EBK CORNERSTONES OF COST MANAGEMENT

3rd Edition

ISBN: 8220100474972

Author: MOWEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 21E

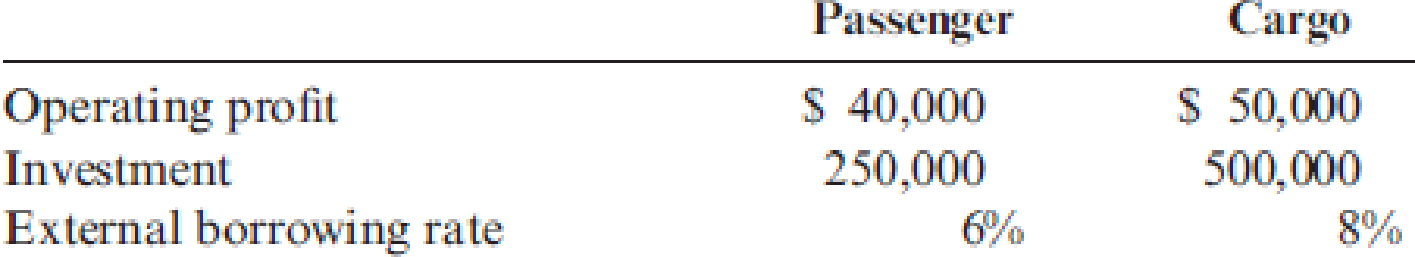

SkyBound Airlines provided the following information about its two operating divisions:

Measuring performance using

- a. The Cargo division, with an ROI of 10%.

- b. The Passenger division, with an ROI of 16%.

- c. The Cargo division, with an ROI of 18%.

- d. The Passenger division, with an ROI of 22%.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Below is a list of various metrics used to measure performance. For each metric, identify the correct balanced scorecard perspective with which the metric is associated.

Metric

Balanced Scorecard Perspective

Average stock price

Economic value added

Employee turnover rates

Manufacturing cycle time

Market share

Number of days from product launch to shelf

Number of defects

Number of new patent applications

Percentage of repeat customers

Percentage decrease in operating costs

Percentage of sales generated by new products

Research and development spending as a percentage of net revenues

options:

Customer

Financial

Internal Business

Learning and Growth

Tan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions

follow:

Sales

Net operating income

Average operating assets

Required 1 Required 2

Required:

1. For each division, compute the return on investment (ROI).

2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any

division is 17%. Compute the residual income for each division.

Complete this question by entering your answers in the tabs below.

ROI

Osaka

$ 10,100,000

$ 808,000

$ 2,525,000

Osaka

Division

For each division, compute the return on investment (ROI).

%

Yokohama

$ 31,000,000

$ 3,100,000

$ 15,500,000

Yokohama

%

Tan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions

follow:

Sales

Net operating income

Average operating assets

Required 1 Required 2

Required:

1. For each division, compute the return on investment (ROI).

2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any

division is 18%. Compute the residual income for each division.

Complete this question by entering your answers in the tabs below.

ROI

Osaka

$ 9,400,000

$ 752,000

$ 2,350,000

Osaka

Division

For each division, compute the return on investment (ROI).

%

Yokohama

$ 24,000,000

$ 2,400,000

$8,000,000

Yokohama

%

Chapter 10 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

Ch. 10 - Prob. 1DQCh. 10 - Explain why firms choose to decentralize.Ch. 10 - Explain how access to local information can...Ch. 10 - What are margin and turnover? Explain how these...Ch. 10 - What are the three benefits of ROI? Explain how...Ch. 10 - What are two disadvantages of ROI? Explain how...Ch. 10 - What is residual income? Explain how residual...Ch. 10 - Prob. 8DQCh. 10 - Prob. 9DQCh. 10 - What is a transfer price?

Ch. 10 - Prob. 11DQCh. 10 - If the minimum transfer price of the selling...Ch. 10 - If an outside, perfectly competitive market exists...Ch. 10 - Prob. 14DQCh. 10 - Prob. 15DQCh. 10 - Forchen, Inc., provided the following information...Ch. 10 - Refer to Cornerstone Exercise 10.1. Forchen, Inc.,...Ch. 10 - Ignacio, Inc., had after-tax operating income last...Ch. 10 - Prob. 4CECh. 10 - Prob. 5CECh. 10 - Prob. 6CECh. 10 - Jarriot, Inc., presented two years of data for its...Ch. 10 - Refer to Exercise 10.7 for data. At the end of...Ch. 10 - Refer to the data given in Exercise 10.8....Ch. 10 - Brewster Company manufactures elderberry wine....Ch. 10 - Xenold, Inc., manufactures and sells cooktops and...Ch. 10 - Prob. 12ECh. 10 - Jocassee Furniture Manufacturing, Inc., has a...Ch. 10 - Prob. 14ECh. 10 - Mossfort, Inc., has a division in Canada that...Ch. 10 - A multinational corporation has a number of...Ch. 10 - Consider the data for each of the following four...Ch. 10 - The following selected data pertain to the Argent...Ch. 10 - Prob. 19ECh. 10 - Prob. 20ECh. 10 - SkyBound Airlines provided the following...Ch. 10 - Wexford Co. has a subunit that reported the...Ch. 10 - Prob. 23ECh. 10 - Prob. 24ECh. 10 - Prob. 25PCh. 10 - Prob. 26PCh. 10 - Prob. 27PCh. 10 - Prob. 28PCh. 10 - Oriole, Inc., owns a number of food service...Ch. 10 - Prob. 30PCh. 10 - Prob. 31PCh. 10 - Prob. 32PCh. 10 - Jump Start Company (JSC), a subsidiary of Mason...Ch. 10 - Prob. 34PCh. 10 - Grate Care Company specializes in producing...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 72 Inc. has developed a balanced scorecard with the following performance metrics: Total sales Employee turnover Market share Number of shipping errors Median training hours per employee Number of new customers Relative to the metric customer satisfaction ratings, which of these performance metrics are leading indicators and which are lagging indicators?arrow_forwardForchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forward1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 12%. Compute the residual income for each division. 3. Is Yokohama's greater amount of residual income an indication that it is better managed?arrow_forward

- Which of the following statements is true? Suppose a company evaluates divisional performance using both ROI and residual income. The company's minimum required rate of return for the purposes of residual income calculations is 12%. If a division has a residual income of $6,000, then its ROI is less than 12%. If a company contains a number of investment centers of differing sizes, return on investment (ROI) should be used rather than residual income to rank the financial performance of the divisions. ROI and residual income are tools used to evaluate managerial performance in investment centers.arrow_forwardThe vice president of operations of Moab Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year ending October 31, 20Y9, for each division are as follows: (P14-5) Touring Bike Division Trail Bike Division Sales $1,500,000 $5,00 Cost of goods sold Operating expenses Invested assets 900,000 4,000,000 495,000 968,000 750,000 3,600,000 Instructions 1. Prepare condensed divisional income statements for the year ended October 31, 20Y9, assuming that there were no service department charges. Touting Bike Division Trial Bike Divisionarrow_forwardMeiji Isetan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Net operating income Average operating assets Required 1 Required 2 Required: 1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 16%. Compute the residual income for each division. 3. Is Yokohama's greater amount of residual income an indication that it is better managed? Osaka $ 10,600,000 $ 742,000 $ 2,650,000 Complete this question by entering your answers in the tabs below. ROI % Division Required 3 For each division, compute the return on investment (ROI) in terms of margin and turnover. Osaka Yokohama Yokohama $ 36,000,000 $ 3,240,000 $ 18,000,000 %arrow_forward

- Meiji Isetan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Net operating income. Average operating assets. Required 1 Required 2 Required: 1. For each division, compute the return on investment (ROI) in terms of margin and turnover. 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 12%. Compute the residual income for each division. 3. Is Yokohama's greater amount of residual income an indication that it is better managed? Complete this question by entering your answers in the tabs below. ROI Osaka $ 9,100,000 $ 455,000 $ 2,275,000 Osaka % Division Required 3 For each division, compute the return on investment (ROI) in terms of margin and turnover. Yokohama $ 21,000,000 $ 1,470,000 $ 10,500,000 Yokohama %arrow_forwardRequired: 1. Compute the ROI for each division. 2. Assume that the company evaluates performance by use of residual income and that the minimum required return for any division is 16%. Compute the residual income for each division.arrow_forwardTan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Net operating income Average operating assets Division Osaka $ 10,100,000 $ 808,000 $ 2,525,000 Yokohama $ 31,000,000 $ 3,100,000 $ 15,500,000 Required: 1. For each division, compute the return on investment (ROI). 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 17%. Compute the residual income for each division.arrow_forward

- Profit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales Cost of goods sold Gross profit Administrative expenses Income from operations The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,950,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin Investment turnover Rate of return on investment Profit margin Investment turnover $1,170,000 526,500 $643,500 409,500 $234,000 b. If expenses could be reduced by $58,500 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on…arrow_forwardDacker Products is a division of a major corporation. The following data are for the most recent year of operations: Sales $ 37,980,000 Net operating income $ 3,558,960 Average operating assets $ 9,500,000 The company's minimum required rate of return 16 % The division's margin used to compute ROI is closest to: Multiple Choice 34.4% 37.5% 25.0% 9.4%arrow_forwardDacker Products is a division of a major corporation. The following data are for the most recent year of operations: Sales Net operating income Average operating assets $ 36,680,000 $ 2,908,960 $ 8,200,000 The company's minimum required rate of return The division's margin used to compute ROI is closest to: Multiple Choice о 30.3% 35.5% 22.4% о 7.9% 14%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License