club’s return on investment (ROI)? 2- Assume that the manager of the club is able to reduce operating assets by $20,000 without any change in sales or net operating income. What would be the club’s return on investment (ROI)? ( Do not intermediate calculations. Round your answer to 2 decimal places.arrow_forwardFitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year: Sales Net operating income Average operating assets 720,000 $ 12,240 $ 100,000 The following questions are to be considered independently. Assume that the manager of the club is able to increase sales by $72,000 and that, as a result, net operating income increases by $5.184. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI)?arrow_forwardHow can get this problem resolve? Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year: Sales $ 810,000 Net operating income $ 21,060 Average operating assets $ 100,000 The following questions are to be considered independently. 4. Assume that the manager of the club is able to reduce average operating assets by $40,000 without any change in sales or net operating income. What would be the club’s return on investmentarrow_forward

- Pecs Alley is a regional chain of health clubs. The managers of the clubs, who have authority to makeinvestments as needed, are evaluated based largely on return on investment (ROI). The Springfield Clubreported the following results for the past year:Sales .................................................................................. $1,400,000Net operating income ......................................................... $70,000Average operating assets ................................................... $350,000Required:The following questions are to be considered independently. Carry out all computations to two decimalplaces.1. Compute the club’s return on investment (ROI).2. Assume that the manager of the club is able to increase sales by $70,000 and that, as a result, netoperating income increases by $18,200. Further assume that this is possible without any increase inoperating assets. What would be the club’s return on investment (ROI)?3. Assume that the manager of the club is…arrow_forwardPlease send answer in chart set up Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center). Investment Center Sales Income AverageInvested Assets Electronics $ 39,840,000 $ 2,988,000 $ 16,600,000 Sporting goods 25,200,000 2,142,000 12,600,000 1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company?2. Assume a target income level of 11% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company?3. Assume the Electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted?arrow_forwardProfit Margin, Investment Turnover, and ROI Cash Company has income from operations of $19,754, invested assets of $83,000, and sales of $282,200. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1% b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3%arrow_forward

- Using ROI and RI to evaluate investment centers Zims, a national manufacturer of lawn-mowing and snow-blowing equipment, segments its business according to customer type: professional and residential. The following divisional information was available for the past year: Management has 21 26% target rate of return for each division. Requirements Calculate each division’s ROI. Round all of your answers to four decimal places. Calculate each division’s profit margin ratio. Interpret your results. Calculate each division’s asset turnover ratio. Interpret your results. Use the expanded ROI formula to confirm your results from Requirement 1. What can you conclude.arrow_forwardProfit Margin, Investment Turnover, and ROI Cash Company has income from operations of $43,578, invested assets of $269,000, and sales of $726,300. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin % b. Investment turnover c. Return on investment %arrow_forwardProfit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $1,026,000 Cost of goods sold 461,700 Gross profit $564,300 Administrative expenses 205,200 Income from operations $359,100 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,710,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin % Investment turnover Rate of return on investment % b. If expenses could be reduced by $51,300 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on…arrow_forward

- Profit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $1,476,000 Cost of goods sold 664,200 Gross profit $811,800 Administrative expenses 295,200 Income from operations $516,600 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $2,460,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Rate of return on investment fill in the blank 3 % b. If expenses could be reduced by $73,800 without decreasing sales, what would be the impact on the…arrow_forwardCompute the Return on Investment (ROI) Alyeska Services Company, a division of a major oil company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below: Required: 1. Compute the margin for Alyeska Services Company. 2. Compute the turnover for Alyeska Services Company. 3. Compute the return on investment (ROI) for Alyeska Services Company.arrow_forwardProfit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $82,500,000 Cost of goods sold 53,625,000 Gross profit $ 28,875,000 Administrative expenses 15,675,000 Income from operations $ 13,200,000 The manager of the Consumer Products Division is considering ways to increase the return on investment a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $55,000,000 of assets have been invested in the Consumer Products Division. If required, round the investment turnover to one decimal place. Profit margin fill in the blank 1% Investment turnover fill in the blank 2 Rate of return on investment fill in the blank 3% b. If expenses could be reduced by $1,650,000 without decreasing sales,…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College