The leverage ratio for the banks with respect to the total assets and bank capital and to ascertain the moral hazards on the banks over the time.

Concept Introduction:

Leverage Ratio: Leverage ratio indicates the debts of a company against its several accounts. Bank capital is a part of debt.

Moral Hazards: Person would take the risk on a condition wherein the other person would suffer the consequences.

Explanation of Solution

Bank Leverage Ratio 1990

| January | July | |||

| Bank Capital | 206.2938 | Bank Capital | 216.4139 | |

| Total Assets | 3151.4032 | Total Assets | 3254.435 | |

| Leverage Ratio | 0.065461 | Leverage Ratio | 0.066498 | |

| February | August | |||

| Bank Capital | 216.4620 | Bank Capital | 214.1683 | |

| Total Assets | 3164.7700 | Total Assets | 3282.767 | |

| Leverage Ratio | 0.068397 | Leverage Ratio | 0.06524 | |

| March | September | |||

| Bank Capital | 211.8968 | Bank Capital | 219.6109 | |

| Total Assets | 3184.0284 | Total Assets | 3279.031 | |

| Leverage Ratio | 0.06655 | Leverage Ratio | 0.066974 | |

| April | October | |||

| Bank Capital | 214.9664 | Bank Capital | 218.4562 | |

| Total Assets | 3197.3688 | Total Assets | 3275.413 | |

| Leverage Ratio | 0.067232 | Leverage Ratio | 0.066696 | |

| May | November | |||

| Bank Capital | 213.0511 | Bank Capital | 216.9110 | |

| Total Assets | 3205.8259 | Total Assets | 3279.432 | |

| Leverage Ratio | 0.066457 | Leverage Ratio | 0.066143 | |

| June | December | |||

| Bank Capital | 217.2948 | Bank Capital | 219.9433 | |

| Total Assets | 3234.4319 | Total Assets | 3285.839 | |

| Leverage Ratio | 0.067182 | Leverage Ratio | 0.066937 | |

| January | 0.065461 |

| February | 0.068397 |

| March | 0.06655 |

| April | 0.067232 |

| May | 0.066457 |

| June | 0.067182 |

| July | 0.066498 |

| August | 0.06524 |

| September | 0.666974 |

| October | 0.66696 |

| November | 0.066143 |

| December | 0.066937 |

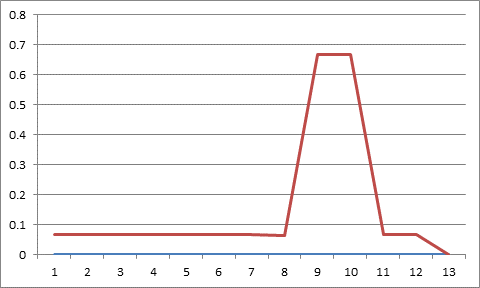

Bank Leverage Ratio 1990

The leverage ratio of the banks during the time period 1990 is indicated in the below graph.

| Bank Leverage ratio 2018 | |

| January | |

| Bank Capital | 1852.716 |

| Total Assets | 16758.4 |

| Leverage Ratio | 0.110554 |

| February | |

| Bank Capital | 1839.269 |

| Total Assets | 16729.74 |

| Leverage Ratio | 0.10994 |

| March | |

| Bank Capital | 1850.533 |

| Total Assets | 16695.79 |

| Leverage Ratio | 0.110838 |

| April | |

| Bank Capital | 1836.656 |

| Total Assets | 16621.14 |

| Leverage Ratio | 0.110501 |

| January | 0.110554 |

| February | 0.10994 |

| March | 0.110838 |

| April | 0.110501 |

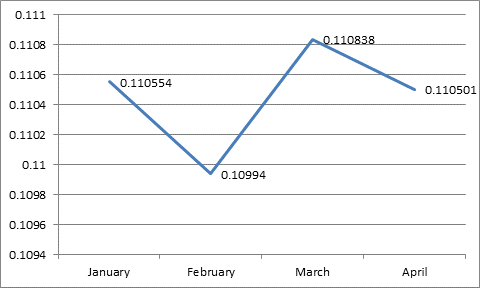

Bank Leverage ratio 2018

The leverage ratio graph indicates that it has dropped during February and has increased during March. The values are fluctuating since the beginning of 2018.

Explanation: The calculations have been carried to identify the leverage ratios for every month during the period 1990 and 2018. From the calculations done for every month, it was identified that the leverage ratio for the commercial banks with respect to the capital and the assets during 1990 was around 0.06. It was identified that if the leverage ratio is high, the

The probability of depositors getting affected in investing in the banks with low ability to repay its credit could be higher. Therefore, Moral Hazard problems could be less for the customers of the US commercial banks in 2018 compared to 1990. The leverage ratio is much higher in 2018 compared to1990.

Want to see more full solutions like this?

Chapter 10 Solutions

Economics Of Money, Banking And Financial Markets, Business School Edition, Student Value Edition

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education