International Accounting

5th Edition

ISBN: 9781259747984

Author: Doupnik, Timothy S., Finn, Mark T., Gotti, Giorgio

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 8EP

Fitzwater Limited (an Irish company) has a foreign subsidiary in Norway, whose manager is evaluated on the basis of profit in euros (EUR). In the current year, the foreign subsidiary was budgeted to generate a profit of 500,000 Norwegian kroner (NOK), and actual profit for the year was NOK 480,000. Fitzwater’s corporate management has calculated an unfavorable total

Required:

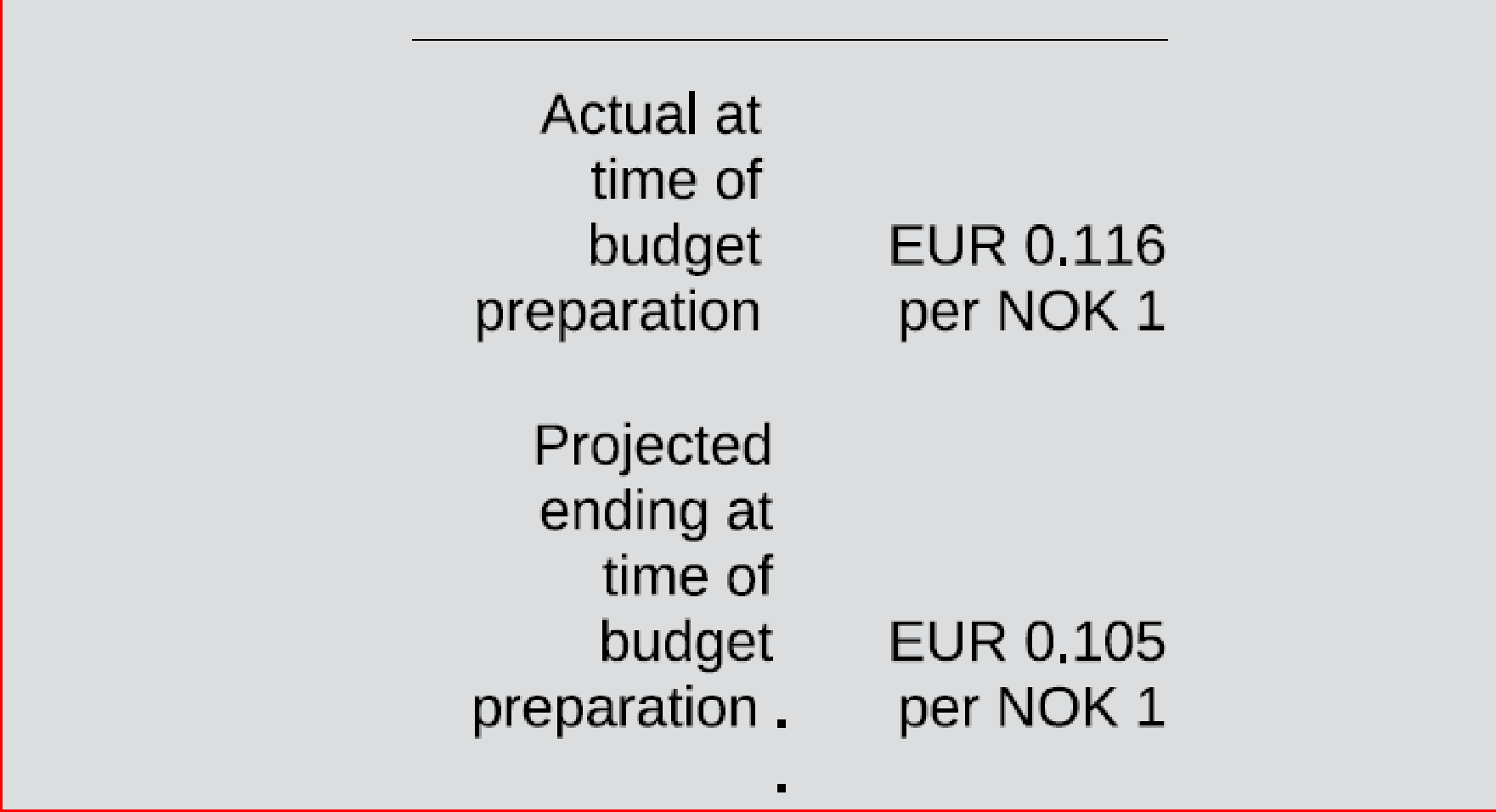

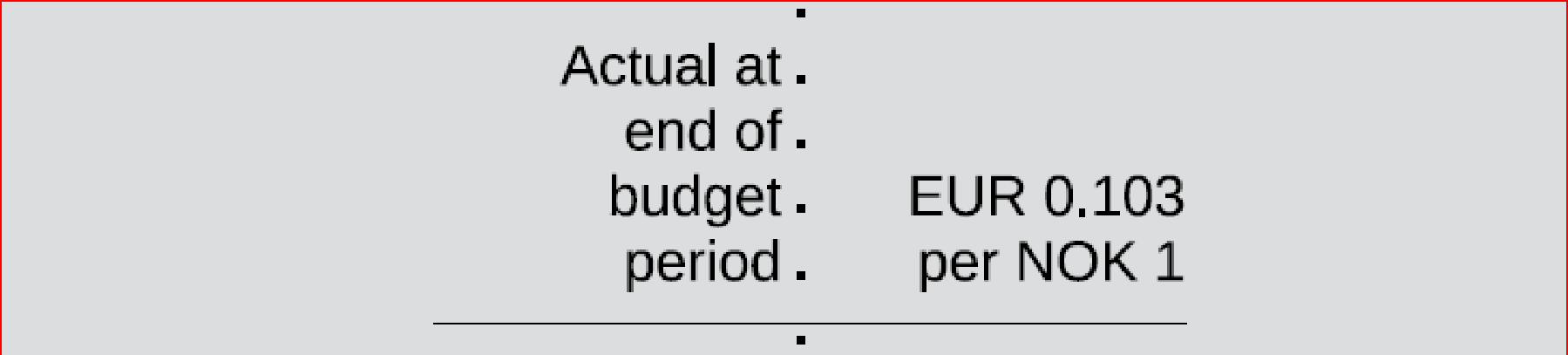

- a. Identify the combination of exchange rates (see Exhibit 10.10) used by Fitzwater’s corporate management in translating budgeted and actual amounts that results in the total budget variance of EUR 8,560.

- b. Determine the portion of the total budget variance calculated by Fitzwater’s corporate management that is caused by a change in the exchange rate between the EUR and the NOK. (There are three possible correct responses to this requirement.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The partnership of GENO and PEARLS is into manufacturing. In the course of the entity’s budgeting process for the quarter, the following information were into consideration:· Sales for the second quarter of the calendar year is seen to be at 10,000 units, 15,000 units, and 12,000 units. However, budgeted sales for May might go up to 20,000 units depending on further analysis of fixed costs and outside market forces. If fixed costs go down and favorable market forces are seen, the increase in sales will proceed in the budget preparation.· The entity wants to maintain 4,000 units as ending inventory every month for the whole year. Each unit of inventory requires 3 lbs. of direct materials, 2 hours of direct labor, and P12 worth of overhead per unit. Direct materials is P10 per pound and labor is P24 per hour.· All operating expenses is estimated to be at 40% of gross profit, giving respect to the potential changes in costs and expenses. Tax rate is 25%.· It…

Sun Company, a subsidiary of Guardian, Inc., produces and sells three product lines. The company employs a standard cost accounting system for record keeping purposes. At the beginning of the current year, the president of Sun Company presented the budget to the parent company and accepted a commitment to contribute $15,800 to Guardian’s consolidated profit for the year. The president has been confident that the year’s profit would exceed the budget target, since the monthly sales reports that he has been receiving have shown that sales for the year will exceed budget by 10%. The president is both disturbed and confused when the controller presents an adjusted forecast as of November 30 indicating that profit will be 11% under budget. The two forecasts are presented below:

Sun Company

Forecasts of Operating Results

1/1

11/30

Sales

$268,000

$294,800

Cost of goods sold at standard*

212,000

233,200

Gross margin at…

Cameron is the Managing Director of PL Ltd, a UK company that manufactures components for the car manufacturing industry. The company accountant has historically used a ‘traditional’ incremental approach tocreating their budgets. However, the company accountant has suddenly resigned at a time of significant political and economic uncertainty. As a result, Cameron has approached you to prepare the functional budgets for the forthcoming financial quarter.

Each of the departmental managers has provided Cameron with the following information in respect to the forthcoming 3-month period:

Sales information

Sales in units are forecast as follows:

Average selling price per unit: £120

August 6,100

September 7,425

October 6,900

November 6,030

December 5,250

Production information

Opening stock of finished goods at 1stAugust are 4,000 units.

In order to always meet customer demand, the sales manager demands that…

Chapter 10 Solutions

International Accounting

Ch. 10 - Prob. 1QCh. 10 - What makes calculation of NPV for a foreign...Ch. 10 - How does the evaluation of a potential foreign...Ch. 10 - Prob. 4QCh. 10 - How does an ethnocentric organizational structure...Ch. 10 - Prob. 6QCh. 10 - When might it be appropriate to evaluate the...Ch. 10 - Prob. 8QCh. 10 - Prob. 9QCh. 10 - How can a local currency operating budget and...

Ch. 10 - Prob. 11QCh. 10 - What is the advantage of using a projected future...Ch. 10 - Prob. 3EPCh. 10 - Prob. 4EPCh. 10 - Imogdi Corporation (a U.S-based company) has a...Ch. 10 - Philadelphia, Inc. (a Greek company) has a foreign...Ch. 10 - Fitzwater Limited (an Irish company) has a foreign...Ch. 10 - Prob. 9EPCh. 10 - Viking Corporation (a U.S.-based company) has a...Ch. 10 - Duncan Street Company (DSC), a British company, is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cassara, Inc., had the following quality costs for the years ended December 31, 20X1 and 20X2: At the end of 20X1, management decided to increase its investment in control costs by 40% for each categorys items, with the expectation that failure costs would decrease by 25% for each item of the failure categories. Sales were 12,000,000 for both 20X1 and 20X2. Required: 1. Calculate the budgeted costs for 20X2, and prepare an interim quality performance report. 2. Comment on the significance of the report. How much progress has Cassara made?arrow_forwardWheat Inc. has an exclusive contract with an exporter. Two brands of wheat are imported, labeled AB and CD. The following data are provided for the current fiscal year: Budgeted Actual Results AB CD AB CD Price per bushel $ 27 $ 12 $ 29 $ 18 Variable cost per bushel $ 22 $ 7 $ 19 $ 14 Sales (in bushels) 2,400 3,000 1,200 4,300 The total market was estimated to 34,000 bushels at the time of budget. The actual total market for the year is 26,000 bushels. What is AB's contribution margin sales volume variance? Multiple Choice $6,000 unfavorable. $8,500 favorable. $14,500 unfavorable. $0. $12,000 unfavorable.arrow_forwardWheat Inc. has an exclusive contract with an exporter. Two brands of wheat are imported, labeled AB and CD. The following data are provided for the current fiscal year: Budgeted Actual Results AB CD AB CD Price per bushel $ 80 $ 25 $ 85 $ 17 Variable cost per bushel $ 75 $ 20 $ 75 $ 13 Sales (in bushels) 2,700 3,700 2,400 4,800 The total market was estimated to 64,000 bushels at the time of budget. The actual total market for the year is 36,000 bushels. $0. $14,000 unfavorable. $10,750 unfavorable. $16,000 unfavorable. $27,500 unfavorable. What is the firm's market size variance?arrow_forward

- The marketing team of a small company had a budget of 2900 euros to spend on events in the prior year, and underspent by 6%. This year, owing to budget cuts, the marketing team can only spend 5/8 of last year's spend.To the nearest euro, what is this year's marketing budgetarrow_forwardLux Co. believes that its collection costs could be reduced through modification of collection procedures. This action is expected to result in a lengthening of the average collection period from 30 to 40 days; however, there will be no change in uncollectible accounts, or in total credit sales. Furthermore, the variable cost ratio is 65%, the opportunity cost of a longer collection period is assumed to be negligible, the company's budgeted credit sales for the coming year are P45,000,000, and the required rate of return is 5%. To justify changes in collection procedures, the minimum annual reduction of costs (using a 360-day year and ignoring taxes) must bearrow_forwardToronto Business Associates, a division of Maple Leaf Services Corporation, offers management and computer consulting services to clients throughout Canada and the northwestern United States. The division specializes in website development and other Internet applications. The corporate management at Maple Leaf Services is pleased with the performance of Toronto Business Associates for the first nine months of the current year and has recommended that the division manager, Richard Howell, submit a revised forecast for the remaining quarter, as the division has exceeded the annual plan year-to-date by 20 percent of operating income. An unexpected increase in billed hour volume over the original plan is the main reason for this increase in income. The original operating budget for the first three quarters for Toronto Business Associates follows. TORONTO BUSINESS ASSOCIATES 20x1 Operating Budget 1st Quarter 2nd Quarter 3rd Quarter Total for FirstThree Quarters Revenue:…arrow_forward

- The Sendai Co. Ltd of Japan has budgeted costs in its various departments as follows for the coming year: Factory administration ¥270.000.000 Custodial services ¥68.760.000 Personnel ¥28.840.000 Maintenance ¥45.200.000 Machining - overhead ¥376.300.000 Assembly - overhead ¥175.900.000 Total cost ¥965.000.000 The Japanese currency is the yen, denoted by ¥. The company allocates service department costs to other departments in the order listed below. Department Number of employees Total labour-hours Square feet of space occupied Direct labour-hours Machine-hours Factory administration 12 - 5.000 - - Custodial services 4 3.000 2.000 - - Personnel 5 5.000 3.000 - - Maintenance 25 22.000 10.000 - - Machining 40 30.000 70.000 20.000 70.000 Assembly 60 90.000 20.000 80.000 10.000 Total 146 150.000 110.000 100.000 80.000 Machining and Assembly are operating departments; the other departments all act in a service capacity. The company does not…arrow_forwardThe following data have been extracted from the budgets of Kelvin Ltd,a company that manufacture and sells a single product $per unit Selling price Direct material cost Direct wages Variable overhead Fixed overhead 45 10 4 2.50 1.50 Fixed production overhead costs are budgeted at $400,000 per annum. Normal production levels are expected to be 200,000 units per annum. Actual Fixed Production overheads are $120,000 Budgeted administration costs are $120,000 per annum. The following pattern of sales and production is expected during 2003: Sales (units) Production (units) 60,000 70,000 You are required a. To prepare budgeted profit statements for the year using (i) (ii) Marginal Costing Absorption Costing b. To reconcile the profits for the yeararrow_forwardAlya Sdn Bhd. manufactures and supplies granite pots and pans with glass lids to a company in Japan. The new manager, Rushdi, wants to monitor the quarterly budgets for the quarter ending 30th September 2021 to ensure the sales targeted can be executed as planned even with the current economic condition. The following information is available: (see the photo) Variable manufacturing overhead cost is RM384,000, while fixed factory overhead is RM214,000 per quarter (including the non-cash expenditure of RM156,000) and is allocated on total units produced. Financial information follows: Beginning cash balance is RM1,800,000 Sales are on credit and are collected 50 percent in the current period and the remainder in the next period. Last quarter’s sales were RM8,400,000. There are no bad debts. Purchases of direct materials and labor costs are paid for in the quarter acquired. Manufacturing overhead expenses are paid in the quarter incurred. Selling and administrative expenses are all…arrow_forward

- Alya Sdn Bhd. manufactures and supplies granite pots and pans with glass lids to a company in Japan. The new manager, Rushdi, wants to monitor the quarterly budgets for the quarter ending 30th September 2021 to ensure the sales targeted can be executed as planned even with the current economic condition. The following information is available: (see the photo) Variable manufacturing overhead cost is RM384,000, while fixed factory overhead is RM214,000 per quarter (including the non-cash expenditure of RM156,000) and is allocated on total units produced. Financial information follows: Beginning cash balance is RM1,800,000 Sales are on credit and are collected 50 percent in the current period and the remainder in the next period. Last quarter’s sales were RM8,400,000. There are no bad debts. Purchases of direct materials and labor costs are paid for in the quarter acquired. Manufacturing overhead expenses are paid in the quarter incurred. Selling and administrative expenses are all…arrow_forwardPatton Corporation uses a standard cost system to account for the costs of its one product. Budgeted fixed overhead is $83,000, budgeted production is 2,420 per month, and practical capacity is 3,400 units. During November, Patton produced 2,200 units. Fixed overhead incurred totaled $70,710. Now assume Patton calculates its fixed overhead rate based on practical capacity. What is the fixed overhead capacity rate? What is the expected (planned) capacity variance? What is the unexpected (unplanned) capacity variance? By how much was fixed overhead over- or underapplied?arrow_forwardBulldogs Inc. has a budgeted gross profit of P2,450,000. The firm also determined that its gross profit margin is 50% and its return on sales is 20%. If the Bulldogs Inc. has a unfavorable total gross profit variance of 600,000 and total assets of P5,920,000, what is the actual return on assets? 25% 30.50% 12.50% 20%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Securities Markets and Transactions Pt1; Author: Larry Byerly;https://www.youtube.com/watch?v=v0ClVlaxWFY;License: Standard Youtube License