Concept explainers

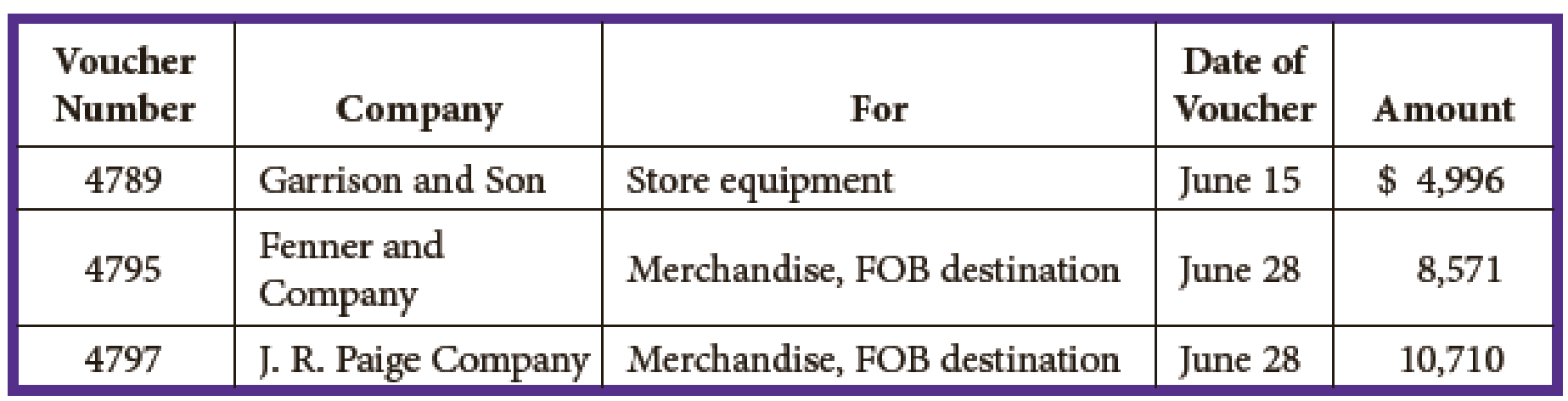

Hartman Company, which uses a voucher system, has the following unpaid vouchers on July 1. The firm follows the practice of recording vouchers at the gross amount.

The company completed the following transactions during July:

July 1 Issued voucher no. 4800 in favor of Mortenson Insurance Company for a premium on a 12-month fire insurance policy, $890.

2 Paid voucher no. 4789 by issuing Ck. No. 8219, $4,996.

2 Issued Ck. No. 8220 in payment of voucher no. 4800, $890.

3 Issued voucher no. 4801 in favor of Quinn Quick Freight for transportation charges on merchandise purchases, $223.

5 Paid voucher no. 4801 by issuing Ck. No. 8221, $223.

7 Issued Ck. No. 8222 in payment of voucher no. 4795, $8,485.29 ($8,571 less 1 percent cash discount).

8 Issued Ck. No. 8223 in payment of voucher no. 4797, $10,602.90 ($10,710 less 1 percent cash discount).

11 Established a petty cash fund of $250. Issued voucher no. 4802.

11 Paid voucher no. 4802 by issuing Ck. No. 8224, $250.

13 Issued voucher no. 4803 in favor of Mohammad Company for merchandise, $14,708; terms 2/10, n/30; FOB shipping point; freight prepaid and added to the invoice, $384 (total, $15,092).

15 Received bill for advertising in the Weekly Ads. Issued voucher no. 4804 in the amount of $410.

17 Received a credit memo for $764 from Mohammad Company for merchandise returned to it, credit memo no. 540 (pertaining to voucher no. 4803).

20 Issued voucher no. 4805 in favor of Vinson County for six months’ property tax (Prepaid Property Taxes), $2,272.

20 Paid voucher no. 4805 by issuing Ck. No. 8225, $2,272.

21 Issued Ck. No. 8226 in payment of voucher no. 4803, $14,049.12 ($14,708 less $764 return, less cash discount, plus freight).

23 Bought merchandise on account from Summers and Company, $6,039; terms 1/10, n/30; FOB destination. Issued voucher no. 4806.

27 Received a credit memo for $984 from Summers and Company for damaged merchandise, credit memo no. 437 (pertaining to voucher no. 4806).

31 Issued voucher no. 4807 to reimburse petty cash fund. The charges were:

July 31 Issued Ck. No. 8227 in payment of voucher no. 4807, $225.10.

31 Issued voucher no. 4808 for wages payable, $8,448, in favor of the payroll bank account. (Assume that the payroll entry was recorded previously in the general journal.)

31 Paid voucher no. 4808 by issuing Ck. No. 8228, payable to Payroll Bank Account.

Required

- 1. Using the voucher issue date, enter the unpaid invoices in the voucher register (page 75) beginning with voucher no. 4789. Then draw double lines across all columns to separate the vouchers of June from those of July.

- 2. Enter the transactions for July in the voucher register at the gross amount. Also record the appropriate transactions in the check register (page 86) and the general journal (page 41).

- 3. Total and rule the voucher register and the check register for the transactions recorded during July.

- 4. Prove the equality of the debits and credits on the voucher register and the check register.

Trending nowThis is a popular solution!

Chapter 10A Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Managerial Accounting: Tools for Business Decision Making

Managerial Accounting (5th Edition)

Principles of Accounting Volume 2

Fundamentals of Cost Accounting

Auditing and Assurance Services (16th Edition)

- CustomTee Inc. contracts with various customers to sell T-shirts. In the case of sales, CustomTees normal accounting policy requires a written and signed sales agreement. On July 1, in response to a special last-minute phone call from a regular customer, CustomTee delivered 500 T-shirts for 5,000. Does CustomTee have an enforceable contract?arrow_forwardOn March 24, MS Companys Accounts Receivable consisted of the following customer balances: S. Burton 310 A. Tangier 240 J. Holmes 504 F. Fullman 110 P. Molty 90 During the following week, MS made a sale of 104 to Molty and collected cash on account of 207 from Burton and 360 from Holmes. Prepare a schedule of accounts receivable for MS at March 31, 20--.arrow_forwardRecord the journal entry for each of the following transactions. Glow Industries purchases 750 strobe lights at $23 per light from a manufacturer on April 20. The terms of purchase are 10/15, n/40, invoice dated April 20. On April 22, Glow discovers 100 of the lights are the wrong model and is granted an allowance of $8 per light for the error. On April 30, Glow pays for the lights, less the allowance.arrow_forward

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardGuardian Services Inc. had the following transactions during the month of April: a. Record the June purchase transactions for Guardian Services Inc. in the following purchases journal format: b. What is the total amount posted to the accounts payable and office supplies accounts from the purchases journal for April? c. What is the April 30 balance of the Officemate Inc. creditor account assuming a zero balance on April 1?arrow_forwardOn January 1, Wei company begins the accounting period with a $35,000 credit balance in Allowance for Doubtful Accounts. On February 1, the company determined that $7,800 in customer accounts was uncollectible; specifically, $1,400 for Oakley Co. and $6,400 for Brookes Co. Prepare the journal entry to write off those two accounts. On June 5, the company unexpectedly received a $1,400 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received. Note: Enter debits before credits. Date General Journal Debit Credit Feb 01arrow_forward

- On June 30, a printing shop provides $1000 of services to a customer to custom print restaurant menus. The customer is sent a bill on July 5 for the amount due. A check in the amount of $1000 is received from the customer on July 25. The printing shop follows GAAP and applies the revenue recognition principle. When is the $1000 sale recognized?arrow_forwardLinstrum Company received a 60-day, 9% note for $56,000, dated July 23, from a customer on account.arrow_forwardSpring Appliances received an invoice dated August 18 with terms 2/10 E.O.M. for the items listed below. 6 refrigerators at $1030 each less 30% and 5% 3 dishwashers at $784 each less 15 and one third %, 12.2%, and 3% (a) What is the last day for taking the cash discount? (b) What is the amount due if the invoice is paid on the last day for taking the discount? (c) What is the amount of the cash discount if a partial payment is made such that a balance of $1700 remains outstanding on the invoice?arrow_forward

- On January 1, Wei Company begins the accounting period with a $30,000 credit balance in Allowance for Doubtful Accounts. a. On February 1, the company determined that $6,800 in customer accounts was uncollectible; specifically, $900 for Oakley Co. and $5,900 for Brookes Co. Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly received a $900 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received.arrow_forwardA check drawn by a company in payment of a voucher for $965 was recorded in the journal as $695. What entry is required in the company's accounts?arrow_forwardGHI Company established a sales agency in a different location. Upon theestablishment of the sales agency, the home office sent merchandise samples costing P10,000 and a cash working fund of P50,000 to be maintained on the imprest basis. During the month of June, the sales agency reported to the home office sales orders. These were billed at P170,000, of which half was collected. The sales agency paid expenses of P45,800 but was reimbursed by the home office. At the end of the month there was no samples left. It was estimated that the gross profit on goods shipped to fill sales agency sales orders averaged 60% of sales. What is the net income of the sales agency for the current month?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,