Foundations Of Finance

10th Edition

ISBN: 9780134897264

Author: KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher: Pearson,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 20SP

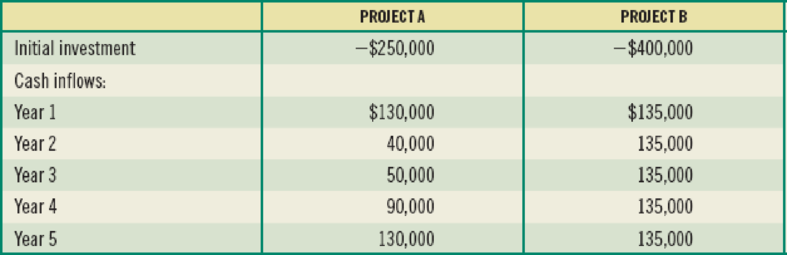

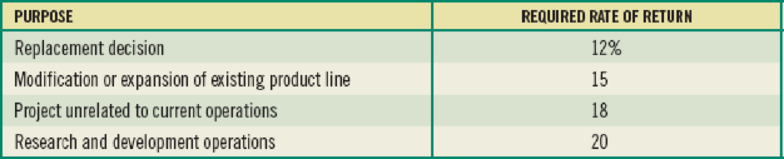

(Risk-adjusted discount rates and risk classes) The G. Wolfe Corporation is examining two capital-budgeting projects with 5-year lives. The first, project A, is a replacement project; the second, project B, is a project unrelated to current operations. The G. Wolfe Corporation uses the risk-adjusted discount rate method and groups projects according to purpose, and then it uses a required rate of return or discount rate that has been preassigned to that purpose or risk class. The expected cash flows for these projects are given here:

The purpose/risk classes and preassigned required

Determine each project’s risk-adjusted

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Moses Manufacturing is attempting to select the best of three mutually exclusive projects, X, Y, and Z. Although all the projects have

5-year

lives, they possess differing degrees of risk. Project X is in class V, the highest-risk class; project Y is in class II, the below-average-risk class; and project Z is in class III, the average-risk class. The basic cash flow data for each project and the risk classes and risk-adjusted discount rates (RADRs) used by the firm are shown in the following tables.

Project X

Project Y

Project Z

Initial investment

(CF0)

$179,000

$235,000

$312,000

Year

(t )

Cash inflows

(CFt)

1

$80,000

$56,000

$85,000

2

66,000

68,000

85,000

3

62,000

73,000

85,000

4

55,000

84,000

85,000

5

65,000

96,000

85,000

Risk Classes and RADRs

Risk Class

Description

Risk adjusted…

Assume the following information for a capital budgeting proposal with a five-year time horizon:

Initial investment:

Cost of equipment (zero salvage value)

$ 550,000

Annual revenues and costs:

Sales revenues

$ 300,000

Variable expenses

$ 130,000

Depreciation expense

$ 50,000

Fixed out-of-pocket costs

$ 40,000

Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

This proposal’s internal rate of return is closest to:

Multiple Choice

5%.

10%.

3%.

8%

Assume the following information for a capital budgeting proposal with a five-year time horizon:

Initial investment:

Cost of equipment (zero salvage value)

$ 460,000

Annual revenues and costs:

Sales revenues

$ 300,000

Variable expenses

$ 130,000

Depreciation expense

$ 50,000

Fixed out-of-pocket costs

$ 40,000

Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

This proposal’s internal rate of return is closest to:

Chapter 11 Solutions

Foundations Of Finance

Ch. 11.A - Prob. 1MCCh. 11.A - Prob. 2MCCh. 11 - Prob. 1RQCh. 11 - Prob. 2RQCh. 11 - If a project requires an additional investment in...Ch. 11 - Prob. 4RQCh. 11 - Prob. 5RQCh. 11 - Prob. 6RQCh. 11 - Prob. 1SPCh. 11 - (Relevant cash flows) Captins Cereal is...

Ch. 11 - Prob. 3SPCh. 11 - Prob. 4SPCh. 11 - Prob. 5SPCh. 11 - Prob. 6SPCh. 11 - Prob. 7SPCh. 11 - Prob. 9SPCh. 11 - Prob. 10SPCh. 11 - Prob. 11SPCh. 11 - Prob. 12SPCh. 11 - Prob. 15SPCh. 11 - (Real options and capital budgeting) You have come...Ch. 11 - (Real options and capital budgeting) Go-Power...Ch. 11 - (Real options and capital budgeting) McDoogals...Ch. 11 - (Risk-adjusted NPV) The Hokie Corporation is...Ch. 11 - (Risk-adjusted discount rates and risk classes)...Ch. 11 - Prob. 1MCCh. 11 - Prob. 2MCCh. 11 - Prob. 3MCCh. 11 - Prob. 7MCCh. 11 - Prob. 8MCCh. 11 - Prob. 9MCCh. 11 - Should the project be accepted? Why or why not?Ch. 11 - Prob. 11MCCh. 11 - Prob. 12MCCh. 11 - Prob. 13MCCh. 11 - Prob. 14MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Would you rather have $7,500 today or at the end of 20 years after it has been invested at 15%? Explain your answer. The following are independent situations. For each capital budgeting project, indicate whether management should accept or reject the project and list a brief reason why.arrow_forwardStaten Corporation is considering two mutually exclusive projects. Both require an initial outlay of 150,000 and will operate for five years. The cash flows associated with these projects are as follows: Statens required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten? a. Accept Project X and reject Project Y. b. Accept Project Y and reject Project X. c. Accept Projects X and Y. d. Reject Projects X and Y.arrow_forwardFenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?arrow_forward

- Assume the following information for a capital budgeting proposal with a five-year time horizon: Initial investment: Cost of equipment (zero salvage value) $ 530,000 Annual revenues and costs: Sales revenues $ 300,000 Variable expenses $ 130,000 Depreciation expense $ 50,000 Fixed out-of-pocket costs $ 40,000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. If the company’s discount rate is 12%, then the net present value for this investment is closest to:arrow_forwardA company wants to decide which project to undertake out of two projects A and B. For this purpose, it wants to evaluate each project that have the same initial investment (cost) but different cash flows for the next three years. The following table gives information on these two projects. The discount rate to be used is 8 percent, which is the WACC for the company. Use two methods of capital budgeting: The Net Present Value (NPV) Method and the Internal Rate of Return (IRR) Method, to evaluate and compare the two projects. Based on the outcome of calculations, choose the best project A or B and explain your decision for each method. Show all your work for each method step by step. Initial Investment and Cash Flows of Projects A and B in AED Project A Project B Initial Investment - 150,000 - 150,000 Year 1 Cash flow 20,000 50,000 Year 2 Cash flow 90,000 90,000 Year 3 Cash flow 70,000 60,000arrow_forwardUnion Atlantic Corporation, which has a required rate of return equal to 14 percent, is evaluating a capital budgeting project that requires an initial investment of $170,000. The project will generate a $60,750 cash inflow at the year-end of each of the next four years. According to this information, which of the following statements is correct? Group of answer choices The project's is acceptable if its discounted payback period is less than the traditional payback period. The project is acceptable because its net present value is negative. The project is acceptable if its internal rate of return (IRR) is more than 14 percent. The project is acceptable if its discounted payback period is greater than its economic life.arrow_forward

- Two firms, Tangerine Inc. and Cyan Inc. analyzed the same capital budgeting project. Tangerine Inc. determined that the project's internal rate of return (IRR) is 9 percent. Cyan Inc. used the net present value (NPV) method to evaluate the project and determined that it is not acceptable. Given this information, which of the following statements is correct? Group of answer choices Cyan Inc.'s required rate of return is greater than 5 percent. I Cyan Inc.'s required rate of return is greater than 9 percent. Tangerine's chief financial officer (CFO) should use the traditional payback period method to evaluate the project. The net present value of the project must be positive for both the firms.arrow_forwardGiven the following attributes of an investment project with a 5-year life and an after-tax discountrate of 12%, calculate both the IRR and MIRR of the project using the built-in functions in Excel:investment outlay, time 0, $5,000; after-tax cash inflows, year 1, $800; year 2, $900; year 3, $1,500;year 4, $1,800; and year 5, $3,200. What accounts for the difference in these two measures?arrow_forwardMaven Design Inc. is considering two investment projects, X and Y. Company’s cost of capital is 7.50% and that the investments will produce the following after-tax cash flows (in thousands of dollars): Year Project X Project Y 0 −$1,100 −$2,700 1 $550 $650 2 $600 $750 3 $100 $800 4 $100 $1,400 A. Calculate the NPV, IRR, MIRR, regular payback period, discounted payback period, and profitability index for each project. For each selection criterion, indicate the correct accept/reject decision for each project and ranking (best acceptable project). Assume a 3-year payback acceptance criterion for the company. Project X Project Y Accept/Reject Ranking NPV ($) IRR (%) MIRR (%) Payback Period (Years) Discounted PB (Years) PI B. If the two projects are independent and the cost of capital is 7.5%, which…arrow_forward

- Please describe NPV, IRR and their relationship. How do you evaluate each for making an investment decision? That is, what is a favorable NPV and IRR for making an investment decision. If you were developing a capital budgeting process at your employer, how would you prioritize your projects? What is the NPV when IRR = WACC, IRR>WACC, and IRR<WACC? There is a duplex for sale in Absecon for $700,000 at this time. It has 2 units that generate a total of $25,000 in gross rent. The property taxes are $4,000, commercial property insurance is $2,000, flood insurance is $1,000, and annual maintenance is $2,000. You expect to sell it in one year at a price growth of 0%. What is the NPV with a WACC of 10%. Is the IRR greater or less than the WACC? Would you invest in this project and why?arrow_forwardBellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 12%. 0 1 2 3 4 Project A -950 700 355 280 330 Project B -950 300 290 430 780 What is Project A's payback? Do not round intermediate calculations. Round your answer to four decimal places. years What is Project A's discounted payback? Do not round intermediate calculations. Round your answer to four decimal places. years What is Project B's payback? Do not round intermediate calculations. Round your answer to four decimal places. years What is Project B's discounted payback? Do…arrow_forwardFor the following item, refer to Exhibit 12B-1 and Exhibit 12B-2 to determine the appropriate discount factor(s) using the tables provided.The management of Osborn Corporation is investigating an investment in equipment that would have a useful life of 5 years. The company uses a discount rate of 12% in its capital budgeting. The net present value of the investment, exclud ing the annual cash inflow, is −$408,614. How large would the annual cash inflow have to be to make the investment in the equipment financially attractive? (Ignore income taxes.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License