International Accounting

5th Edition

ISBN: 9781259747984

Author: Doupnik, Timothy S., Finn, Mark T., Gotti, Giorgio

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 5EP

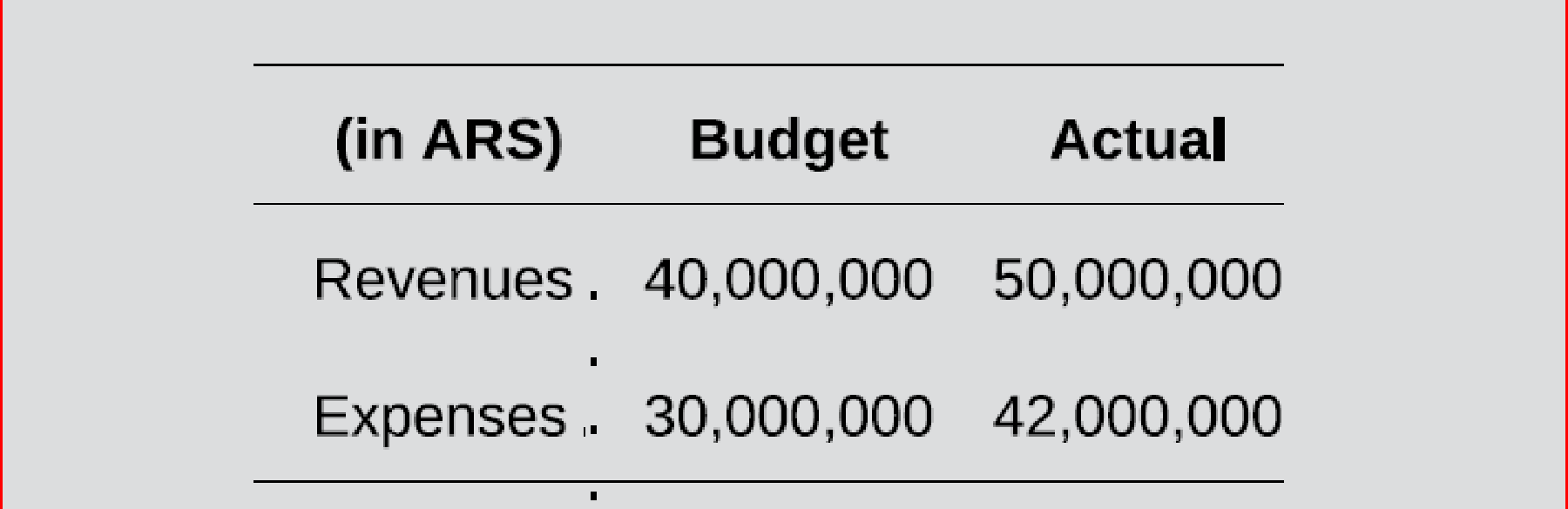

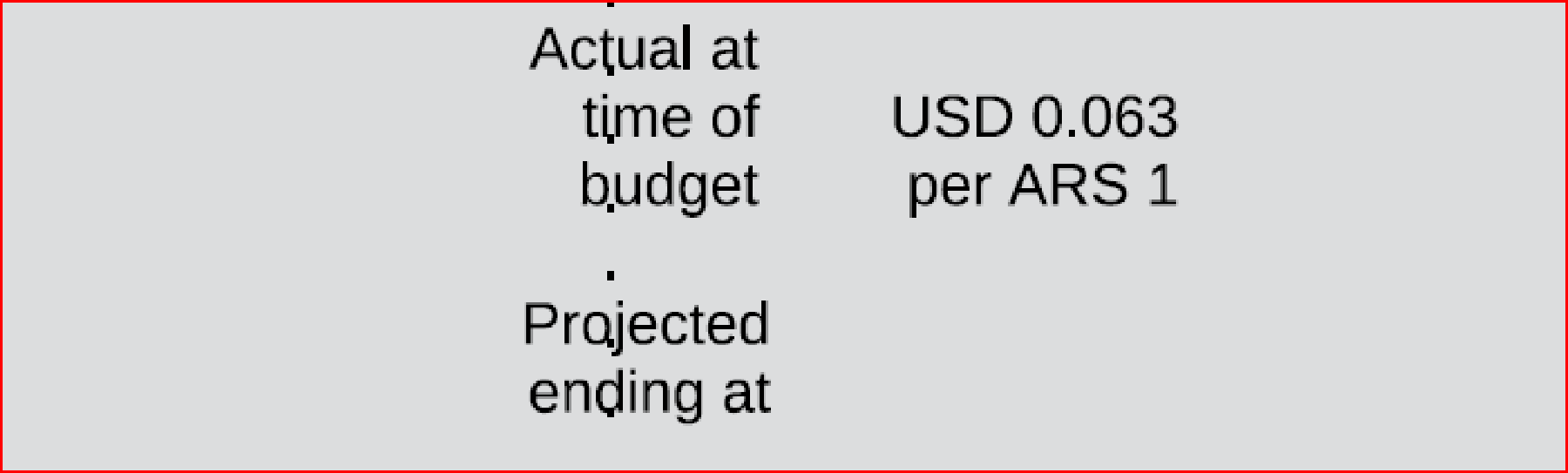

Imogdi Corporation (a U.S-based company) has a wholly-owned subsidiary in Argentina, whose manager is being evaluated on the basis of the variance between actual profit and budgeted profit in U.S. dollars. Relevant information in Argentine pesos (

Current year actual and projected exchange rates between the ARS and the U.S. dollar (USD) are as follows:

Required:

- a. Calculate the total

budget variance for the current year using each of the five combinations of exchange rates for translating budgeted and actual results shown in Exhibit 10.10. - b. Make a recommendation to Imogdi’s corporate management as to which combination in item (a) should be used, assuming that the manager of the Argentinian subsidiary does not have the authority to hedge against changes in exchange rates.

- c. Make a recommendation to Imogdi’s corporate management as to which combination in item (a) should be used, assuming that the manager of the Argentinian subsidiary has the authority to hedge against unexpected changes in exchange rates.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The partnership of GENO and PEARLS is into manufacturing. In the course of the entity’s budgeting process for the quarter, the following information were into consideration:· Sales for the second quarter of the calendar year is seen to be at 10,000 units, 15,000 units, and 12,000 units. However, budgeted sales for May might go up to 20,000 units depending on further analysis of fixed costs and outside market forces. If fixed costs go down and favorable market forces are seen, the increase in sales will proceed in the budget preparation.· The entity wants to maintain 4,000 units as ending inventory every month for the whole year. Each unit of inventory requires 3 lbs. of direct materials, 2 hours of direct labor, and P12 worth of overhead per unit. Direct materials is P10 per pound and labor is P24 per hour.· All operating expenses is estimated to be at 40% of gross profit, giving respect to the potential changes in costs and expenses. Tax rate is 25%.· It…

In the process of preparing a budget for the second quarter of the current fiscal year, Anderson Welding, Inc., has forecasted foreign sales of 1,200,00 foreign currency (FC). The company is concerned that the dollar will strengthen relative to the FC and has decided to hedge one-half of the forecasted foreign sales with a forward contract to sell FC in 90 days. Assume that all 1,200,000 of the forecasted sales are shipped 60 days after acquiring the contract and that payment of the sales invoices occurs 30 days after shipment, with terms FOB shipping point.Selected rate information is as shown below.

Days remaining on forward contract

90 days

60 days

30 days

0 days

Spot rate . . . . . . . . . .

Forward rate .

$1.900

1.890

$1.920

1.910

$1.880

1.900

$1.850

1.850

Assume that contract premiums or discounts are to be amortized over the term of the contract using the implicit interest rate of 0.1757% per 30-day period. This results in amortization of $2,004, $2,000, and…

Westport Company is preparing its master budget for May. Use the estimates provided to determine the amounts necessary for each of the following requirements. (Estimates may be related to more than one requirement.

a. What should total sales revenue be if territories E and W estimate sales of 50,000 and 100,000 units, respectively, and the unit selling price is $65?

9750000

b. If the beginning finished goods inventory is an estimated 6,000 units and the desired ending inventory is 11,000 units, how many units should be produced?

155000

c. What dollar amount of materials should be purchased at $5.50 per pound if each unit of product requires 2.5 pounds and beginning and ending materials inventories should be 12,000 and 13,500 pounds, respectively.

2139500

How much direct labor cost should be incurred if each unit produced requires 0.5 hours at an hourly rate of $22?

How much manufacturing overhead should be incurred if fixed manufacturing overhead is $45,000 and variable…

Chapter 10 Solutions

International Accounting

Ch. 10 - Prob. 1QCh. 10 - What makes calculation of NPV for a foreign...Ch. 10 - How does the evaluation of a potential foreign...Ch. 10 - Prob. 4QCh. 10 - How does an ethnocentric organizational structure...Ch. 10 - Prob. 6QCh. 10 - When might it be appropriate to evaluate the...Ch. 10 - Prob. 8QCh. 10 - Prob. 9QCh. 10 - How can a local currency operating budget and...

Ch. 10 - Prob. 11QCh. 10 - What is the advantage of using a projected future...Ch. 10 - Prob. 3EPCh. 10 - Prob. 4EPCh. 10 - Imogdi Corporation (a U.S-based company) has a...Ch. 10 - Philadelphia, Inc. (a Greek company) has a foreign...Ch. 10 - Fitzwater Limited (an Irish company) has a foreign...Ch. 10 - Prob. 9EPCh. 10 - Viking Corporation (a U.S.-based company) has a...Ch. 10 - Duncan Street Company (DSC), a British company, is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Westport Company is preparing its master budget for May. Use the estimates provided to determine the amounts necessary for each of the following requirements. (Estimates may be related to more than one requirement. a. What should total sales revenue be if territories E and W estimate sales of 50,000 and 100,000 units, respectively, and the unit selling price is $65? b. If the beginning finished goods inventory is an estimated 6,000 units and the desired ending inventory is 11,000 units, how many units should be produced? c. What dollar amount of materials should be purchased at $5.50 per pound if each unit of product requires 2.5 pounds and beginning and ending materials inventories should be 12,000 and 13,500 pounds, respectively.arrow_forwardWestport Company is preparing its master budget for May. Use the estimates provided to determine the amounts necessary for each of the following requirements. (Estimates may be related to more than one requirement.) a. What should total sales revenue be if territories E and W estimate sales of 50,000 and 100,000 units, respectively, and the unit selling price is $35? b. If the beginning finished goods inventory is an estimated 6,000 units and the desired ending inventory is 8,000 units, how many units should be produced?Answer units c. What dollar amount of materials should be purchased at $2.50 per pound if each unit of product requires 2.5 pounds and beginning and ending materials inventories should be 12,000 and 13,500 pounds, respectively. d. How much direct labor cost should be incurred if each unit produced requires 0.5 hours at an hourly rate of $16? e. How much manufacturing overhead should be incurred if fixed manufacturing overhead is $45,000 and variable manufacturing…arrow_forwardBulldogs Inc. wants to analyze the variances in its actual and budgeted gross profit. The following are available:· Actual gross profit and actual gross profit ratio is P600,000 and 25%, respectively.· The actual sales are P400,000 more than the total budgeted sales.· Budgeted sales price at actual quantity sold is P2,000,000What is the Sales Volume Variance under 4-way analysis?arrow_forward

- Wheat Inc. has an exclusive contract with an exporter. Two brands of wheat are imported, labeled AB and CD. The following data are provided for the current fiscal year: Budgeted Actual Results AB CD AB CD Price per bushel $ 27 $ 12 $ 29 $ 18 Variable cost per bushel $ 22 $ 7 $ 19 $ 14 Sales (in bushels) 2,400 3,000 1,200 4,300 The total market was estimated to 34,000 bushels at the time of budget. The actual total market for the year is 26,000 bushels. What is AB's contribution margin sales volume variance? Multiple Choice $6,000 unfavorable. $8,500 favorable. $14,500 unfavorable. $0. $12,000 unfavorable.arrow_forwardSammy Inc. wants to analyze the variances in its actual and budgeted gross profit. The following are available: Actual gross profit and actual gross profit ratio is P600,000 and 25%, respectively. • The actual sales are P400,000 more than the total budgeted sales. Budgeted sales price at actual quantity sold is P2,000,000 What is the Sales Volume Variance under 4-way analysis?arrow_forwardThe accountant of a Japan Surplus business in the Philippines budgeted P112,294 on the monthly import of merchandise. Other charges it budgeted are as follows: P856,000 cost of merchandise (including shipping charges), P3,200 arrastre fee, P4,200 brokerage fee, P3,900 wharfage fee and P5,000 facilitation fee. Assuming the accountant discovered that the P856,000 cost of merchandise was exclusive of the P23,000 shipping charges, how much would be the correct amount of VAT on importation?arrow_forward

- If OMS continues to sell through the independent sales agents and pays the higher commission rate (20% instead of 15%), compute the estimated sales dollars that would be required to generate the level of profit as projected in the budgeted income statement.arrow_forwardWheat Inc. has an exclusive contract with an exporter. Two brands of wheat are imported, labeled AB and CD. The following data are provided for the current fiscal year: Budgeted Actual Results AB CD AB CD Price per bushel $ 80 $ 25 $ 85 $ 17 Variable cost per bushel $ 75 $ 20 $ 75 $ 13 Sales (in bushels) 2,700 3,700 2,400 4,800 The total market was estimated to 64,000 bushels at the time of budget. The actual total market for the year is 36,000 bushels. $0. $14,000 unfavorable. $10,750 unfavorable. $16,000 unfavorable. $27,500 unfavorable. What is the firm's market size variance?arrow_forwardCollins Company is preparing its master budget for April. Use the given estimates to determine the amounts necessary for each of the following requirements. (Estimates may be related to more than one requirement.) a. What should total sales revenue be if territories A and B estimate sales of 10,000 and 14,000 units, respectively, and the unit selling price is $44? $1,056,000 b. If the beginning finished goods inventory is an estimated 2,000 units and the desired ending inventory is 3,000 units, how many units should be produced? Answer c. What dollar amount of material should be purchased at $4 per pound if each unit of product requires 3 pounds and beginning and ending materials inventories should be 5,000 and 4,000 pounds, respectively? $Answer d. How much direct labor cost should be incurred if each unit produced requires 1.5 hours at an hourly rate of $15? $Answer e. How much manufacturing overhead should be incurred if fixed manufacturing overhead is $53,000 and…arrow_forward

- The Baldwin Company, in its master budget for 2019, predicted total sales of $168,000, variable costs of $52,000, and fixed costs of $54,400 ($24,800 manufacturing and $29,600 nonmanufacturing). Actual sales revenue for 2019 turned out to be $188,000. Actual costs were as follows: variable, $54,800, and fixed, $54,000. What was the total master (static) budget variance for 2019? (Note that this variance is also referred to as the total operating income variance.) Was this total variance favorable (F) or unfavorable (U)?arrow_forwardCollins Company is preparing its master budget for April. Use the given estimates to determine the amounts necessary for each of the following requirements. (Estimates may be related to more than one requirement.) a. What should total sales revenue be if territories A and B estimate sales of 10,000 and 13,000 units, respectively, and the unit selling price is $43? b. If the beginning finished goods inventory is an estimated 2,000 units and the desired ending inventory is 3,000 units, how many units should be produced? c. What dollar amount of material should be purchased at $4 per pound if each unit of product requires 3 pounds and beginning and ending materials inventories should be 5,000 and 4,000 pounds, respectively? d. How much direct labor cost should be incurred if each unit produced requires 1.5 hours at an hourly rate of $14? e. How much manufacturing overhead should be incurred if fixed manufacturing overhead is $52,000 and variable manufacturing overhead is $2.50 per…arrow_forwardLionel Corporation manufactures pharmaceutical products sold through a network of sales agents in the United States and Canada. The agents are currently paid an 18% commission on sales; that percentage was used when Lionel prepared the following budgeted income statement for the fiscal year ending June 30, 2019: Lionel Corporation Budgeted Income Statement For the Year Ending June 30, 2019 ($000 omitted) Sales $ 29,100 Cost of goods sold Variable $ 13,095 Fixed 3,492 16,587 Gross profit $ 12,513 Selling and administrative costs Commissions $ 5,238 Fixed advertising cost 873 Fixed administrative cost 2,328 8,439 Operating income $ 4,074 Fixed interest cost 728 Income before income taxes $ 3,346 Income taxes (30%) 1,004 Net income $ 2,342 Since the completion of the income statement, Lionel has learned that its…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY