McGraw-Hill's Taxation of Individuals and Business Entities 2020 Edition

11th Edition

ISBN: 9781260432466

Author: SPILKER, Brian

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 76CP

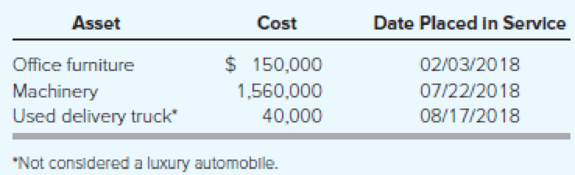

Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2018. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2018:

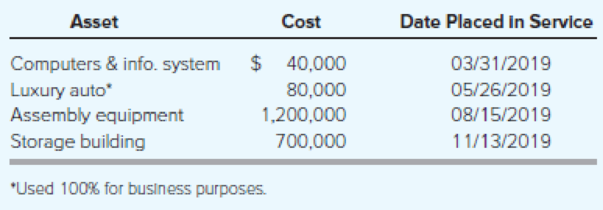

During 2018, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2019 to increase its production capacity. These are the assets acquired during 2019:

Karane generated taxable income in 2019 of $1,732,500 for purposes of computing the §179 expense limitation.

Required

- a) Compute the maximum 2018

depreciation deductions, including §179 expense (ignoring bonus depreciation). - b) Compute the maximum 2019 depreciation deductions, including §179 expense (ignoring bonus depreciation).

- c) Compute the maximum 2019 depreciation deductions, including §179 expense, but now assume that Karane would like to take bonus depreciation.

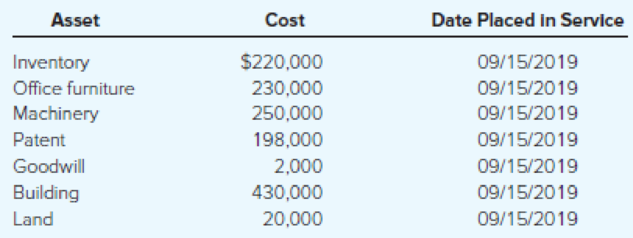

- d) Now assume that during 2019, Karane decides to buy a competitor’s assets for a purchase price of $1,350,000. Compute the maximum 2019 cost recovery, including §179 expense and bonus depreciation. Karane purchased the following assets for the lump-sum purchase price:

- e) Complete Part I of Form 4562 for part (b) (use the most current form available).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

using information below how can I prepere Bringle company income statement effects for year end December 31, 2019?

We have the following information:

A patent was purchased from Lou Company for $1,845,000 on January 1, 2018. Bringle estimated the remaining useful life of the patent to be 15 years. The patent was carried in Lou's accounting records at a net book value of $1,635,000 when Lou sold it to Bringle.

During 2019, a franchise was purchased from Rink Company for $470,000. In addition, 6% of revenue from the franchise must be paid to Rink. Revenue from the franchise for 2019 was $2,000,000. Bringle estimates the useful life of the franchise to be 5 years and takes a full year's amortization in the year of purchase

On January 1, 2019, Bringle estimates, based on new events, that the remaining life of the patent purchased on January 1, 2018, is only 10 years from January 1, 2019

Step 2

Schedule showing the intangibles section of Bringle's balance sheet at December 31, 2019…

Alucard Company has 2 divisions, Aye and Bee. Both qualify as business components. In 2018, the firm decided to

dispose of the assets and liabilities of division Bee and it is probable that the disposal will be completed early 2019. The

revenue and expenses of Alucard Company for 2018 and 2017 are as follows:

2018 2017

Sales-Aye 5,000,000 4,600,000

Total nontax expenses-Aye 4,400,000 4,100,000

Sales-Bee 3,500,000 5,100,000

Total nontax expenses-Bee 3,900,000 4,500,000

During the later part of 2018, Alucard disposed of a portion of division Bee and recognized a pretax loss of 2,000,000 on the

disposal. The income tax rate is 30%. What amount of loss from discontinued operation should Alucard report in 2018?

SINCO Ltd. purchased a piece of equipment in the year 2018 for the sum of $ 200,000. The company is subject to a tax depreciation rate of 25%. According to the following table, what is the depreciation allowance that this company can claim in 2020? (in the following picture : Année is year)

Chapter 10 Solutions

McGraw-Hill's Taxation of Individuals and Business Entities 2020 Edition

Ch. 10 - Explain why certain long-lived assets are...Ch. 10 - Prob. 2DQCh. 10 - Explain the similarities and dissimilarities...Ch. 10 - Is an assets initial or cost basis simply its...Ch. 10 - Prob. 5DQCh. 10 - Explain why the expenses incurred to get an asset...Ch. 10 - Graber Corporation runs a long-haul trucking...Ch. 10 - What depreciation methods are available for...Ch. 10 - If a business places several different assets in...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PTI Inc., located in a country which has a capital gains tax, conducted the following transactions: a. Purchased a building in February 2018 for $26,000,000. In March 2019, the company spent $2, 800,000 to install solar panels for electricity in the building. The building was sold for $40,000,000 in 2021. The annual maintenance cost was $500,000. The cost of advertising the sale of the building and the legal fees amounted to $1,200,000. b. A motor vehicle was purchased for $5 million on January 1, 2018. The vehicle was sold in 2021 for $4.5 million. c. Bought an antique painting for $3.5 million in 2019. The painting was sold in 2021 for 1 million. d. Purchased a government bond for $5,000,000 in 2018 and sold it for $7,500,000 in 2021.The company is entitled to Annual Exemption of $500,000. Capital losses as at 1 January 2021 was $3,500,000. Calculate the capital gains tax in 2021, assuming a capital gains tax of 20%.arrow_forwardPresented below is selected information for Alatorre Company. 1. Alatorre purchased a patent from Vania Co. for $1,000,000 on January 1, 2018. The patent is being amortized over its remaining legal life of 10 years, expiring on January 1, 2028. During 2020, Alatorre determined that the economic benefits of the patent would not last longer than 6 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2020? 2. Alatorre bought a franchise from Alexander Co. on January 1, 2019, for $400,000. The carrying amount of the franchise on Alexander's books on January 1, 2020, was $400,000. The franchise agreement had an estimated useful life of 30 years. Because Alatorre must enter a competitive bidding at the end of 2021, it is unlikely that the franchise will be retained beyond 2028. What amount should be amortized for the year ended December 31, 2020? 3. On January 1, 2020, Alatorre incurred…arrow_forwardTamra, Inc. began work on a $ 7000,000 contract in 2019 to construct an office building. During 2010, Tamra, Inc. incurred costs of $1,700,00, billed their customers for $1,200,000, and collected $960,000. At December 31,2019, the estimated future costs to complete the project total $3,300,000. Instructions: compute Tamra’s Gross profit to be recognized in 2019?arrow_forward

- In January 2021, Blossom Corporation purchased a patent for a new consumer product for $558900. At the time of purchase, the patent was valid for fifteen years. Due to the competitive nature of the product, however, the patent was estimated to have a useful life of only ten years. In 2026 the product was determined to be obsolete due to a competitor's new product. What amount should Blossom report on the income statement during 2026 related to the patent, assuming straight-line amortization is recorded at the company's December 31 year-end? $35890 O $279450 O $578900 O $179450arrow_forwardOMG is in a country which has a capital gains tax, conducted the following transactions:a. Purchased a building in February 2018 for $26,000,000. In March 2019, the companyspent $2,000,000 to install solar panels for electricity in the building. The building wassold for $28,500,000 in 2021. The annual maintenance cost was $500,000. The cost ofadvertising the sale of the building and the legal fees amounted to $1,500,000.b. A motor vehicle was purchased for $5 million on January 1, 2018. The vehicle was soldin 2021 for $4.5 million.c. Bought an antique painting for $3.5 million in 2019. The painting was sold in 2021 for$10 million.d. Purchased a government bond for $5,000,000 in 2018 and sold it for $7,500,000 in 2021.The company is entitled to an Annual Exemption of $500,000. Capital losses as of 1 January2021 were $1,500,000.Calculate the capital gains tax in 2021, assuming a capital gains tax of 15%.arrow_forwardPart BPTI Inc., located in a country which has a capital gains tax, conducted the followingtransactions:a. Purchased a building in February 2018 for $26,000,000. In March 2019, thecompany spent $2, 800,000 to install solar panels for electricity in the building. Thebuilding was sold for $40,000,000 in 2021. The annual maintenance cost was$500,000. The cost of advertising the sale of the building and the legal feesamounted to $1,200,000.b. A motor vehicle was purchased for $5 million on January 1, 2018. The vehicle wassold in 2021 for $4.5 million.c. Bought an antique painting for $3.5 million in 2019. The painting was sold in 2021for 1 million.d. Purchased a Government bond for $5,000,000.The company is entitled to Annual Exemption of $500,000. Capital losses as at 1 January2021 was $7,500,000.Required:Calculate the capital gains tax in 2021, assuming a capital gains tax of 20% If PTI Inc. were resident in Jamaica, what would the balancing adjustment be on the sale of the motor…arrow_forward

- I need help on how to calculate this problem step by step, please. Information concerning Sure Corporation's intangible assets is as follows: On January 1, 2019, Sure signed an agreement to operate as a franchisee of Rapid Copy Service Inc. for an initial franchise fee of $81,000. Of this amount, $21,000 was paid when the agreement was signed, and the balance is payable in 4 annual payments of $15,000 each beginning January 1, 2020. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. The present value at January 2, 2019, of the 4 annual payments discounted at 12% (the implicit rate for a loan of this type) is $45,600. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. Sure's revenue from the franchise for 2019 was $800,000. Sure estimates the useful life of the franchise to be 5 years. Sure incurred $69,000 of experimental and development costs in its…arrow_forwardIn January, 2022, Harmony Inc. has the following expenditures related to manufacturing a new generation of its product. Match each expenditure to the appropriate accounting treatment on the right. Takes possession of a manufacturing machine. The vendor sends an invoice for A. No accounting entry is necessary. B. Capitalize to a different asset account. C. Capitalize to the Machine account. $650,000. D. Expense. Pays a machine import duty of $35,000 to the government. Pays employees $75,000 for research and development to finalize the new product design. Receives an invoice for $4,250 from the company that shipped the machine. Pays employees $16,500 to install, customize, and test the new manufacturing machine. v Pays $1,200 for a one-year insurance policy for the machine, with coverage beginning when the machine is placed into service on February 16.arrow_forwardWHITE started constructing a building to be used for producing its goods in January 2021, WHITE incurred interest of $100,000 from its borrowings to finance the construction. In 2021, the Company also earned interest income of $20,000 and dividend income of $30,000 from its temporary placement of the proceeds According to IAS23, how much borrowing cost should be capitalized by in 2021?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Revenue recognition explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=816Q6pOaGv4;License: Standard Youtube License