INDIVIDUAL INCOME TAX

2019th Edition

ISBN: 9780357323410

Author: VALUE EDITION

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 40P

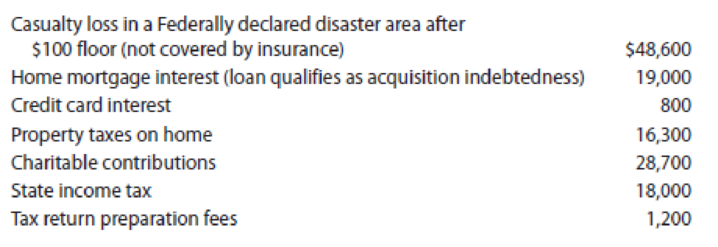

LO.2, 3, 4, 5, 6, 7 For calendar year 2019, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows:

Calculate the amount of itemized deductions the Gibsons may claim for the year.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 10 Solutions

INDIVIDUAL INCOME TAX

Ch. 10 - Prob. 1DQCh. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Prob. 4DQCh. 10 - LO.2 David, a sole proprietor of a bookstore, pays...Ch. 10 - LO.2 Jayden, a calendar year taxpayer, paid 16,000...Ch. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - Prob. 9DQCh. 10 - Prob. 10DQ

Ch. 10 - LO.5 Thomas purchased a personal residence from...Ch. 10 - Prob. 12DQCh. 10 - Prob. 13DQCh. 10 - LO.6, 8 William, a high school teacher, earns...Ch. 10 - LO.2 Barbara incurred the following expenses...Ch. 10 - Prob. 16CECh. 10 - Prob. 17CECh. 10 - Prob. 18CECh. 10 - Prob. 19CECh. 10 - Prob. 20CECh. 10 - Prob. 21CECh. 10 - Prob. 22PCh. 10 - Prob. 23PCh. 10 - LO.2 Paul suffers from emphysema and severe...Ch. 10 - LO.2 For calendar year 2019, Jean was a...Ch. 10 - LO.2 During 2019, Susan incurred and paid the...Ch. 10 - In May, Rebeccas daughter, Isabella, sustained a...Ch. 10 - Prob. 28PCh. 10 - Prob. 29PCh. 10 - Prob. 30PCh. 10 - Prob. 31PCh. 10 - Prob. 32PCh. 10 - Prob. 33PCh. 10 - Prob. 34PCh. 10 - On December 27, 2019, Roberta purchased four...Ch. 10 - Prob. 36PCh. 10 - Prob. 37PCh. 10 - Prob. 38PCh. 10 - LO.2, 3, 4, 5, 6, 7 Linda, who files as a single...Ch. 10 - LO.2, 3, 4, 5, 6, 7 For calendar year 2019, Stuart...Ch. 10 - Prob. 41CPCh. 10 - Marcia, a shareholder in a corporation with stores...Ch. 10 - Prob. 4RPCh. 10 - Prob. 1CPACh. 10 - Prob. 2CPACh. 10 - Prob. 3CPACh. 10 - Kurstie received a 800 state income tax refund...Ch. 10 - Which of the following would preclude a taxpayer...Ch. 10 - Prob. 6CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License