INDIVIDUAL INCOME TAX

2019th Edition

ISBN: 9780357323410

Author: VALUE EDITION

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 39P

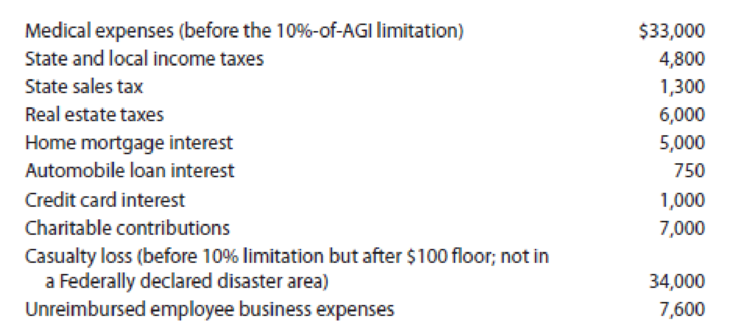

LO.2, 3, 4, 5, 6, 7 Linda, who files as a single taxpayer, had AGI of $280,000 for 2019. She incurred the following expenses and losses during the year:

Calculate Linda’s allowable itemized deductions for the year.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 10 Solutions

INDIVIDUAL INCOME TAX

Ch. 10 - Prob. 1DQCh. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Prob. 4DQCh. 10 - LO.2 David, a sole proprietor of a bookstore, pays...Ch. 10 - LO.2 Jayden, a calendar year taxpayer, paid 16,000...Ch. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - Prob. 9DQCh. 10 - Prob. 10DQ

Ch. 10 - LO.5 Thomas purchased a personal residence from...Ch. 10 - Prob. 12DQCh. 10 - Prob. 13DQCh. 10 - LO.6, 8 William, a high school teacher, earns...Ch. 10 - LO.2 Barbara incurred the following expenses...Ch. 10 - Prob. 16CECh. 10 - Prob. 17CECh. 10 - Prob. 18CECh. 10 - Prob. 19CECh. 10 - Prob. 20CECh. 10 - Prob. 21CECh. 10 - Prob. 22PCh. 10 - Prob. 23PCh. 10 - LO.2 Paul suffers from emphysema and severe...Ch. 10 - LO.2 For calendar year 2019, Jean was a...Ch. 10 - LO.2 During 2019, Susan incurred and paid the...Ch. 10 - In May, Rebeccas daughter, Isabella, sustained a...Ch. 10 - Prob. 28PCh. 10 - Prob. 29PCh. 10 - Prob. 30PCh. 10 - Prob. 31PCh. 10 - Prob. 32PCh. 10 - Prob. 33PCh. 10 - Prob. 34PCh. 10 - On December 27, 2019, Roberta purchased four...Ch. 10 - Prob. 36PCh. 10 - Prob. 37PCh. 10 - Prob. 38PCh. 10 - LO.2, 3, 4, 5, 6, 7 Linda, who files as a single...Ch. 10 - LO.2, 3, 4, 5, 6, 7 For calendar year 2019, Stuart...Ch. 10 - Prob. 41CPCh. 10 - Marcia, a shareholder in a corporation with stores...Ch. 10 - Prob. 4RPCh. 10 - Prob. 1CPACh. 10 - Prob. 2CPACh. 10 - Prob. 3CPACh. 10 - Kurstie received a 800 state income tax refund...Ch. 10 - Which of the following would preclude a taxpayer...Ch. 10 - Prob. 6CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the 2019 tax year, Brian, a single taxpayer, received $ 7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $ 30,000 in tax-exempt interest income and has no for-AGI deductions, Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2019. SIMPIFIED TAXABLE SOCIAL SECURITY WORKSHEET (FOR MOST PEOPLE) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2,3, and 4 6. Enter all adjustments for AGl except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5 . If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $ 25,0001 $ 32,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 9. Subtract line 8 from line 7 . If zero or less, enter -0 - Note: If line 9 is zero or less, stop here; none of your benefits are faxable. Otherwise, go on to line 10 10. Enter $ 9,0001 $12,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 11. Subtract line 10 from line 9. If zero or less, enter -0 -. 12. Enter the smaller of line 9 or line 10 . 13. Enter one-half of line 12 14. Enter the smaller of line 2 or line 13 . 15. Multiply line 11 by 85 (. 85 ). If line 11 is zero, enter -0 -. 16. Add lines 14 and 15 17. Multiply line 1 by 85(.85) 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 1.____________ 2.____________ 3.____________ 4.____________ 5.____________ 6.____________ 7.____________ 8.____________ 9.____________ 10.____________ 11.____________ 12.____________ 13.____________ 14.____________ 15.____________ 16.____________ 17.____________ 18.____________arrow_forwardEmily, who is single, sustains an NOL of 7,800 in 2019. The loss is carried forward to 2020. For 2020, Emilys income tax information before taking into account the 2019 NOL is as follows: The 2019 single standard deduction is 12,200; Emilys itemized deductions will exceed the 2020 single standard deduction (after adjustment for Inflation). The medical expense AGI floor is 10% In 2019. How much of the NOL carryforward can Emily use in 2020, and what is her adjusted gross income and her taxable income?arrow_forwardB Corporation, a calendar year-end, accrual basis taxpayer, is owned 75 percent by Bonnie, a cash basis taxpayer. On December 31,2019, the corporation accrues interest of $4,000 on a loan from Bonnie and also accrues a $15,000 bonus to Bonnie. The bonus is paid to Bonnie on February 1,2020; the interest is not paid until 2021 . How much can B Corporation deduct on its 2019 tax return for these two expenses? $0 $4,000 $15,000 $19,000 $12,000arrow_forward

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License